Charitable Contribution Letter Template Guide

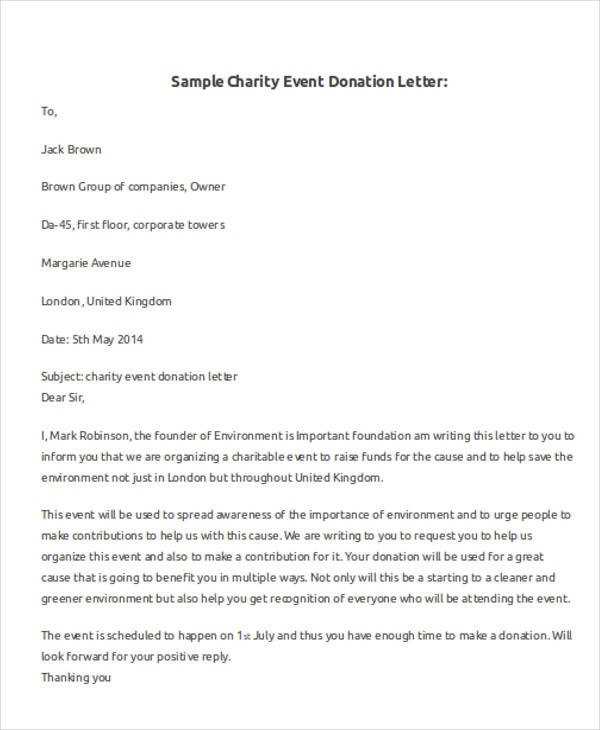

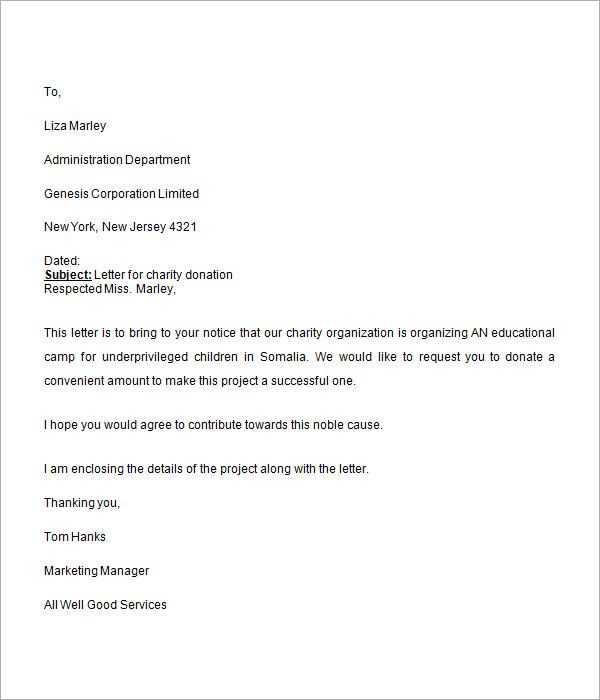

When it comes to expressing support for a cause, a well-written message is essential. It helps ensure your intentions are clear and appreciated by the recipient. Whether you are acknowledging a past contribution or encouraging future support, the structure of your message can make a significant difference. Crafting a thoughtful and respectful communication is key to fostering lasting relationships with those who contribute to your cause.

Understanding the core elements of such a message is crucial. The tone should remain polite and professional, while also conveying the gratitude and importance of the gesture. Knowing what information to include and how to present it effectively ensures that the recipient feels valued and respected.

Moreover, personalization plays an important role in strengthening the connection. A tailored approach makes the communication feel more sincere and less generic, increasing the likelihood of a positive response. This guide will outline the best practices for structuring and writing impactful messages to those who support your mission.

Creating Effective Donation Acknowledgements

When expressing appreciation for a donation, clarity and sincerity are paramount. A well-crafted communication serves not only as a thank you, but also as a record for the giver, acknowledging their impact. This type of correspondence should effectively convey gratitude while maintaining a professional tone. Properly structured, it reinforces the importance of the support and ensures the donor feels valued.

Key Elements to Include

To ensure your message resonates, include the following essential components:

| Element | Description |

|---|---|

| Introduction | A warm and personal greeting that establishes the tone of the message. |

| Donation Acknowledgement | A clear statement confirming the gift and its significance. |

| Specific Use of Funds | Optional: Briefly mention how the donation will be used, enhancing transparency. |

| Closing | Reaffirm your appreciation and provide contact information for further engagement. |

Best Practices for Crafting Your Message

Always ensure the tone is both appreciative and professional. Tailor the message to the recipient by incorporating specific details related to their support. Personalization helps the donor feel their gift is truly valued, rather than just a generic thank you. Moreover, maintaining a concise structure keeps the message impactful while allowing for a clear and focused communication of gratitude.

How to Structure Your Donation Message

Effective communication is essential when acknowledging a donation. The structure of your message should ensure that it’s clear, concise, and respectful. By organizing your message properly, you not only express gratitude but also provide the recipient with all the necessary details they need to understand the impact of their support.

Step-by-Step Structure

A well-organized message typically follows a simple structure, making it easy for the recipient to digest the information. Consider including the following key components:

- Opening Greeting: Start with a warm, personal greeting to set a positive tone.

- Acknowledgement of the Donation: Clearly express gratitude for the gift received.

- Details of the Gift: Briefly describe the donation’s value or significance.

- Impact Statement: Explain how the donation will make a difference, helping the recipient feel their contribution matters.

- Closing Remarks: End with a final thank you and a note of appreciation.

Additional Tips for a Professional Tone

- Keep It Personal: Customize the message to reflect the specific donation and the relationship with the giver.

- Maintain Clarity: Avoid jargon or overly complex language; aim for simplicity and clarity.

- Stay Concise: While detail is important, brevity ensures the message is clear and easy to read.

Key Details to Include in the Message

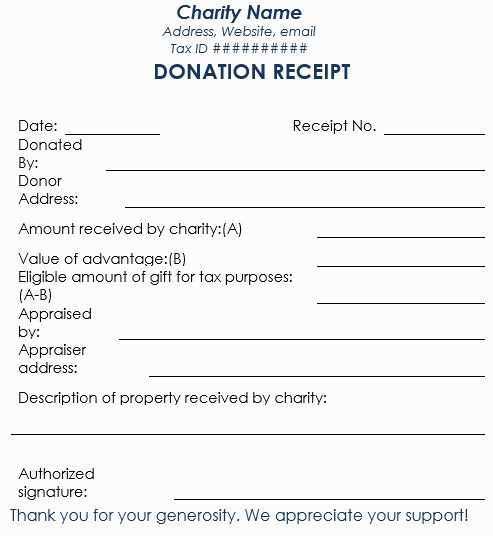

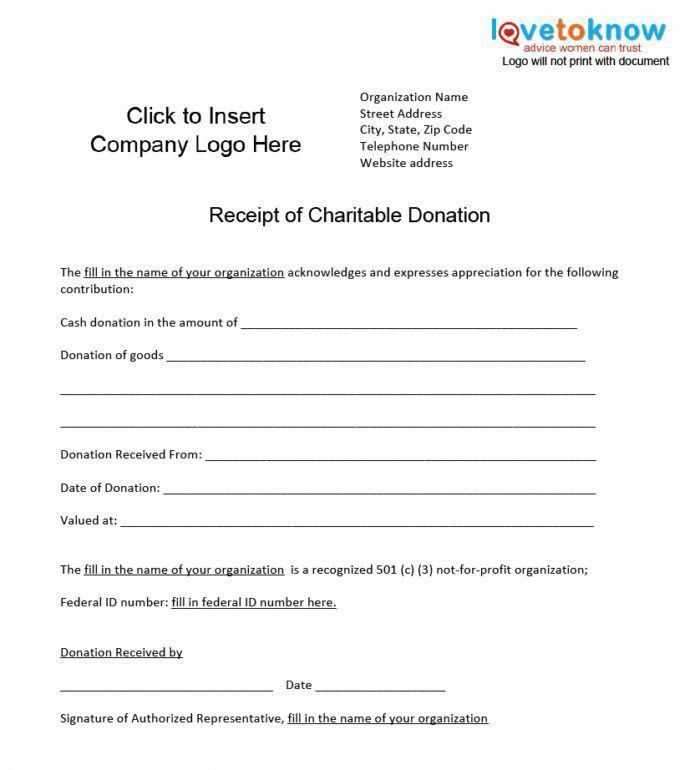

When drafting a message of thanks or recognition, it’s essential to ensure that all relevant details are clearly communicated. This not only helps the recipient understand the importance of their support but also provides them with necessary documentation for their records. A well-structured message will make the recipient feel appreciated and informed.

Essential Information to Mention

- Donor’s Name: Always address the individual or organization by name to add a personal touch.

- Date of Donation: Specify the date the gift was received, which is important for both acknowledgment and record-keeping.

- Donation Amount or Value: Include the precise amount or an estimated value, especially if the donation is in-kind.

- Purpose of the Gift: Briefly mention how the donation will be used or what it supports. This reinforces the impact of the giver’s contribution.

- Tax Deduction Information: If applicable, provide information on how the gift may be used for tax purposes, especially for larger donations.

Formatting Tips

- Clarity: Ensure all key details are easy to locate by using clear headings and structured formatting.

- Conciseness: While it’s important to be thorough, try to keep the message brief and to the point, avoiding unnecessary details.

- Professional Tone: Maintain a formal and respectful tone throughout the message to convey professionalism and sincerity.

Best Practices for Composing a Donation Note

Crafting a thoughtful and well-structured note of appreciation is essential to maintain a positive relationship with supporters. The way you express gratitude can leave a lasting impression, making it more likely that the individual will continue their support in the future. Adopting best practices ensures that your message is clear, sincere, and professional.

Key Recommendations for an Effective Message

- Be Specific: Whenever possible, mention the exact gift or support provided. This shows attention to detail and makes the recipient feel acknowledged.

- Express Genuine Gratitude: Sincerely convey your appreciation. The more personal and heartfelt your thanks, the stronger the impact on the donor.

- Highlight the Impact: Emphasize how their support is making a difference. This not only acknowledges the value of their gesture but also strengthens their connection to the cause.

- Use Positive Language: Keep the tone upbeat and positive, focusing on the good that has come from their help.

- Keep It Concise: Respect the recipient’s time by keeping your message clear and to the point, while still conveying all necessary details.

Additional Tips for Tone and Style

- Maintain a Professional Tone: Even though the note is a thank-you, it should still reflect the professional nature of your organization or cause.

- Personalize the Message: A personalized message feels more meaningful and shows that you’ve taken the time to acknowledge the individual’s specific support.

- Proofread for Clarity: Ensure that the message is free of grammatical or spelling errors, as these can detract from the professionalism of your note.

Common Pitfalls to Avoid in Correspondence

When drafting a message of thanks or acknowledgment, it’s crucial to avoid common mistakes that can diminish the impact of your communication. By being aware of potential pitfalls, you can ensure that your message is well-received and leaves a positive impression on the recipient.

Frequent Mistakes to Watch For

- Vague Language: Avoid using generic phrases like “thank you for your support” without providing specific details about what was received. Personalizing the message makes it more meaningful.

- Missing Information: Failing to include key details such as the date of the gift, the amount, or its intended purpose can lead to confusion or a lack of proper documentation.

- Overly Complex Tone: While it’s important to maintain professionalism, be sure the language remains clear and accessible. Avoid using overly formal or complex phrases that could create confusion.

- Neglecting to Acknowledge the Impact: Focusing only on the donation itself, without highlighting its importance or how it will make a difference, misses an opportunity to engage the recipient emotionally.

Additional Tips for Clear Communication

- Inconsistent Formatting: Make sure your message has a clear structure and is easy to follow. This ensures the recipient can easily find important details without struggling to navigate through the message.

- Failure to Proofread: Even small mistakes in grammar or spelling can undermine the professionalism of your message. Always proofread before sending to ensure clarity and accuracy.

Personalizing Your Contribution Letter

When composing a message to express your gratitude, personalizing the content can significantly enhance its impact. A message that feels tailored to the recipient not only shows that you value their specific gesture but also strengthens the connection between your cause and their support.

Ways to Make Your Message Stand Out

- Use the Donor’s Name: Start by addressing the individual directly. Acknowledging them by name adds a personal touch that shows you recognize and appreciate their unique support.

- Reference the Specific Gift: Mention the exact donation or support they provided. Whether it’s a monetary gift or a material contribution, specifying what they have given makes the message feel more thoughtful.

- Share the Impact: Include details about how their support is being utilized. By explaining the positive changes their gesture is helping to create, you make them feel more connected to the outcome of their contribution.

Customizing the Tone and Content

- Match the Recipient’s Style: If you have an established relationship with the donor, adapt the tone to reflect it. A more formal tone may be appropriate for some, while a warmer, conversational style might be better suited for others.

- Express Personal Gratitude: Share why their support means so much to you personally or to the cause. A heartfelt message can make the recipient feel truly appreciated.

Legal and Tax Considerations for Gifts

When offering or receiving gifts, it is essential to be aware of the legal and tax implications involved. Understanding the requirements and obligations ensures that both parties comply with relevant regulations while maximizing the benefits of their donations or support.

Tax Benefits and Requirements

- Tax Deductibility: In many regions, certain types of gifts can be claimed as tax deductions. Donors should ensure that they are donating to recognized organizations to qualify for such benefits.

- Recordkeeping: Proper documentation is critical for both the donor and the recipient. Donors should retain receipts, acknowledgment letters, or other proof of their gift for tax reporting purposes.

- Limits on Deductions: Be aware that there are often limits on how much can be deducted from taxable income based on the value of the gift and the recipient’s tax-exempt status.

Legal Considerations and Compliance

- Compliance with Laws: Ensure that the donation complies with local laws and that the recipient organization holds the proper legal status to receive the gift.

- Donor Privacy: Donors should be aware of how their personal information will be handled, ensuring that the recipient organization respects privacy laws.