Private Equity Letter of Intent Template Guide

In the world of business deals, having a structured document that outlines the preliminary terms of a transaction is essential. This document serves as the foundation for future negotiations and helps to ensure that all parties are aligned before moving forward. It lays out the main points that will be further refined in a formal contract, providing clarity and security for both sides.

Such agreements are commonly used in investment and acquisition scenarios, where parties seek to define critical aspects of the deal early on. By having a draft that outlines these key elements, both investors and business owners can avoid misunderstandings and save time during the formal negotiation process. A well-prepared document also minimizes risks by addressing potential concerns upfront.

Using a predefined structure for this document can streamline the process, helping to focus on the essential elements without reinventing the wheel each time. A clear and concise approach ensures that the goals and expectations of all parties are documented effectively, fostering trust and promoting a smoother transaction.

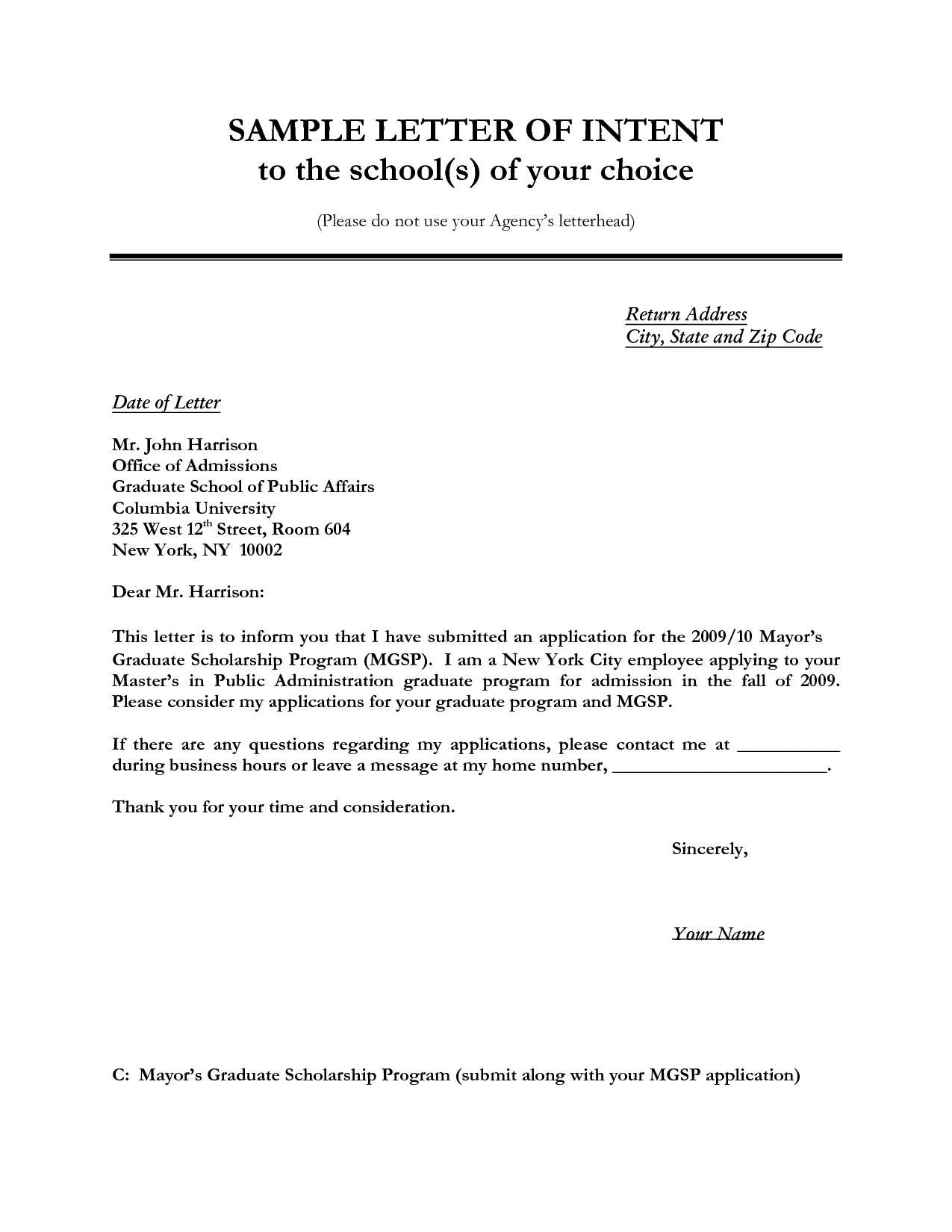

Understanding the Role of a Letter of Intent

In the realm of business transactions, a document outlining the initial agreement between parties plays a crucial role. This preliminary agreement sets the tone for more detailed discussions and helps to clarify the primary terms before committing to a final contract. It ensures that both sides are on the same page, which reduces the likelihood of conflicts later in the negotiation process.

Establishing a Foundation for Negotiations

This type of agreement serves as a starting point for negotiations, laying out the essential aspects of the deal that need further discussion and refinement. It acts as a non-binding outline, signaling the intent of the parties involved while leaving room for adjustments. The goal is to establish trust and demonstrate a shared understanding of the deal’s main points, paving the way for more in-depth conversations.

Clarifying Expectations and Minimizing Risks

By clearly outlining the major components of the transaction, the document helps prevent misunderstandings. It defines the roles, responsibilities, and expectations of each party, which helps to avoid potential disputes down the line. This clarity also reduces the chance of miscommunication, giving both sides confidence in moving forward with the formalities of the agreement.

Key Components of a Private Equity Letter

When drafting a document that outlines the preliminary terms of a business transaction, several key components must be included to ensure clarity and prevent confusion. These elements form the foundation for further negotiations and help define the roles, responsibilities, and expectations of all parties involved. Understanding these components can make the process smoother and more effective.

Essential Elements of the Agreement

Each transaction document should contain several crucial sections to guide the ongoing discussions and set clear boundaries for what is to be expected. These sections typically include the following:

- Introduction and Purpose: This section clearly defines the parties involved and the overarching goals of the agreement.

- Deal Structure: Describes the general framework of the transaction, including the purchase price, terms of payment, and any contingencies.

- Confidentiality Clause: Ensures that sensitive information shared between parties remains private throughout negotiations.

- Exclusivity Period: Outlines the time frame during which the parties agree not to negotiate with others regarding the same deal.

- Non-binding vs. Binding Provisions: Clarifies which parts of the agreement are legally binding and which are simply indicative of future intent.

Additional Considerations

In addition to the core components, it’s important to include specific terms related to timelines, due diligence, and dispute resolution mechanisms. These add further structure to the negotiation process and help all parties feel confident about moving forward with the transaction.

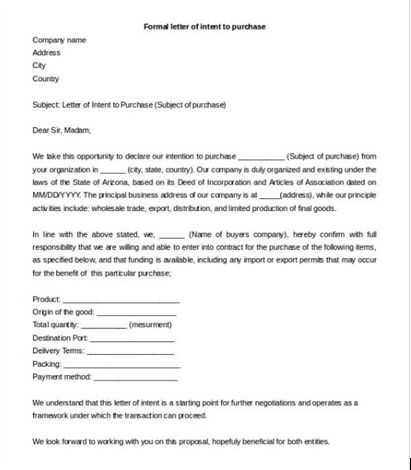

How to Draft a Letter of Intent

Creating a well-structured document to outline the preliminary terms of a deal requires careful attention to detail and clarity. The goal is to provide a clear overview of the agreement that both parties can review and use as a basis for further negotiations. A properly drafted document helps set expectations and ensures that both sides understand the key aspects of the transaction before proceeding further.

To effectively create this document, start by clearly identifying all parties involved and stating the purpose of the agreement. Specify the main terms, such as the transaction structure, financial considerations, and any conditions that must be met before moving forward. Make sure to include a timeline, confidentiality clauses, and outline whether any provisions will be legally binding or simply indicative of intent.

Next, be sure to highlight any critical deadlines or due diligence steps required to complete the deal. It’s also important to clarify what happens if the deal doesn’t proceed as planned, including exit clauses or penalties. Finally, ensure that the language used is clear, concise, and free of ambiguity to avoid potential misunderstandings during future negotiations.

Common Mistakes to Avoid in LOI

When preparing a document that outlines the preliminary terms of a business agreement, certain mistakes can undermine its effectiveness and lead to confusion down the line. Avoiding common pitfalls ensures that the document accurately reflects the parties’ intentions and provides a strong foundation for future negotiations. Understanding these errors can help you craft a clearer, more effective agreement.

Key Errors in Drafting the Agreement

There are several frequent mistakes that can complicate the process and potentially derail the transaction. These errors often arise from vague language, missed details, or miscommunication between parties. Below is a table that highlights the most common mistakes:

| Mistake | Impact |

|---|---|

| Unclear Terms | Leads to misunderstandings about the deal’s scope and expectations. |

| Failure to Define Key Conditions | Leaves important contingencies unaddressed, which can cause delays or failure to meet objectives. |

| Overly Complex Language | Creates ambiguity and confusion, making it difficult for parties to fully understand the agreement. |

| Omitting Deadlines | Delays the process and creates uncertainty about time-sensitive actions. |

How to Prevent These Mistakes

To avoid these issues, ensure that all terms are clearly defined, timelines are set, and conditions are thoroughly outlined. Keep the language simple and precise, making sure both parties understand every aspect of the agreement. Additionally, carefully review the document to ensure that no critical elements are overlooked, as these omissions could lead to complications in future negotiations.

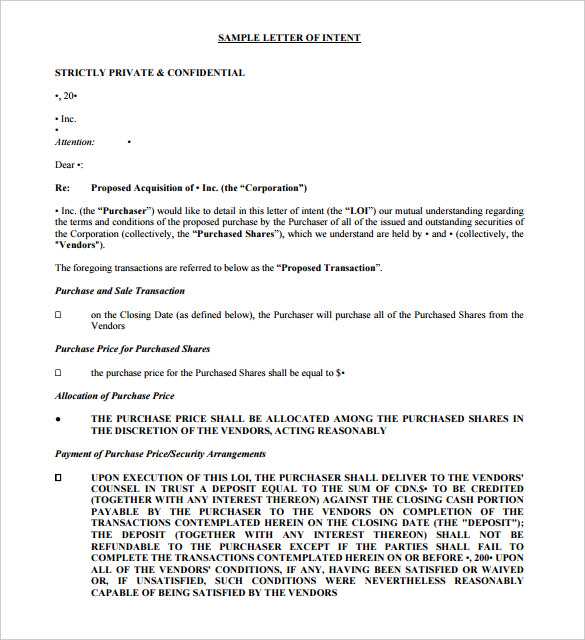

Legal Considerations in Private Equity LOIs

When drafting a document outlining the preliminary terms of a business transaction, it’s crucial to consider the legal implications that can arise from its contents. While such an agreement is often non-binding, certain clauses may still have significant legal consequences. Understanding the legal aspects ensures that all parties are aware of their rights, obligations, and any potential liabilities before proceeding further.

Binding vs Non-Binding Provisions

One of the key legal considerations is distinguishing between binding and non-binding clauses. While the majority of the agreement may serve as an indication of intent, certain provisions, such as confidentiality and exclusivity clauses, are often legally enforceable. It’s important to clearly indicate which sections are legally binding and which are meant solely to guide further negotiations.

Confidentiality and Non-Disclosure Agreements

Another critical aspect to address is the confidentiality of the information shared during negotiations. Many transactions involve sensitive data, and a confidentiality agreement ensures that proprietary information is protected. Including a non-disclosure agreement (NDA) within the document helps prevent unauthorized use or sharing of this information, providing both parties with the necessary legal protections.

Additionally, understanding the jurisdiction and applicable laws is vital. Jurisdictional issues may arise, especially if the parties are based in different countries or regions, which can impact the enforcement of certain clauses. Ensuring that the document complies with the relevant legal framework can help avoid potential disputes in the future.

Benefits of Using a Template

Using a predefined structure for drafting a business agreement can offer significant advantages in terms of efficiency and consistency. Templates provide a ready-made format that simplifies the process of outlining the key terms and conditions of a deal. By using such a structure, businesses can save time, reduce the risk of errors, and ensure that all essential elements are included in the document.

Efficiency and Time-Saving

One of the main benefits of using a structured format is the time saved in drafting the document. Rather than starting from scratch, a template provides a clear outline, allowing parties to focus on filling in the details. This efficiency is especially valuable when time is of the essence in closing a deal, enabling quicker turnaround times without compromising on the quality of the agreement.

Consistency and Accuracy

By relying on a standard format, businesses ensure that all the necessary components are consistently addressed. This reduces the likelihood of missing key provisions or repeating mistakes from previous agreements. Additionally, templates are often created by professionals, ensuring that the document adheres to legal and industry standards, which enhances its accuracy and reliability.