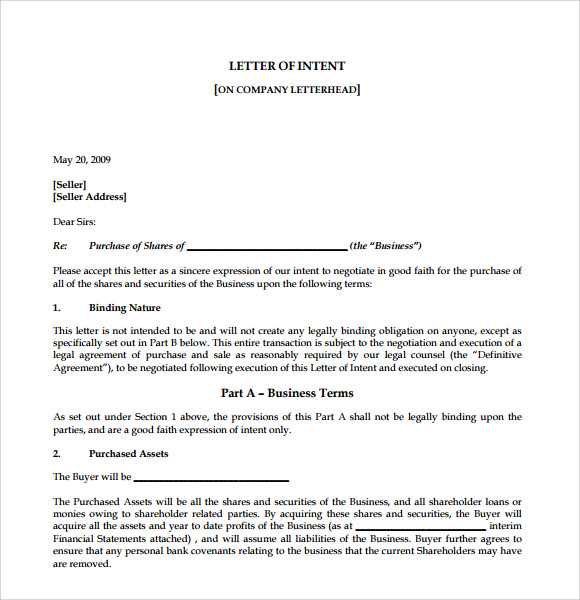

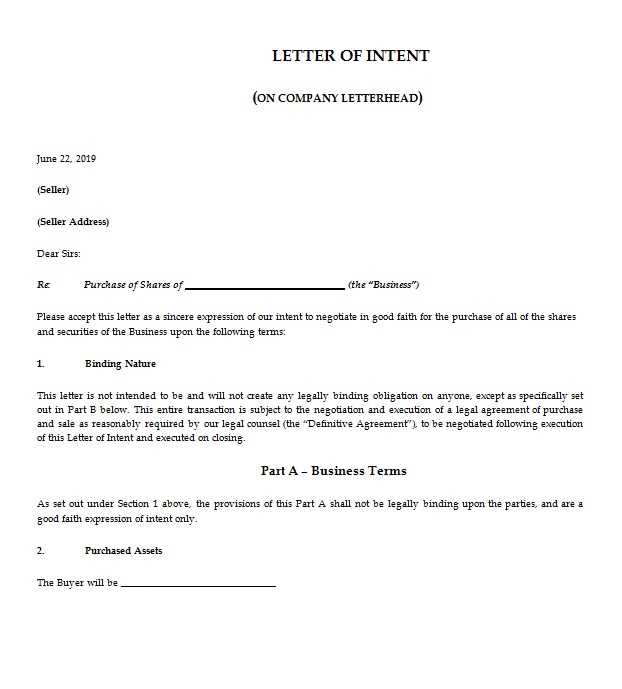

Letter of Intent to Purchase Shares Template

When engaging in a business transaction, especially one involving equity or ownership, a formal agreement is essential to outline the terms and demonstrate commitment. This type of document serves as a preliminary step in formalizing a potential deal, establishing the intentions of the involved parties before any binding contract is signed.

Clear communication is key to ensuring that both sides understand their roles, expectations, and the scope of the proposed arrangement. By outlining essential points in a clear and concise manner, you can avoid confusion and ensure that all involved parties are aligned in their goals.

In this article, we will explore how to effectively draft such a document, focusing on the components that contribute to a professional and legally sound agreement. Whether you are buying or selling ownership stakes, knowing how to structure this initial communication is crucial for a successful partnership.

Understanding the Purpose of a Letter

This type of document serves as a formal expression of interest in engaging in a business transaction, typically related to acquiring ownership or control in a company. Its primary role is to establish the initial terms and demonstrate the seriousness of the proposal without entering into a binding commitment. By setting out clear expectations, it helps both parties assess the potential for a successful deal before proceeding to more detailed negotiations.

Why It Is Important

Before formal agreements are drawn up, both parties need to be aligned on basic terms and conditions. This document lays out the foundation for a potential deal, providing a mutual understanding of the transaction’s scope. It ensures that both sides are on the same page, reducing the risk of misunderstandings later in the process.

Key Benefits

| Benefit | Description |

|---|---|

| Clarity | Outlines essential terms and expectations upfront, reducing confusion. |

| Commitment | Shows a genuine desire to proceed, indicating seriousness in the transaction. |

| Structure | Provides a clear framework for further discussions, streamlining negotiations. |

| Security | Helps mitigate risks by defining key points before advancing to legal contracts. |

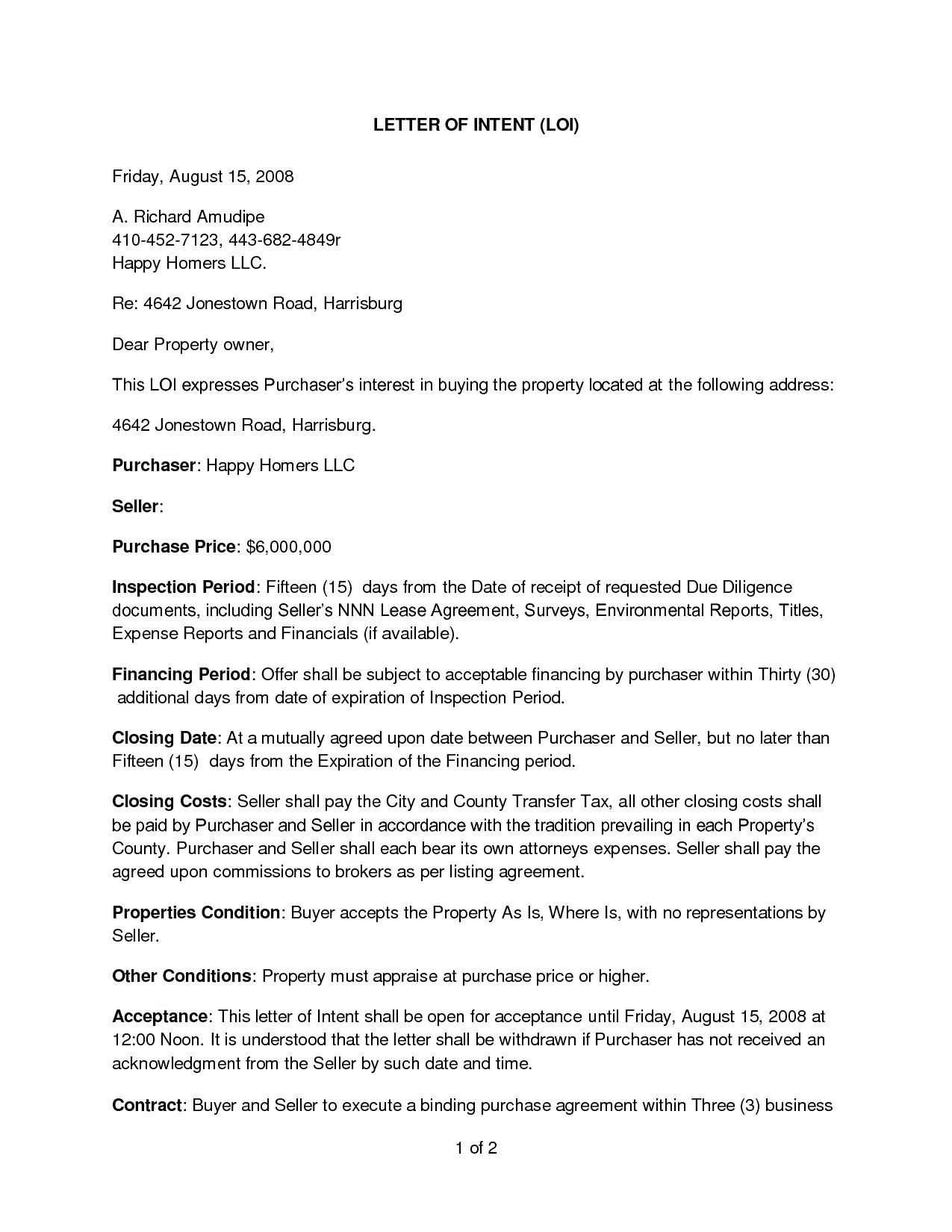

Key Elements to Include in the Document

To ensure that this formal agreement clearly reflects the understanding between the involved parties, certain elements must be present. These components not only establish a clear direction for future steps but also help safeguard both sides by addressing potential concerns early in the process.

Crucial Information

- Parties Involved: Clearly identify all entities or individuals participating in the transaction.

- Transaction Overview: Provide a summary of what is being proposed, including the key terms and goals.

- Financial Considerations: Outline any monetary terms, such as the proposed price or financial structure.

- Timeline: Establish a timeline for negotiations, agreements, and final decisions.

- Confidentiality: Specify whether the terms of the agreement should remain private during the process.

Additional Factors to Address

- Conditions Precedent: Note any conditions that must be met before the deal can proceed.

- Termination Clause: Outline circumstances under which either party can withdraw from the agreement.

- Legal Implications: Briefly mention any legal framework or actions required to finalize the agreement.

- Future Negotiations: Address whether further discussions will be needed to refine terms or agree on specifics.

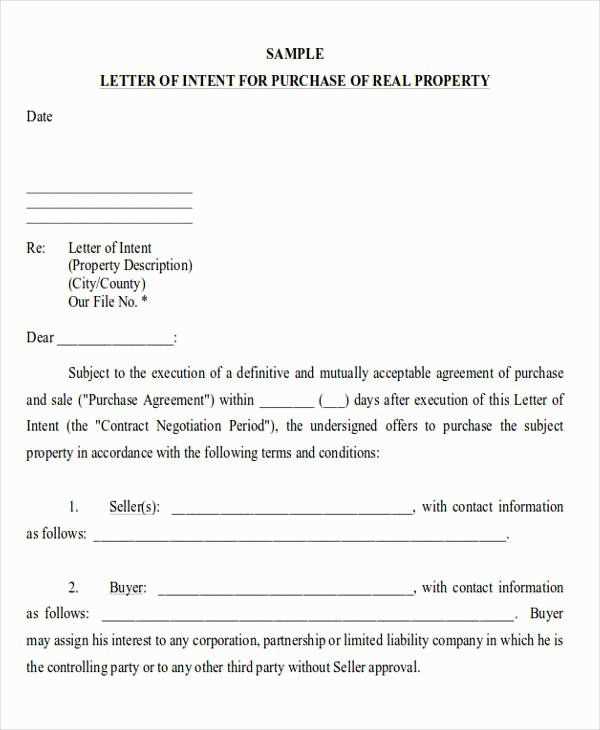

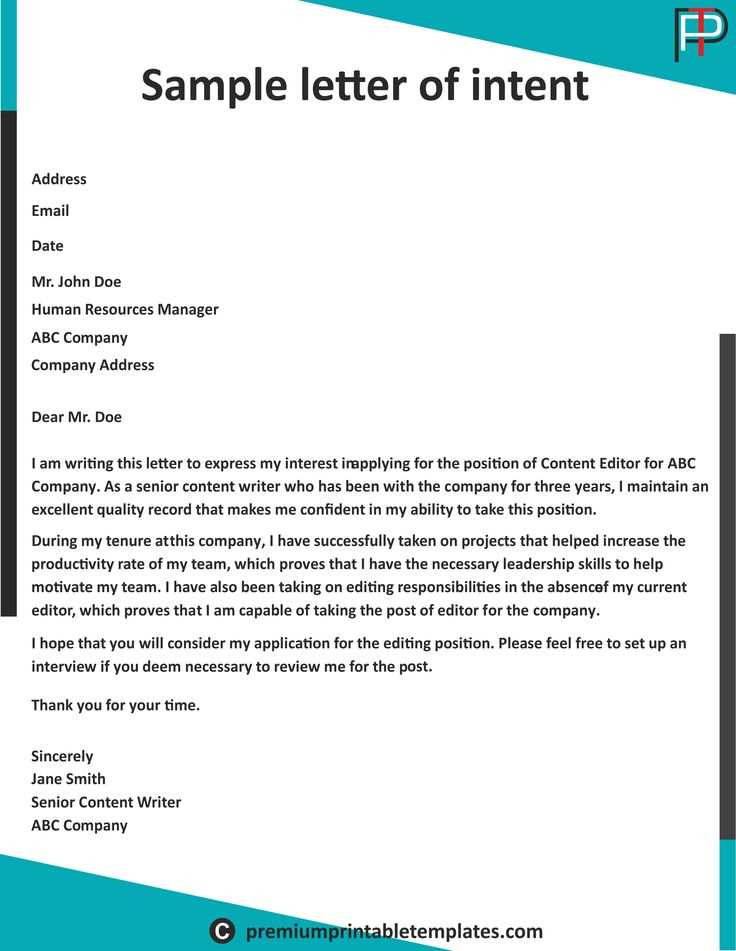

How to Structure Your Document

Organizing this type of communication in a logical and professional manner is crucial for clarity and effectiveness. A well-structured document ensures that all parties can easily understand the terms and expectations, and it sets the stage for more detailed negotiations. Each section should be clear, concise, and follow a natural flow from introduction to conclusion.

Start with a Clear Introduction

The opening should briefly introduce the purpose of the document and identify the parties involved. This section provides the context for the transaction, helping the reader understand the intent behind the proposed arrangement.

Body of the Document

The body should cover the key points of the agreement, starting with a summary of the terms, followed by any financial details, conditions, and other critical factors. This section is the most important part of the document, as it outlines what each party expects from the deal. Ensure that all points are clearly defined to avoid misunderstandings.

Conclude the document by reaffirming the intent to move forward, including any next steps, timelines, or actions required by both sides. Make sure the language used is professional and precise to demonstrate a serious commitment to the proposed agreement.

Common Mistakes to Avoid

When drafting this kind of document, there are several pitfalls that can lead to confusion, miscommunication, or even failed negotiations. It’s essential to be aware of these common errors to ensure the message is clear and the terms are properly outlined. Avoiding these mistakes can help maintain professionalism and prevent unnecessary complications down the line.

Frequent Errors in Drafting

- Vague Language: Using unclear or overly complex terms can lead to misunderstandings. Be specific and precise in your wording.

- Lack of Detail: Failing to include key terms, such as deadlines or financial specifics, may leave both parties uncertain about the next steps.

- Overlooking Legal Aspects: Neglecting to consider the legal implications can lead to issues later. Always ensure compliance with applicable laws and regulations.

- Ignoring Future Conditions: It’s important to address any contingencies or future requirements in the agreement, such as the completion of due diligence or financing approval.

- Failure to Proofread: Grammatical errors or inconsistencies in the document can damage its credibility. Always proofread before sending.

Ensuring Clarity and Accuracy

- Be Specific with Timelines: Clearly outline deadlines for actions and responses to avoid delays in the process.

- Include Clear Terms: Make sure that all conditions and obligations are well-defined and easily understood.

- Review for Completeness: Double-check that all necessary points are addressed and no crucial detail is missing.

Tips for Professional Tone and Clarity

Maintaining a professional tone and ensuring clarity are essential when drafting any formal business document. A well-crafted message not only helps establish credibility but also prevents misunderstandings between parties. By focusing on precise language and proper structure, you can create an effective document that clearly conveys your intentions while maintaining professionalism.

Use Clear and Concise Language

Avoid jargon or overly complex phrases that could confuse the reader. Keep your sentences straightforward and to the point. Make sure that your terms are easily understood, and avoid ambiguity to prevent any potential issues in the future. When in doubt, choose simpler words to express your ideas clearly.

Maintain a Respectful and Formal Tone

Even though the document may be intended to express interest in a business transaction, it’s crucial to maintain a respectful and formal tone throughout. Use polite, professional language, and avoid being too casual or overly familiar. This will help convey seriousness and respect for the other party, setting the tone for future negotiations.

Final Steps Before Sending the Document

Before finalizing and sending the communication, it’s important to take a few critical steps to ensure its accuracy and professionalism. These final checks will help verify that all terms are correct, the message is clear, and nothing important has been overlooked. Taking the time to carefully review the document can prevent any potential misunderstandings or errors from arising later on.

First, thoroughly proofread the content to identify any grammatical errors or inconsistencies. Next, confirm that all relevant details, such as timelines, financial terms, and any obligations, have been included and clearly defined. It’s also wise to have a second pair of eyes review the document, as an external perspective can often spot issues that were missed during the initial draft.

Finally, ensure that the document is formatted properly and that it adheres to any required standards or regulations. Double-check the contact information and the names of all parties involved to avoid any confusion. After completing these final checks, you’ll be ready to proceed with sending the document, knowing that it reflects the professionalism and clarity needed for a successful negotiation process.