How to Use a Credit Letter Dispute Template Effectively

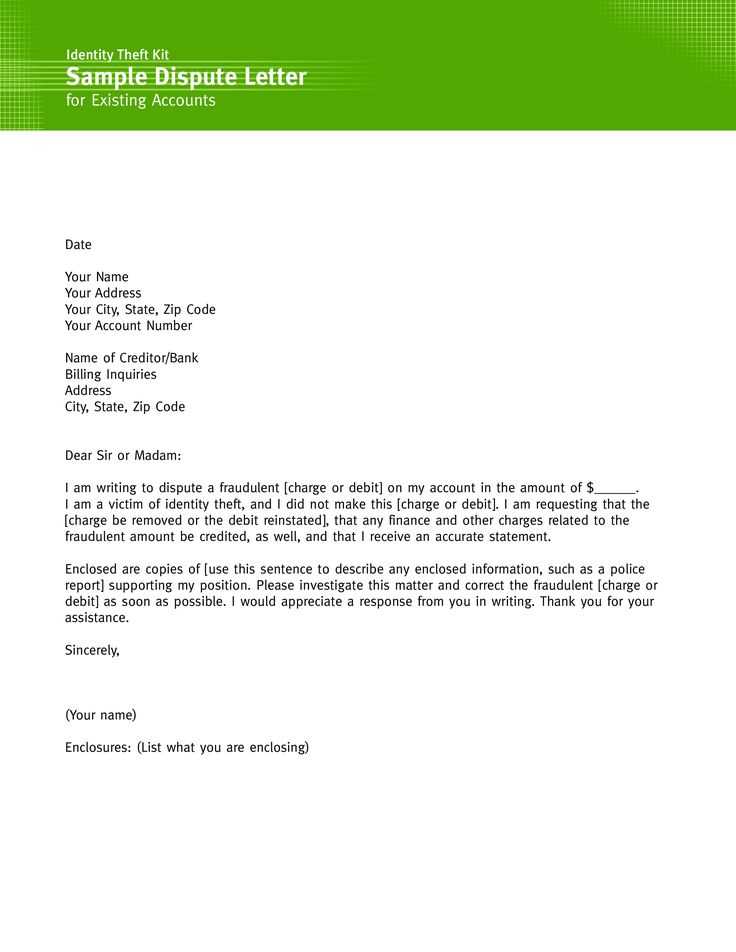

Inaccuracies in your financial documents can significantly impact your creditworthiness. Whether it’s due to clerical mistakes or fraudulent activity, correcting these discrepancies is essential. A well-structured formal communication can help resolve such issues effectively. This section will guide you through the process of addressing errors with an official letter that serves as a request for correction.

Key Information to Include

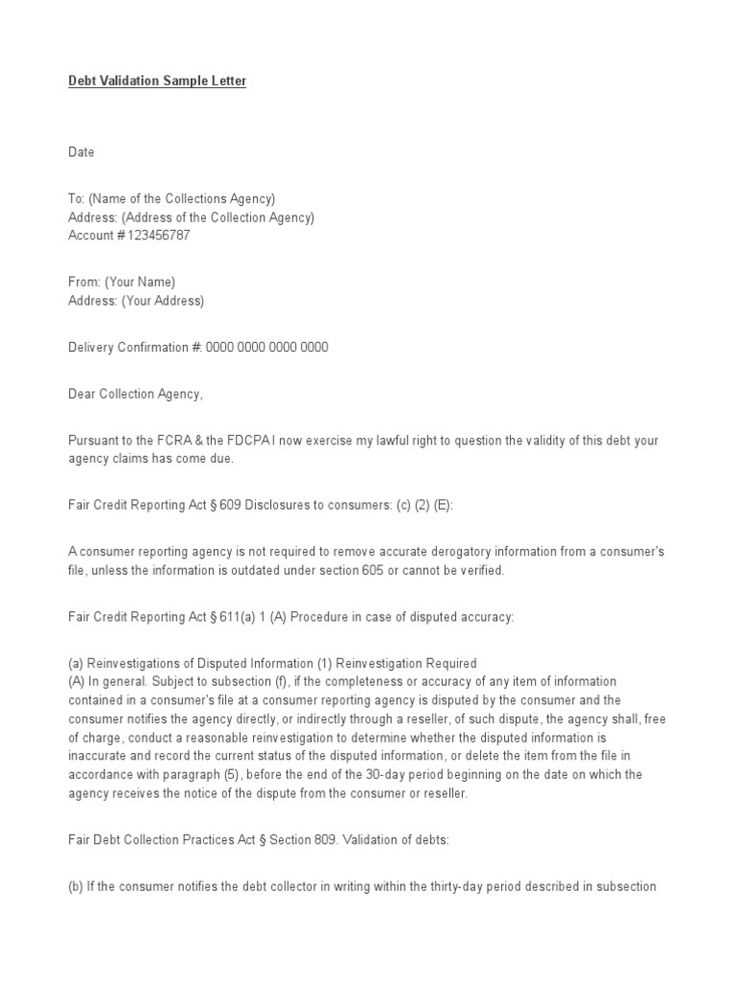

To ensure your request is clear and persuasive, include the following elements:

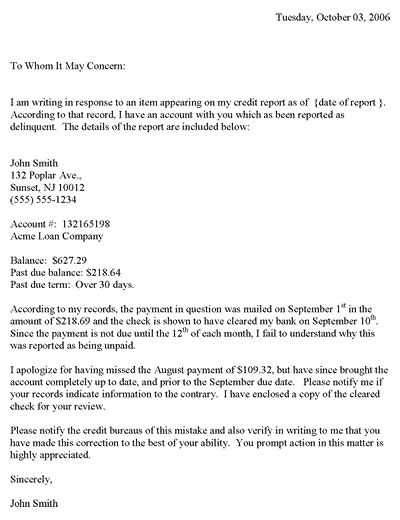

- Personal details: Provide your full name, contact information, and relevant identification numbers.

- Clear description: State the specific mistake in the records and why you believe it’s inaccurate.

- Supporting evidence: Attach any documents or proof that back your claim, such as bank statements or transaction records.

- Desired resolution: Explain how you want the error to be corrected or clarified.

When to Take Action

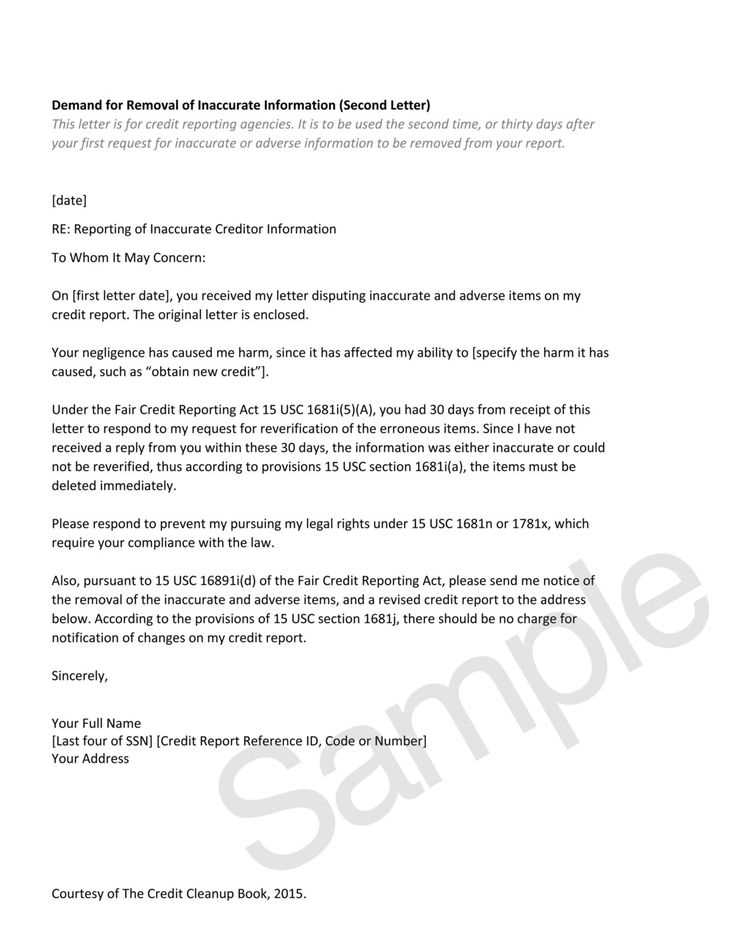

If you spot an error, it’s crucial to act swiftly. Delaying can result in continued negative impacts on your financial standing. Send the request promptly after identifying the issue to minimize further complications.

How to Tailor the Request

Each situation is unique, so it’s important to customize your communication based on the specific error you’re addressing. Adjust the language and details to make your case as clear as possible. A personalized approach increases the likelihood of a favorable outcome.

Avoiding Common Mistakes

While addressing financial errors, it’s important to avoid certain pitfalls:

- Being vague: Avoid general statements and provide specific details to back your claim.

- Using aggressive language: Keep the tone polite and professional, as this can foster a more positive response.

- Failing to follow up: After submitting your request, follow up regularly to ensure progress is being made.

Why It’s Worth Using This Approach

Utilizing a formal request not only helps correct inaccuracies but also demonstrates your commitment to maintaining a healthy financial profile. By taking the proper steps, you can ensure that your records are accurate and reflect your true financial standing.

Understanding Financial Record Correction Requests

Inaccuracies in your financial documents can negatively affect your overall financial health. Correcting these errors requires a clear, structured approach to ensure the issue is resolved promptly and effectively. This section provides guidance on the necessary steps to take when requesting changes to your records, and how to do so in a way that increases your chances of a successful outcome.

Key Information to Include in Your Request

When drafting a formal request for correction, it’s essential to provide the following details:

- Personal Information: Include your full name, contact details, and any relevant account or identification numbers.

- Issue Description: Clearly explain what the error is, providing as much context and detail as necessary.

- Supporting Documentation: Attach any records, statements, or other evidence that support your claim of the error.

- Desired Outcome: Specify how you would like the mistake to be addressed or corrected.

When to Take Action

It’s crucial to act quickly after identifying an error in your financial documents. Addressing the issue without delay helps prevent further complications, such as continued reporting of incorrect data. Prompt action increases your chances of having the mistake rectified swiftly.

By customizing your request to suit your specific situation, you can present a compelling case. Tailoring the content ensures that the recipient understands the nature of the error and why it needs to be corrected, facilitating a smoother process.

Avoiding Common Errors

To improve the chances of your request being processed correctly, be sure to avoid these common pitfalls:

- Vague Language: Be specific in your description of the issue. Generalities can lead to confusion and delays.

- Aggressive Tone: Keep your tone polite and professional. An aggressive approach may negatively impact the response.

- Failure to Follow Up: After sending the request, follow up regularly to ensure that progress is being made toward resolution.

Using a well-structured approach, such as a formal correction request, can significantly enhance the likelihood of getting your financial records amended. This process not only ensures accuracy but also demonstrates your proactive approach to maintaining your financial standing.