Template for Validation Letter to Collection Agency

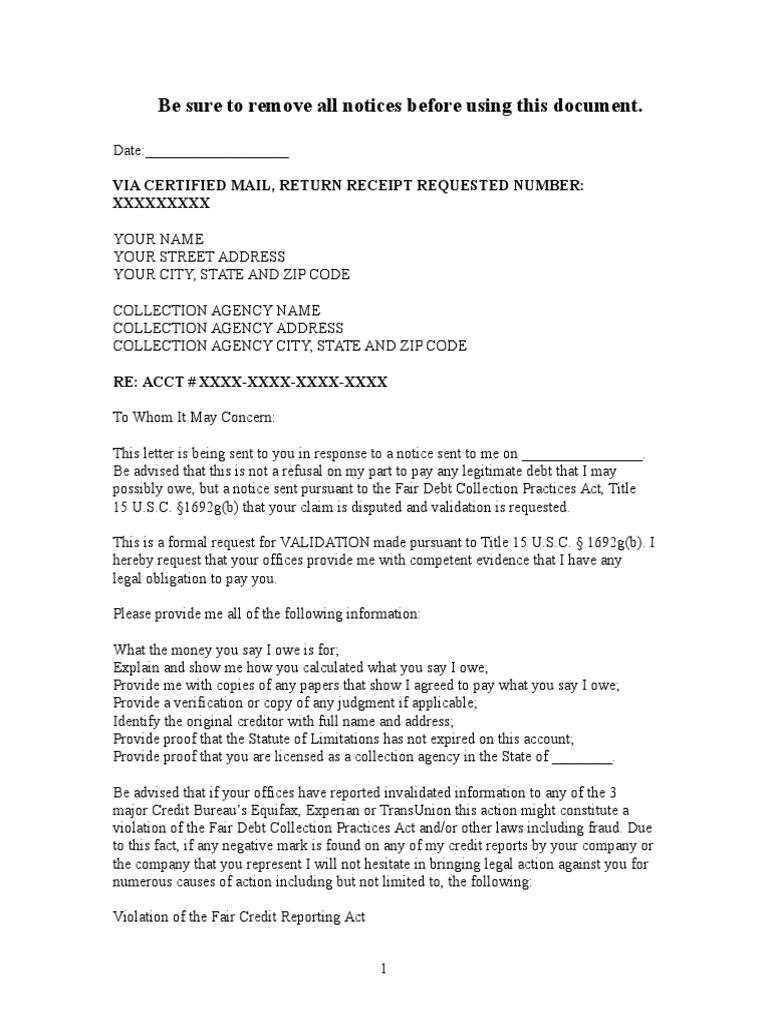

When faced with a request for payment from a third-party creditor, it is crucial to ensure that all communications are clear, precise, and legally sound. The process of addressing such claims involves offering a formal response that confirms your awareness of the issue while asserting your rights under the law.

This form of correspondence is essential for anyone seeking to resolve disputes, clarify misunderstandings, or challenge the legitimacy of claims. Writing such a response requires a structured approach to make sure all necessary information is included and that the document is in line with your legal entitlements.

By following a set structure, you can safeguard your interests and prevent unwanted actions from creditors. This type of communication can also serve as a formal request for verification of the debt, giving you the chance to confirm details before moving forward with any payment obligations.

Understanding the Validation Letter Process

The process of responding to a debt claim involves taking the proper steps to verify its authenticity and ensure that your rights are protected. The primary goal is to gather accurate information about the demand and confirm whether the amount requested is valid and legally enforceable. A well-crafted response serves as a formal method to request additional details or challenge the legitimacy of the claim.

Why It’s Crucial to Respond

Failing to address such requests can lead to misunderstandings or actions that may not be in your best interest. Responding in a timely and structured manner helps to clarify your position and opens the door for further dialogue, should the need arise. It also prevents potential issues such as incorrect entries in your financial records or the possibility of unwarranted actions being taken against you.

Key Considerations When Sending a Response

When preparing a formal response, it’s important to include relevant information and keep the tone professional. This not only ensures clarity but also creates a solid foundation for any future discussions or disputes. Knowing what details to request and how to phrase them can make a significant difference in how your concerns are addressed and whether you can resolve the matter effectively.

Importance of Communication with Debt Collectors

Maintaining clear and transparent communication with third-party creditors is essential when addressing any financial disputes or requests. Open dialogue helps to clarify any confusion surrounding claims, allowing for a smoother resolution process. It ensures that both parties are on the same page and that your rights are respected throughout the interaction.

By engaging in this process, you create an opportunity to verify the legitimacy of the claim, discuss payment options, or negotiate terms. Without this form of communication, misunderstandings can arise, potentially leading to further complications. Proactively addressing such matters can also prevent unnecessary stress and protect your financial standing from being negatively affected by incorrect information.

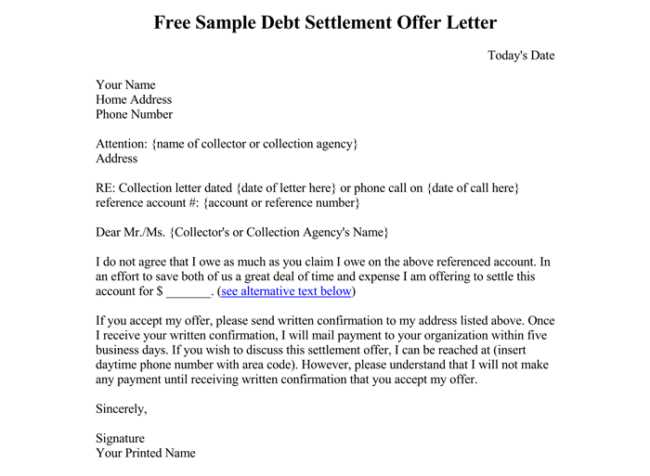

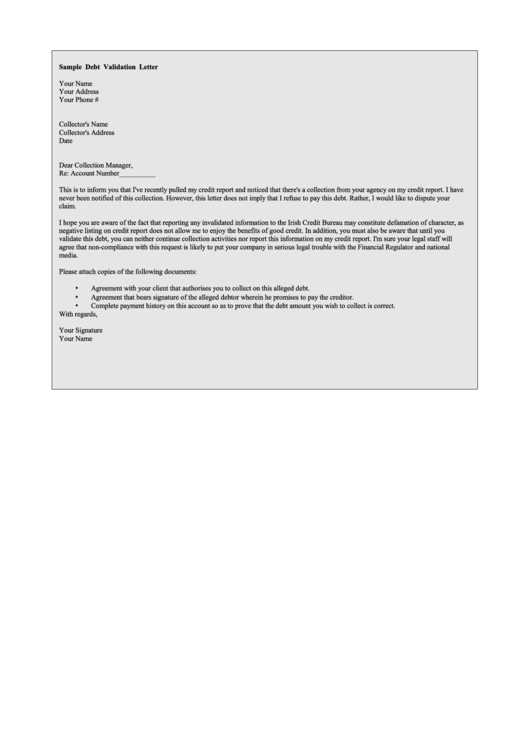

How to Craft a Response to a Debt Request

When addressing a financial claim, it’s important to prepare a structured response that clearly communicates your intentions and seeks necessary information. A well-constructed reply ensures that all required details are covered while maintaining professionalism and clarity. By following the right steps, you can effectively protect your rights and ensure that the claim is properly verified before taking any further action.

Essential Components to Include

A response should be carefully drafted, covering all necessary points. Here are the key elements to consider:

- Your contact information – Clearly state your full name, address, and any other relevant identification details.

- Details of the claim – Include information such as the amount requested and the creditor’s name.

- Request for verification – Politely ask for documentation that proves the validity of the claim.

- Statement of your intentions – Indicate that you are addressing the issue in good faith and are willing to discuss further.

Maintaining Professional Tone

It’s important to keep the tone of your response respectful and professional. Avoid aggressive language or threats, as this may complicate the situation further. A clear and polite approach can foster better communication and increase the likelihood of a favorable resolution.

Key Elements to Include in the Response

When crafting a formal response to a debt request, it’s important to ensure that all critical details are clearly presented. Including the right information not only helps clarify your position but also ensures that your request is taken seriously. A well-structured reply addresses the key points necessary for validating the claim and protecting your legal rights.

Critical Information to Mention

Here are the essential elements that should be part of your response:

- Your personal information – Ensure that your full name, address, and any relevant identification details are provided.

- Claim details – Include information such as the amount of the debt and the name of the creditor.

- Request for documentation – Politely ask for supporting documentation to verify the validity of the debt.

- Clear statement of intent – Indicate that you are addressing the matter seriously and are open to further dialogue.

Providing Clarity and Transparency

Each part of the response should be written clearly and without ambiguity. Being specific about what you are requesting helps avoid unnecessary confusion and speeds up the process of resolving the issue. Clear communication shows that you are serious about protecting your rights and resolving any potential discrepancies efficiently.

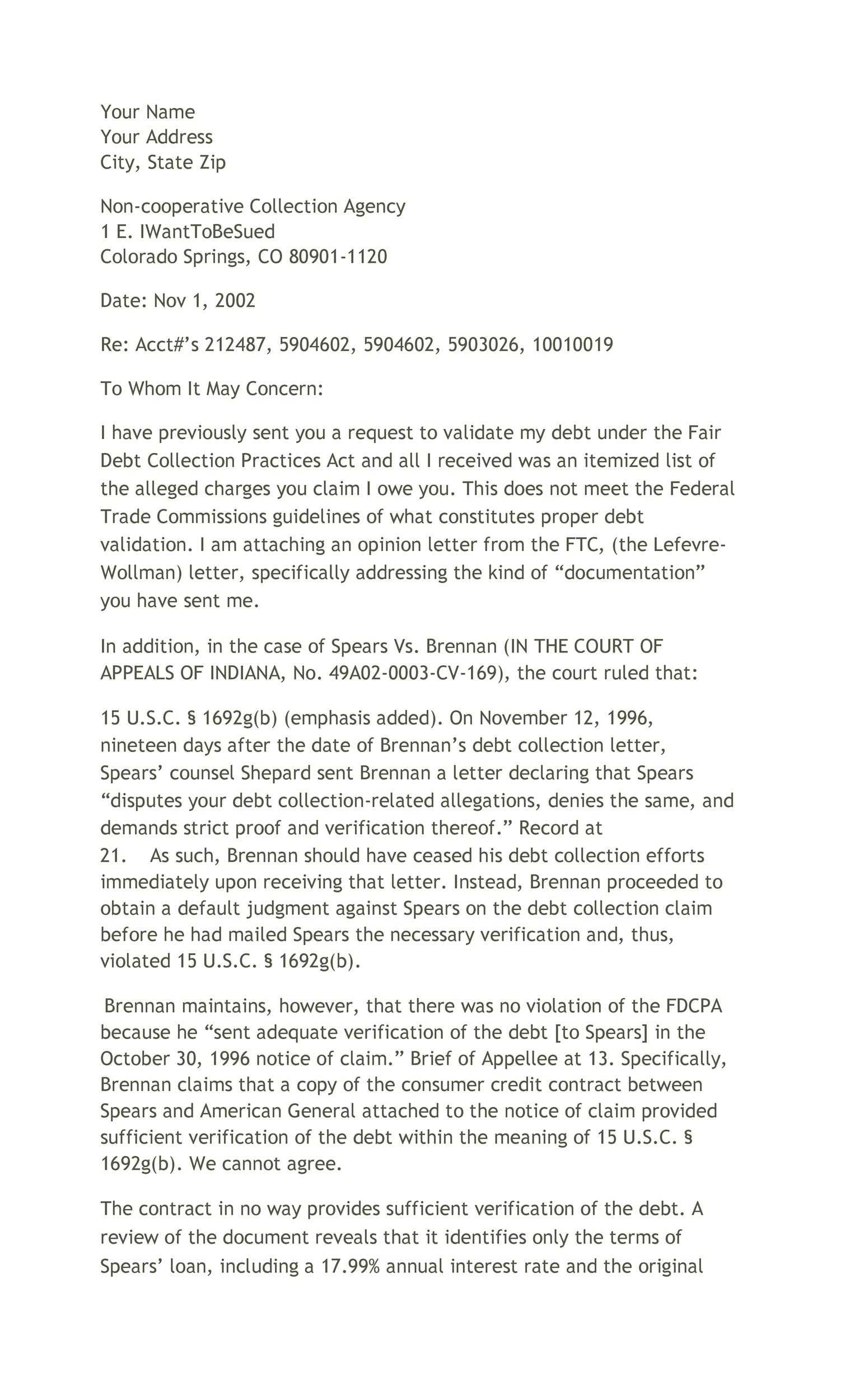

Ensuring Legal Protection Through Verification

When dealing with financial claims, ensuring your legal rights are protected is crucial. Requesting proper documentation and verifying the details of any outstanding debts not only safeguards you from potential errors but also helps avoid unjust demands. Taking these steps demonstrates that you are aware of your rights and are prepared to defend them if necessary.

Legal Rights in the Debt Process

Understanding your rights is essential for ensuring that you are not taken advantage of. Different laws and regulations exist to protect consumers, allowing you to request proof of any claimed debt. Here’s a quick look at some key protections you may have under the law:

| Protection | Description |

|---|---|

| Right to Request Documentation | You are entitled to ask for proof that the debt exists and that the creditor has the legal right to collect it. |

| Right to Dispute Debt | If you believe the claim is incorrect, you can dispute it and request further investigation. |

| Protection from Harassment | Debt collectors are prohibited from using aggressive tactics, such as threatening calls or abusive language. |

Steps to Safeguard Yourself

By requesting verification, you are taking proactive steps to protect yourself. You ensure that the claim is legitimate and avoid making payments that you may not be responsible for. This process helps keep your financial records accurate and prevents future complications.

Common Mistakes to Avoid When Writing

When responding to a financial claim, it’s essential to be clear, concise, and precise. Making mistakes in your response can delay the process or even worsen the situation. To ensure your communication is effective, it’s important to avoid common errors that could undermine your position.

One common mistake is failing to include all necessary details, such as your contact information or the specifics of the claim. Without these, your request may be disregarded or ignored. Another issue is using an aggressive or confrontational tone, which can lead to unnecessary conflict and complicate negotiations.

Additionally, being vague in your request for verification can result in insufficient proof being provided. It’s important to ask for clear and specific documentation. Lastly, not following up after sending your response can leave the matter unresolved, causing further complications down the line.