How to Use a Deduction Letter Template for Effective Communication

In situations where you need to address financial modifications or corrections with an organization, having a clear and structured format for your communication is essential. Whether you are negotiating tax reductions, disputing charges, or requesting a revision of an account balance, a properly crafted message can make all the difference. Below is a guide on how to approach such communications effectively.

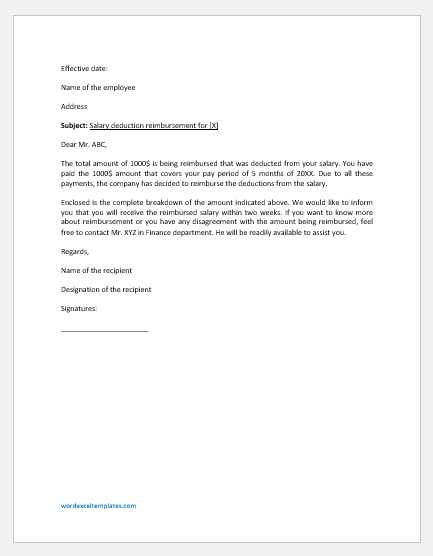

Key Elements of an Effective Request

When composing a formal communication regarding financial matters, certain components are crucial for clarity and professionalism. These include:

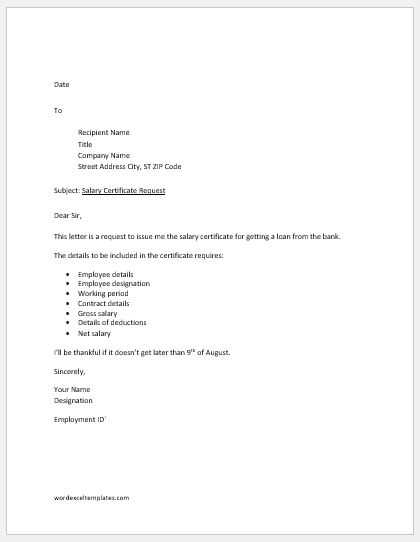

- Subject line or heading: This should clearly indicate the nature of your communication.

- Introduction: Provide a brief explanation of why you are reaching out, including relevant account details or reference numbers.

- Detailed explanation: Outline the adjustments you seek, ensuring to support your request with any pertinent evidence or figures.

- Closing: Politely express your expectation for a timely response and provide your contact details for further clarification.

How to Adapt Your Communication for Different Situations

While the general structure remains consistent, the tone and specifics will change depending on the context. For example:

- Tax-related issues: Be sure to reference specific forms, periods, or tax codes relevant to your situation.

- Financial disputes: Include supporting documents, such as receipts or transaction records, to substantiate your claim.

- Account adjustments: Clearly explain the error and how you would like the situation rectified, being as precise as possible.

Best Practices for Clarity and Precision

To ensure that your request is taken seriously and processed swiftly, consider the following tips:

- Be concise: Avoid unnecessary details that could cloud your main point.

- Proofread: Check for grammar or spelling mistakes that could undermine your professionalism.

- Use clear formatting: Break your message into sections to make it easier to read and follow.

By following these guidelines, you can increase the chances of your financial request being understood and acted upon quickly and efficiently.

Understanding the Purpose of a Formal Request for Financial Adjustments

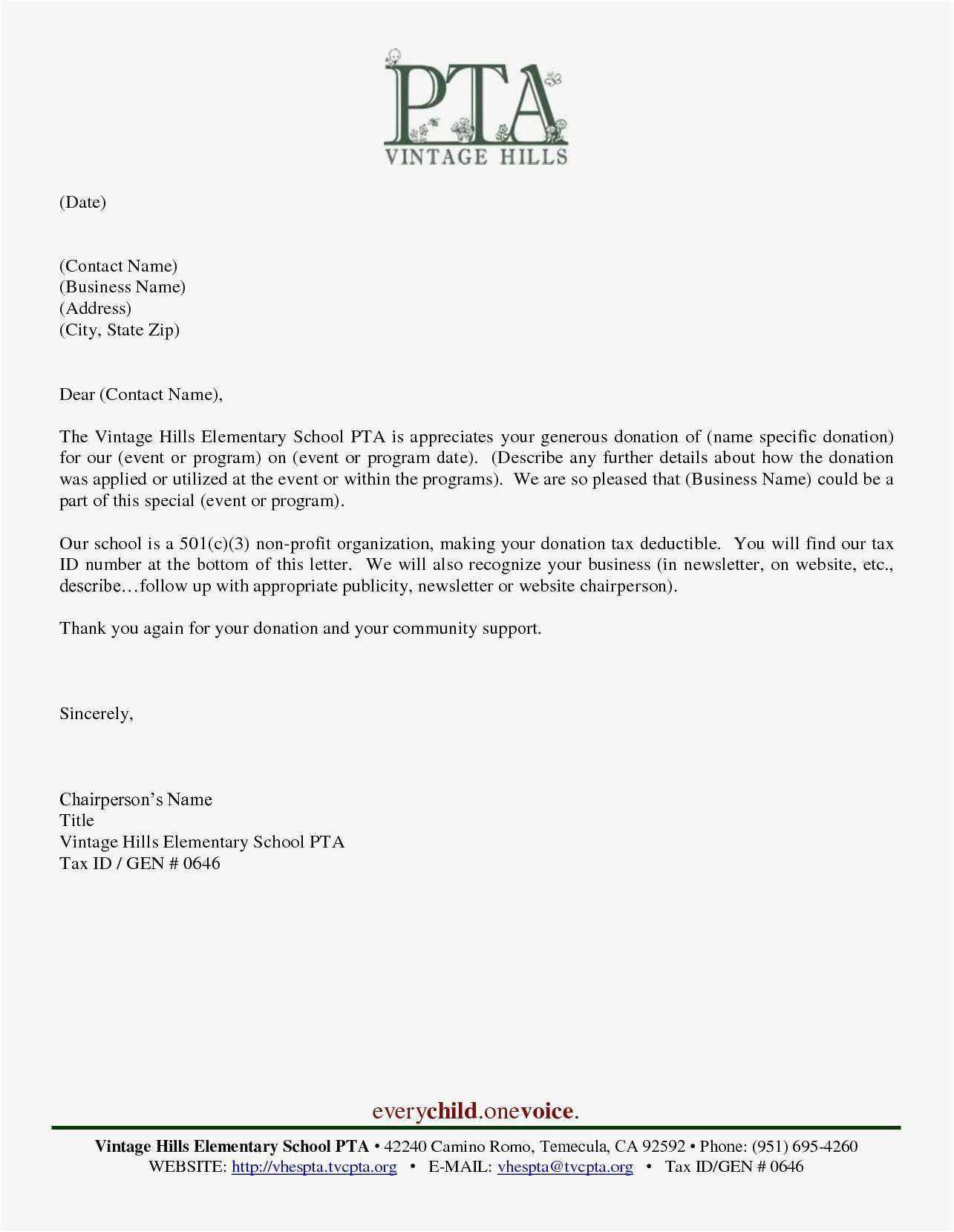

When communicating with an institution about modifying or reviewing financial matters, having a structured approach is essential. Such messages serve as formal requests, allowing individuals to clearly express their intentions, outline the desired changes, and ensure that all necessary steps are followed. Crafting this communication accurately is crucial for a positive response and resolution.

When to Use a Structured Communication Format

Using a pre-designed format becomes necessary in specific situations where clarity and professionalism are key. For example, if you are seeking a tax reduction, disputing an overcharge, or requesting changes to your account, having a consistent method for drafting your message ensures all critical points are covered. This helps save time and reduces the risk of important details being overlooked.

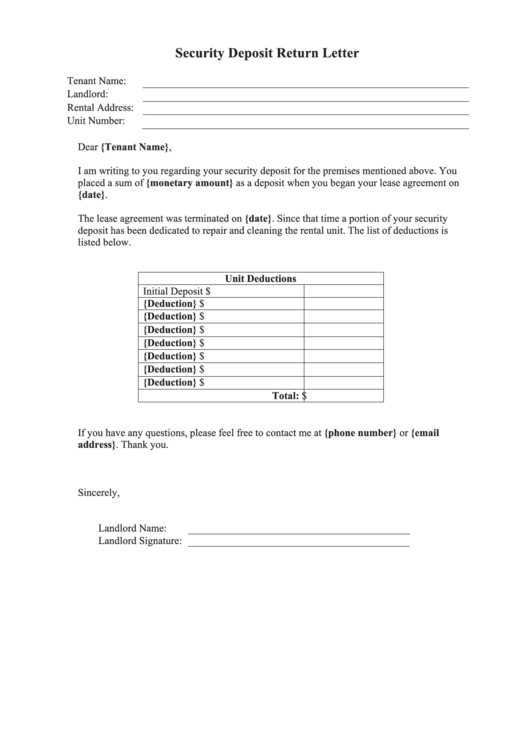

Essential Components of a Financial Adjustment Request

A well-structured request should always include several key components to ensure its effectiveness. These are:

- Introduction: Clearly state your purpose and provide necessary details such as account number or reference codes.

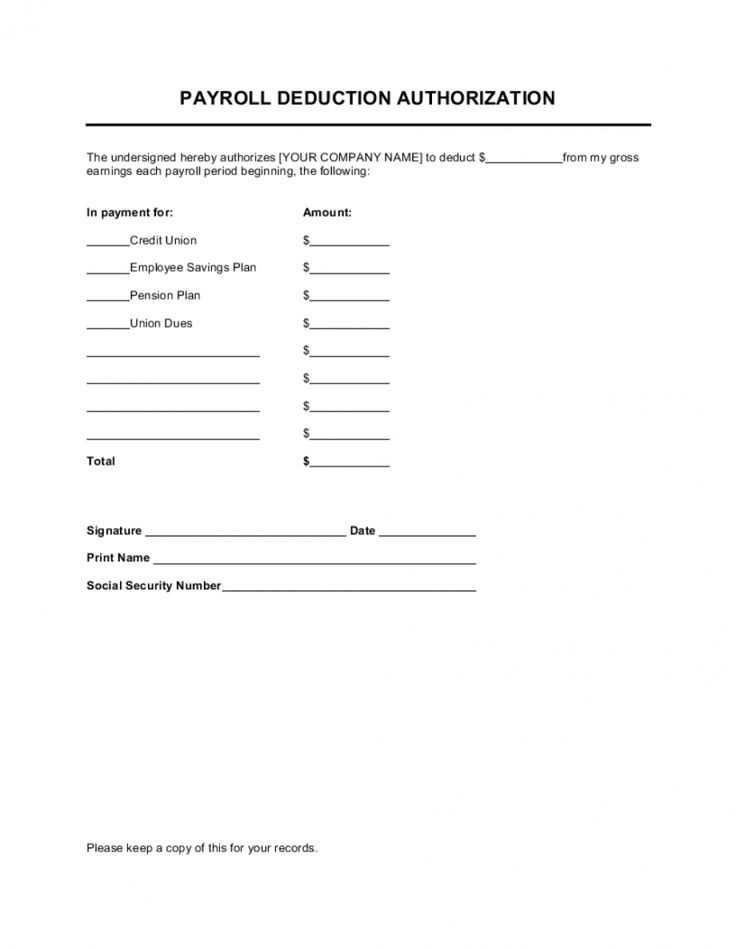

- Explanation: Describe the specific change you are requesting and support it with relevant information or documentation.

- Conclusion: Politely ask for the requested adjustment, offering your contact details for further communication if needed.

By following these steps, you ensure that your request is both clear and persuasive, increasing the likelihood of a favorable outcome.

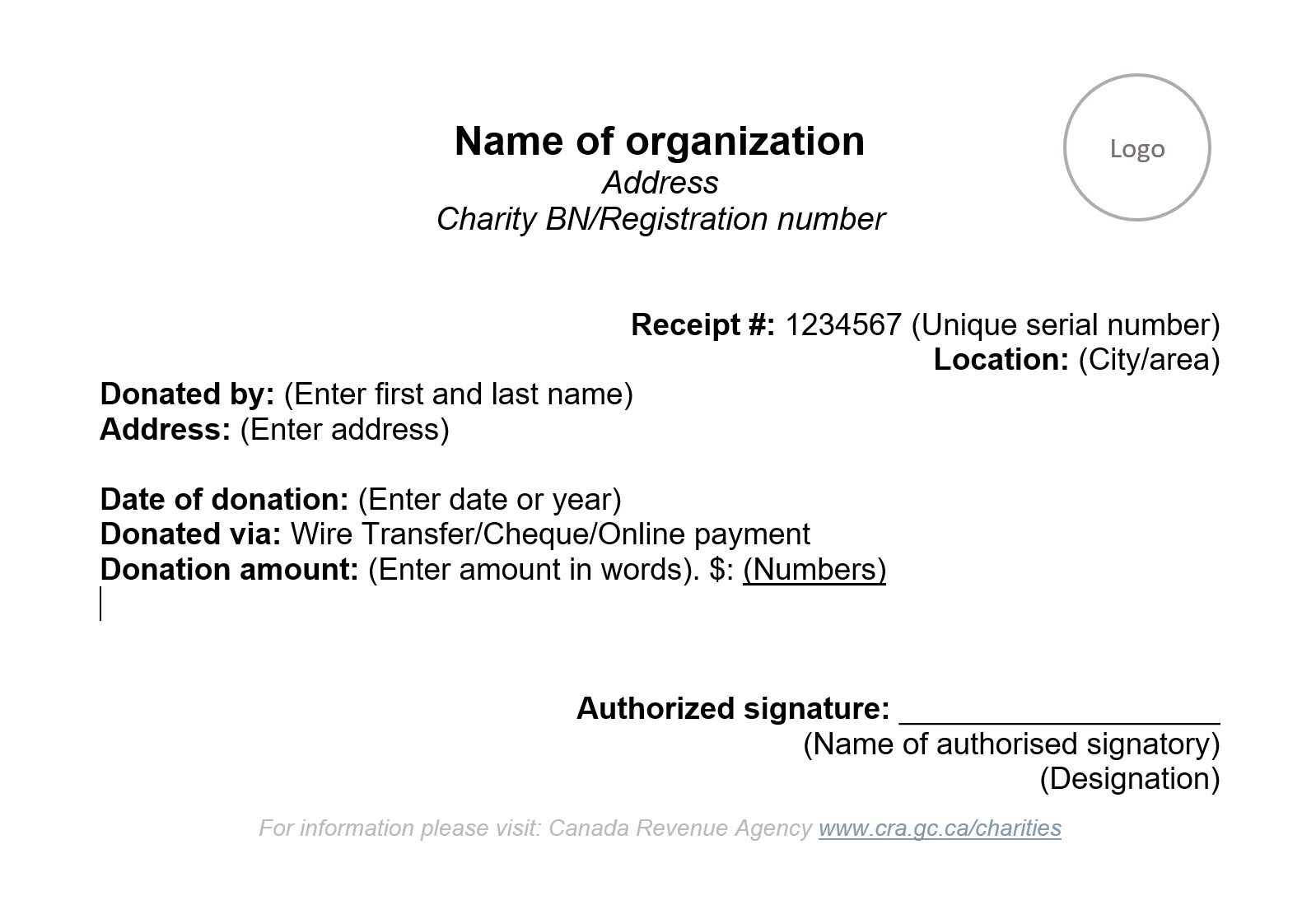

How to Tailor Your Request for Different Scenarios

While the general structure remains the same, it’s essential to adjust your message depending on the context. Whether you’re addressing a tax issue, disputing a charge, or seeking an account update, make sure to include the relevant specifics. The more precise and organized your request, the easier it will be for the recipient to understand and process.

Common Mistakes to Avoid: Failing to include necessary details, using a vague tone, or leaving out supporting evidence can significantly weaken your communication. Always check for these issues before submitting your request to ensure it is as effective as possible.

Advantages of Using a Pre-Formatted Structure: A ready-made structure allows you to save time and avoid unnecessary revisions. It also helps ensure that you never forget to include any important elements, thus making the process smoother and more efficient.