Debt Lawsuit Settlement Letter Template Guide

When facing a legal or financial disagreement, it’s essential to approach the matter with clarity and professionalism. Crafting a well-structured communication can help resolve issues efficiently while protecting your interests. Properly addressing the situation with the right tone and detail ensures that both parties have a clear understanding of the terms and conditions moving forward.

Writing a formal agreement in these situations requires careful attention to both content and structure. The goal is to present your position clearly, outlining proposed terms in a way that encourages negotiation and a mutually beneficial outcome. Being precise and concise in your approach can significantly improve the chances of reaching an amicable resolution.

In this article, we will explore the key elements that make up an effective communication in such matters, providing you with the tools and guidance to draft a document that addresses the necessary details without overwhelming the recipient. Whether you are a business owner, individual, or legal representative, understanding how to compose such important documents is crucial to navigating financial disputes successfully.

Understanding Legal Resolution Process

When disputes arise over unpaid financial obligations, both parties often seek a way to resolve the matter without the need for prolonged litigation. This process involves negotiation, where one party proposes terms that allow for a resolution, typically involving a reduction in the owed amount or a flexible payment plan. The goal is to reach an agreement that benefits both sides and avoids the complexity and cost of court proceedings.

Stages of the Negotiation Process

The resolution process typically begins with one party making an offer, outlining the terms they believe will resolve the issue. The other party then reviews the proposal and may counter with adjustments to the terms. This back-and-forth continues until both sides agree on the final conditions, at which point they formalize the agreement in writing. It’s important that both parties fully understand the terms before agreeing to ensure that the solution is mutually acceptable.

Benefits of Reaching an Agreement

Opting for this approach rather than pursuing formal legal action can be advantageous for both parties. It allows for more control over the outcome and can save time and money. By agreeing on a resolution, the involved individuals or businesses can avoid court fees and potentially harmful legal proceedings. Furthermore, reaching an amicable agreement often fosters a more cooperative relationship between the parties, which may be beneficial in future interactions.

When to Use a Formal Agreement Document

There are specific instances where drafting a formal document becomes crucial in resolving financial disagreements. This approach is often used when informal communication has not led to a resolution, or when both parties are ready to finalize the terms of an arrangement. Using this method ensures that the understanding between both parties is clear and legally recognized, minimizing the risk of further disputes.

Scenarios to Consider

Here are some common situations when a formal agreement may be necessary:

- When informal negotiations have stalled or failed.

- If there’s a need to document agreed-upon terms for future reference.

- When a payment plan or reduced amount is being proposed.

- If there’s a desire to avoid further legal complications.

- When both parties want a clear, binding understanding of the arrangement.

Why Use a Formal Document

Utilizing this formal approach serves several purposes:

- It provides legal protection by ensuring that both sides agree to the terms explicitly.

- It reduces ambiguity and clarifies each party’s responsibilities.

- It fosters trust by showing a commitment to honoring the agreement.

- It serves as a reference in case either party needs to revisit the terms.

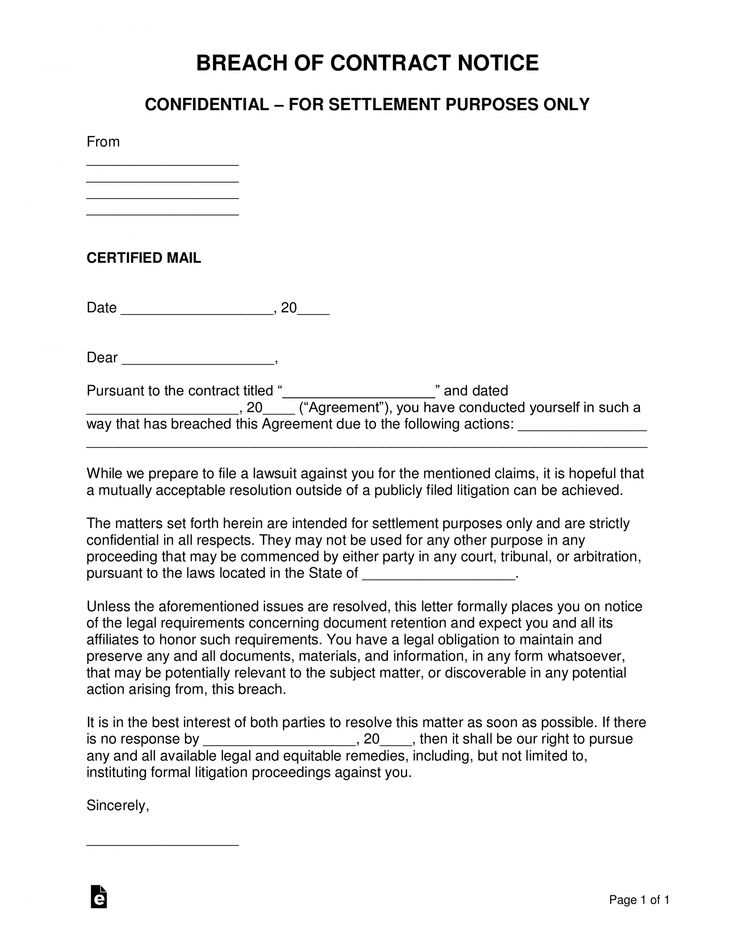

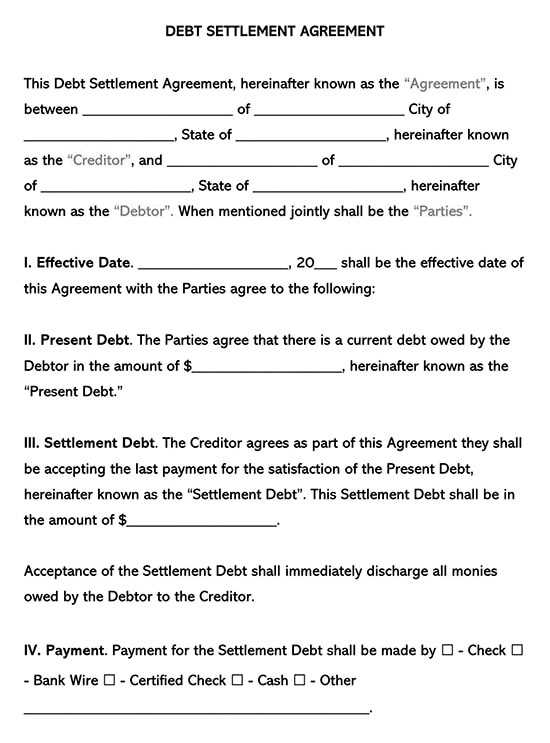

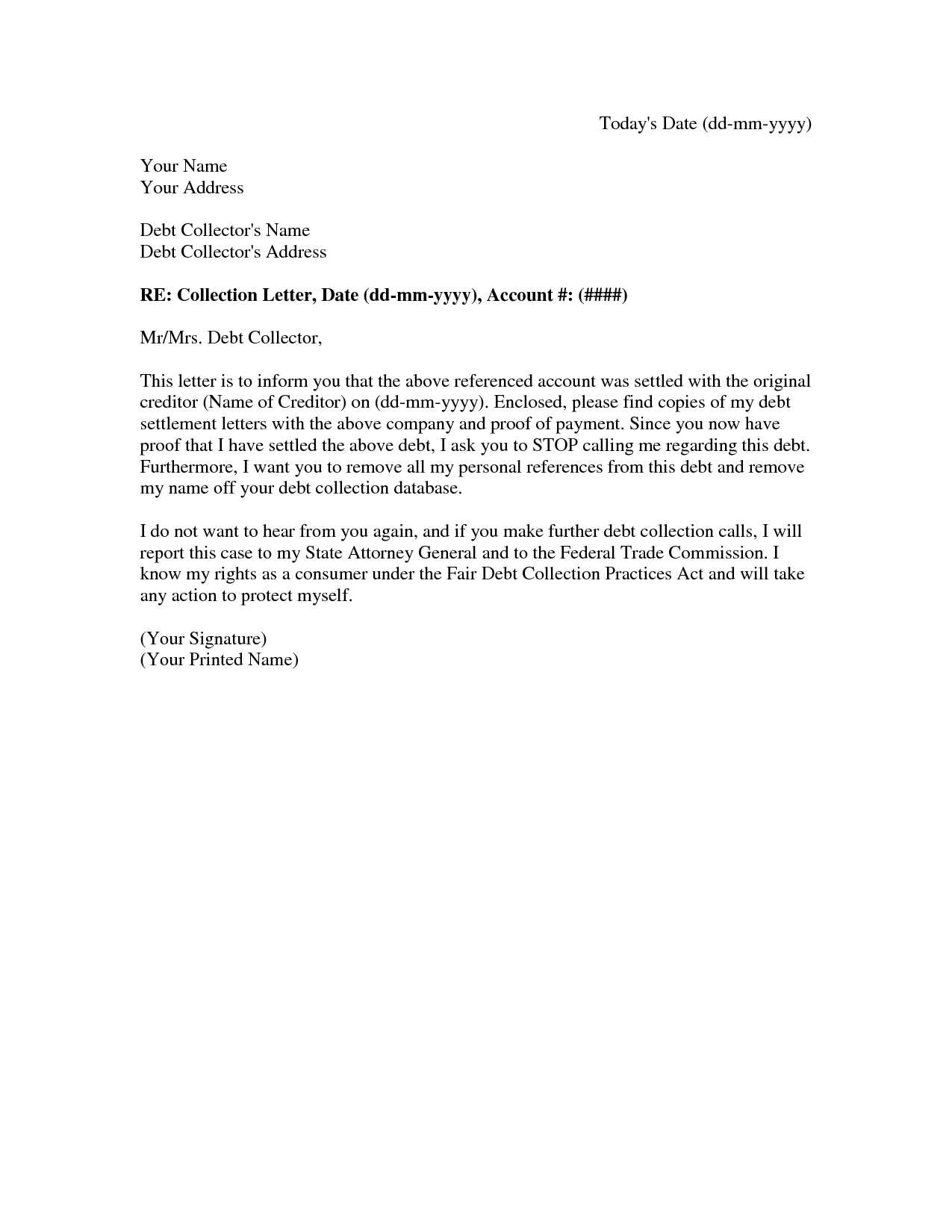

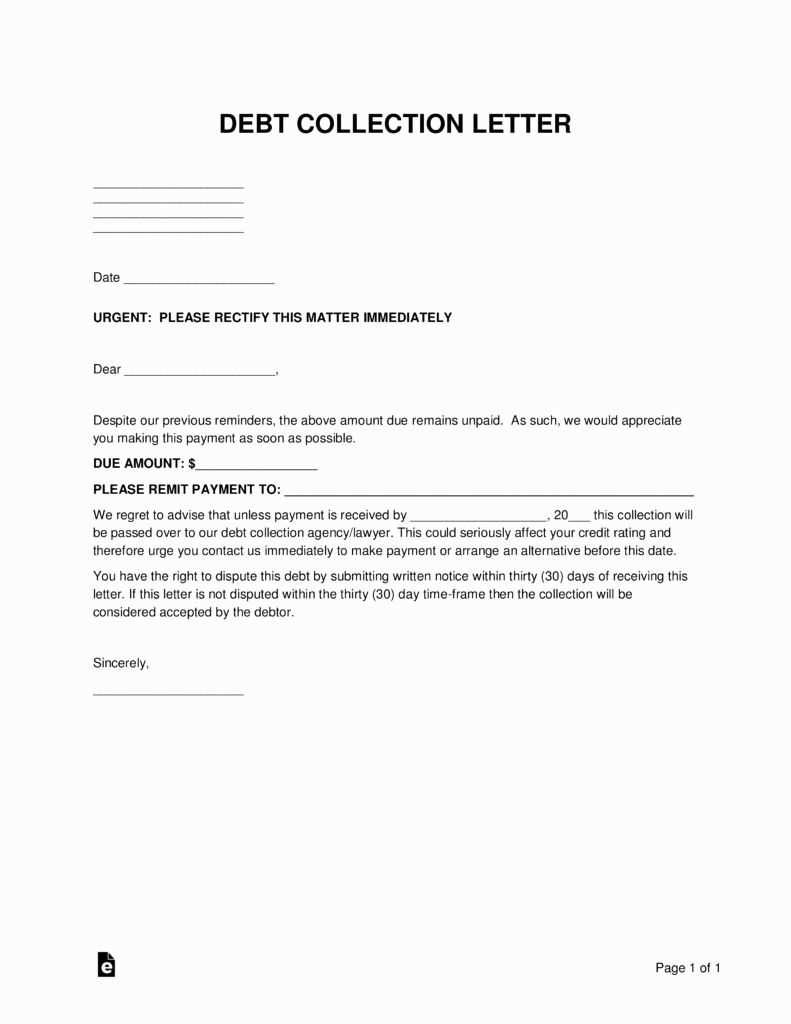

Key Components of a Financial Resolution Document

When drafting a formal document to resolve a financial dispute, it’s important to ensure that certain elements are clearly outlined. These components will help to establish a clear understanding between both parties, ensuring that the agreement is fair, enforceable, and specific. A well-structured communication includes necessary details about the terms of the arrangement, responsibilities, and any necessary timelines.

Essential Elements to Include

Every document should contain the following elements to be effective:

- Identification of Both Parties: Clearly state the names and contact information of all involved parties to avoid confusion.

- Description of the Issue: Provide a concise summary of the issue at hand, including the original agreement and the current situation.

- Proposed Terms: Outline the agreed-upon terms, such as the total amount to be paid, payment plan, or any other concessions made.

- Timeline for Payment or Actions: Specify the dates or timeframes in which payments or actions must be completed.

- Consequences of Breach: Indicate the steps that will be taken if the terms are not followed or the agreement is violated.

Additional Considerations

In some cases, it may also be important to include:

- Signatures: Both parties should sign the document to acknowledge their agreement.

- Witness Information: If applicable, include details of any witnesses who can verify the agreement.

- Legal Clauses: If necessary, consult with a legal professional to ensure that the document complies with local regulations.

How to Draft a Professional Document

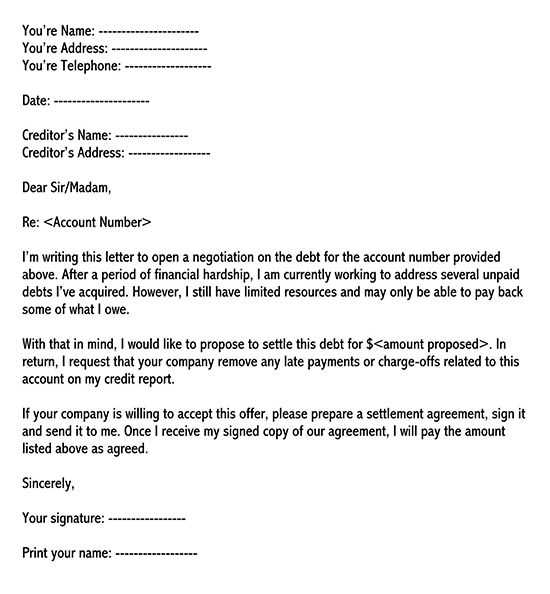

Writing a formal document to resolve a financial matter requires a clear and structured approach. It is important to communicate the key points in a way that is both respectful and professional, while ensuring that all necessary details are included. The tone should be neutral and assertive, focusing on the facts and proposed solutions.

Step-by-Step Approach

When creating such a document, follow these steps to ensure clarity and professionalism:

- Start with a Clear Introduction: Begin by stating the purpose of the communication and providing any relevant background information to give context.

- Use Clear, Concise Language: Avoid jargon or overly complex language. The document should be easy to understand by all parties involved.

- Focus on Solutions: Clearly outline your proposed resolution, ensuring that all terms are well-defined and actionable.

- Be Respectful: While assertive, maintain a respectful tone to foster positive communication and increase the likelihood of a successful resolution.

- Finish with a Call to Action: Conclude by suggesting a next step or requesting a response, allowing the recipient to take the appropriate action.

Common Mistakes to Avoid

To ensure your document is effective, avoid the following pitfalls:

- Overcomplicating the Message: Keep the content direct and to the point to prevent confusion.

- Leaving Out Important Details: Make sure all relevant information, such as timelines and amounts, is included.

- Using an Aggressive Tone: A confrontational tone can derail negotiations, so maintain a calm and objective approach.

Common Mistakes to Avoid in Documents

When drafting a formal communication to resolve a financial matter, several common mistakes can undermine the effectiveness of the document. These errors may lead to confusion, miscommunication, or even delays in resolving the issue. It is essential to pay attention to detail and ensure that the document is clear, concise, and professional in tone.

Errors in Structure and Clarity

Here are some common structural and clarity-related mistakes to avoid:

- Vague Language: Avoid using ambiguous terms or phrases that could be interpreted in different ways. Be specific about what is being proposed and agreed upon.

- Lack of Organization: Ensure the document is well-structured, with a logical flow. Start with an introduction, followed by key points, and conclude with actionable steps.

- Overly Complex Sentences: Keep sentences short and straightforward to avoid confusion. Avoid jargon or overly technical terms unless necessary.

- Omitting Important Details: Make sure to include all relevant information, such as timelines, amounts, and expectations, to avoid any misunderstandings.

Tone and Professionalism Issues

It’s also important to maintain the right tone and level of professionalism:

- Using an Aggressive or Confrontational Tone: Avoid sounding accusatory or overly emotional. A professional, respectful tone is key to fostering positive negotiations.

- Being Too Casual: While it’s important to be clear, ensure the document maintains a formal tone, as this will help convey seriousness and professionalism.

- Failing to Proofread: Always review the document for spelling or grammatical errors. A mistake-free document reflects well on you and shows your commitment to professionalism.

Negotiation Tips for Effective Settlements

When resolving financial disputes, negotiation plays a critical role in reaching a mutually agreeable solution. The ability to effectively negotiate can lead to favorable outcomes for both parties, ensuring that both sides are satisfied with the resolution. Here are some essential strategies to consider when engaging in such discussions.

To make the process smoother and more productive, understanding key negotiation tactics is crucial. Below are several tips that can help improve the likelihood of a successful resolution:

| Tip | Description |

|---|---|

| Know Your Goals | Clearly define your objectives before entering negotiations. Understand what you are willing to accept and what your bottom line is. |

| Remain Calm and Professional | Maintain a composed and respectful tone. Keep emotions in check to avoid escalating tensions during discussions. |

| Be Open to Compromise | Flexibility can help build rapport and encourage the other party to make concessions. Identify areas where you can give a little in exchange for more favorable terms. |

| Focus on Mutual Benefits | Highlight solutions that benefit both sides. This collaborative approach can lead to a more harmonious agreement and faster resolution. |

| Document Key Points | Make sure to write down key terms discussed during negotiations. This ensures both parties are on the same page and helps avoid misunderstandings later on. |

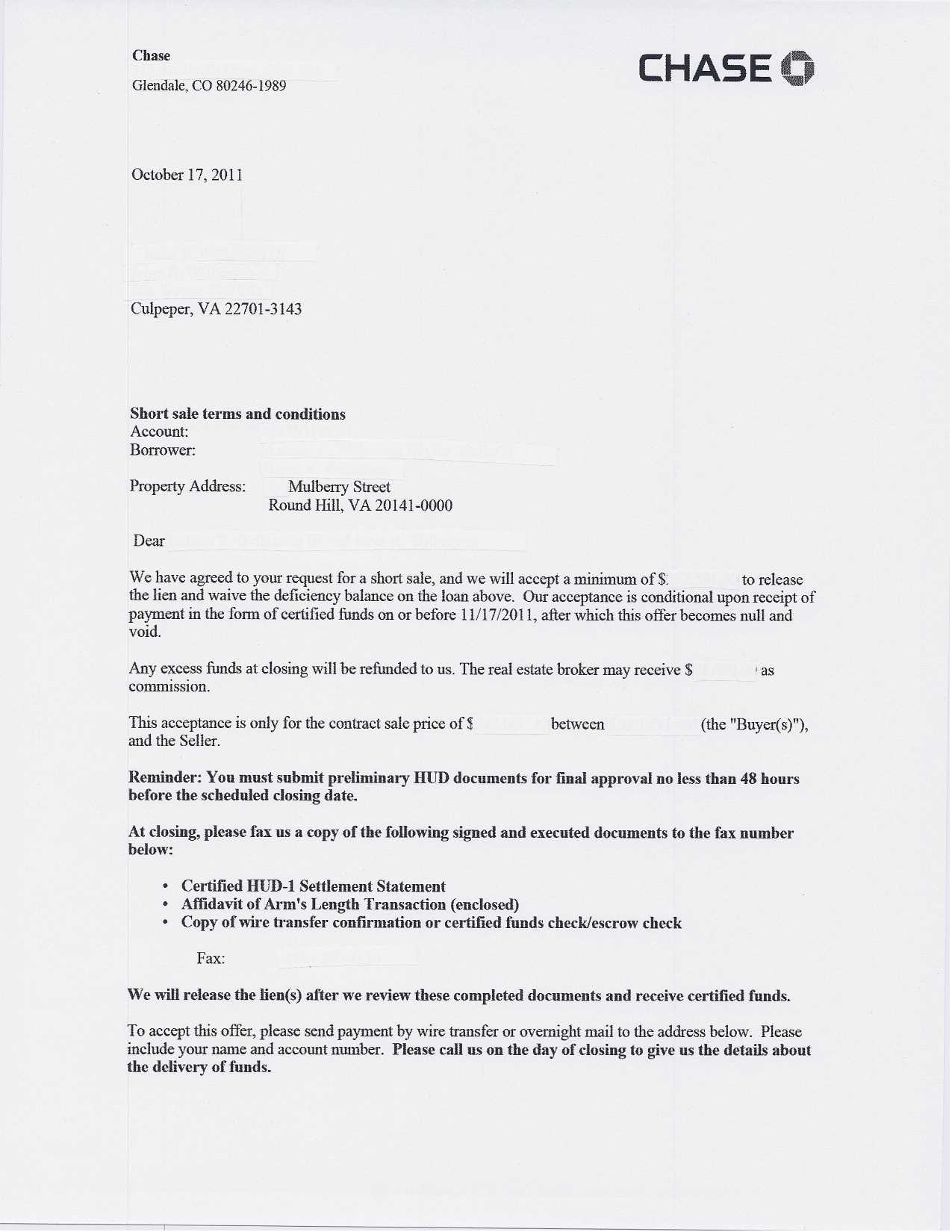

Finalizing the Agreement After Sending

Once you’ve sent your formal proposal to resolve a financial matter, the next crucial step is ensuring that the agreement is properly concluded. This phase involves confirming that all parties are on the same page and that the terms are understood and agreed upon. Properly finalizing the agreement ensures that both sides adhere to the terms set out in the correspondence, avoiding future disputes.

Here are some key steps to take when finalizing the deal:

- Follow-Up Communication: After sending the initial document, follow up with the recipient to confirm receipt and discuss any potential concerns or adjustments. This ensures clarity and prevents misunderstandings.

- Review the Terms: Both parties should carefully review the proposed terms one last time before making any commitments. Ensure all the important details, such as timelines and payment amounts, are correctly included.

- Formal Agreement: Once both sides are satisfied with the terms, it’s important to formalize the arrangement. This could involve signing a final document or creating a written confirmation outlining the agreed-upon points.

- Document Everything: Keep a record of all communications and the final agreement. Having a written record ensures that there’s proof of the agreement in case any issues arise in the future.

- Implementation: Once everything is agreed upon, begin implementing the terms as soon as possible. This ensures the process is completed in a timely manner and helps prevent further complications.