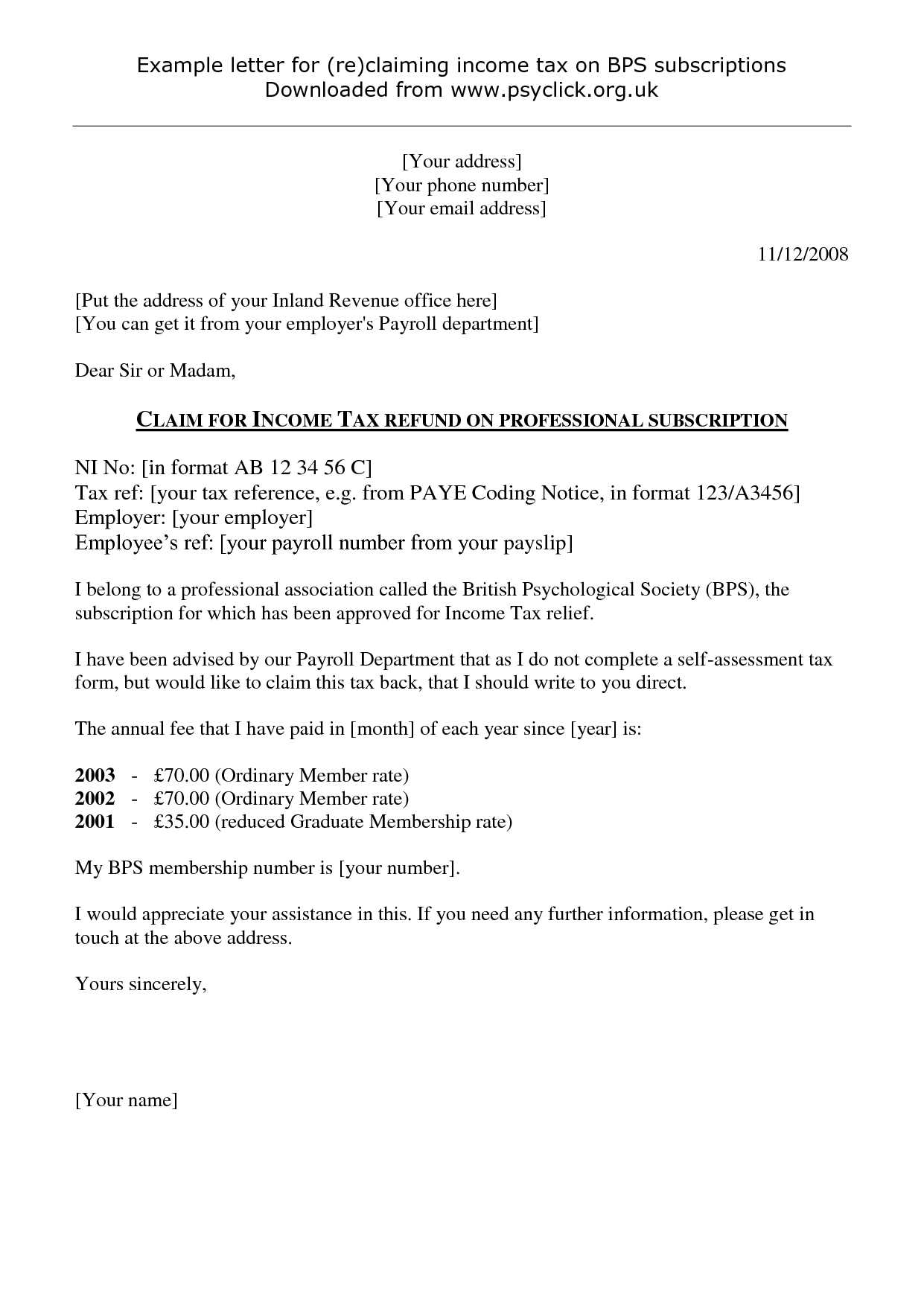

IRS Protest Letter Template for Tax Disputes

When facing an unfavorable decision from the tax authority, it’s important to express your disagreement formally. A well-crafted document can help clarify your position and potentially lead to a favorable resolution. Understanding the structure of such a response is crucial for ensuring its effectiveness.

Essential Elements of a Dispute Response

A properly composed response should include specific sections to ensure it meets the requirements of the tax office. The following elements should always be present:

- Introduction: Clearly state the reason for writing and the decision you’re challenging.

- Detailed Explanation: Provide a thorough explanation of the disagreement, backed by relevant facts.

- Request for Action: Indicate the desired outcome, such as a reevaluation or reconsideration of the decision.

Common Pitfalls to Avoid

While crafting your response, avoid common mistakes that could hinder the process:

- Lack of Clarity: Be specific about the issue and your position to prevent misunderstandings.

- Omission of Supporting Documents: Always attach relevant evidence that can substantiate your claim.

- Failure to Follow Instructions: Ensure the submission method and deadlines are adhered to precisely.

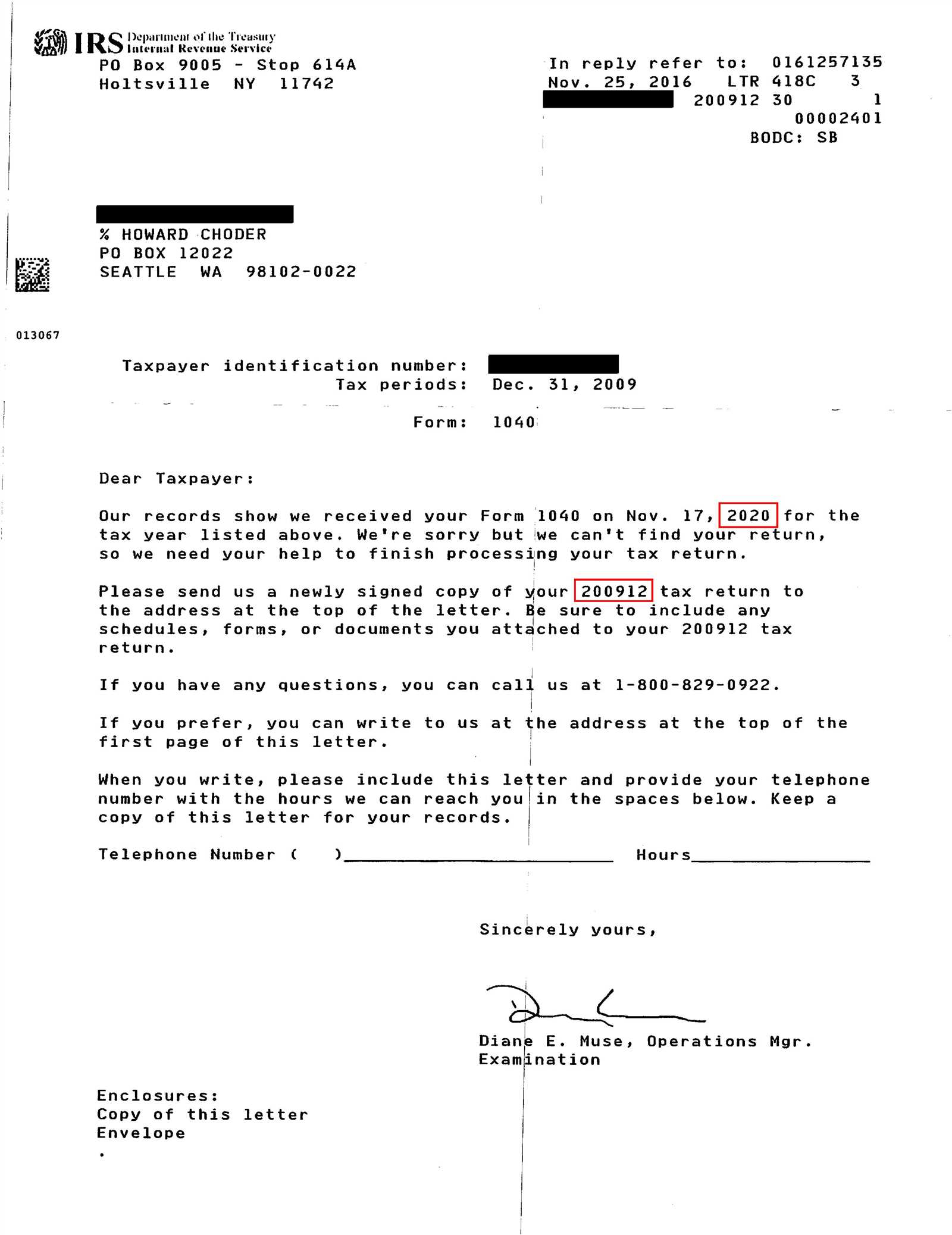

How to Submit Your Response

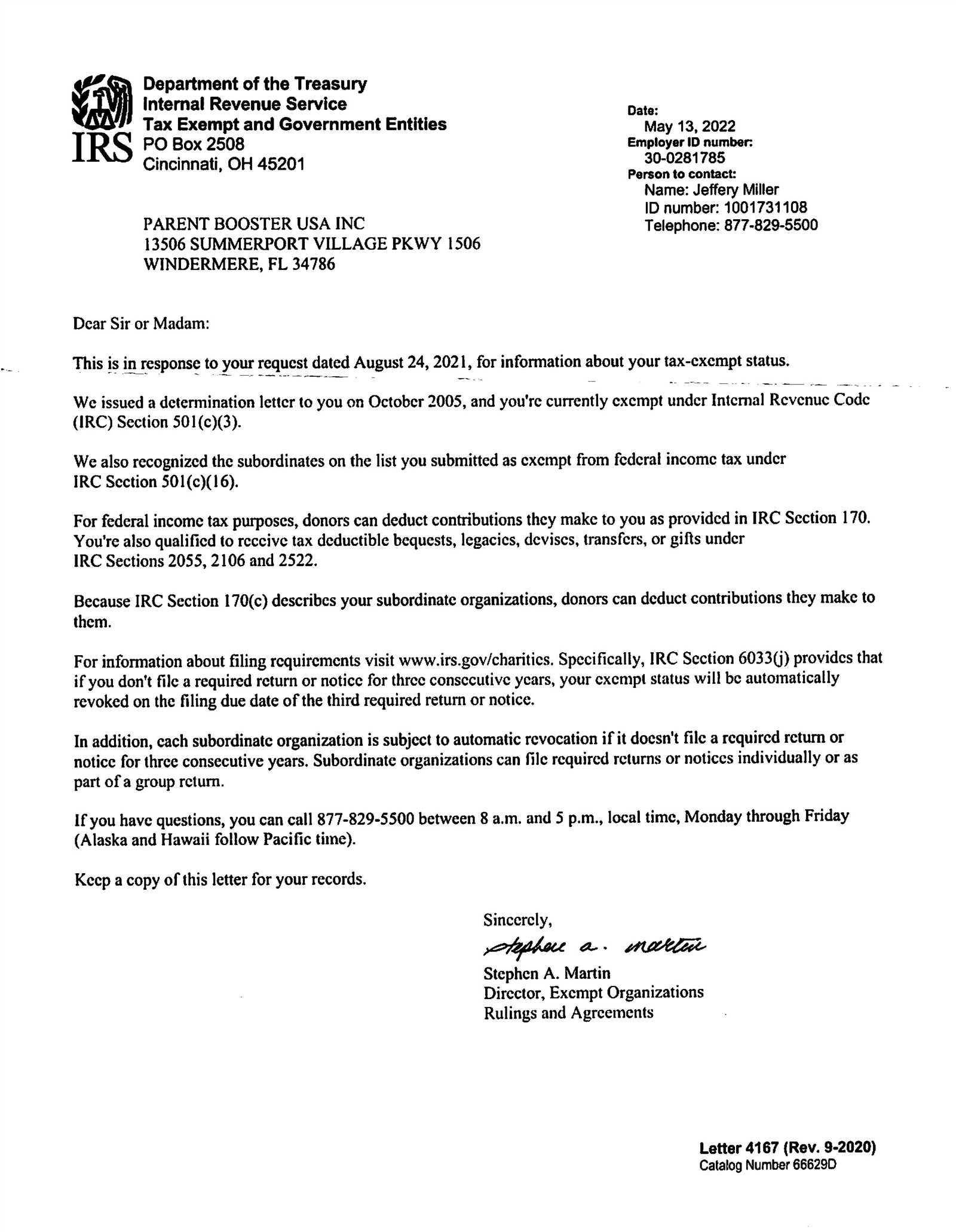

After completing your response, submit it in accordance with the specified guidelines. Be sure to keep a copy of all correspondence for your records. Double-check that your submission reaches the correct department and within the required timeframe.

What Happens Next

Once the response is received, the tax office will review it and may take further action based on the information provided. Be prepared to follow up or provide additional documentation if requested. Patience and persistence are key during this process.

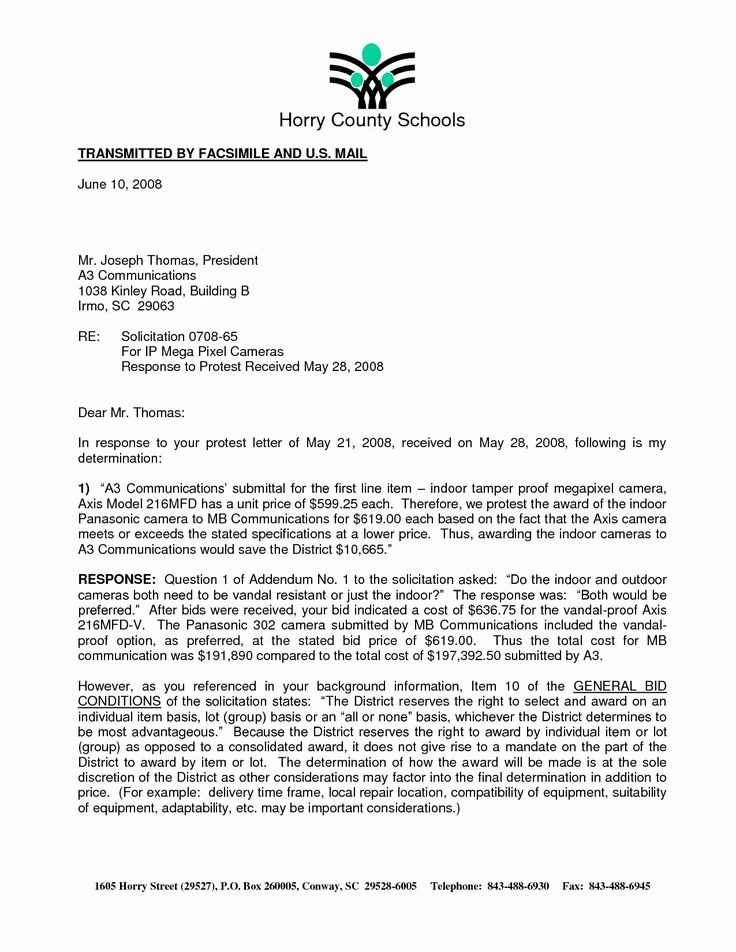

How to Write an Effective Response for Dispute

When you disagree with a tax decision, crafting a well-structured and clear response is essential. This document serves as an official request for reconsideration, providing a chance to present your case in a professional manner. A strong submission can significantly increase your chances of a positive outcome.

Key Components of a Successful Appeal

A comprehensive appeal should be organized and direct. Here are the core elements to include:

- Clear Introduction: Begin by stating the reason for your response and the specific decision you’re challenging.

- Detailed Justification: Offer a thorough explanation, including relevant facts and any supporting evidence.

- Desired Resolution: Clearly articulate what you seek, such as a reevaluation of the decision or a correction of any errors.

Avoiding Common Mistakes

When preparing your submission, be mindful of frequent errors that can undermine its effectiveness:

- Vague Explanations: Ensure that your statements are precise, leaving no room for ambiguity.

- Missing Documentation: Attach all necessary documents that reinforce your claim and demonstrate your position.

- Non-compliance with Guidelines: Always adhere to the submission rules, including format and deadlines.

Proper formatting plays a crucial role in presenting a clear and professional case. Double-check that the document adheres to the required structure to avoid unnecessary delays. Once submitted, monitor for any updates or requests for additional information. Staying proactive will help you navigate the process efficiently.