Letter to Close Bank Account Template Guide

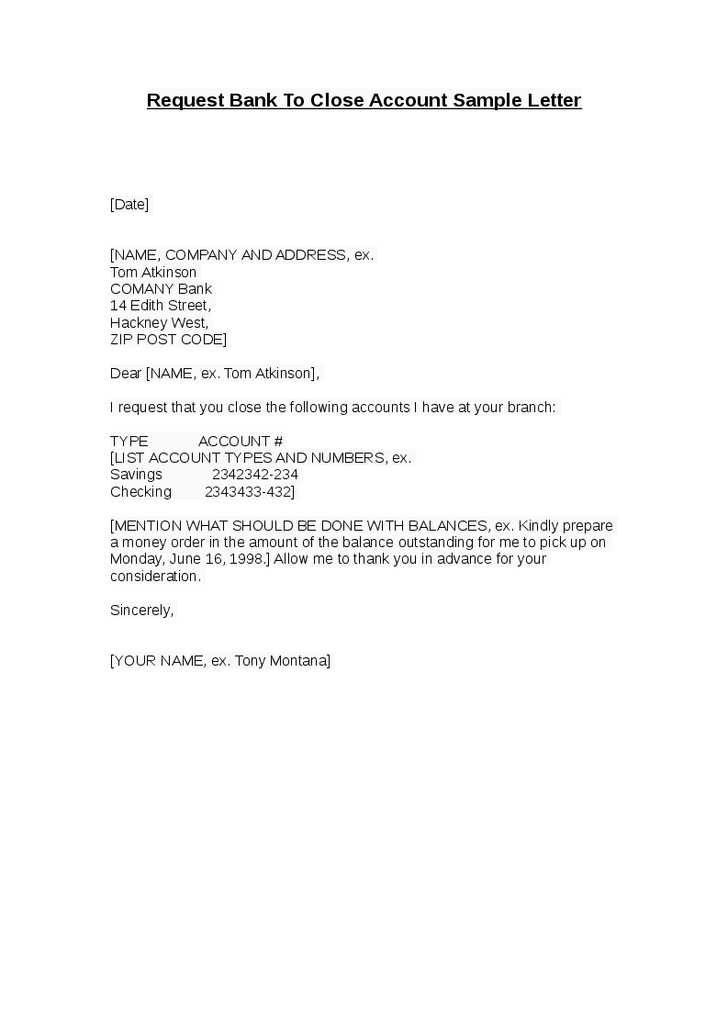

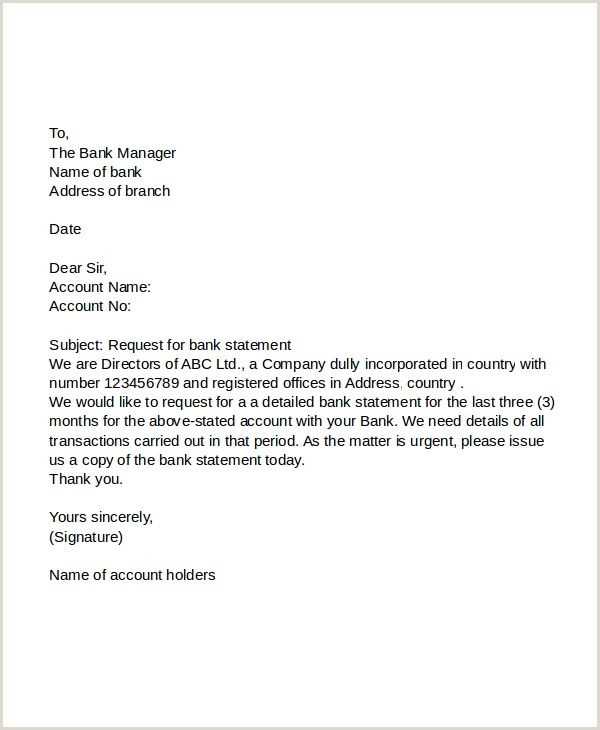

When you decide to end your relationship with a financial institution, it’s important to communicate your intention in writing. A well-structured formal request ensures that the process is smooth and that your request is properly documented. This guide outlines how to effectively draft such a communication, ensuring clarity and professionalism.

Key Information to Include in Your Request

Your communication should contain specific details that will help the recipient identify your request and process it efficiently. Include the following elements:

- Your full name and account details.

- Identification number or any reference linked to the service.

- Reason for discontinuing the service (optional but helpful).

- Request for confirmation that the service has been successfully ended.

Additional Considerations

To avoid delays or confusion, make sure to check if there are any fees or pending transactions before submitting the request. Address the correspondence to the correct department or individual, and retain a copy for your records.

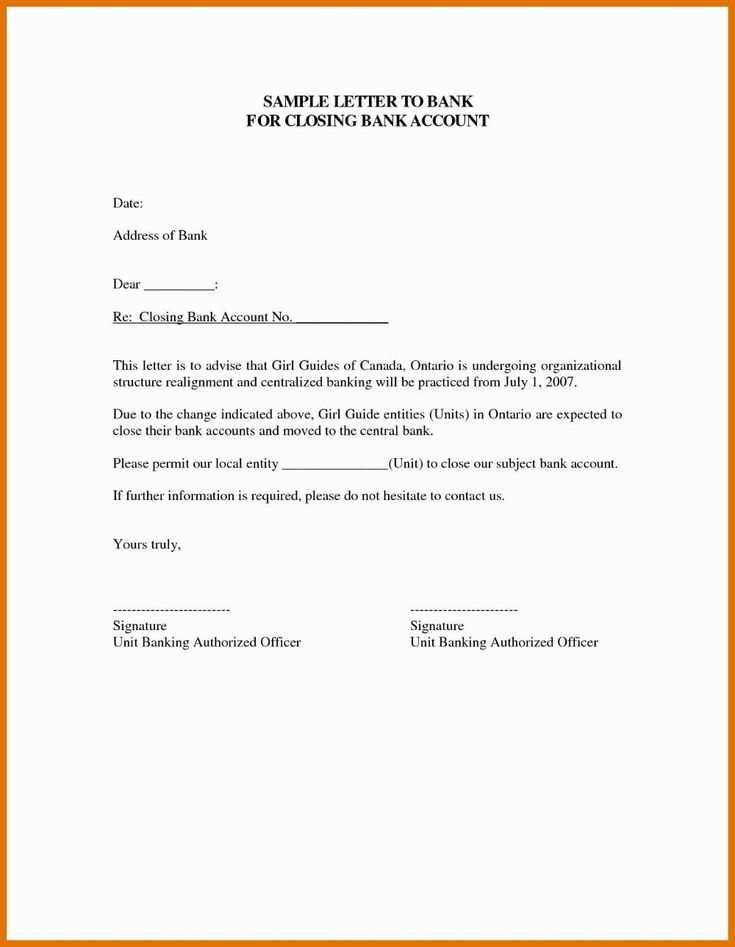

Delivery Methods

Depending on the institution, you may be able to send your request by email, post, or even through an online form. Ensure that you choose the most suitable method to guarantee your request is processed quickly.

Common Errors to Avoid

- Ambiguity in your request can lead to confusion or delays in processing.

- Forgetting to include important details such as account numbers can cause unnecessary complications.

- Not requesting a confirmation of the closure can result in issues down the line.

By following these steps, you can ensure that your decision to end services is handled professionally and promptly. A well-written document can make the entire process smoother and more efficient for both parties involved.

How to Draft a Request to End Financial Services

Writing a formal document to end a service relationship with a financial institution involves ensuring all necessary details are included to facilitate a smooth process. It’s essential to maintain professionalism and clarity to avoid misunderstandings. This section covers key steps to consider when creating such a request.

Key Elements of a Termination Request

To make sure your request is processed efficiently, it should include specific information. First, include your full name, identification number, and any associated reference number. Additionally, specify your intention clearly and ask for confirmation of the termination. You may also wish to provide reasons, though this is optional.

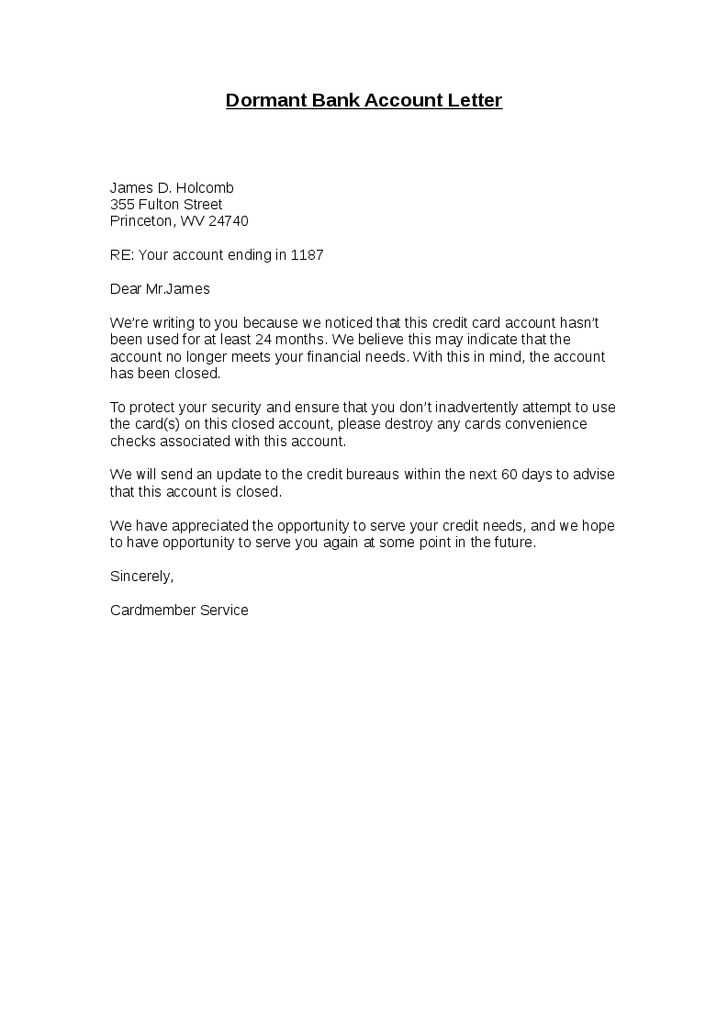

When to End Financial Services

There are several reasons why you might choose to end a service. Whether you are moving to another institution, no longer need the service, or are dissatisfied with the terms, it’s important to time your request appropriately. Make sure all outstanding transactions are completed before submitting your formal request.

To avoid mistakes, double-check your information and ensure you’ve provided all necessary details, including your request for confirmation. This will make the process faster and prevent any delays or misunderstandings.

Other Methods for Service Termination

While submitting a written request is common, many institutions also offer online forms or phone support for terminating services. Depending on the provider, you may have multiple ways to initiate the process. Always choose the method that ensures your request will be processed without issues.