Debt Forgiveness Letter Templates You Can Use

When seeking to reduce or eliminate a financial obligation, crafting a well-structured request can significantly improve your chances of success. This communication serves as a formal means to appeal to a creditor or lender, explaining your situation and requesting a reduction or waiver of your responsibilities. Having a clear, respectful, and persuasive message is crucial for increasing the likelihood of a positive response.

Key Elements of an Effective Financial Relief Request

To create an impactful appeal, it’s important to include several key components that clearly communicate your intentions and financial circumstances.

- Introduction: Begin with a brief statement of your situation and the purpose of the message.

- Explanation of Hardship: Outline any financial struggles that have led to your current situation. Be honest but concise.

- Specific Request: Clearly state the action you want the recipient to take, whether it’s reducing the amount owed, delaying payment, or canceling the debt.

- Closing: End with a polite conclusion, expressing appreciation for their consideration and offering further communication if necessary.

Tips for Writing a Persuasive Appeal

Writing a convincing message requires more than just stating facts. It’s essential to approach the situation with a respectful tone and present a well-reasoned argument. Here are some tips to make your appeal more compelling:

- Be clear and concise: Avoid unnecessary details that might distract from the main message.

- Show willingness to cooperate: Demonstrating flexibility can build goodwill with the recipient.

- Use professional language: A formal tone will help convey seriousness and respect.

Common Mistakes to Avoid

While writing your request, be mindful of common errors that could hinder your appeal:

- Being too vague: Clearly state what you are asking for and why.

- Over-promising: Do not make commitments you are unsure you can keep.

- Being confrontational: Maintain a polite and respectful tone throughout the message.

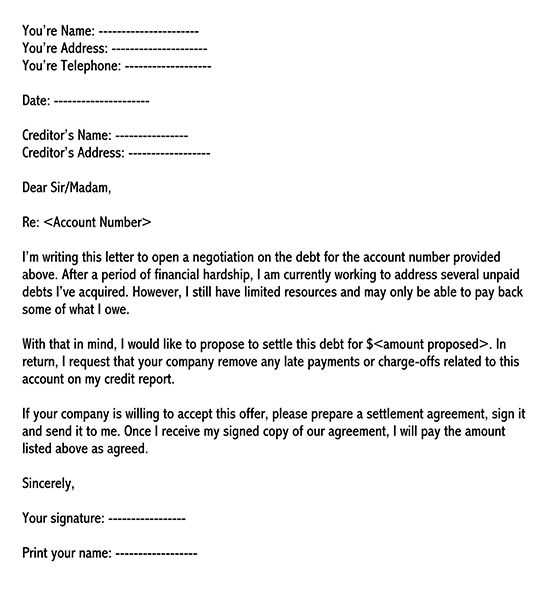

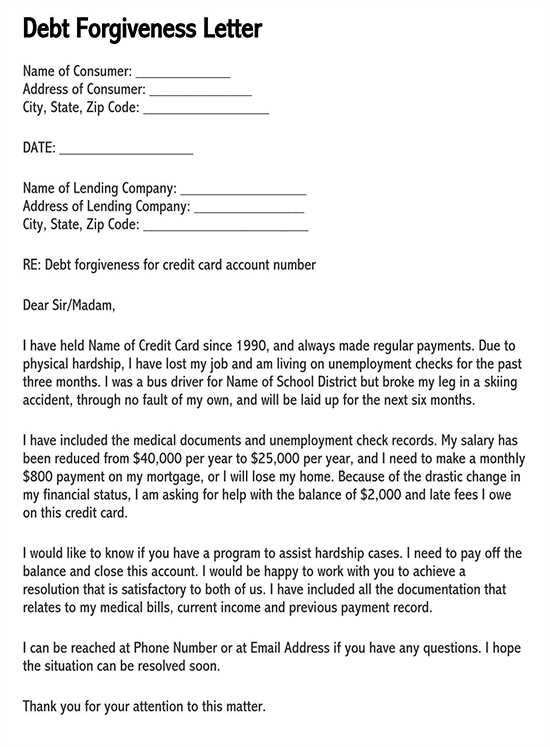

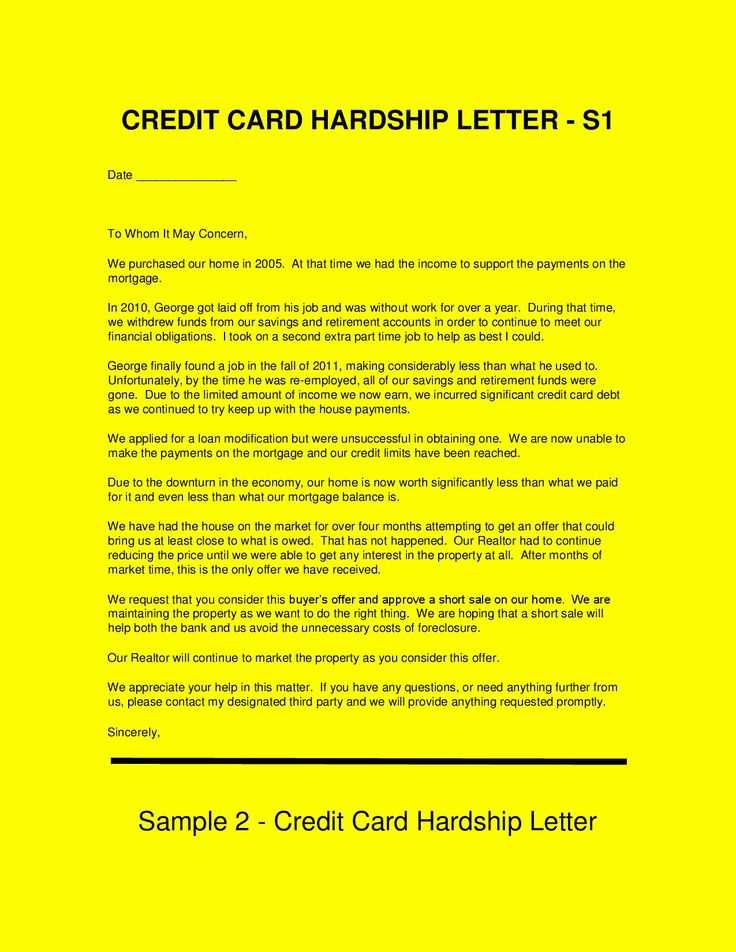

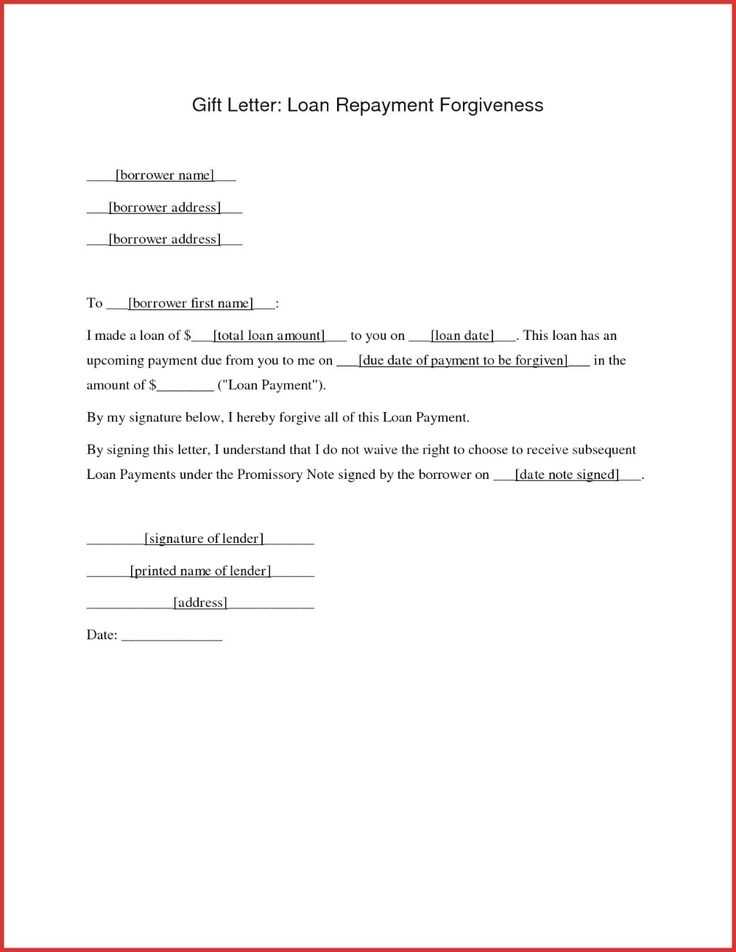

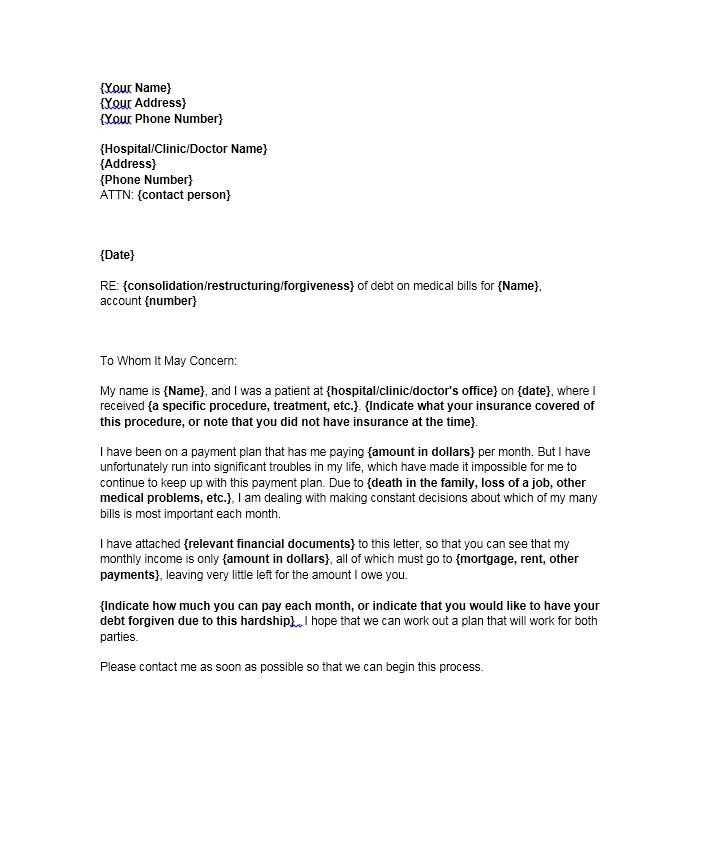

Examples of Successful Requests

Here are some examples of how to structure your appeal effectively:

- Example 1: A request for a temporary reduction in payment due to temporary job loss.

- Example 2: A plea for a permanent settlement of debt due to medical expenses.

- Example 3: A request for a payment extension in light of financial hardship.

Understanding Financial Obligation Reduction Requests

When seeking to reduce or eliminate financial responsibilities, formal communication is essential. These requests serve as a way to express one’s inability to meet obligations while offering a solution to the creditor. Properly drafted correspondence can increase the chances of a favorable outcome, whether the aim is to reduce the amount owed or request a complete waiver of the debt.

Steps to Create a Financial Settlement Appeal

Crafting an effective message requires a clear structure and persuasive language. Start by briefly explaining your situation, emphasizing the reasons for your hardship. Then, provide a specific request, detailing how you hope the creditor will respond, whether it’s a reduction in the total amount, a payment plan, or full discharge. Conclude with gratitude and a polite tone to maintain a positive relationship.

Key Factors in Negotiating Financial Relief

Negotiating successfully involves more than just stating your case. Key factors include being transparent about your financial difficulties, showing willingness to cooperate, and understanding the creditor’s perspective. It’s also helpful to propose a reasonable solution that benefits both parties, such as extending the payment timeline or offering a partial lump sum settlement.

Avoiding Mistakes in Financial Relief Requests

There are common errors that can undermine your appeal. Avoid vague statements that don’t clearly outline what you’re asking for. It’s also important not to overpromise, as creditors may hold you accountable for unrealistic commitments. Additionally, maintaining a respectful tone is crucial; any sign of hostility or frustration could hinder the chances of receiving favorable terms.

Legal Aspects of Reducing Financial Obligations

Before submitting any request, it’s essential to be aware of the legal implications involved. Each creditor may have specific rules regarding how such requests are handled. Some financial institutions may require proof of hardship or a formal agreement before any reduction can occur. Understanding your rights and the legal frameworks governing financial settlements will help ensure that your appeal is handled appropriately.

How to Communicate with Creditors Effectively

Effective communication is the foundation of any successful negotiation. Start by being clear and direct in your message, avoiding unnecessary jargon. Keep the tone formal and professional, demonstrating that you respect the creditor’s time and position. Additionally, remain open to discussions and compromise, as this can facilitate a more productive conversation.

Examples of Successful Financial Relief Appeals

Here are a few examples of how to approach your request:

- Requesting a temporary reduction in payments due to unexpected medical expenses.

- Proposing a settlement offer in exchange for a reduction of the total amount owed.

- Asking for an extension on the payment timeline due to unemployment or other financial setbacks.