IRS Gift Letter Template for Tax Compliance

When transferring significant sums of money or valuable assets to someone, it is crucial to ensure proper documentation to comply with tax regulations. This process helps both the giver and the recipient avoid potential misunderstandings or penalties related to tax obligations. Properly outlining the details of the transfer can streamline the reporting process and clarify the intent behind the action.

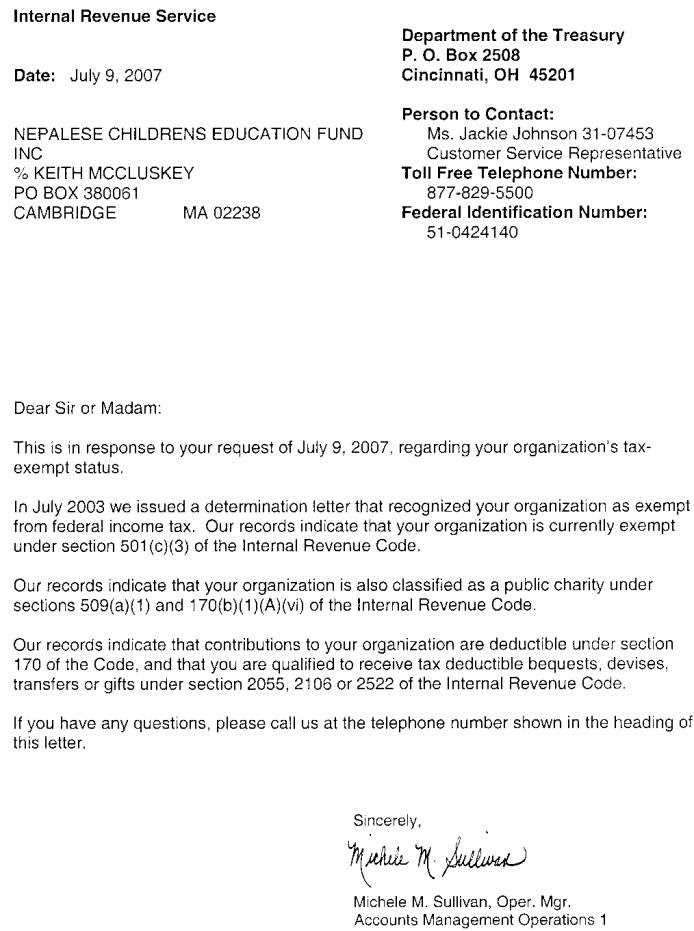

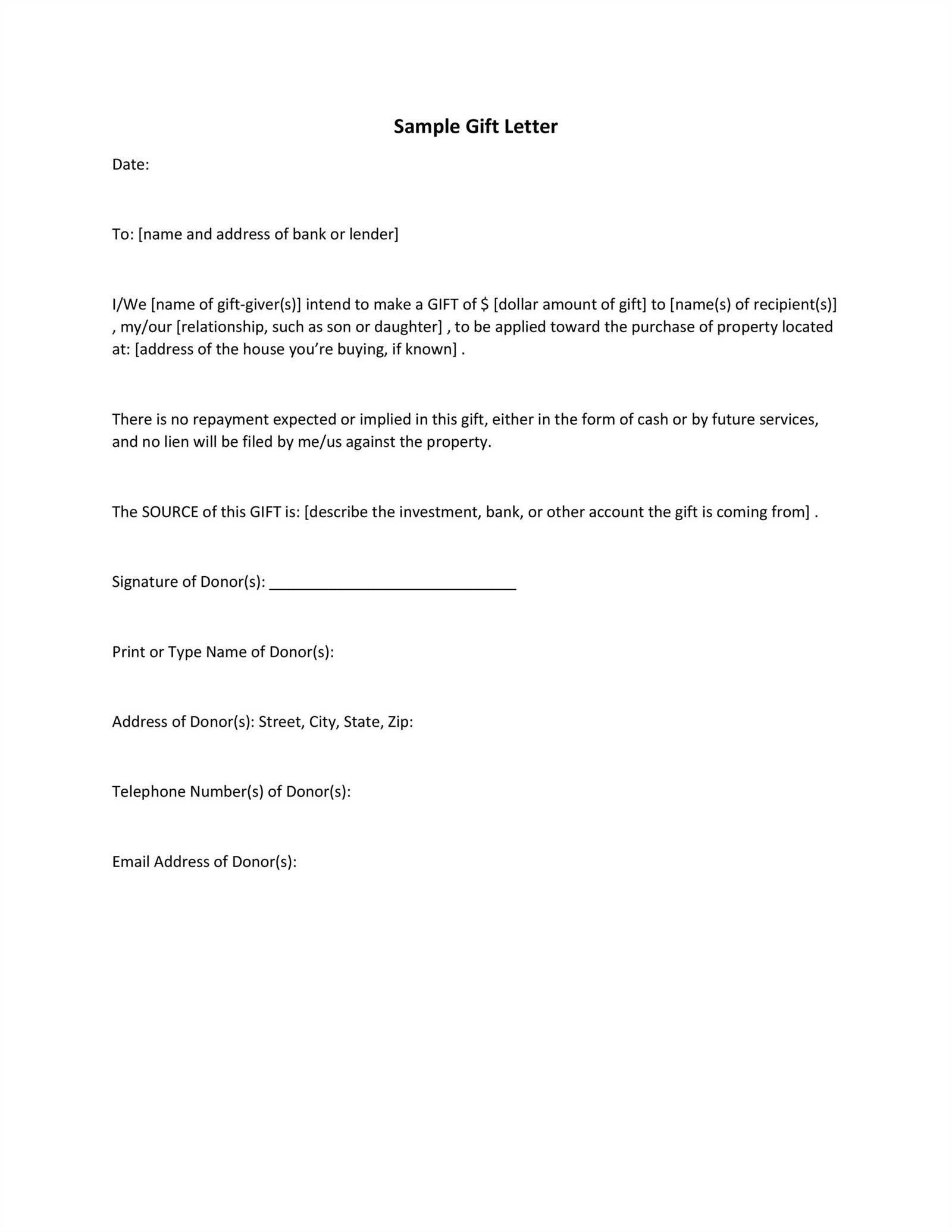

Key Elements of a Valid Document

To ensure accuracy and compliance, certain elements should be included in the document outlining the transfer. These include basic information about both parties, the amount or value of the transfer, and a clear statement that no repayment is expected. The details should be specific to avoid confusion, ensuring that tax authorities understand the nature of the transaction.

Important Information to Include

- Full names and addresses of both individuals involved.

- Amount or value of the transfer and description of the assets, if applicable.

- Statement of no repayment specifying that the amount is a gift and not a loan.

- Date of transfer to establish the timing of the event.

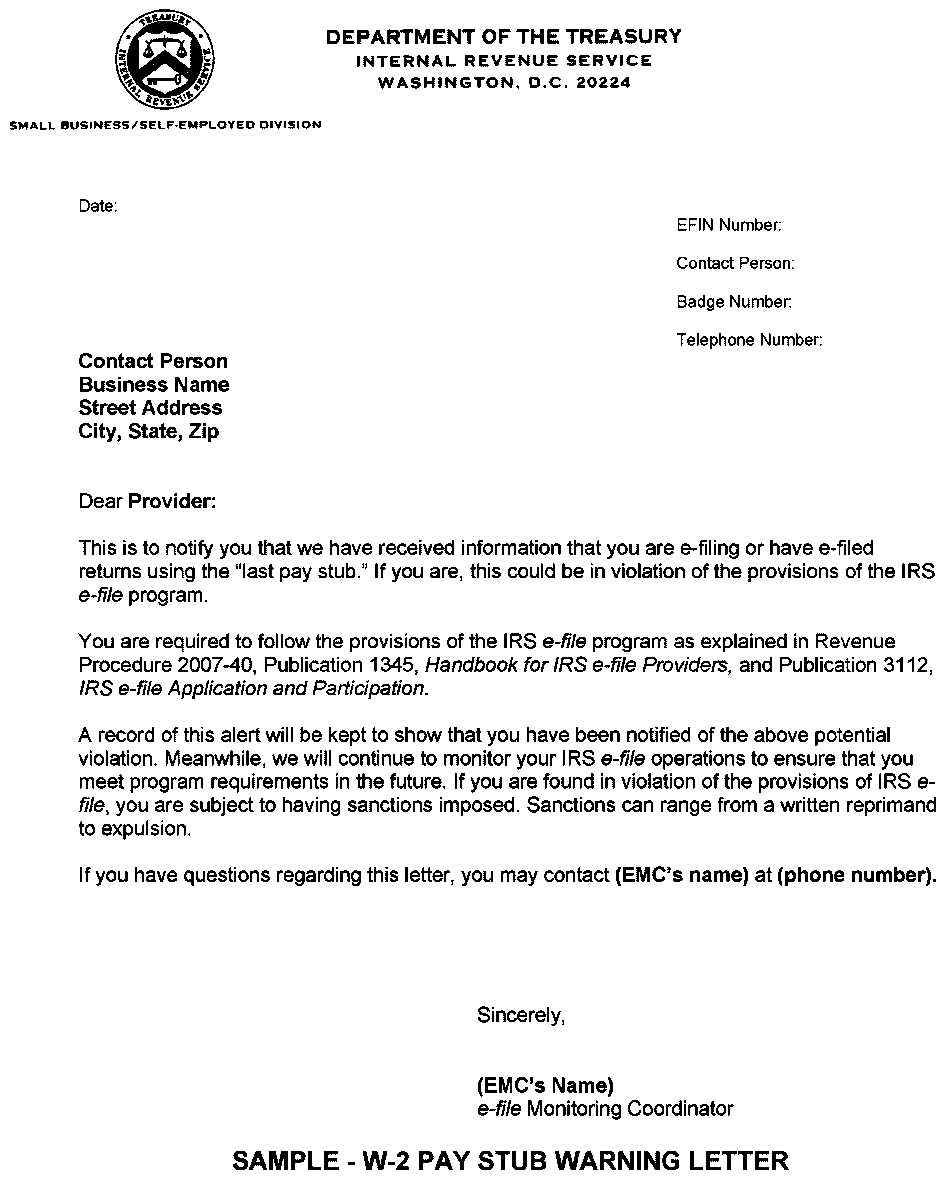

When a Document is Required

Generally, if the transfer exceeds a certain threshold set by tax authorities, formal documentation becomes necessary. It is important to determine when such a record is needed, as failing to file can lead to complications. Even if the amount falls below the threshold, having proper documentation is advisable to avoid any future questions about the nature of the transfer.

Thresholds and Limits

The specific amount that triggers the need for a formal record can vary based on the regulations of the relevant authorities. Keeping track of these limits is crucial for compliance. Always refer to current guidelines to avoid missing important requirements.

Understanding Documentation for Tax-Free Transfers

When making a transfer of funds or valuable items to another person, it’s important to document the transaction clearly. This helps ensure that both parties are in compliance with tax regulations and protects against potential issues in the future. Proper documentation specifies the nature of the transfer and provides a transparent record for both the giver and the recipient.

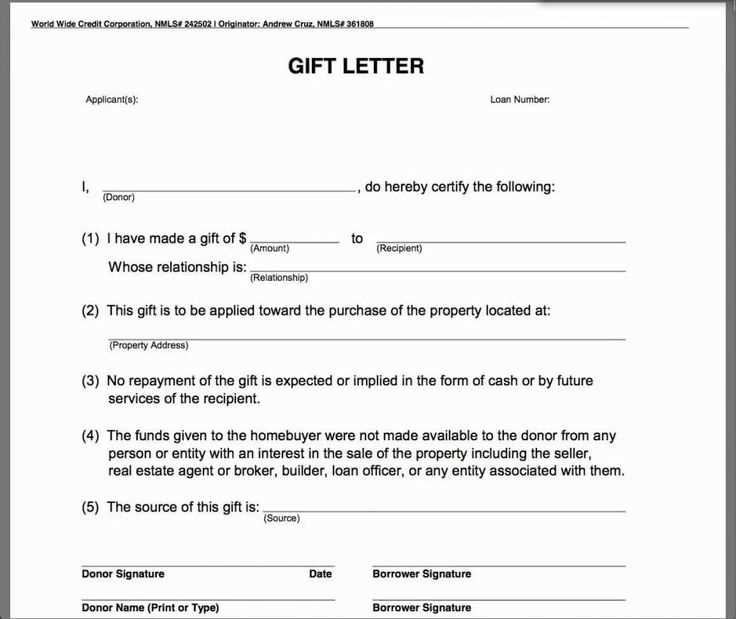

Purpose of the Documentation

Such a document serves as proof that the transfer was made without any expectation of repayment, distinguishing it from loans or other types of financial exchanges. It allows tax authorities to determine whether the transaction falls within the tax-free limits or whether it needs to be reported as taxable. Clear communication of intent through the document can help prevent unnecessary complications during the filing process.

How to Draft a Proper Record

Creating this kind of document requires attention to detail. It’s important to include specific facts about the transfer, including the identities of both individuals involved, the value of the transfer, and a clear statement confirming that no repayment is expected. This helps to avoid misunderstandings or disputes later. The document should be written in a way that is easy to understand and should be signed by both parties to affirm its accuracy.

Key Information to Include

To ensure the document serves its purpose, it should include the following details:

- Names and addresses of the giver and the recipient.

- Amount or value of the transferred assets.

- Statement confirming no repayment is expected.

- Date of the transaction.

Tax Regulations on Non-Taxable Transfers

Tax rules provide specific guidelines for when transfers of this nature are not subject to tax. These rules vary based on the amount being transferred and the relationship between the individuals involved. Familiarizing yourself with the tax-free limits and guidelines can help you determine whether a report needs to be filed or if the transfer remains under the threshold.

When Documentation is Necessary

In many cases, formal documentation is only required when the amount of the transfer exceeds certain thresholds. However, even if the transaction falls below these limits, it is still a good practice to create such a record to avoid any misunderstandings in the future. This ensures that the transaction remains transparent and can be referenced if needed for tax reporting purposes.