Diminished Value Letter Template for Insurance Claims

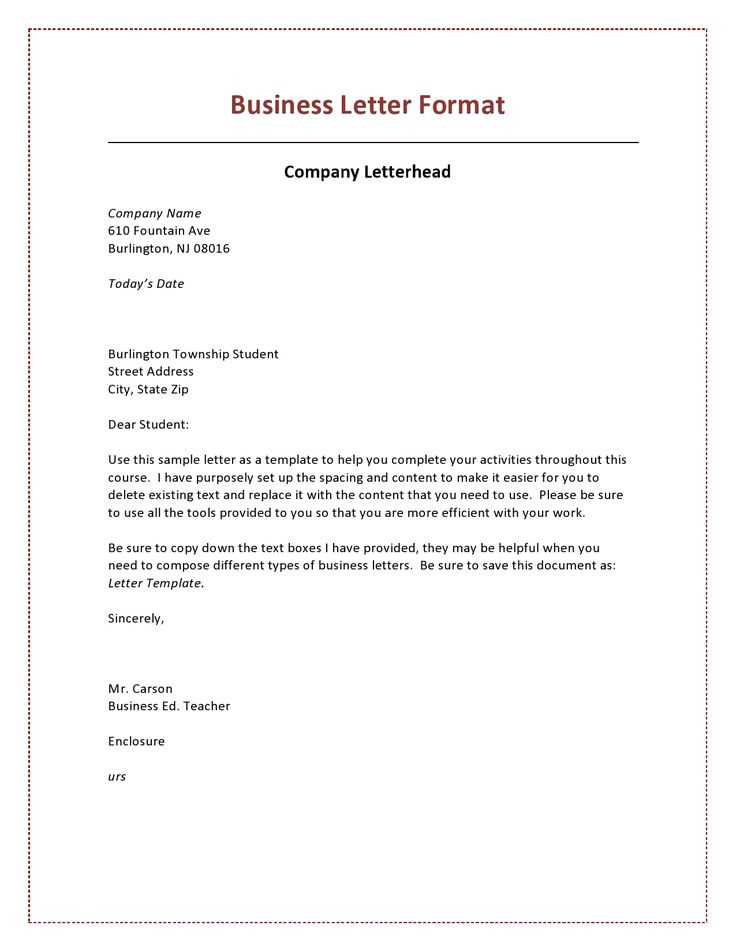

When dealing with insurance claims, it is often necessary to formally communicate the financial loss resulting from an incident that impacts your property. Having a structured document can help you effectively present your case and ensure you receive appropriate compensation. This document should outline the depreciation in the worth of your asset due to an event such as an accident or damage, and it is essential to be clear and precise.

Crafting a well-organized request can greatly influence the outcome of your claim. It is important to focus on key details and present the facts in a professional tone, avoiding unnecessary or irrelevant information. By using the right format, you can provide the necessary evidence and make it easier for the insurance company to evaluate your situation fairly.

Understanding how to write this kind of document is crucial for a smooth claim process. With the right approach, you can clearly demonstrate your loss and increase the chances of receiving the compensation you deserve.

Understanding the Basics of a Claim Request

When preparing a formal request for compensation after an event that has reduced the worth of your property, it’s important to have a well-structured format. This document should provide the relevant details, including the cause of the depreciation, the affected item, and the amount of loss you have sustained. By using a clear and organized approach, you ensure that your request is taken seriously and considered thoroughly by the insurer.

Key Information to Include

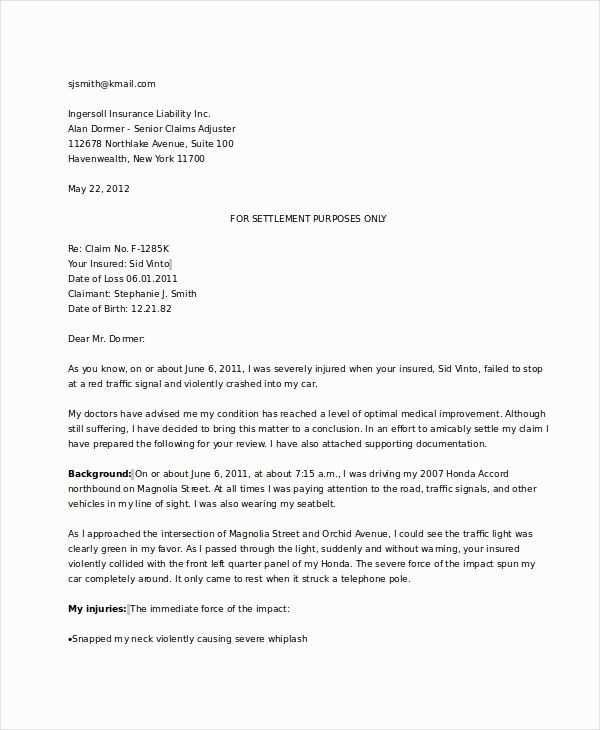

- Detailed description of the incident

- Proof of the financial reduction in asset worth

- Evidence supporting your claim, such as repair bills or estimates

- Clear request for compensation based on loss

Why Proper Format Matters

- It helps convey your message effectively

- It makes the evaluation process easier for the insurance company

- It increases your chances of receiving fair compensation

Incorporating these elements and following a specific structure will help ensure that your submission is professional and aligns with insurance company expectations. Proper documentation and clarity in your request can make a significant difference in how your claim is processed.

Understanding Diminished Value Claims Process

The process of filing a claim for the reduced worth of your asset due to an incident is an essential step in ensuring you are fairly compensated. This procedure typically involves documenting the loss, providing supporting evidence, and communicating effectively with your insurance company. Understanding the steps involved can help make the process smoother and more efficient.

Steps Involved in the Claims Process

- Assessing the extent of the damage or loss

- Gathering supporting evidence such as repair estimates or expert evaluations

- Submitting the documentation to the insurance company for review

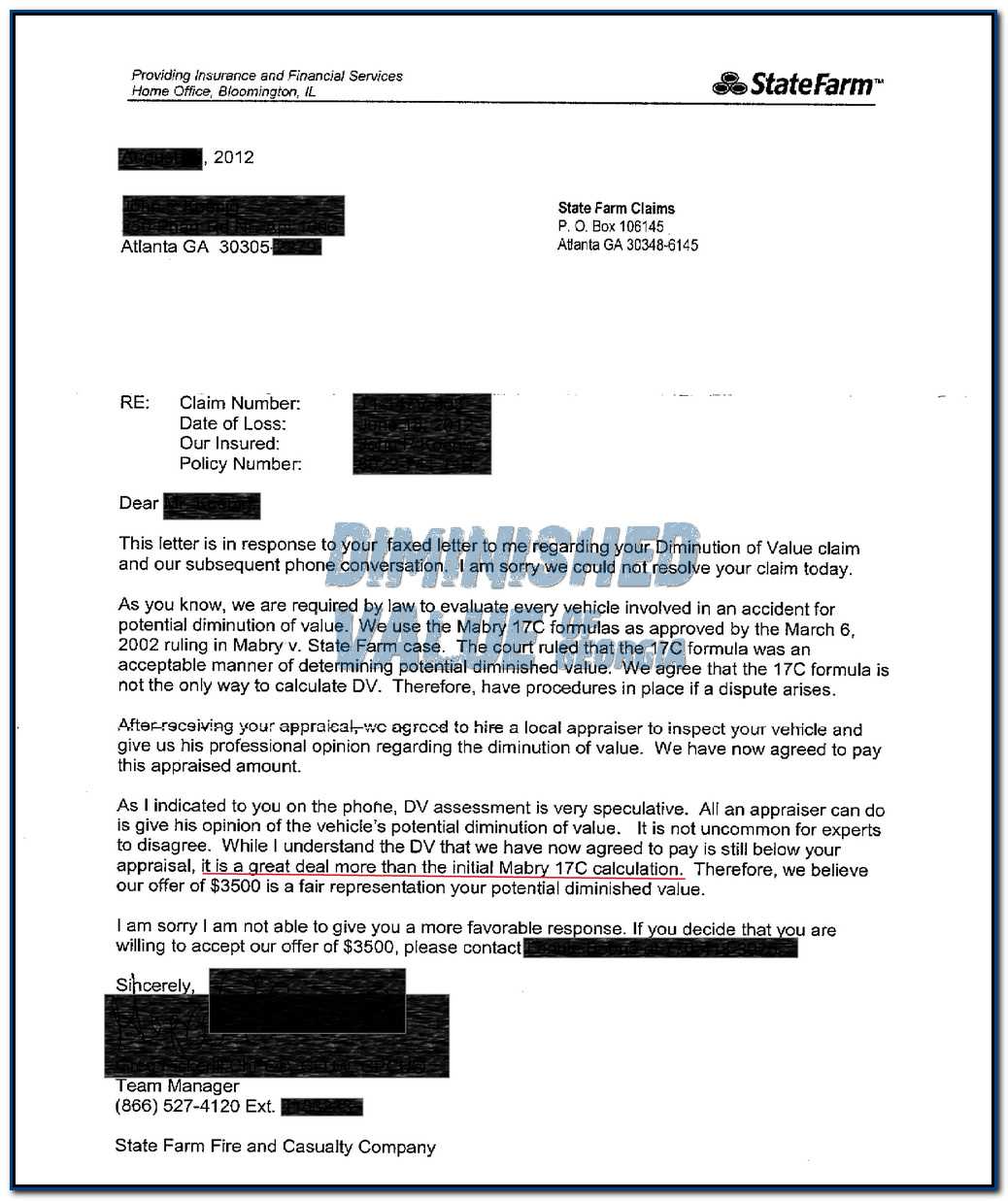

- Waiting for the insurer’s assessment and response

Factors That Influence Your Claim Outcome

- The accuracy and completeness of the provided evidence

- The insurance company’s guidelines and policies

- State regulations and the specifics of the incident

By understanding each step of the claims process and the factors that affect your claim, you can be better prepared to present your case and work towards a fair resolution.

Essential Components for Your Letter

When composing a formal request for compensation, including all necessary details in a clear and organized manner is critical to ensure your case is properly understood and assessed. Certain key elements should always be present to present your case effectively and support your claim for financial recovery.

Key Information to Include

- Incident Details: Describe the event that led to the financial loss.

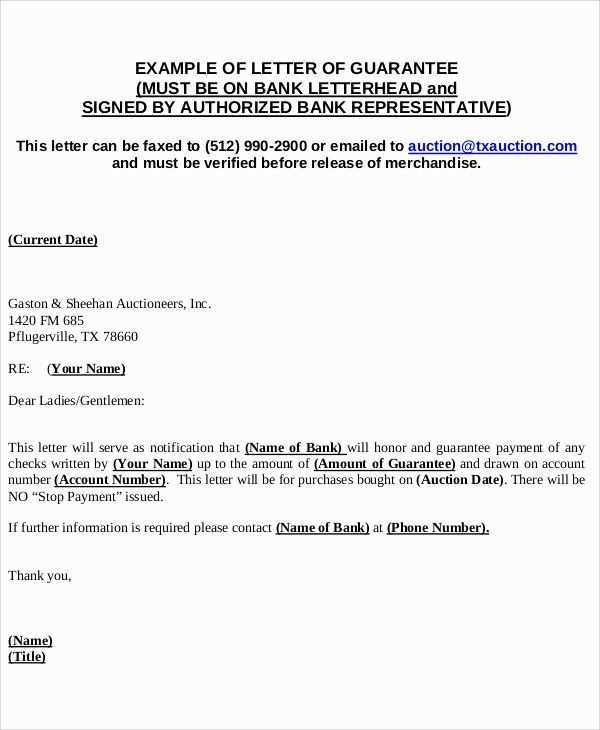

- Supporting Documentation: Include repair estimates, photographs, or professional evaluations to strengthen your claim.

- Request for Compensation: Clearly state the amount you are seeking based on the damage or depreciation.

Formatting Tips

- Clear Structure: Organize the content in a way that allows easy reading and understanding.

- Professional Tone: Use polite, formal language throughout the request.

Including these components and following the right structure will help make your claim more compelling and increase the likelihood of a fair outcome.

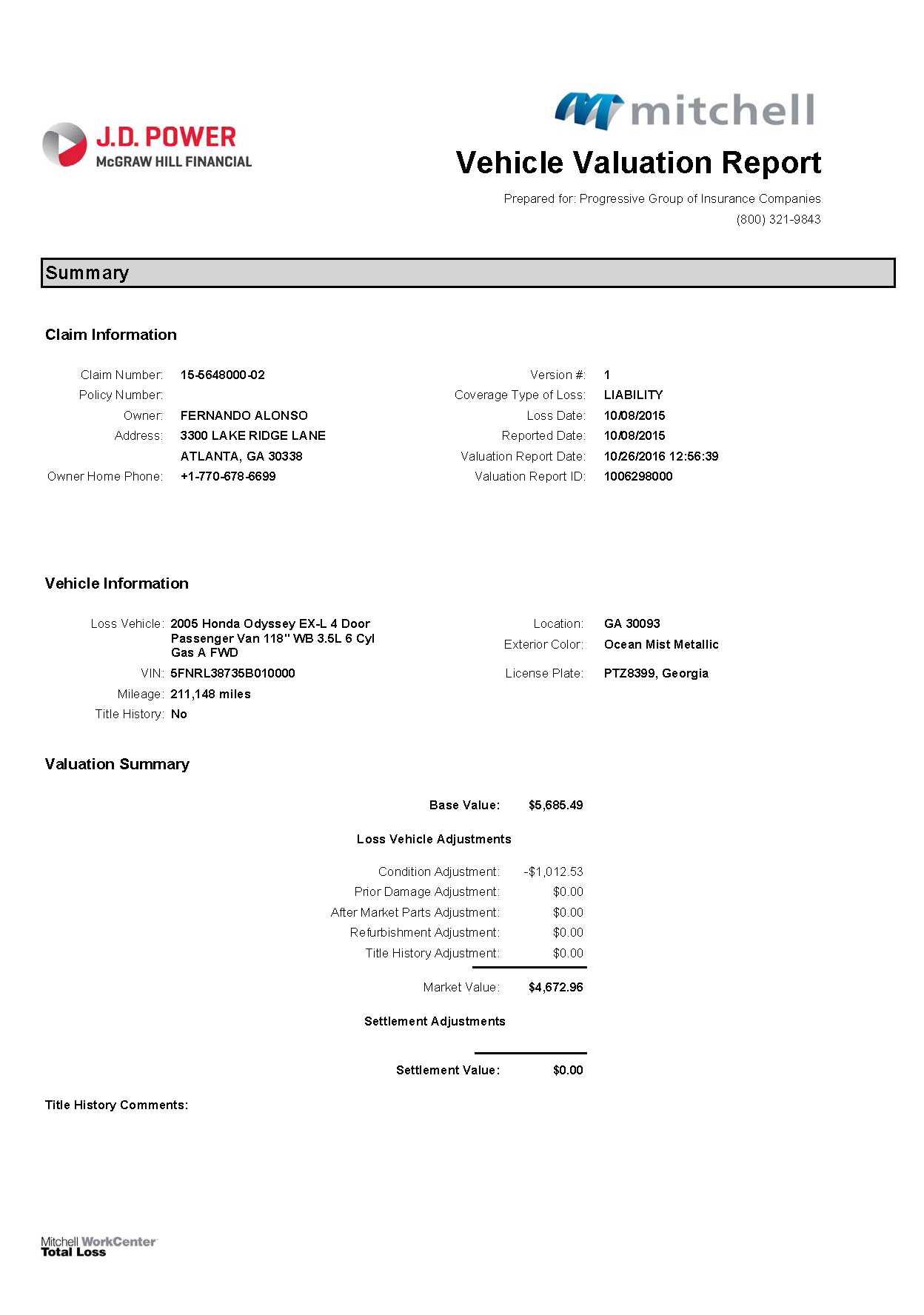

How to Calculate Depreciated Vehicle Value

Determining the reduction in a vehicle’s worth after an incident requires an understanding of various factors that affect its market price. This process involves considering the car’s age, mileage, repair history, and the extent of the damage. By taking these elements into account, you can arrive at a reasonable estimate for the amount of financial loss.

Factors to Consider

| Factor | Explanation |

|---|---|

| Age of Vehicle | The older the car, the more depreciation it typically experiences. |

| Mileage | Higher mileage often leads to a greater reduction in value. |

| Repair Costs | Major repairs can impact the resale value, especially if they affect the vehicle’s performance or appearance. |

| Market Conditions | Trends in the automotive market can influence a vehicle’s depreciation. |

After assessing these factors, you can calculate the adjusted worth of your vehicle by considering how each element contributes to its current condition. This approach helps to provide a more accurate and fair estimate of the financial loss you have incurred.

Tips for Crafting an Effective Letter

To maximize the chances of a favorable outcome, it is essential to compose a well-structured and persuasive communication. A clear and professional tone, along with detailed supporting information, can make a significant difference in the response you receive. The following tips can help ensure that your request is both compelling and thorough.

Maintain a Professional and Polite Tone

- Use formal language throughout the message.

- Be respectful, even if you are frustrated or dissatisfied.

- Avoid emotional language that may undermine your case.

Provide Comprehensive Evidence

- Include relevant documentation such as photos, repair estimates, or expert assessments.

- Be specific about the damages and their impact on the overall condition of your asset.

By following these suggestions, you can craft a strong communication that presents your case clearly and professionally, increasing the likelihood of a positive response.

Common Errors to Avoid in Claims

When submitting a request for financial recovery, it’s crucial to avoid common mistakes that could weaken your case or delay the process. By being mindful of certain pitfalls, you can improve your chances of a successful resolution and ensure that your request is taken seriously.

Failing to Provide Sufficient Documentation

- Always include supporting evidence such as photos, repair estimates, or expert assessments.

- Inadequate documentation can lead to delays or rejection of your claim.

Using Vague Language

- Be as specific as possible about the damages and the requested amount for compensation.

- Ambiguous descriptions can make it difficult for the recipient to understand your case and needs.

By avoiding these common mistakes and ensuring that your communication is clear and well-supported, you can increase the likelihood of a positive outcome in your claim process.

What to Do After Sending Your Letter

Once you have sent your communication, it’s important to stay proactive and monitor the progress of your request. While waiting for a response, taking a few essential steps can help ensure that the process moves smoothly and that you are prepared for any follow-up actions.

First, keep track of your correspondence, including the date the letter was sent and any tracking or delivery confirmation. This will help you stay organized and provide proof if necessary. Additionally, if you do not receive a response within a reasonable timeframe, follow up with a polite inquiry to check on the status of your request.

Be prepared for possible negotiations or requests for additional information. Having all your documentation readily available and maintaining clear communication will help facilitate a quicker resolution.