Dispute Letter Template for Collection Agencies

When facing an unjust financial claim, it’s important to take proactive steps to protect your rights. The process of disputing inaccurate charges can seem overwhelming, but knowing how to approach it correctly can significantly improve your chances of success. Crafting a clear and formal response is one of the most effective ways to assert your position.

In many cases, consumers are unaware that they can question the validity of debts they do not recognize or believe to be incorrect. By preparing a well-structured and concise communication, you can address the issue directly with the relevant party. Understanding the necessary components and knowing what to expect next is crucial to achieving a favorable resolution.

Whether you’re dealing with a minor error or a more serious misunderstanding, addressing it promptly and efficiently is key to safeguarding your financial reputation.

Understanding Collection Disputes

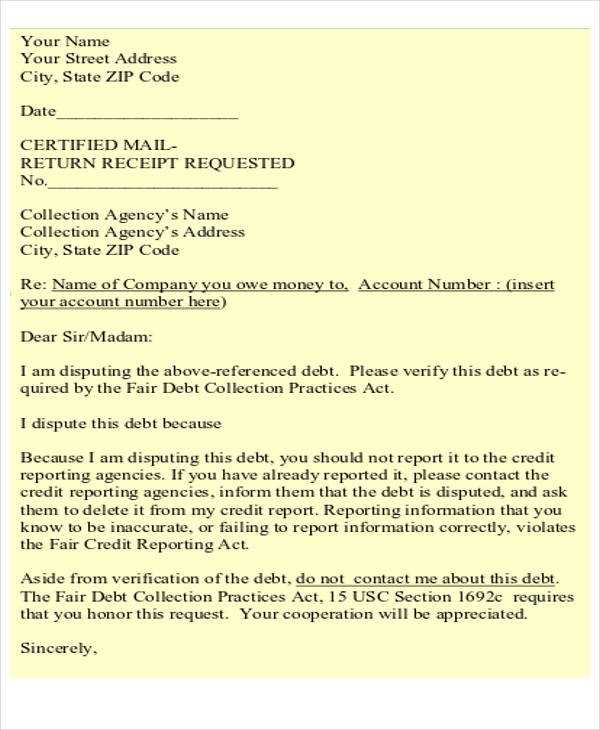

When an individual faces an accusation of owing money they don’t believe they are responsible for, it is essential to understand how to challenge these claims effectively. Often, such situations arise from clerical errors, misunderstandings, or even fraudulent activity. Resolving these issues requires a clear approach and knowledge of the process to protect one’s financial standing.

In many cases, the burden of proof lies with the party making the claim. It’s important to recognize that not all demands for payment are valid. Knowing how to respond can help prevent unwarranted penalties and avoid damage to credit scores.

| Potential Reasons for Disagreements | How to Address Them |

|---|---|

| Inaccurate Information | Request verification from the creditor and ask for supporting documentation. |

| Fraudulent Claims | Report to the relevant authorities and demand investigation. |

| Unclear Payment Terms | Review contracts or agreements and request clarification if necessary. |

Importance of a Dispute Letter

When confronting a financial claim that is believed to be incorrect, it is crucial to respond in a formal and structured manner. A well-prepared communication serves as a formal request for clarification, ensuring that the issue is addressed in an official capacity. This process not only helps in protecting your rights but also establishes a documented record of your actions in case further legal or financial proceedings are needed.

Addressing inaccurate charges directly through formal channels can prevent misunderstandings and stop potential damage to your credit score. Without a proper response, an unjust claim may escalate, leading to more severe consequences. Additionally, initiating a conversation through an organized written response can often lead to quicker resolutions, as it shows seriousness and an intent to resolve the matter amicably.

Taking the time to craft a clear and assertive statement is key to maintaining control over your financial situation.

How to Write a Dispute Letter

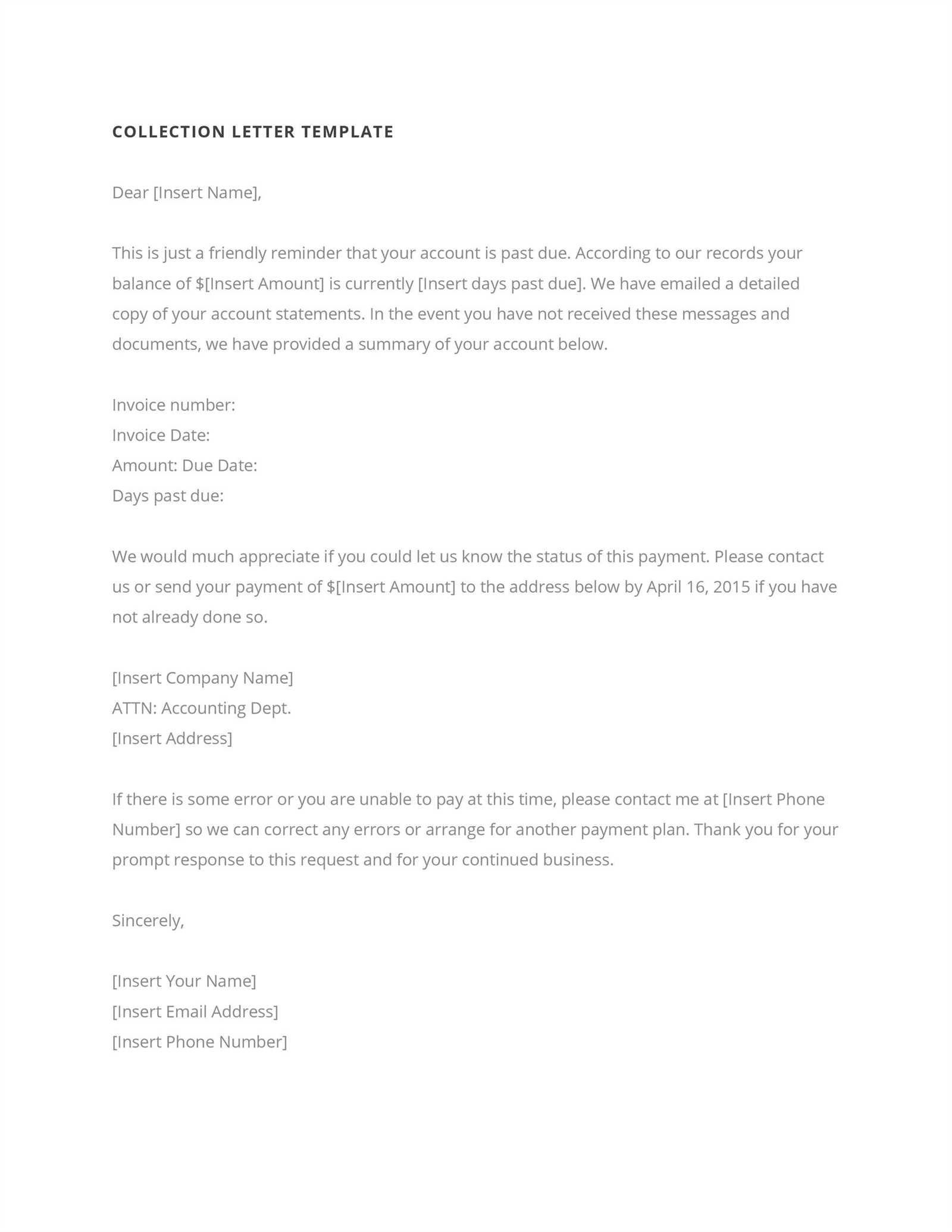

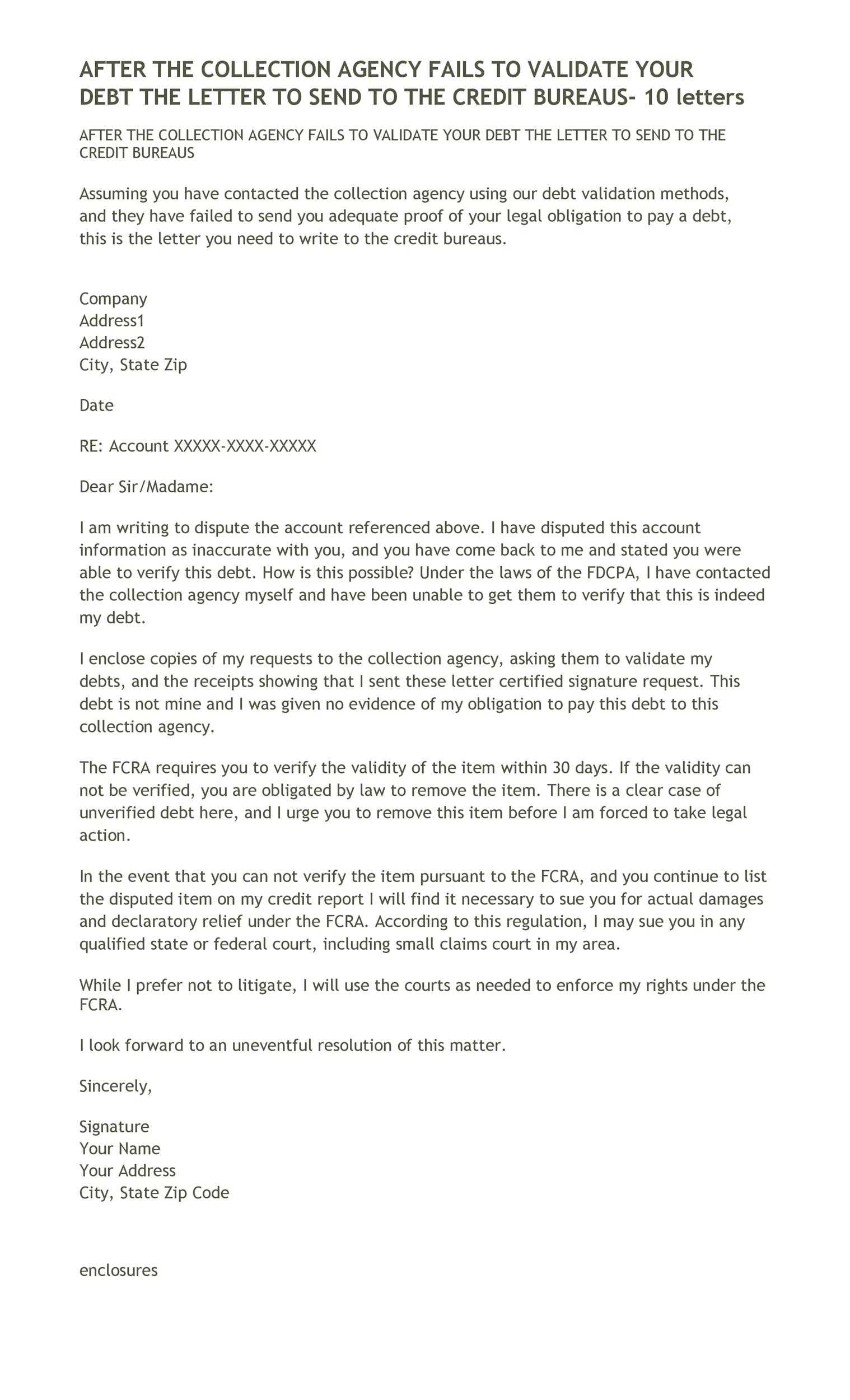

When you need to challenge an incorrect financial claim, it’s essential to approach the situation methodically. A formal written response should clearly state your concerns, request specific actions, and provide any relevant details to support your case. Taking the time to organize your thoughts and ensure your message is clear can help resolve the issue quickly and effectively.

Begin by including all necessary personal and account details. This ensures that the recipient can easily locate your file and review the specifics of the claim. It’s also important to state your position clearly and reference any documents or evidence that support your case.

Finally, request a formal response or resolution within a specified time frame. This shows that you are serious about the matter and expect prompt action. Remaining polite but firm can increase the chances of a favorable outcome while maintaining professionalism throughout the process.

Key Elements to Include

When addressing an incorrect financial claim, certain details must be incorporated to ensure clarity and facilitate resolution. A well-structured communication should not only state the issue clearly but also provide the necessary information for the recipient to investigate and take action. Including the right components can significantly improve the likelihood of a positive outcome.

Start by including your full name, contact information, and any relevant account or reference numbers. This ensures that the recipient can quickly locate your file and understand the context of the issue. Next, explain the reason for your disagreement and provide supporting evidence, such as transaction records or other documents, to back up your claims.

Lastly, be sure to request a specific resolution or action, such as a correction or removal of the incorrect information, and set a reasonable timeline for a response. This helps establish the urgency and importance of addressing the issue promptly.

Common Mistakes in Disputing Debt

When challenging an incorrect financial claim, there are several common pitfalls that individuals often fall into. These mistakes can delay resolution, create confusion, or even weaken your position. Understanding these errors and how to avoid them can help ensure that your communication is clear and effective.

Not Providing Sufficient Information

- Failure to include essential details such as account numbers or personal identification can lead to delays in processing.

- Omitting supporting documentation weakens your case and may result in the claim being dismissed.

Being Too Vague or Aggressive

- Using unclear language or failing to clearly state the issue can make it difficult for the recipient to address your concerns.

- Being overly hostile or confrontational may lead to a breakdown in communication, rather than fostering a resolution.

By avoiding these errors and being thorough, clear, and respectful in your communication, you can increase the chances of a quick and favorable resolution. Being organized and staying focused on the facts helps keep the process on track.

Avoiding Common Errors

When addressing a financial claim that you believe is incorrect, it’s essential to be mindful of several common mistakes that can hinder the process. These errors, whether in communication or documentation, can slow down the resolution and may negatively impact the outcome. By taking care to avoid these missteps, you can improve the chances of a swift and favorable resolution.

- Always ensure that your communication is clear and concise. Vagueness or ambiguous language can lead to confusion and delay the process.

- Double-check that you’ve included all relevant information, such as account numbers, dates, and any supporting documents. Missing details can cause unnecessary setbacks.

- Remain professional and polite, even if you feel frustrated. Aggressive or emotional language may provoke a negative response and escalate the situation.

By paying attention to these key factors and staying focused on the facts, you can enhance the likelihood of resolving the issue effectively and efficiently.

Legal Rights in Debt Disputes

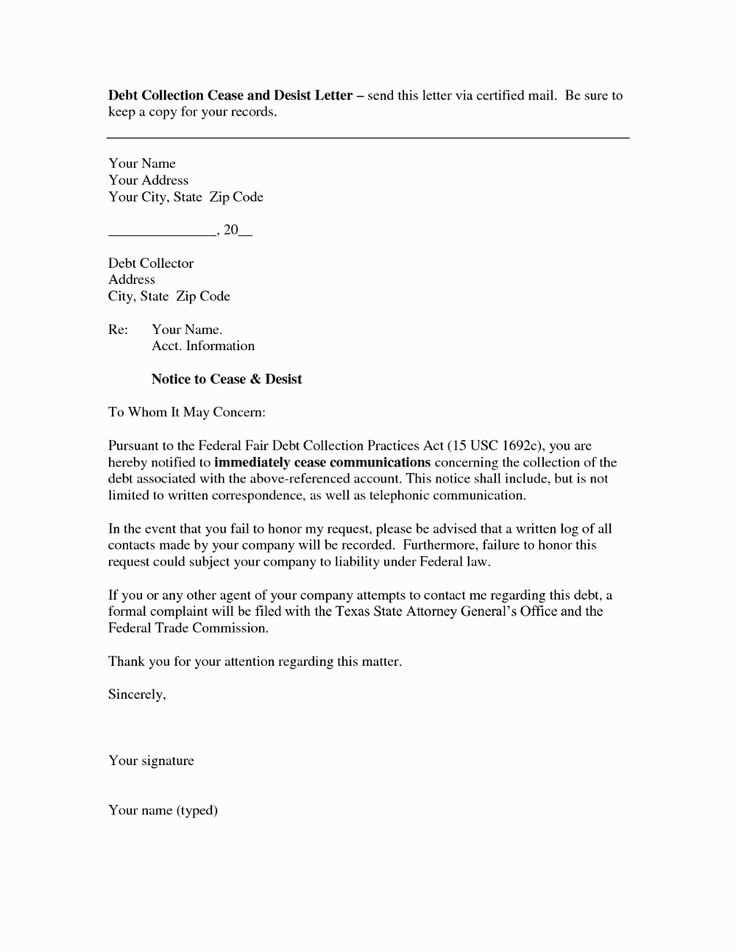

When facing an incorrect financial claim, it’s crucial to understand your legal rights. Laws exist to protect consumers from unfair or inaccurate charges and to ensure that any claims are properly substantiated. Knowing your rights can help you take the necessary steps to challenge an unjust accusation effectively and prevent harm to your financial reputation.

Consumer Protection Laws

In many countries, there are strict regulations in place that protect individuals from fraudulent or inaccurate debt claims. For example, the Fair Debt Collection Practices Act (FDCPA) in the United States ensures that consumers are not harassed or misled by debt collectors. It also requires that all claims be properly validated before collection efforts can proceed.

How to Assert Your Rights

Should you encounter an issue, you have the legal right to request verification of the debt. This means that the claiming party must provide clear documentation proving that the debt is valid. If the debt cannot be validated, they must cease any further attempts to collect the money. Additionally, consumers are entitled to dispute inaccurate information on their credit reports, and in some cases, have it removed if found to be incorrect.

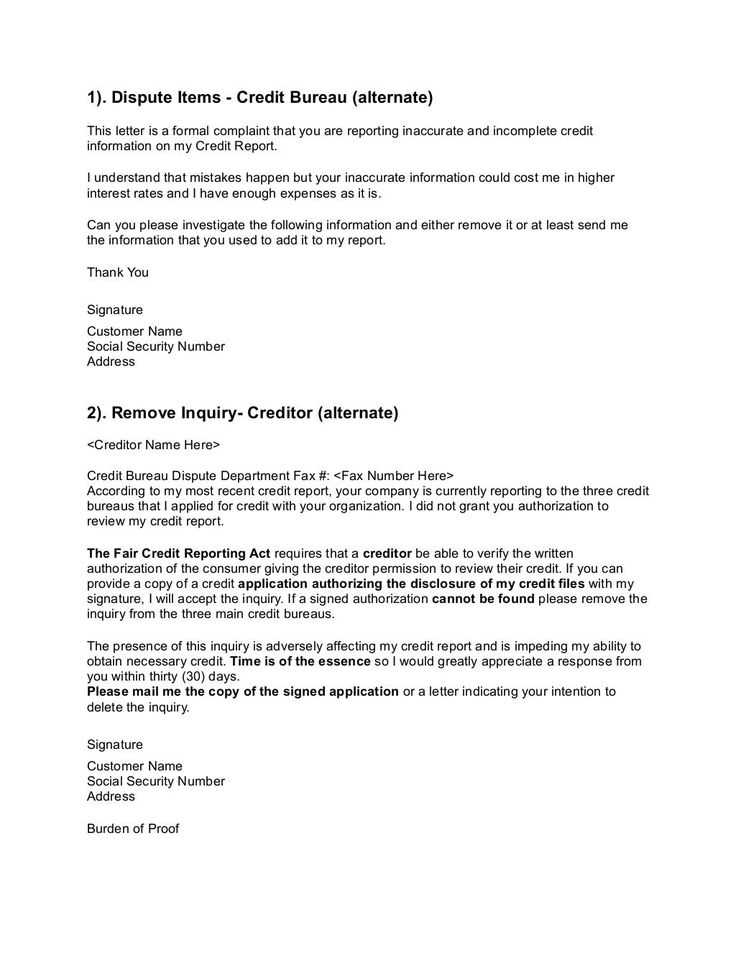

How the Law Protects You

The law provides essential protections for individuals when facing wrongful or erroneous claims related to debts. These legal safeguards are designed to prevent harassment, ensure accurate information, and offer a way to challenge false accusations. Understanding your rights helps you take action to defend yourself and avoid potential harm to your financial reputation.

- Protection from harassment: Laws prohibit abusive or aggressive tactics by those making financial claims. Harassment, threats, and unfair communication practices are illegal.

- Right to verification: You are entitled to request proof of any debt claimed against you. The creditor or collector must provide detailed evidence that the amount is valid and owed.

- Accurate reporting: Any incorrect or misleading information reported to credit bureaus can be challenged and corrected under consumer protection laws.

- Time limits on claims: Legal frameworks often set time limits for debt claims, meaning if a debt is too old, it may no longer be pursued legally.

By knowing how the law works in your favor, you can confidently handle disputes and prevent undue harm to your financial situation.