Credit Report Dispute Letter Template for Easy Resolution

htmlEdit

Errors in personal financial documents can negatively affect various aspects of life, including loan approvals, interest rates, and financial stability. When inaccuracies appear, it is crucial to take prompt action to rectify them. This section outlines the proper steps to follow in order to communicate effectively with relevant institutions and seek corrections.

Addressing discrepancies requires clear and precise communication. By carefully outlining the issue and supporting it with evidence, you increase the likelihood of a swift and accurate resolution. It is essential to approach the matter professionally and constructively, ensuring all relevant details are included to avoid delays.

Timely intervention is key to preventing further complications. By following the appropriate process, individuals can maintain their financial integrity and ensure their personal documents reflect accurate information.

htmlEdit

htmlEditTemplate for Financial Record Corrections

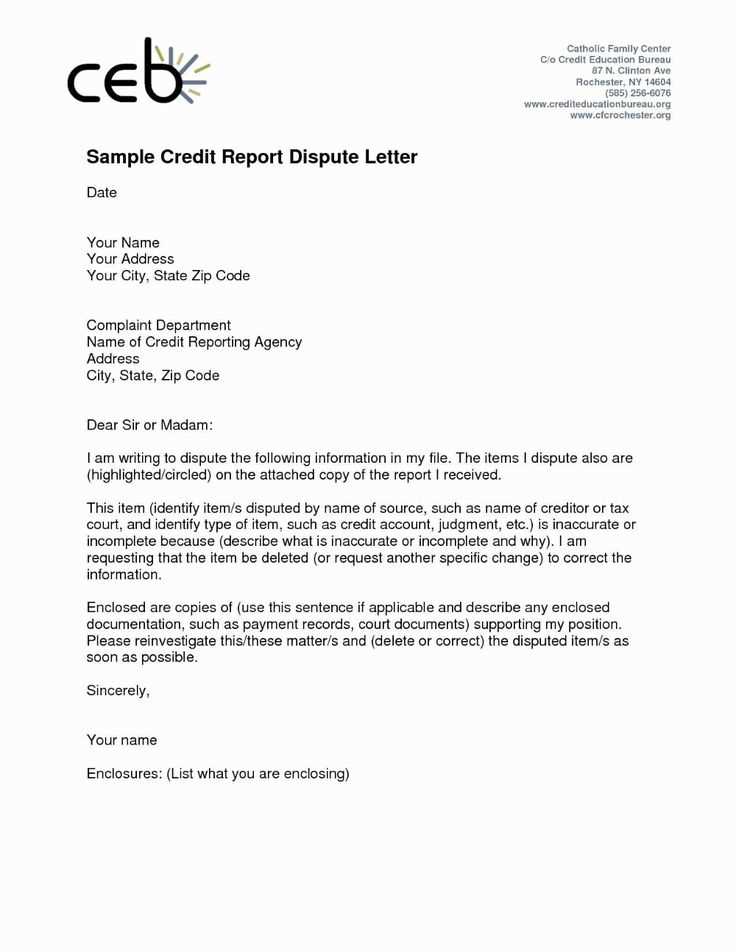

When addressing inaccuracies in personal financial documents, it is important to craft a clear and structured communication. This section guides you through creating an organized format that presents your case effectively. A well-constructed message ensures the responsible party understands the issue and can take the necessary steps toward resolution.

The structure should include essential details such as the specific error, supporting documentation, and a request for correction. A direct and respectful tone will help maintain professionalism throughout the process. Be sure to provide all necessary information to avoid back-and-forth, which can delay corrections.

By focusing on the accuracy and clarity of your message, you can enhance the chances of a prompt response and the swift resolution of any discrepancies in your financial records.

htmlEdit

Understanding Financial Record Corrections

Errors in personal financial documents can have significant consequences, affecting one’s ability to secure loans, obtain favorable interest rates, or even maintain financial stability. It is crucial to understand the process of identifying and addressing such inaccuracies to protect your financial standing and ensure that your records are up to date.

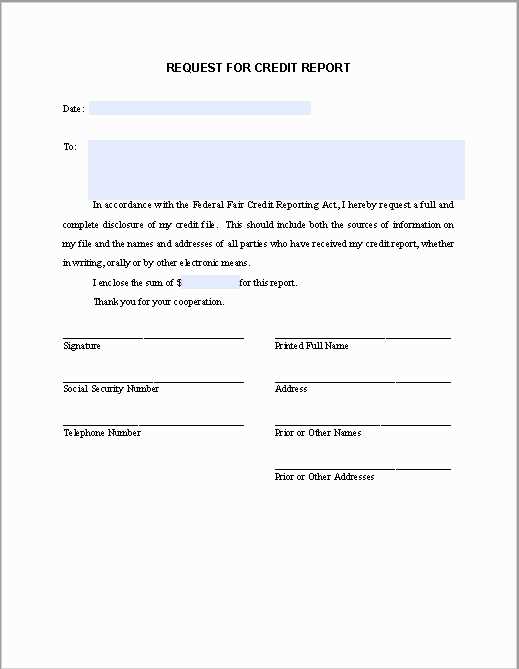

The first step is to carefully examine your financial history and spot any discrepancies that may have occurred. These errors can range from incorrect personal information to outdated account statuses. Recognizing these mistakes allows you to take the necessary action to rectify them.

Once you’ve identified a mistake, it is important to follow the correct procedure to request a revision. This typically involves communicating with the relevant institution or agency, providing necessary documentation, and clearly stating the error that needs to be corrected. Understanding this process ensures you can handle the situation effectively and resolve any issues in a timely manner.

htmlEdit

Key Information to Include in the Letter

When communicating about inaccuracies in your financial documents, it is essential to include all the relevant details to ensure a clear understanding of the issue. Providing a thorough explanation of the error, supported by evidence, will help expedite the resolution process and improve the chances of a positive outcome.

Personal Details and Identification

Start by including your full name, address, and contact information. This helps the recipient verify your identity and locate the specific document or account in question. Additionally, be sure to include any relevant identification numbers, such as account numbers, to pinpoint the exact issue you are addressing.

Clear Description of the Issue

Describe the error you are addressing in detail. Make sure to point out specific discrepancies, including dates, amounts, or incorrect information. Attach supporting documents that validate your claim, such as bank statements or transaction records, to make your request more compelling and easier to process.

htmlEdit

Common Mistakes to Avoid in Disputes

When addressing inaccuracies in your financial records, it is important to approach the situation carefully to avoid common mistakes that could delay or hinder the resolution process. Ensuring that your communication is clear, accurate, and professional will greatly increase your chances of success. Understanding these common pitfalls will help you take the right steps and avoid unnecessary complications.

Providing Insufficient Details

One of the most frequent errors is failing to provide enough information about the issue. Without a clear explanation and supporting evidence, it can be difficult for the recipient to understand the problem or take action. Always be specific about the discrepancy, and include all relevant documentation to back up your claim.

Using Inaccurate or Vague Language

Another common mistake is using vague or inaccurate language. Ambiguity can lead to confusion or misinterpretation of your request. It is important to be as precise as possible when describing the error to ensure the correct action is taken.

| Mistake | Impact | Solution |

|---|---|---|

| Not Including Evidence | Can delay or reject the correction | Attach clear documentation, such as statements or invoices |

| Being Too General | Unclear communication, possible misunderstanding | Provide specific details and dates related to the issue |

| Using Inappropriate Tone | Risk of escalating the situation | Remain polite and professional in your request |

htmlEdit

Steps to Take Before Sending the Letter

Before sending your communication to address errors in your financial records, it is important to ensure that you have taken all necessary steps to prepare. Properly preparing your message and reviewing your information can help avoid delays and ensure the process is as smooth as possible. Carefully following these steps will maximize the effectiveness of your request.

First, thoroughly review the details of the issue. Verify that you have identified the correct error and that all the necessary information is included. Double-check any supporting documents to ensure they are accurate and complete. It’s also essential to gather any relevant reference numbers or accounts to streamline the process.

Next, make sure your message is clear and concise. Review your communication for clarity, ensuring that all points are explained in detail. This will help the recipient understand the issue without needing further clarification, which can delay the resolution.

htmlEdit

How to Follow Up After Submission

Once you have sent your communication to address inaccuracies, it is essential to track the progress and ensure that your request is being handled. Following up promptly can help maintain momentum and prevent unnecessary delays in resolving the issue. Here are the key steps to take after submission:

- Keep a record of your submission, including dates and any confirmation numbers or receipts you receive. This will help you track the process and provide proof if needed.

- Set a timeline for follow-up. Wait for the appropriate amount of time to allow the recipient to process your request, typically 30 days, and plan to follow up if no response is received.

- Contact the recipient if you haven’t received a response within the expected timeframe. You can reach out through the same channel you used for submission, such as email, phone, or online portal.

If you follow these steps, you can help ensure that your request is being processed and take further action if necessary to resolve the issue in a timely manner.

htmlEdit

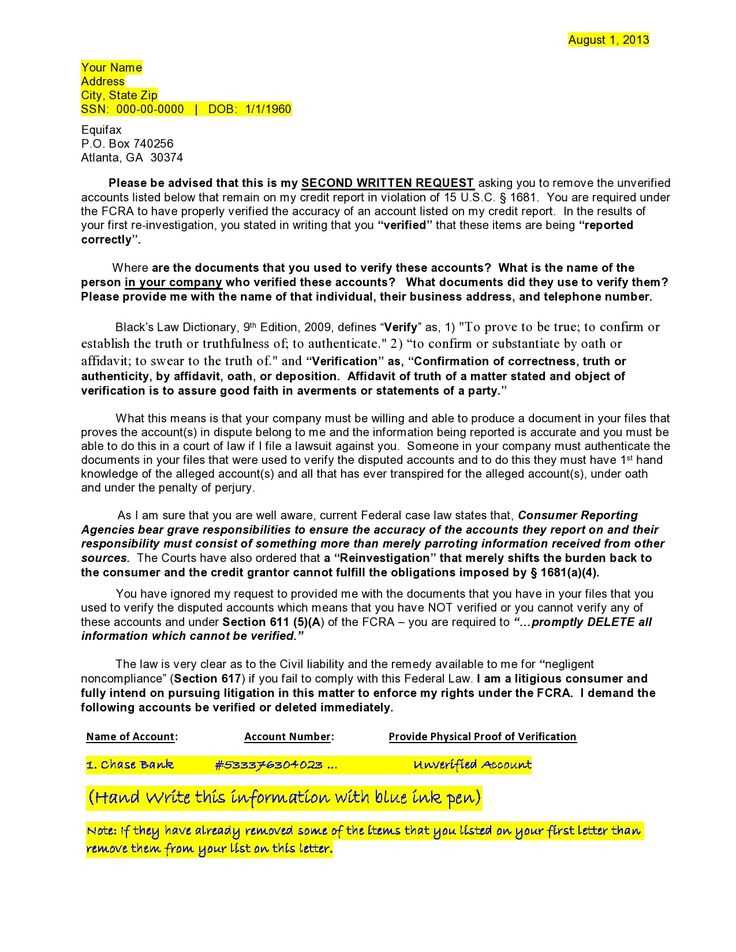

Legal Rights in Financial Record Corrections

When addressing inaccuracies in personal financial documents, it is important to be aware of your legal rights. Understanding the protections available to you ensures that you can effectively assert your position and seek a fair resolution. These rights are designed to prevent errors from negatively impacting your financial future and to promote fairness in the correction process.

Right to Dispute Inaccuracies

You have the legal right to challenge any inaccurate or incomplete information in your financial records. If you notice a discrepancy, you are entitled to request that the institution or agency investigate and rectify the error. It is essential to follow the appropriate procedure and provide supporting documentation to back up your claim.

Timely Resolution Requirements

By law, agencies must investigate disputes and provide a response within a certain timeframe, usually 30 days. Failure to address your concern within this period may give you grounds to escalate the issue or pursue further action. Understanding the timelines ensures that you are not left in limbo.

- Right to Access Information: You are entitled to view your financial documents and any data used to make decisions about your financial standing.

- Right to Timely Notification: If any changes are made following your dispute, you must be notified of the outcome and any actions taken.

- Right to Seek Legal Remedies: If you believe your rights have been violated, you can pursue legal action against institutions that fail to comply with regulations.