Certified Collection Letter Template for Debt Recovery

When businesses or individuals face unpaid debts, it becomes crucial to send a formal notice to remind the debtor of their outstanding obligations. This process ensures a clear and professional communication channel, increasing the chances of recovering the funds owed. A well-crafted message not only conveys the seriousness of the situation but also adheres to legal requirements, making the process smoother for both parties involved.

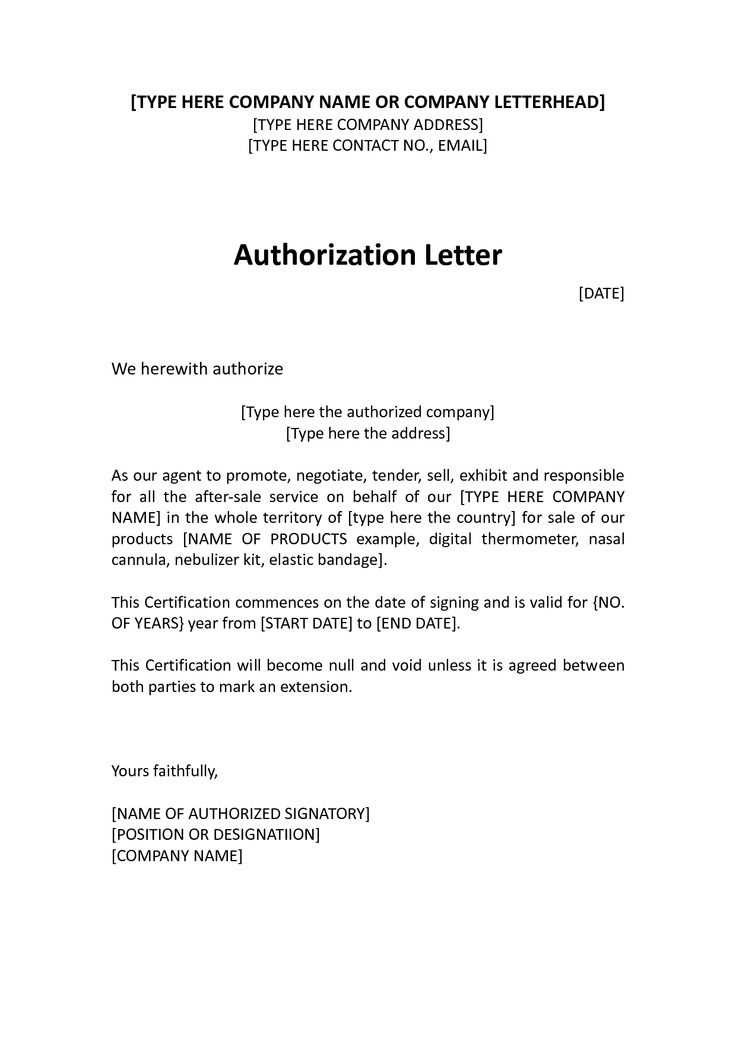

Key Elements of an Effective Notice

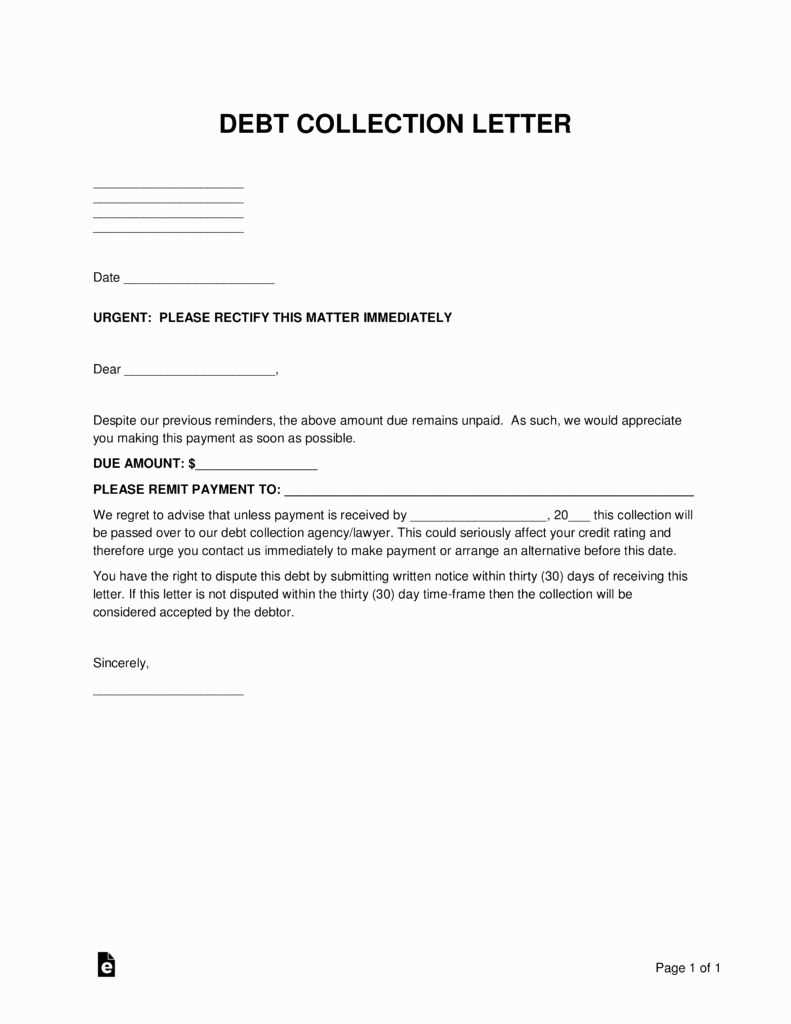

For any formal demand, it is important to include several key details to ensure clarity and avoid confusion. These components help establish the legitimacy of the request and guide the recipient towards taking action:

- Identification Information: Include details such as the sender’s name, address, and contact information.

- Debtor’s Information: Clearly state the debtor’s name and any identifying details such as account numbers.

- Outstanding Amount: Specify the exact amount owed, including any interest or late fees, if applicable.

- Payment Instructions: Provide clear instructions on how to remit payment and any deadlines for settlement.

- Legal Consequences: Politely inform the debtor of any potential legal steps if the situation remains unresolved.

Customizing Your Document for Specific Cases

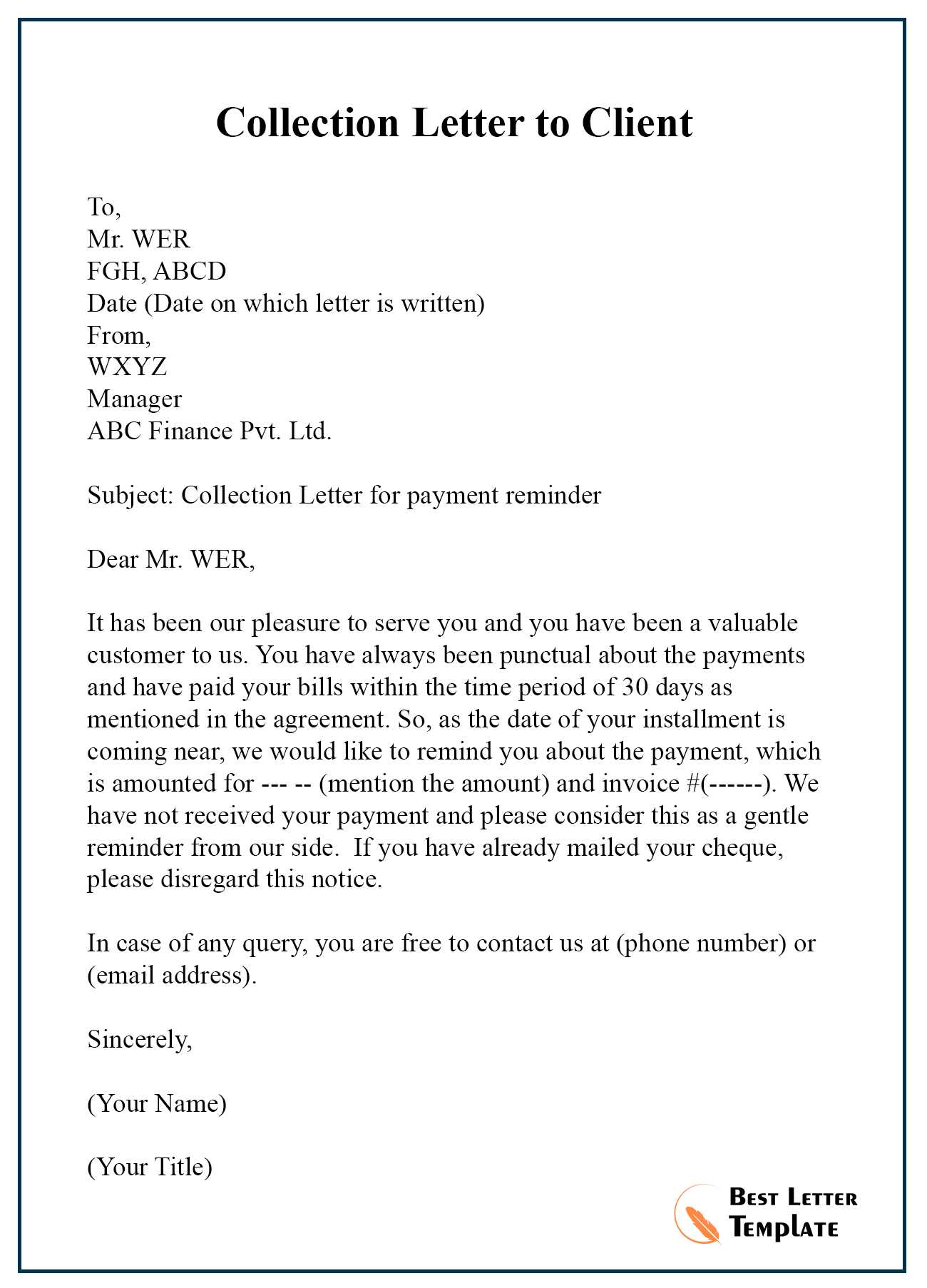

Personalizing your notice to fit the specific circumstances of the debtor can improve the likelihood of payment. For example, if you have had previous communication with the individual, referencing this in the message helps provide context. Customization also involves adjusting the tone of the message to suit the relationship you have with the debtor, whether it’s more formal or lenient.

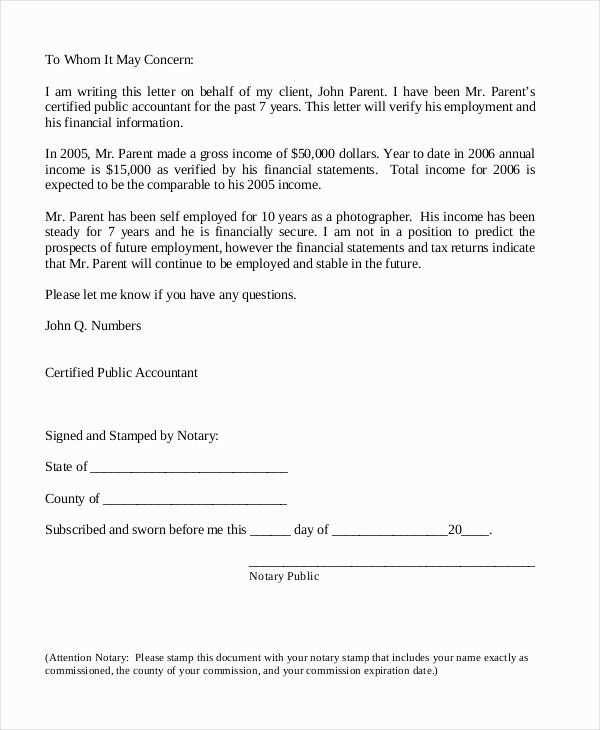

Ensuring Compliance with Legal Standards

It’s important to ensure that all communication complies with applicable laws to avoid potential legal issues. Depending on your location, there may be specific regulations on how to word your demand or the methods you can use to send the communication. Understanding these requirements will help you craft a message that both encourages payment and protects your rights.

Best Practices for Sending Formal Notices

Once your communication is ready, it’s time to send it out. The way you deliver the document can significantly impact its effectiveness:

- Use a Tracked Service: Opt for a delivery method that provides proof of receipt, ensuring the recipient gets the notice.

- Maintain Professionalism: Keep the tone respectful and professional, regardless of the circumstances.

- Follow Up: If there is no response within the specified time, consider following up with another reminder.

By adhering to these principles, you increase the chances of resolving outstanding debts in an efficient and professional manner.

Understanding Formal Debt Recovery Notices

When dealing with unpaid debts, it is important to send a formal written communication to remind the debtor of their outstanding balance. This type of message serves as a legal tool for requesting payment, helping to establish a clear and professional approach to resolving financial disputes. A properly crafted document ensures that the process is handled efficiently and with respect to the legal framework governing such matters.

Why Choose a Formal Debt Request?

Using a formal document ensures that the request for payment is taken seriously. It not only serves as an official reminder but also demonstrates a professional attitude towards debt recovery. By sending a written notice, you create a paper trail that can be useful if further legal action is required. The formal nature of the communication adds weight to the request, increasing the likelihood of prompt payment.

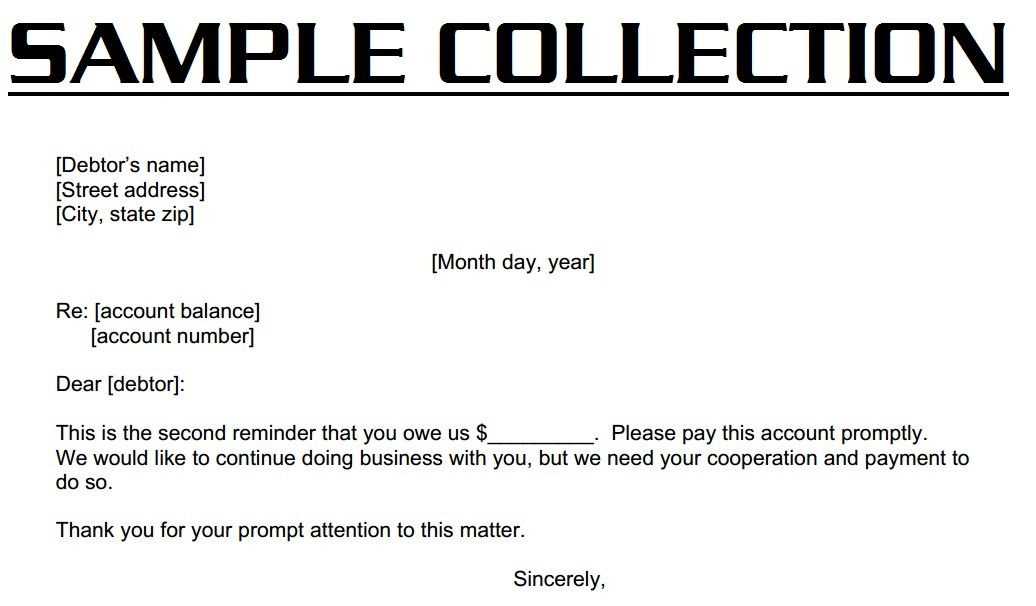

Key Elements of an Effective Demand

To make sure your message is clear and impactful, certain elements should be included in the communication. These components help ensure the recipient understands the situation and knows how to proceed:

- Sender Information: Include the sender’s full name, address, and any relevant identification details.

- Recipient Information: Clearly state the debtor’s name and address, as well as any relevant account or reference numbers.

- Amount Due: Specify the exact amount owed, including any additional charges or interest.

- Payment Instructions: Provide clear steps on how the debtor can settle the debt, including payment methods and deadlines.

- Consequences of Non-payment: Politely outline any potential legal actions that could follow if the debt remains unpaid.

How to Personalize Your Request

Tailoring your message to the specific situation of the recipient can increase its effectiveness. Personalization involves referencing prior communications, adjusting the tone based on the relationship, and adding any specific details relevant to the debt. A personalized message shows the debtor that you are attentive to their circumstances, which can encourage a more favorable response.

Legal Aspects of Debt Recovery

It is crucial to ensure that your communication complies with local laws and regulations. Different jurisdictions may have specific rules regarding how you must word the message or what steps you must take to ensure that the request is legally binding. Being aware of these legal requirements helps protect both parties and ensures that any future actions are legitimate.

Common Errors to Avoid in Requests

There are several mistakes that can undermine the effectiveness of your request. These include unclear or vague wording, failing to include necessary details, and using an overly aggressive or threatening tone. It’s also important to avoid sending the communication through unreliable methods. These errors can delay the resolution process and complicate any future legal steps.

Best Practices for Sending Formal Requests

When sending a formal demand, ensure that you use a reliable and trackable delivery method, such as registered mail. This provides proof that the recipient has received the communication. Always maintain professionalism in your tone, even if the situation is urgent, and follow up if the debt remains unpaid after the specified deadline. Following these practices will increase the chances of successfully recovering the owed amount.