Personal Loan Repayment Letter Template for Easy Use

When managing financial obligations, clear communication is key to ensuring both parties understand the terms of payment and repayment schedules. A well-crafted document can serve as a formal record of your intent to honor financial commitments. It helps avoid misunderstandings and maintains trust between you and the other party involved.

Key Aspects to Include in Your Communication

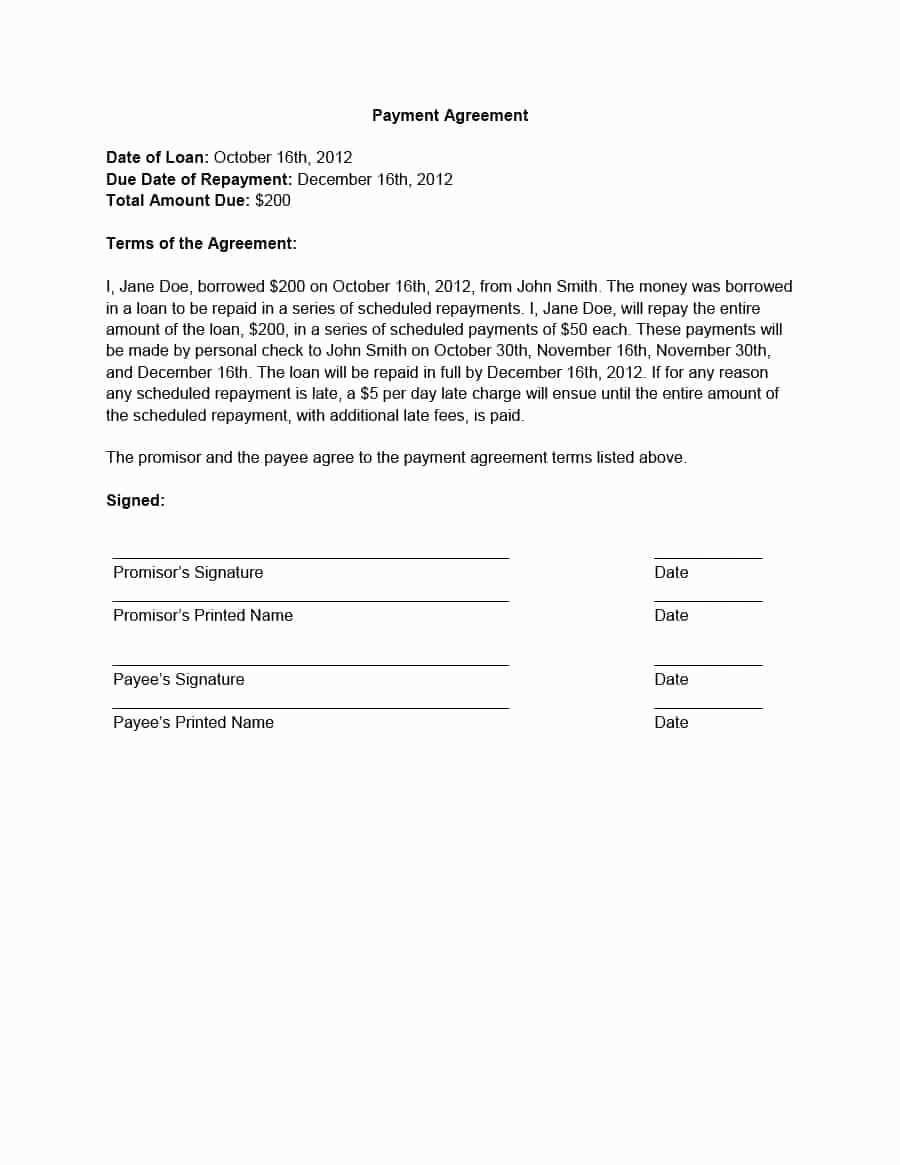

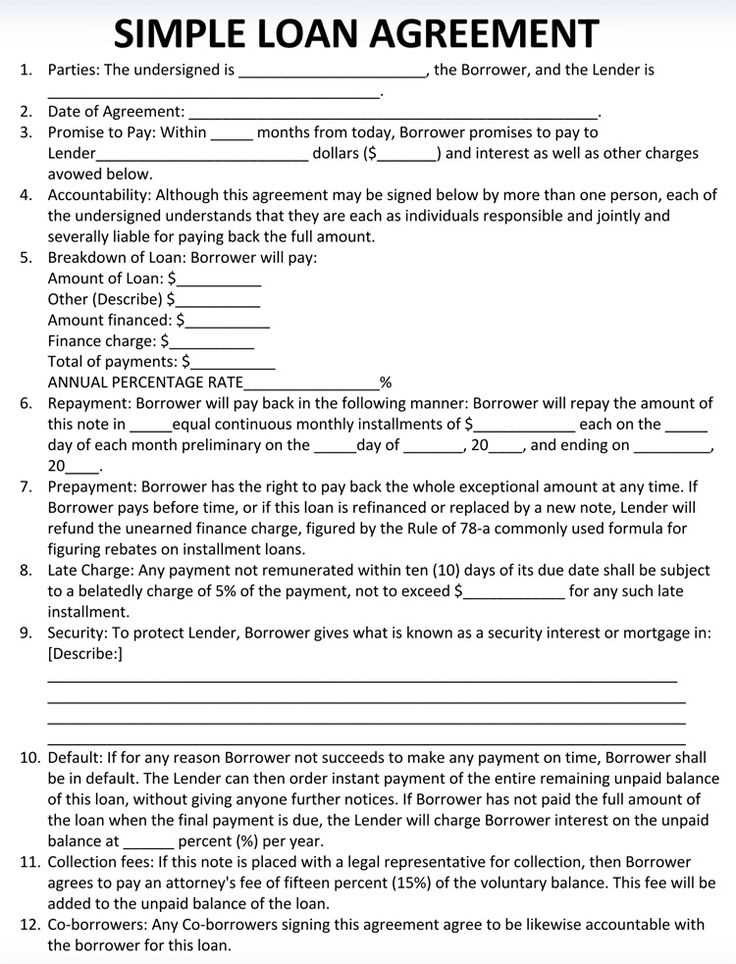

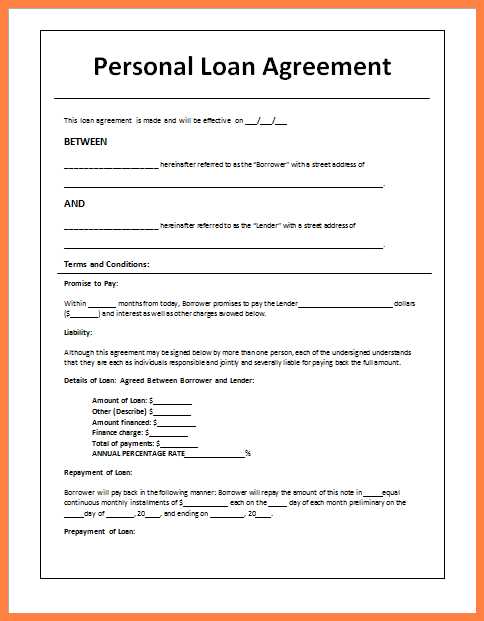

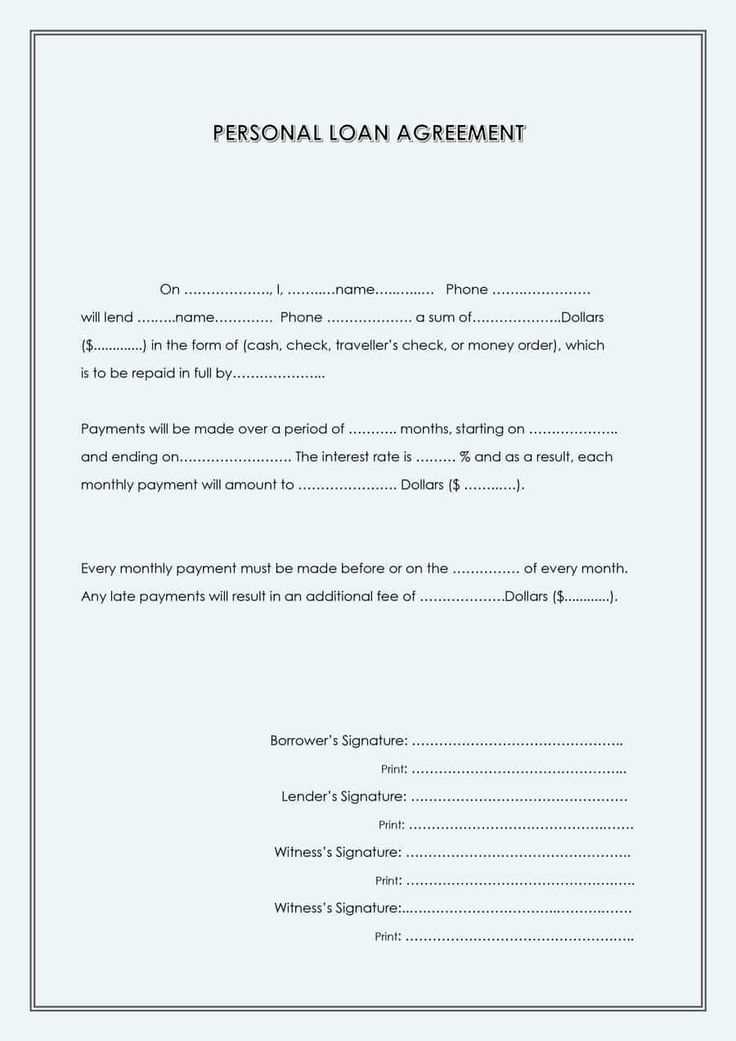

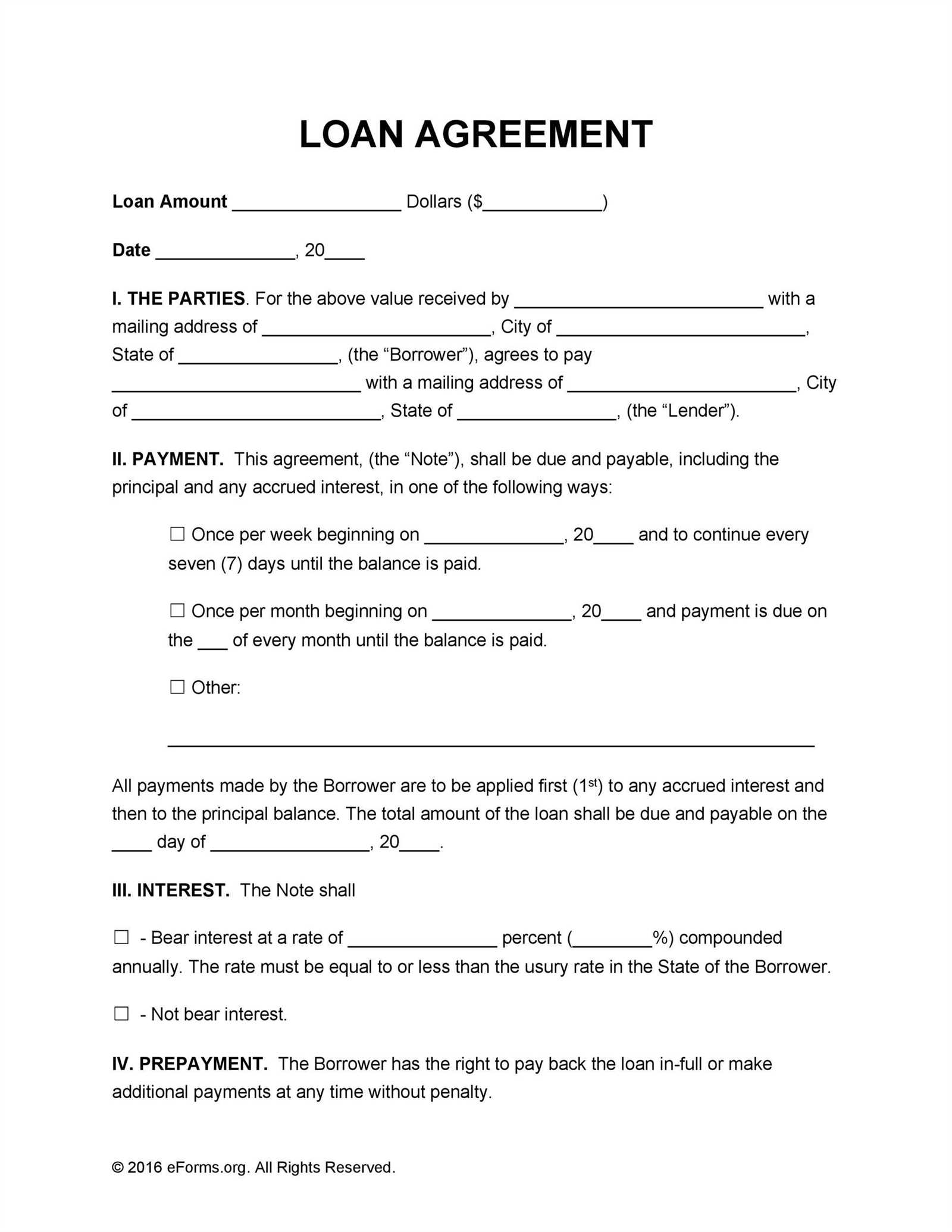

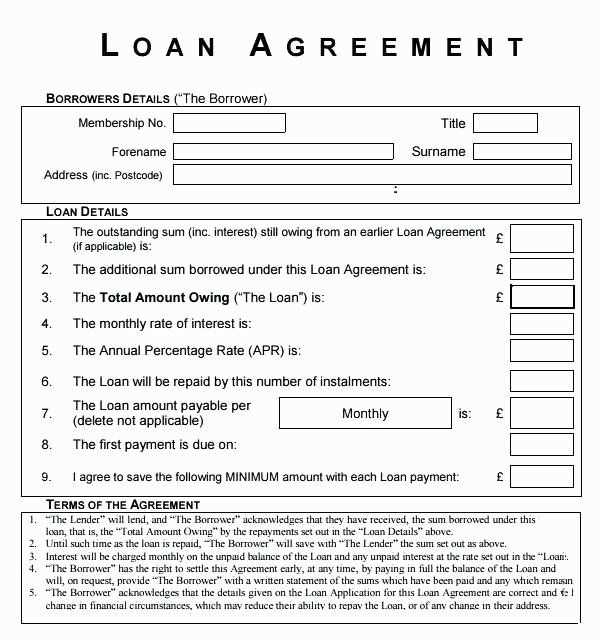

It is essential to cover all necessary details when crafting a formal note regarding your financial agreement. This includes specifying the amount owed, the proposed schedule for settlement, and any relevant terms that might affect the process.

- Amount to be settled: Clearly state the exact sum that needs to be paid.

- Payment dates: Outline a clear timeline with dates for each installment, if applicable.

- Contact information: Provide all relevant details for easy communication, including phone numbers or email addresses.

- Terms of agreement: Mention any conditions that may affect the repayment, such as interest rates or penalties for late payment.

Setting the Right Tone

While it’s important to be professional, the tone should also reflect your willingness to cooperate and fulfill your financial obligations. A polite, respectful, and straightforward approach will help foster goodwill and ensure that your intentions are clearly understood.

Customizing for Different Situations

Each financial arrangement can vary, so it’s crucial to tailor your document to the specific context. If you’re dealing with a financial institution, they may have specific expectations. For personal arrangements, a more informal approach might be acceptable, but the essential details should remain intact.

Avoiding Common Pitfalls

While creating such a document, there are common mistakes to watch out for. Ambiguity in the terms or failing to mention crucial details can cause delays or misunderstandings. Ensure that all important information is included and clearly stated to prevent future confusion.

- Vague wording: Be specific in outlining the payment amounts and due dates.

- Missing signatures: Ensure that both parties acknowledge the terms in writing.

- Failure to proofread: Double-check the content for accuracy before sending it.

Sending and Monitoring the Document

Once your document is ready, ensure that it’s delivered to the appropriate recipient. Keep a copy for your records and track any responses. If any follow-up is required, you’ll have a clear record of your communication to refer back to.

Understanding the Importance of Financial Commitment Communication

When managing outstanding financial obligations, it’s essential to establish clear and formal communication with the concerned party. A structured document serves as a mutual understanding of the payment schedule and ensures that both sides are aligned regarding expectations and timelines.

Key Elements to Include in the Document

To ensure clarity and transparency, certain details must be included in the communication. These elements help provide a comprehensive overview and avoid any confusion later in the process.

- Amount owed: Clearly specify the total amount that is to be paid.

- Payment schedule: Break down the payment plan, including the due dates and amounts for each installment.

- Contact details: Provide all necessary contact information to ensure easy communication.

- Terms and conditions: Mention any agreements related to late fees or interest rates, if applicable.

Choosing the Right Tone and Approach

The tone of the document plays a significant role in maintaining a professional relationship. It should be respectful yet assertive, focusing on conveying your intention to meet the financial obligation. A well-balanced approach will reflect your commitment without sounding overly formal or too casual.

Customizing Your Message for the Recipient

Different recipients may have unique requirements or expectations. For formal financial institutions, your communication should follow their guidelines. However, for personal arrangements, a more conversational tone might suffice. Regardless of the recipient, always ensure that the core details remain clear and concise.

Avoiding Common Mistakes

It’s easy to overlook certain details when drafting such documents. Here are some common mistakes to avoid:

- Vague terms: Ensure all terms are specific to avoid any future confusion.

- Missing signatures: Always have both parties sign to acknowledge the agreement.

- Incomplete information: Double-check that all necessary data is included before sending.

Sending and Tracking the Document

Once the document is finalized, it’s essential to send it promptly to the right person or entity. Keep a copy for your records and monitor any responses or confirmations. This will help you stay organized and ensure that the repayment process proceeds smoothly.