Mortgage Lender Underwriter Letter of Explanation Template

When applying for a loan, applicants often need to clarify certain aspects of their financial situation. This communication serves as a means to resolve any concerns that arise during the evaluation of the application. Crafting this document properly can streamline the approval process and improve the likelihood of success.

The Purpose of a Financial Support Document

This document is essential for clarifying discrepancies or unusual items that might raise questions. It provides a clear, concise explanation from the applicant’s perspective, ensuring that evaluators fully understand their financial background and the reasons behind certain actions. This can include a variety of situations such as missed payments, recent changes in income, or other financial events that need clarification.

Why Clear Communication is Key

Clear communication ensures that evaluators can accurately assess the applicant’s situation without making assumptions. A well-constructed response helps prevent delays and reduces the risk of misunderstandings. By providing a direct explanation, applicants can avoid having their applications delayed due to confusion or lack of transparency.

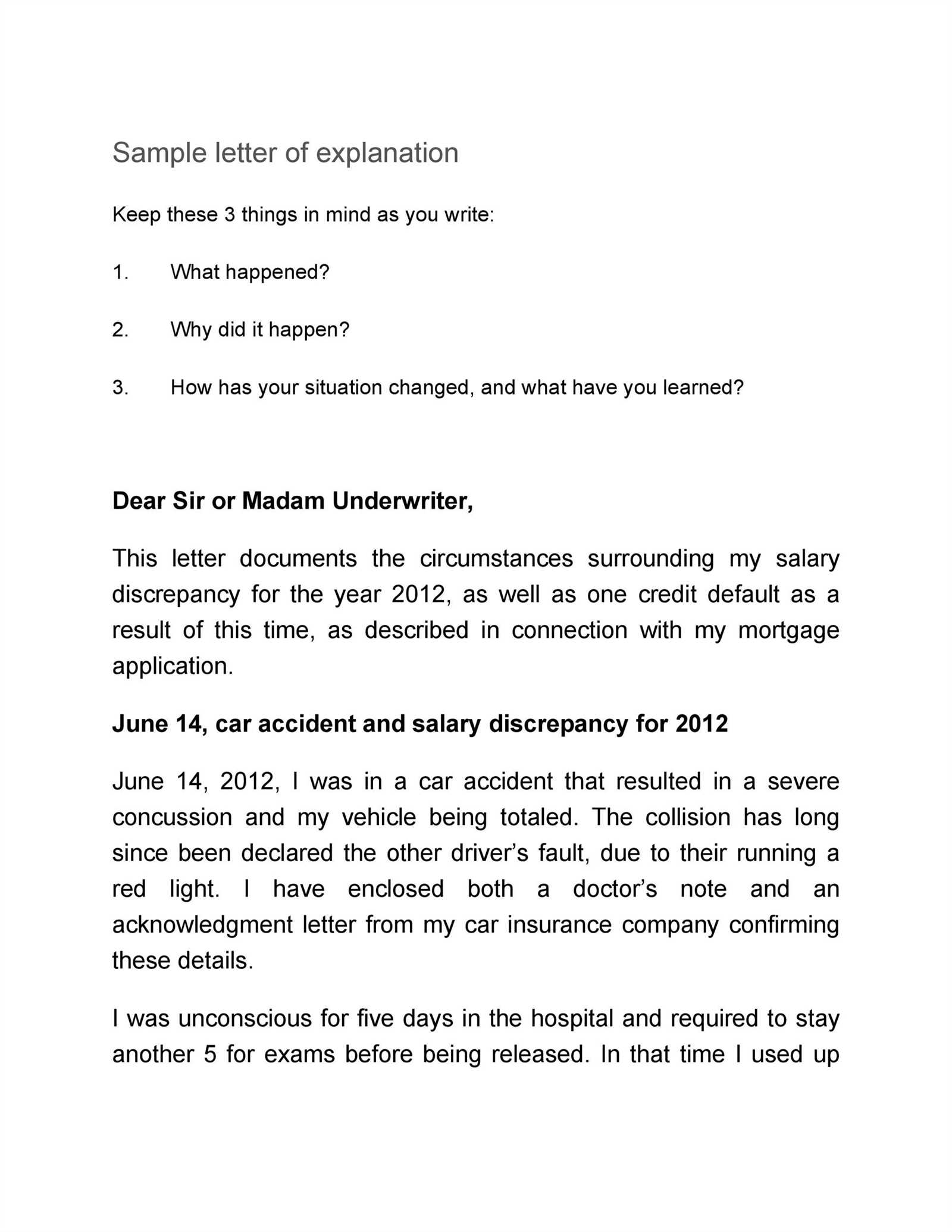

Essential Elements for Crafting an Effective Response

- Clarity: Keep the explanation simple and to the point. Avoid unnecessary jargon or complex terms.

- Honesty: Provide accurate information, even if it’s not ideal. Honesty helps build trust.

- Specificity: Address the exact issue in question with relevant details and documentation when necessary.

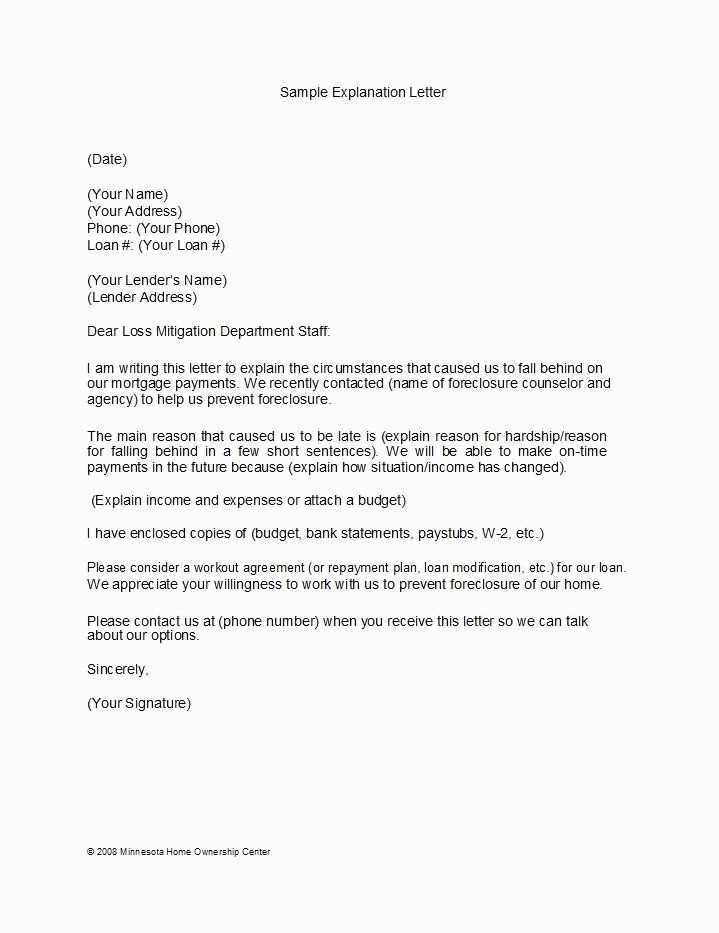

Streamlining the Process with Pre-Written Forms

Using a structured approach can save time and ensure that all the necessary information is included. Pre-written forms or guides can be incredibly helpful in ensuring that applicants cover all required points without overlooking key elements. These forms often come with instructions on how to fill out each section effectively, offering guidance to avoid errors and ensuring all important aspects are addressed.

Common Mistakes to Avoid

- Providing too much information: Keep the explanation focused and relevant to the query.

- Leaving out key details: Make sure no important facts are omitted.

- Using vague language: Be as specific as possible to avoid confusion.

Final Thoughts on Writing Effective Financial Clarifications

Drafting a strong financial clarification letter requires attention to detail, transparency, and a clear structure. By ensuring that the document is both informative and concise, applicants can improve their chances of a favorable review and expedite the entire process.

Understanding Financial Clarification Documents

When applying for a loan, applicants may need to provide additional information to address specific concerns raised during the review process. These documents are crucial in ensuring transparency and resolving any doubts that may arise, ultimately helping to speed up the approval procedure.

Clear Communication’s Importance in Loan Approval

Effective communication is essential for both applicants and evaluators. A well-structured response can clarify the applicant’s financial situation and resolve any issues efficiently. By providing relevant details in a straightforward manner, applicants can minimize delays and ensure their request is accurately reviewed.

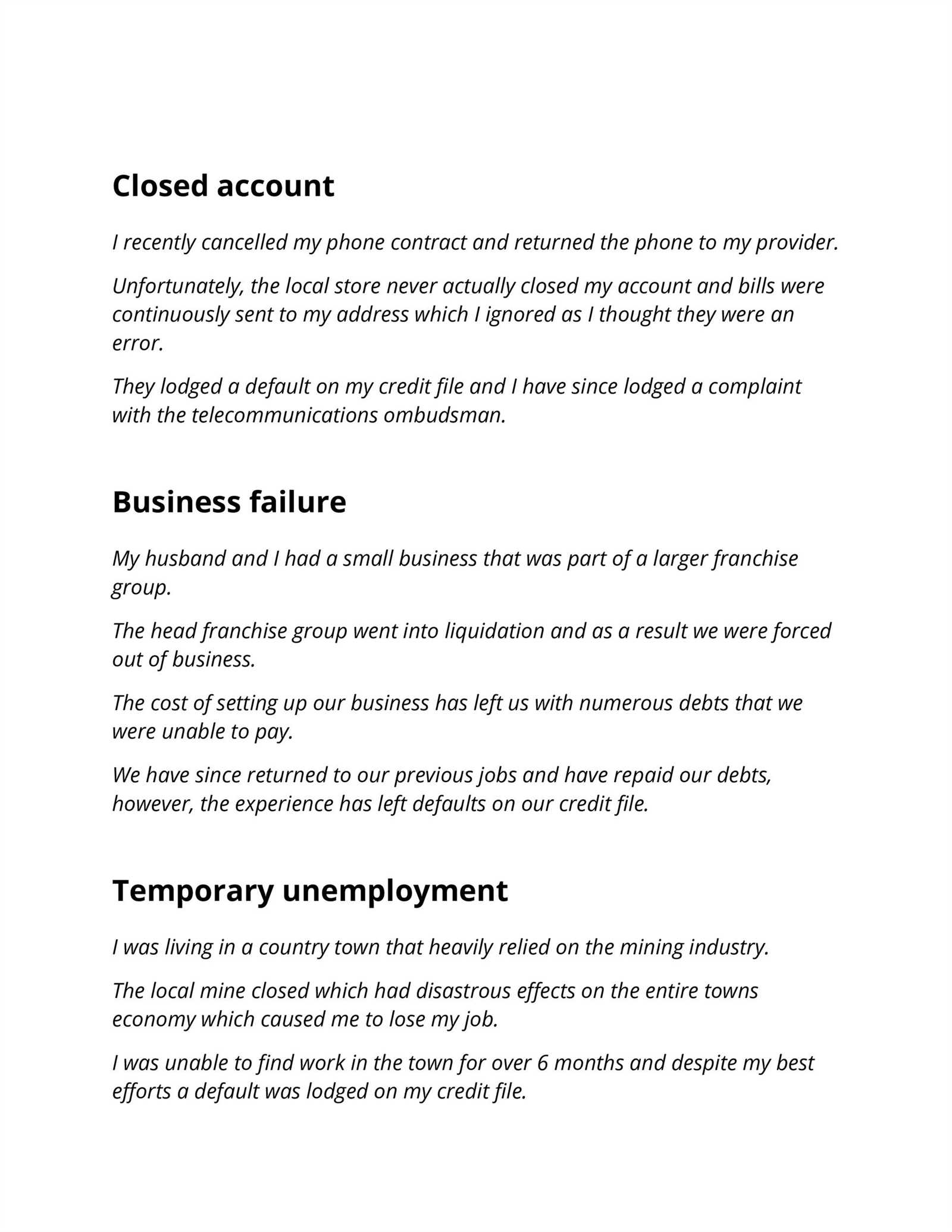

Challenges Often Encountered in Clarification Documents

There are common obstacles that arise when drafting these documents. These may include vague explanations, missing information, or excessive details that complicate the review process. Ensuring clarity and conciseness is key to avoiding these issues and making the process smoother for all parties involved.

By following best practices for drafting these important documents, applicants can ensure their financial background is communicated effectively. This includes addressing specific concerns, keeping the message clear and concise, and using established guidelines or forms to avoid errors and omissions.