Bank Proof of Funds Letter Template Guide

In various situations, individuals and businesses are required to demonstrate their financial stability and the availability of certain resources. This type of document is essential for proving one’s capacity to meet specific obligations, whether it be for a transaction, investment, or other financial matters.

By drafting a professional and clear document, you ensure that your intentions and financial standing are clearly communicated to the receiving party. The document should convey all necessary information in an organized way, avoiding any ambiguities or misunderstandings.

Understanding the key elements involved in crafting this kind of statement is crucial. A well-structured document will not only meet requirements but will also leave a lasting impression of your financial reliability.

In the following sections, we’ll explore how to create such a document, focusing on the most important components to include and tips for avoiding common mistakes.

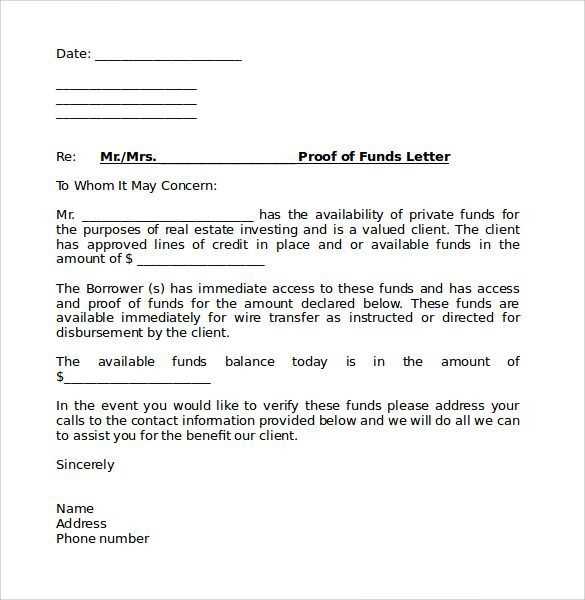

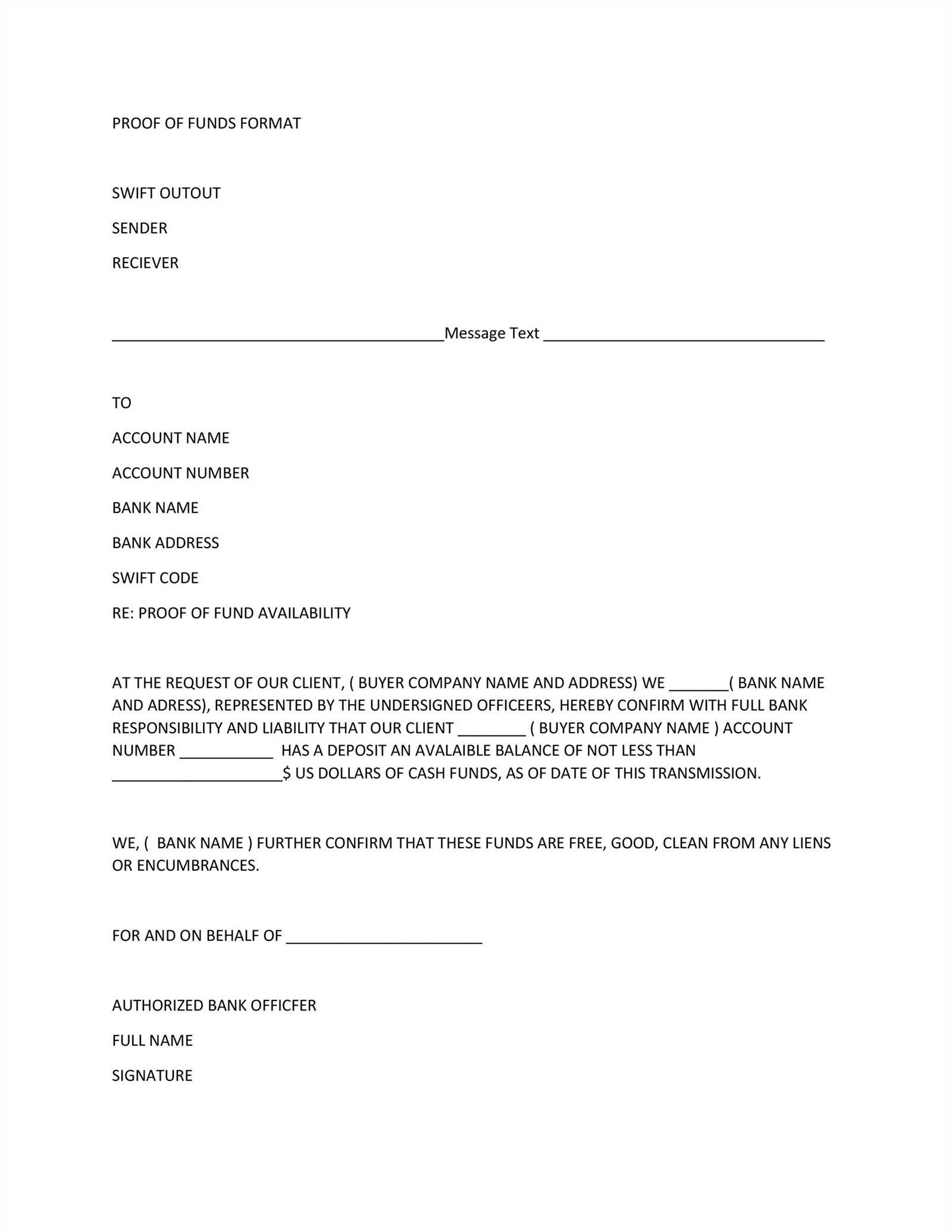

Financial Verification Document Example

When engaging in significant transactions, whether personal or professional, a formal statement confirming the availability of resources may be required. This type of document serves as evidence to assure others of your financial reliability and ability to meet certain obligations. It is essential to ensure that the details presented are clear, precise, and meet the expectations of the institution or individual requesting the verification.

Key Components to Include

To make your document valid, it must include several important elements. These include the exact amount of resources, the source of the assets, and the date the verification is provided. It should be clear and free of any ambiguous wording, presenting only the relevant information. Moreover, having the document officially signed and stamped by the appropriate authority adds credibility and formality.

Why Accuracy is Crucial

Accuracy plays a vital role when creating this type of statement. Inaccurate or unclear details could result in rejection or unnecessary delays in processing the request. Therefore, it is essential to double-check all the figures, dates, and official signatures before submitting the document. A precise and well-structured verification is much more likely to be accepted without issues.

Importance of Financial Verification Documents

In many situations, demonstrating that one possesses sufficient resources to meet certain obligations is a vital requirement. Such documentation assures the involved parties that the necessary capital or assets are available for use. This form of confirmation plays an essential role in transactions, lending processes, and agreements, where trust and transparency are crucial.

Building Trust and Credibility

When entering into a significant agreement or transaction, it is important to prove your financial reliability. Having a clear, official statement verifies that you have the means to follow through with your commitments. This not only builds trust with the recipient but also strengthens your credibility in financial matters.

Meeting Legal and Institutional Requirements

Various institutions and legal entities often require confirmation of available resources to ensure that obligations can be met without issues. A formal verification document may be a necessary step before proceeding with certain processes, such as securing a loan, purchasing property, or investing in major projects.

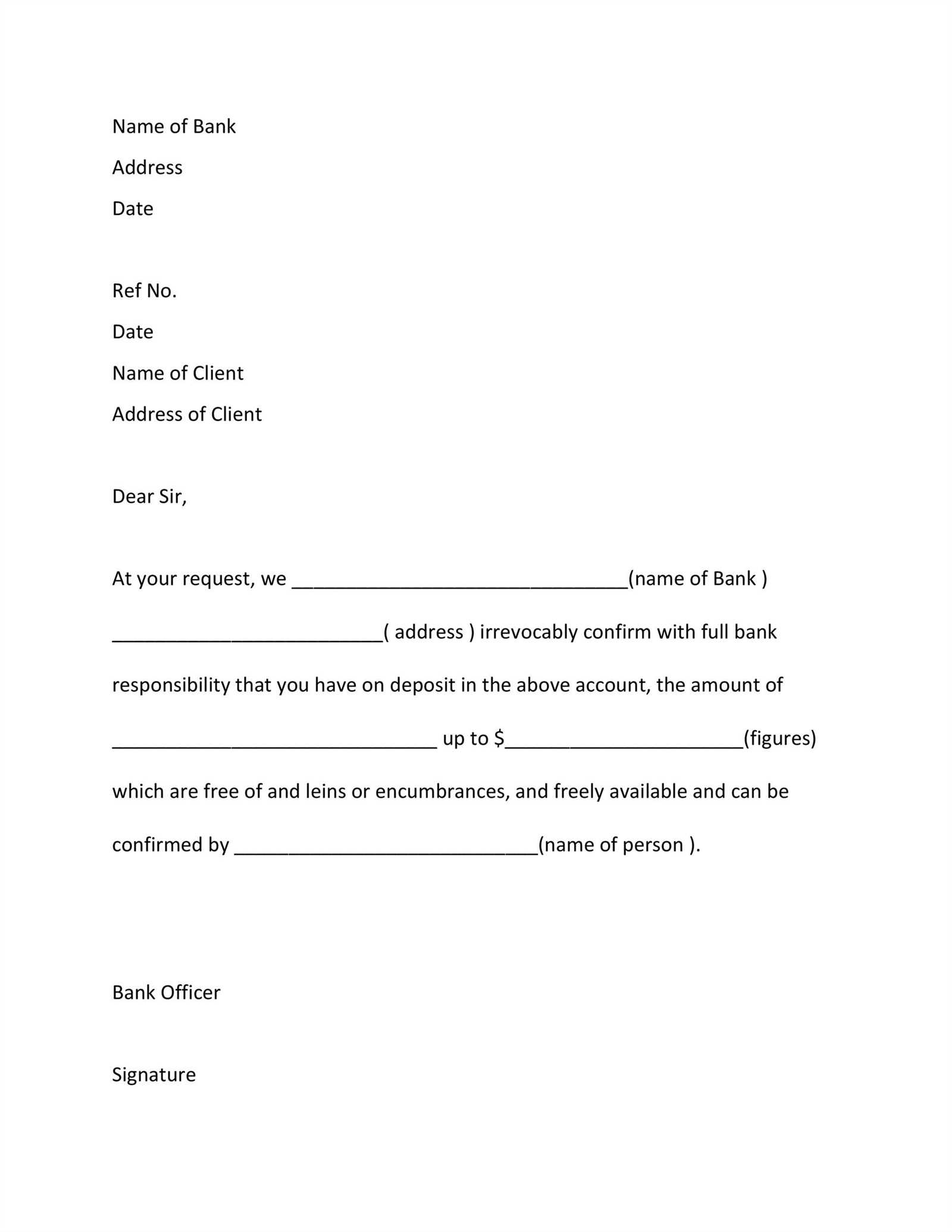

Steps to Create a Financial Letter

Creating an official statement to verify your financial standing requires careful planning and attention to detail. The process involves several essential steps to ensure that the document is both accurate and acceptable to the requesting party. Below are the key stages to follow when preparing such a document.

- Gather Relevant Information

Start by collecting all necessary details about your available assets, including account balances, investments, and any other financial resources that are part of the verification.

- Determine the Format

Choose a format that best suits the requirements of the institution or individual requesting the document. This may include a formal business letter structure or a more straightforward statement.

- Include Key Details

Ensure that the document clearly states the amount of available resources, their origin, and the verification date. Additionally, make sure the details are free from ambiguity.

- Official Authorization

For added validity, have the statement signed or stamped by the appropriate authorized party, such as a financial institution or other recognized authority.

- Review for Accuracy

Before submitting, carefully review the document for any errors or omissions. Double-check all the figures and ensure all information is up to date and precise.

Essential Elements for a Valid Document

For any financial verification document to be considered valid, it must include certain key elements that clearly convey the necessary information. These components not only ensure that the statement is legally sound but also that it meets the expectations of the requesting party.

Key Information to Include

Start by clearly stating the amount of available resources, the source from which they originate, and the specific date on which the verification is being issued. This provides transparency and helps avoid any confusion regarding the details presented.

Official Authorization and Signature

To enhance the document’s credibility, it should include the signature or stamp of an authorized representative, such as from a financial institution. This validation confirms that the details provided have been verified and are accurate.

Common Errors to Avoid in Documents

When preparing a financial verification document, it’s important to avoid common mistakes that can render the document invalid or cause delays. These errors typically arise from incomplete or incorrect information, or from failing to follow the necessary procedures. Being mindful of these issues ensures that the document is clear and accepted by the intended recipient.

Incorrect or Incomplete Information

One of the most common issues is providing inaccurate or missing details. This could include incorrect account numbers, the wrong amount of resources, or failure to specify the source of assets. Such errors could lead to rejection or requests for additional clarification.

Failure to Include Official Validation

Another frequent mistake is neglecting to have the document properly validated. This could mean missing signatures, stamps, or authorizations from the necessary authorities, reducing the document’s credibility and effectiveness.

| Error Type | Possible Consequence |

|---|---|

| Incorrect Amounts | Rejection of the document, delays |

| Missing Official Signature | Lack of credibility, invalidation |

| Incomplete Details | Request for further information, delays |

Scenarios Requiring Proof of Funds

There are several situations where it is essential to demonstrate financial capability, often in the form of an official document. These scenarios can vary across industries and contexts but share the common goal of confirming that an individual or entity has sufficient resources to complete a transaction or commitment.

- Real Estate Transactions

When purchasing property, a statement of available resources is commonly required to prove the buyer’s ability to complete the purchase without relying on unsecured loans.

- Visa and Immigration Applications

Some countries require evidence of financial capacity for visa applications, particularly for long-term stays or residency, to ensure applicants can support themselves without public assistance.

- Loan Applications

Lenders may request verification of available assets to assess the borrower’s ability to repay the loan before approving credit or other financial products.

- Investment Opportunities

Investors may be asked to present a document proving that they have the financial means to participate in specific investment opportunities, particularly in high-value sectors.

- Legal Settlements

In certain legal cases, parties may need to provide verification of resources to settle disputes or meet obligations related to alimony, child support, or settlements.

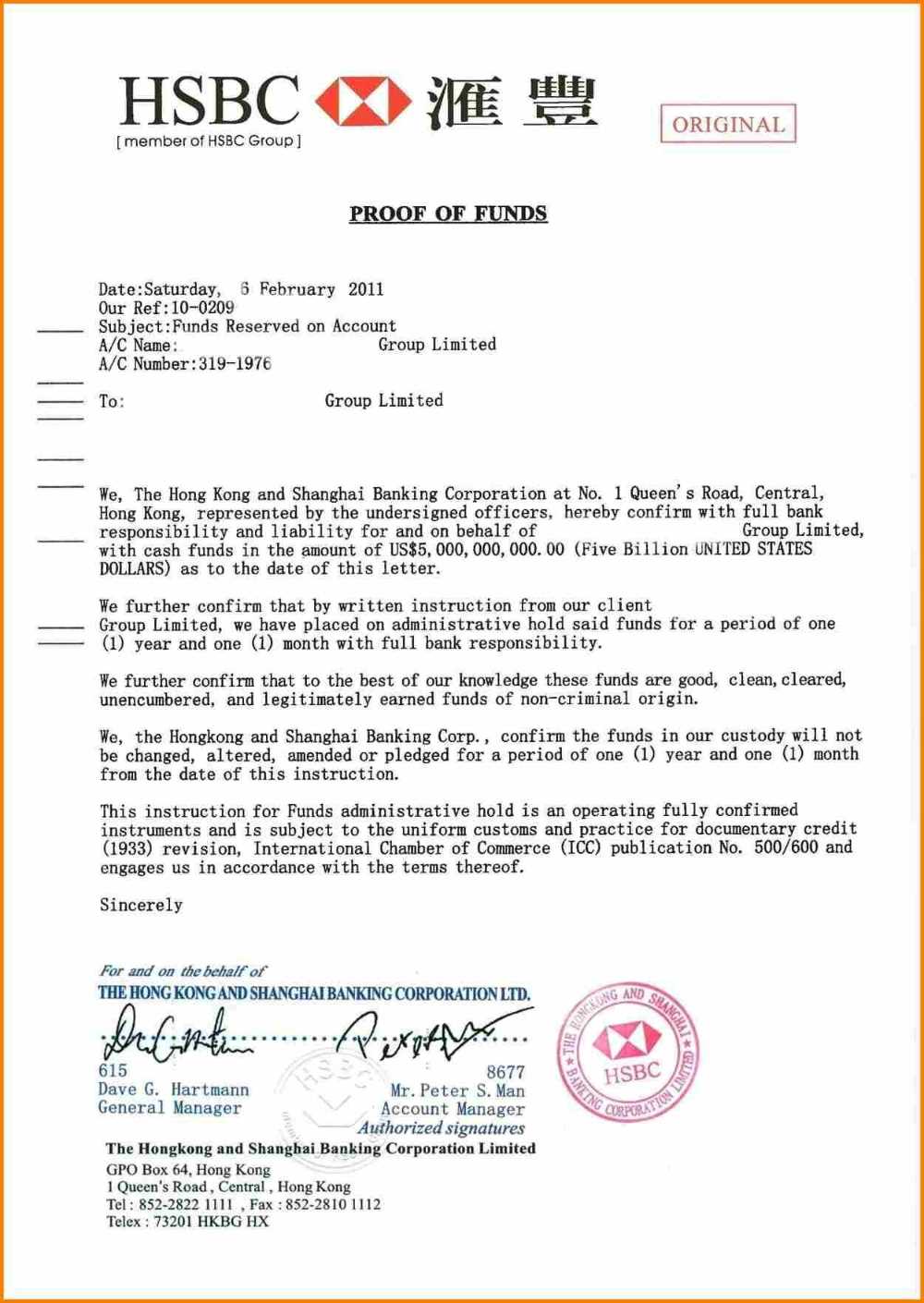

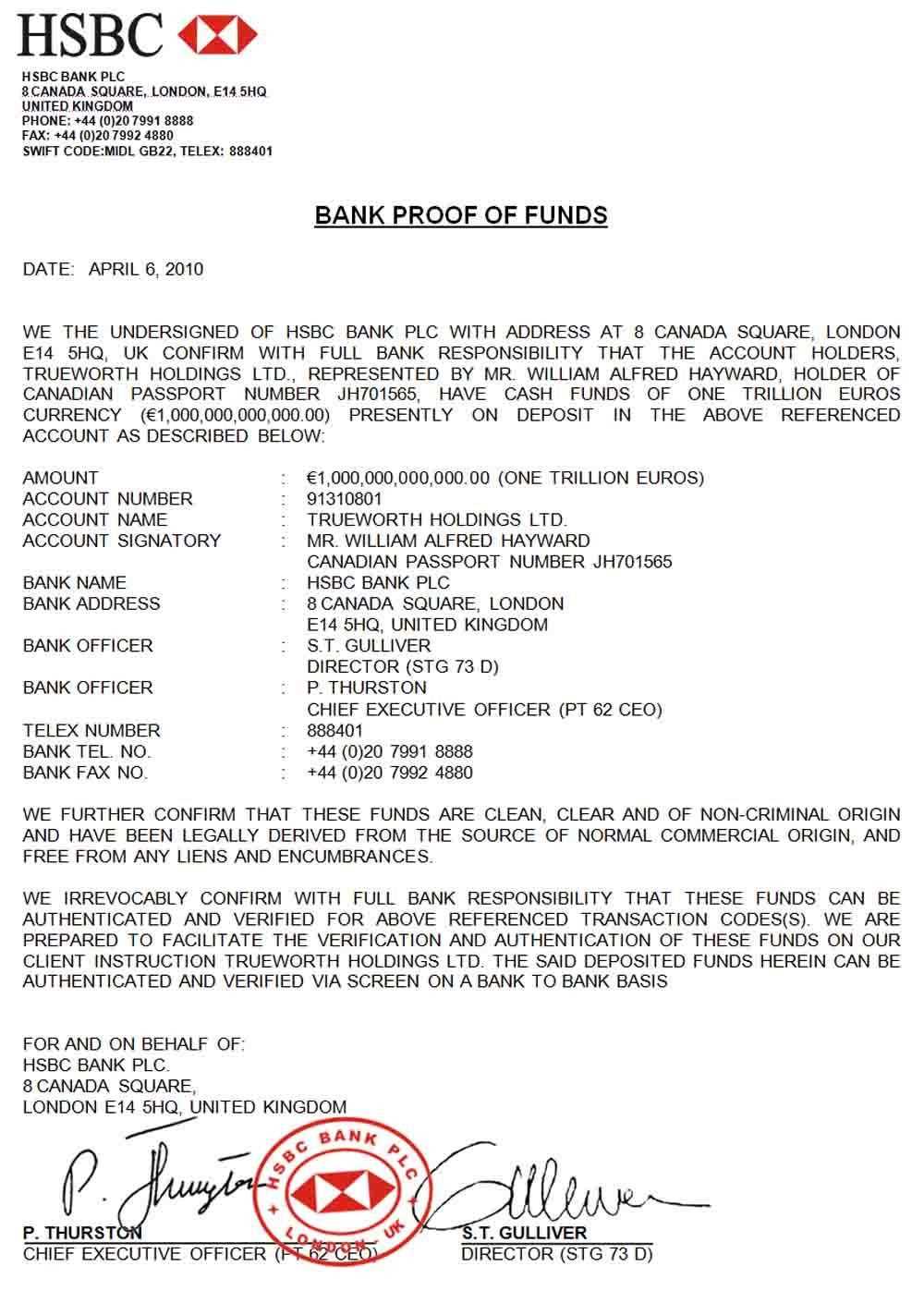

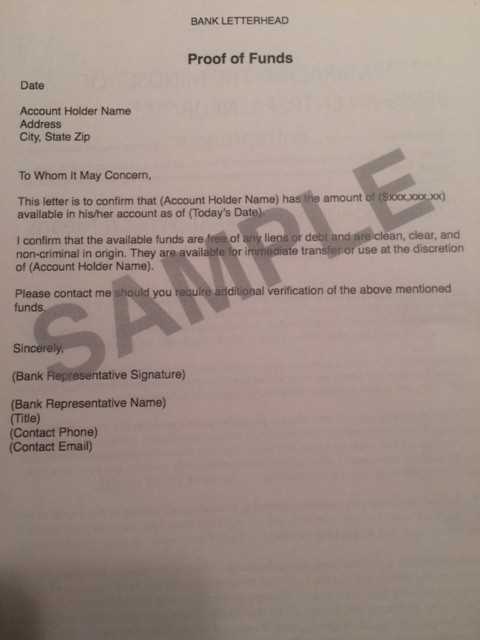

Sample Templates for Financial Letters

When preparing a document to verify available resources, having a clear and concise format is crucial. Various formats can be used depending on the specific purpose, but each should include essential information such as the account holder’s details, the value of assets, and any necessary verification from authorized institutions.

Below are some common examples of formats that can be adapted to suit different situations:

- Personal Asset Verification

This format is typically used for individual asset verification, including savings accounts, investments, and other personal resources.

- Corporate Asset Statement

Used by businesses to verify financial standing, this format highlights company-owned assets and available capital for business transactions.

- Property Ownership Verification

This type of document is used to demonstrate ownership of real estate or other valuable properties that can serve as a financial resource.

- Investment Portfolio Statement

For individuals or businesses showing proof of investment capacity, this format summarizes stocks, bonds, and other investment holdings.