Past Due Balance Letter Template for Businesses

Dealing with outstanding invoices is an essential part of maintaining smooth financial operations. When clients or customers delay payments, it is crucial to address the situation in a professional and clear manner to ensure timely resolution. The right approach can help preserve business relationships while also ensuring that debts are recovered promptly.

Communicating the need for payment involves crafting a message that is both polite and firm. By including the necessary information and presenting it in a well-structured format, businesses can effectively encourage clients to settle their accounts. Such communication should emphasize the importance of timely payments while maintaining a respectful tone.

Using the proper wording and format can make a significant difference in the outcome. A carefully constructed request not only conveys the urgency but also reinforces the professionalism of the business. Understanding how to structure these communications can greatly impact the efficiency of the payment collection process.

Understanding Overdue Payment Notices

Handling unpaid invoices effectively is crucial for maintaining financial health in any business. These communications are designed to remind customers of unsettled amounts while maintaining professionalism. A well-crafted request helps both the business and the client reach a resolution swiftly and respectfully. The goal is to recover the owed sum while preserving a positive relationship.

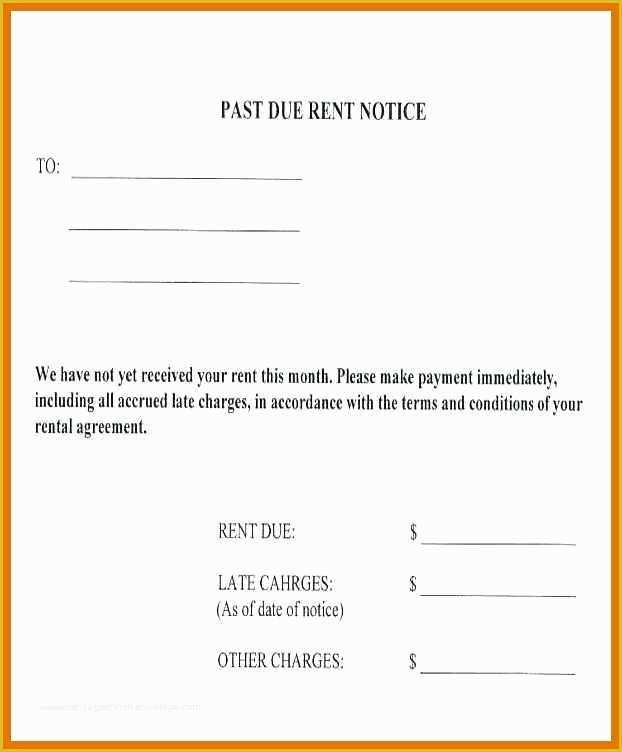

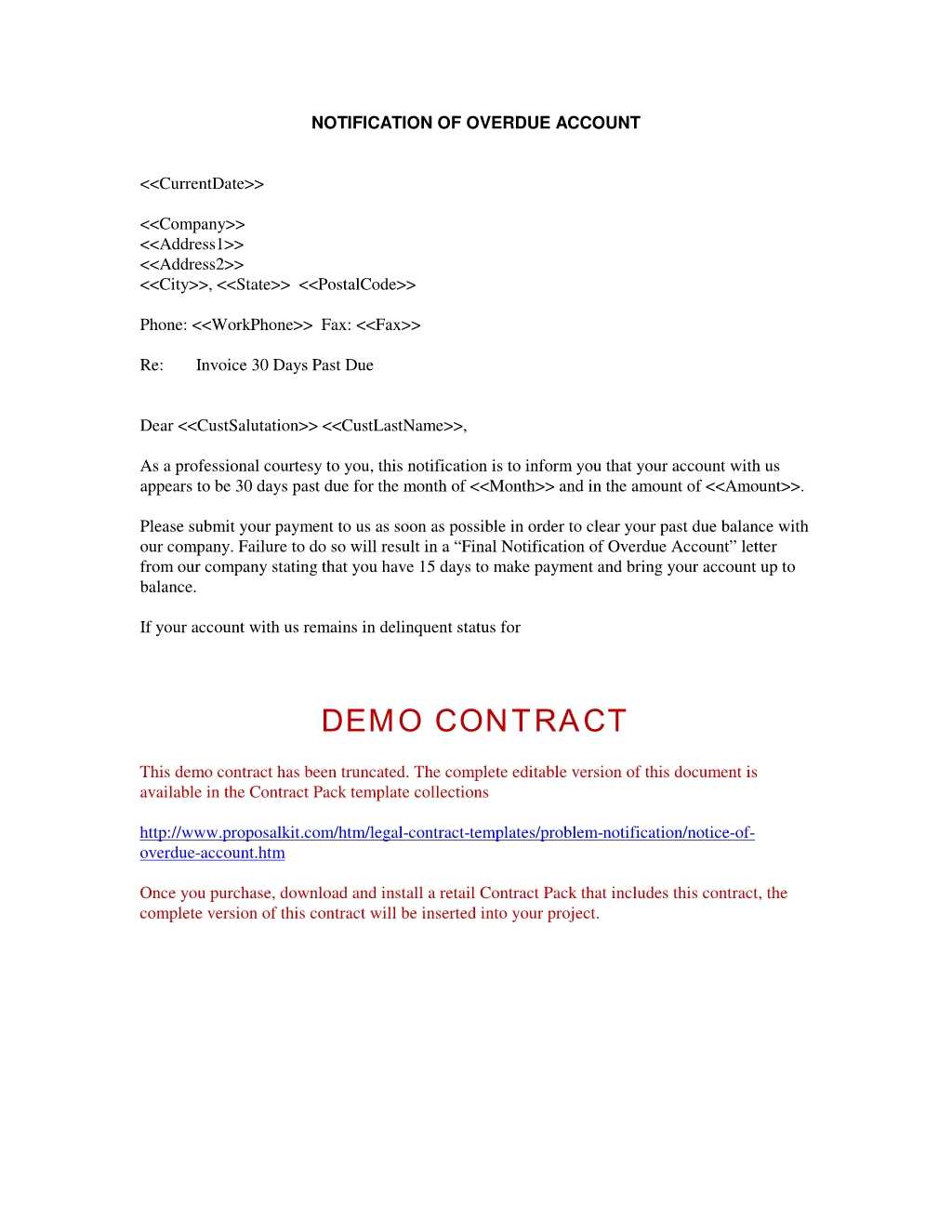

When drafting such messages, clarity and professionalism are essential. It’s important to include specific information, such as the amount owed, the original due date, and any applicable late fees. By structuring the content correctly, businesses can increase the likelihood of a prompt response and minimize misunderstandings.

| Key Element | Description |

|---|---|

| Customer Information | Clearly mention the client’s details for easy identification of the outstanding account. |

| Amount Owed | State the exact amount that needs to be settled, including any late fees if applicable. |

| Original Payment Date | Reference the initial payment deadline to highlight the duration of the delay. |

| Action Required | Specify the payment method and due date for the outstanding amount to be paid. |

| Polite Closing | Ensure a respectful tone, inviting cooperation to resolve the matter promptly. |

How to Write an Effective Payment Reminder

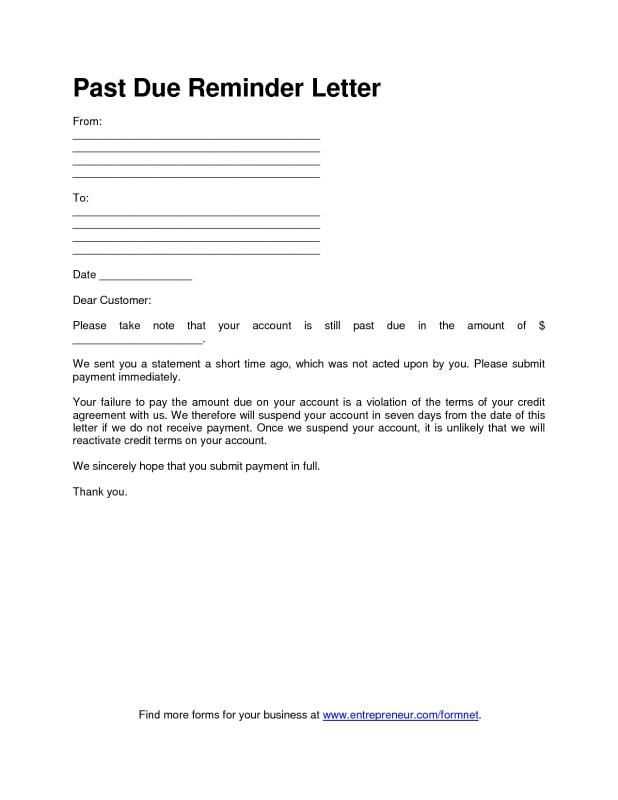

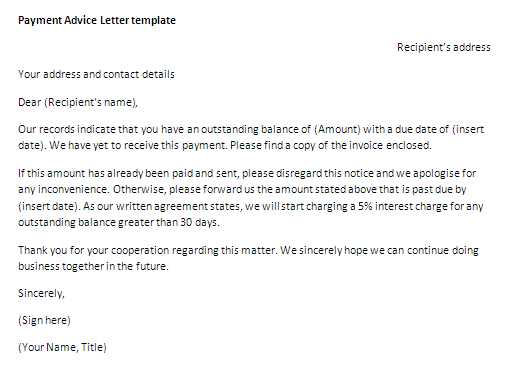

Crafting an effective payment reminder involves more than just requesting payment. It’s about striking the right balance between being firm and respectful. A well-structured reminder ensures that the recipient understands the urgency of the situation while also maintaining professionalism. The key is to provide clear details about the owed amount and the next steps, encouraging prompt action without causing offense.

Start by addressing the recipient politely, clearly stating the reason for the reminder. Include all relevant details, such as the amount owed, any previous correspondence, and the date when payment is expected. Additionally, provide payment instructions or options to make it easier for the recipient to complete the transaction.

Finally, close the message with a positive tone, inviting the recipient to resolve the matter promptly. By keeping the communication clear, concise, and courteous, businesses can encourage faster payments while preserving positive relationships with their clients.

Key Elements of an Overdue Payment Reminder

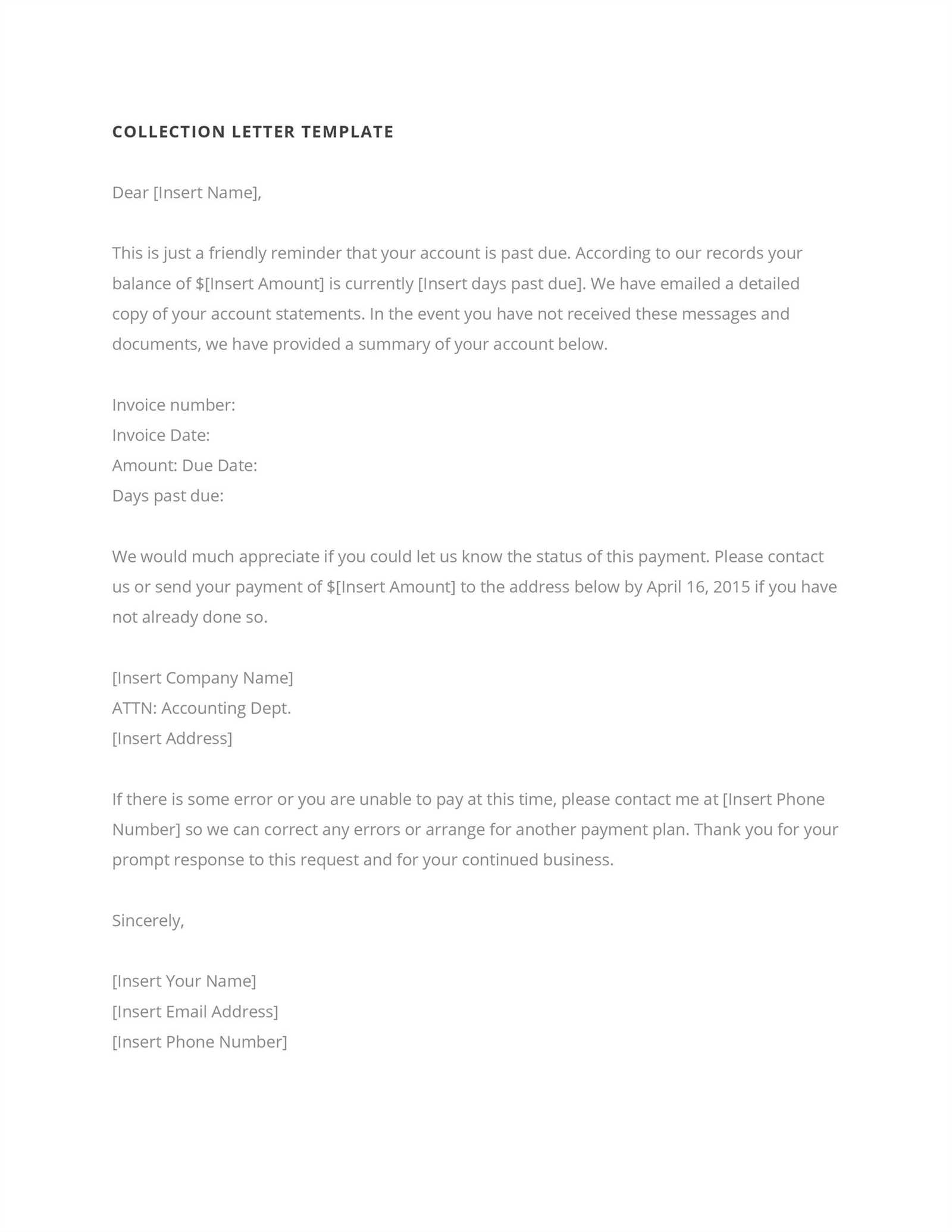

When requesting payment for an unpaid invoice, it’s essential to include key elements to ensure the communication is clear, effective, and professional. Each component should convey important information, making it easy for the recipient to understand the situation and take action promptly. By addressing the necessary details, the message increases the likelihood of a swift resolution.

Customer and Payment Information

Start by clearly stating the customer’s name and the amount they owe. Include the original invoice date and reference number, making it easy for the recipient to locate the corresponding record. Providing a detailed breakdown of the charges, including any penalties or fees, ensures transparency.

Action and Payment Instructions

Clearly outline what is required from the recipient, such as making a payment by a specific date. Offer various payment methods or instructions on how they can resolve the outstanding amount. Ending with a polite yet firm reminder of the importance of settling the account helps reinforce the urgency while maintaining a respectful tone.

Best Practices for Sending Overdue Payment Notices

When communicating with clients regarding unpaid invoices, following best practices ensures that the request is handled professionally and effectively. A well-timed, clear, and courteous message helps in achieving a quicker resolution while maintaining good business relationships. Implementing the right strategies can significantly improve your chances of getting paid promptly.

- Send the Notice Early – Don’t wait too long to send a reminder. The sooner you address the unpaid amount, the more likely you are to resolve the issue quickly.

- Be Clear and Specific – Include important details such as the total amount owed, the original payment date, and the invoice number. This clarity helps the recipient understand the situation immediately.

- Choose the Right Tone – While the request should be firm, it is essential to remain polite and professional. A respectful tone maintains a good relationship with the client.

- Offer Flexible Payment Options – Provide different payment methods or arrangements to make it easier for the client to settle the amount. This can increase the likelihood of prompt payment.

- Follow Up Consistently – If the payment is not received after the first notice, send a follow-up reminder. Be persistent but respectful in your communications.

Legal Considerations in Overdue Payment Communications

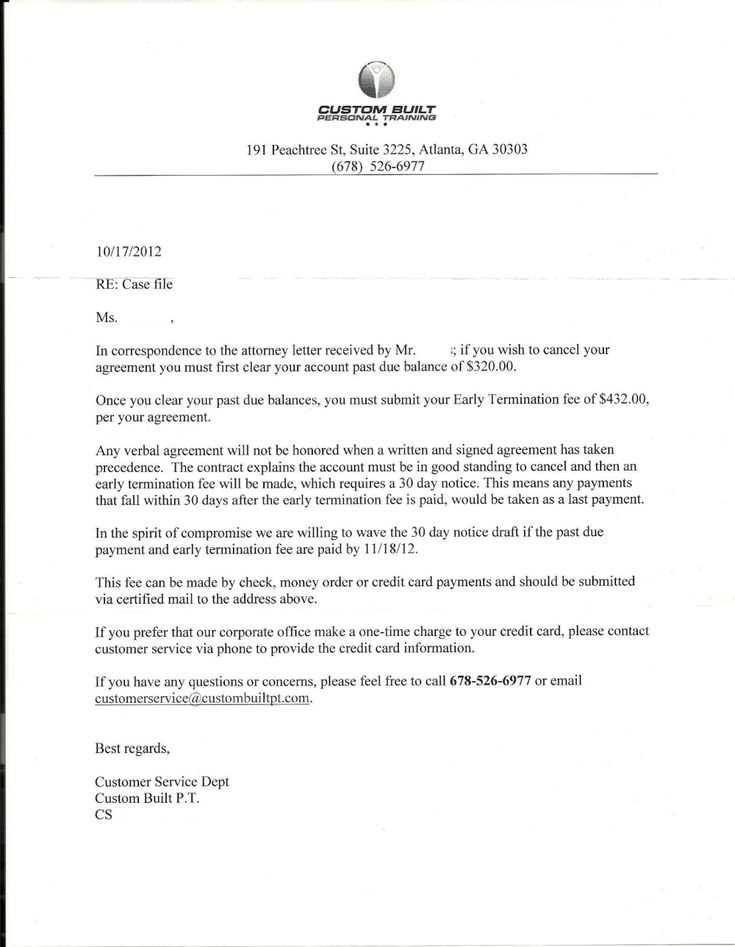

When requesting payment for an outstanding amount, businesses must ensure their communications comply with legal standards. The language, tone, and content of these messages can significantly impact both the effectiveness of the request and the legal standing of the business. Understanding the legal considerations involved helps businesses avoid any potential violations and ensures that the collection process remains professional and lawful.

Complying with Collection Laws

Each region has specific laws regulating debt collection practices. It’s essential to familiarize yourself with these laws to avoid harassment or unfair practices. For example, many jurisdictions limit the hours during which you can contact a customer and set boundaries on how aggressive your communication can be. Violating these laws could lead to legal consequences, including fines or damage to the business’s reputation.

Maintaining Professionalism and Respect

While it is crucial to be firm about the outstanding payment, maintaining professionalism is key. Using threatening or overly aggressive language can lead to legal repercussions and damage customer relations. Instead, focus on using polite yet assertive language, offering flexible payment solutions where appropriate. Respecting your client’s rights is not only legally required but also helps preserve long-term business relationships.

Common Mistakes to Avoid in Debt Communications

When requesting payment for an outstanding amount, it’s easy to make mistakes that could hinder the chances of resolving the issue efficiently. By understanding common errors, businesses can improve the effectiveness of their requests and maintain professionalism. Avoiding these pitfalls ensures that communication remains clear, respectful, and legally compliant.

Using Harsh or Aggressive Language

One of the most significant mistakes is using threatening or overly harsh language. This approach can alienate customers and may even violate consumer protection laws. Instead, focus on firm but polite language that conveys urgency without crossing into hostility. Being respectful helps preserve the customer relationship while still addressing the issue at hand.

Failing to Provide Clear Payment Information

Another mistake is not offering clear and straightforward instructions on how the recipient can settle the amount owed. Always include specific details about the outstanding amount, any applicable penalties, and the payment options available. Clear communication reduces confusion and increases the chances of timely payment.

Tips for Maintaining Professionalism in Collection Communications

When requesting payment for an unpaid invoice, it’s crucial to maintain a professional tone throughout the communication process. Even though the matter involves a financial issue, treating the recipient with respect and professionalism will help achieve a positive resolution while preserving the business relationship. Here are some tips to ensure your communication remains courteous and effective.

- Be Clear and Direct – Clearly state the outstanding amount and the necessary actions for resolution. Providing all relevant details upfront avoids confusion and shows professionalism.

- Use Polite Language – Maintain a polite tone, even when stressing the urgency of the situation. Avoid language that could be seen as threatening or too demanding.

- Provide Payment Options – Offering different payment methods or a structured payment plan helps the recipient feel more in control of the situation and shows flexibility.

- Be Empathetic – Show understanding by acknowledging that the recipient may be facing financial difficulties. A simple statement of empathy can go a long way in maintaining a professional relationship.

- Stay Firm but Respectful – While it’s important to assert your expectations, remaining respectful throughout the process increases the likelihood of a positive outcome.