Collection Agency Letter Template for Debt Collection

When a person or business fails to meet their financial obligations, it often becomes necessary to remind them of their outstanding balance. Sending a clear and professional communication can help recover funds while maintaining a respectful relationship. A well-structured message ensures the recipient understands the situation and the necessary actions they must take.

Key Elements for Successful Debt Recovery Messaging

To maximize the impact of your communication, it is essential to include the following key elements:

- Clear Identification of the Debt: Specify the amount owed and the purpose of the debt to avoid confusion.

- Payment Instructions: Provide easy-to-follow instructions for how the debtor can settle the outstanding amount.

- Consequences for Non-Payment: Politely but firmly explain the possible legal or financial consequences if the debt is not resolved.

Crafting a Professional Tone

It is important that the message remains polite and professional. Avoid using aggressive language or threats, as this may damage the relationship with the recipient. A respectful tone encourages prompt action and increases the likelihood of a favorable response.

Timing and Follow-Up Strategies

Sending a reminder at the right time is crucial for a successful outcome. Consider the recipient’s situation and the nature of the debt. If no response is received, follow up with a second notice that reiterates the urgency of the matter.

Legal Considerations

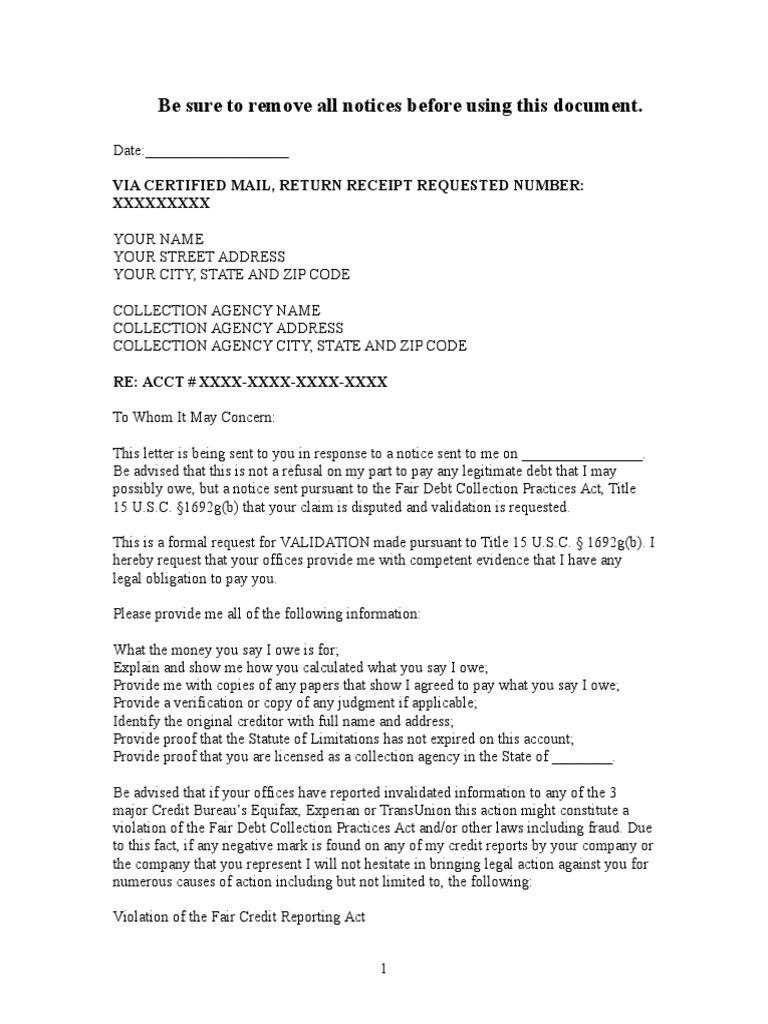

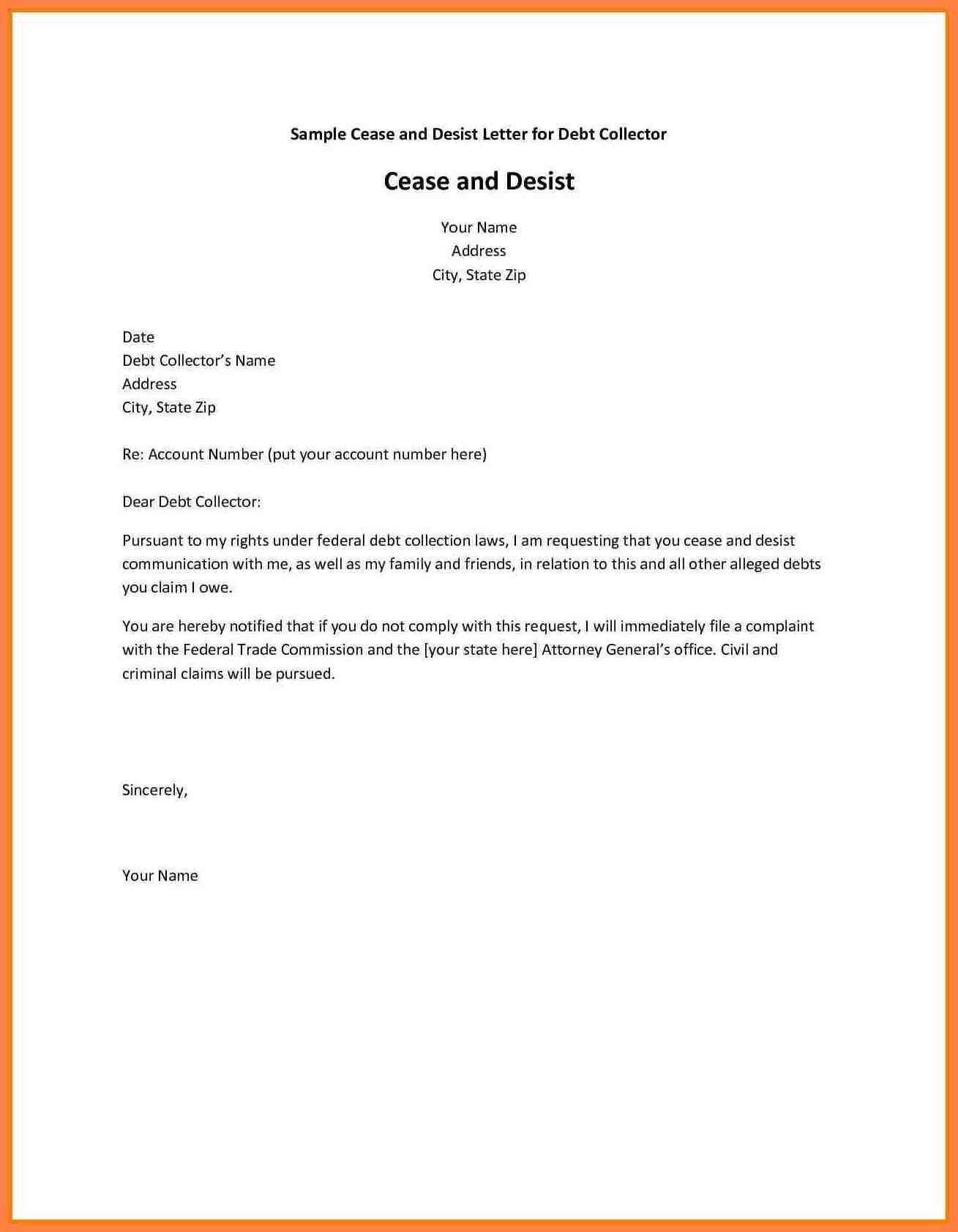

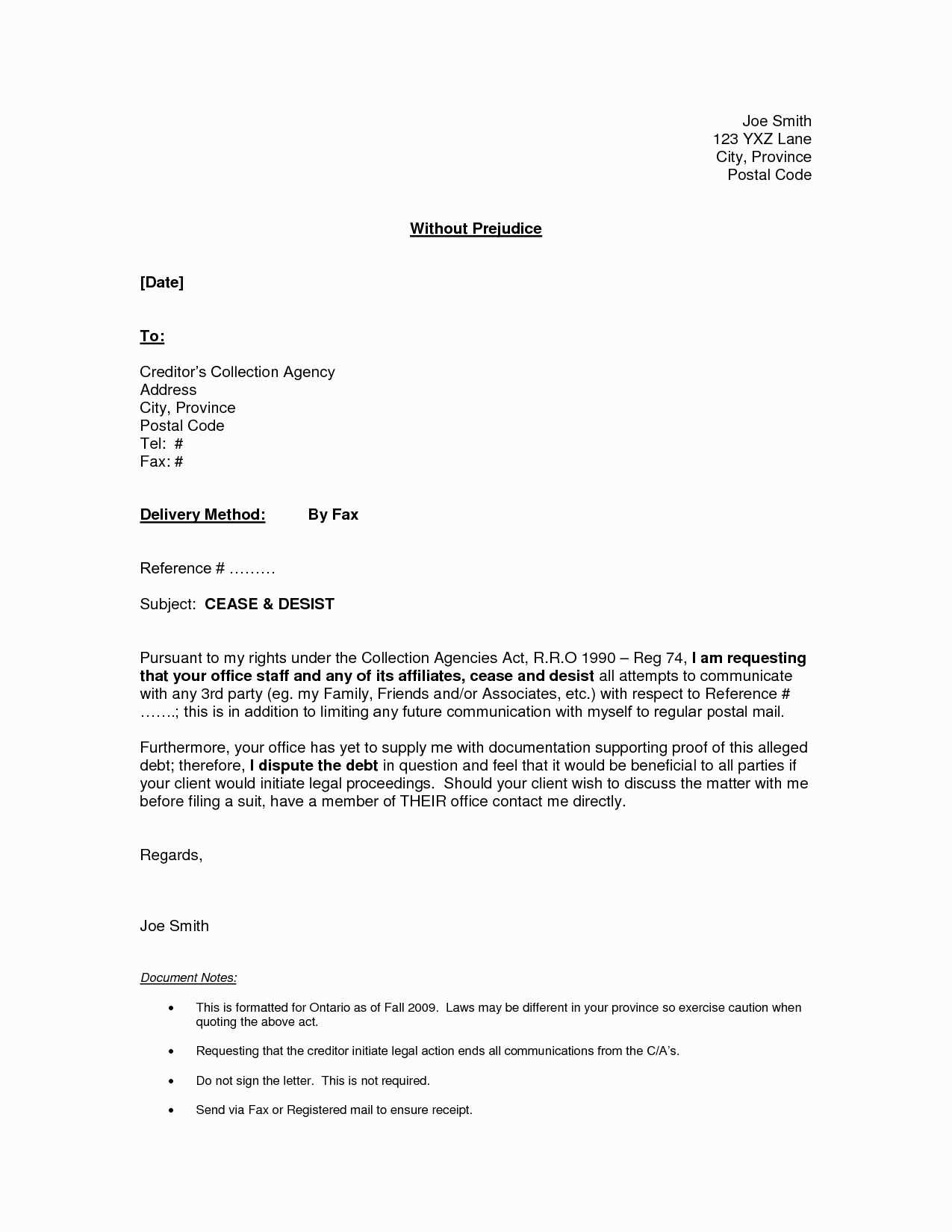

Before sending any form of correspondence, ensure that the content complies with local laws and regulations regarding debt recovery. Some jurisdictions have specific rules on how and when such messages can be sent, as well as what information can be included. Ignoring these guidelines could result in penalties or legal challenges.

Final Thoughts

Approaching debt recovery with professionalism and respect is the most effective way to resolve financial disputes. By following best practices and staying within legal boundaries, you can improve the chances of recovering owed funds while maintaining positive business relations.

Creating an Effective Debt Recovery Communication

When seeking repayment for outstanding obligations, it is crucial to craft a clear and professional message that prompts action without causing unnecessary conflict. An efficient communication should detail the specifics of the debt, outline how the debtor can settle the amount, and establish the urgency of resolving the matter.

Why Use a Structured Approach for Debt Reminders

Using a structured format for your communication ensures that all relevant information is included and easy for the recipient to understand. A standardized approach makes it simpler to convey key details, maintain consistency, and avoid overlooking important aspects of the situation.

Essential Components of an Effective Debt Communication

Any successful message should contain the following essential elements:

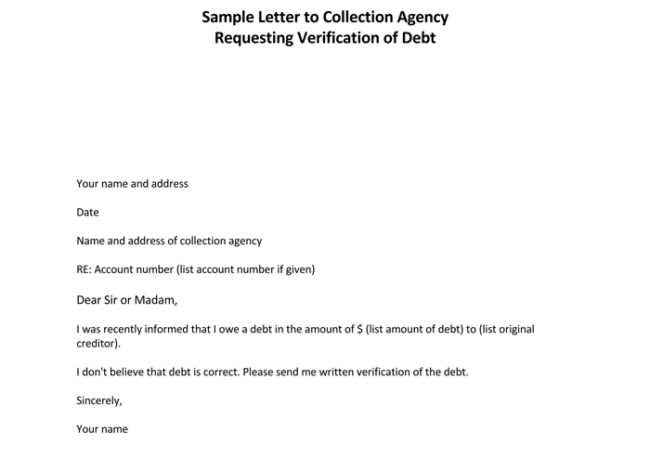

- Detailed Information on the Debt: Clearly mention the amount owed and the reason for the debt.

- Instructions for Payment: Provide step-by-step guidance on how the recipient can settle the balance.

- Clear Deadline for Payment: Specify the due date to create a sense of urgency.

- Consequences of Non-Payment: Politely inform the recipient of the potential next steps if payment is not received on time.

Best Practices for Drafting Effective Demand Notices

Craft your message with a balance of firmness and professionalism. Be concise and direct while maintaining a courteous tone. Avoid overly aggressive language, as this could lead to negative outcomes. Keeping the language neutral and respectful ensures a higher chance of a positive response.

Ensure that the content of your communication complies with all relevant legal requirements. Many regions have specific rules regarding the timing, format, and content of these notices. Ignoring these rules could result in penalties or delays in debt recovery.

Common mistakes to avoid include using unclear or confusing language, failing to include all necessary details, or sending the communication too late. Taking these precautions helps ensure a more effective and efficient recovery process.

If these steps do not result in payment, it may be time to consult professionals specializing in recovering funds. Seeking expert assistance could help resolve the issue more quickly while minimizing potential legal risks.