Mortgage Hardship Letter Template for Financial Relief

When facing unexpected challenges that affect your ability to make timely payments, it’s crucial to effectively communicate with your loan provider. This section will guide you on how to clearly express your situation and provide necessary details to facilitate a resolution.

Important Details to Include in Your Request

To ensure your message is taken seriously and considered for assistance, include these essential elements:

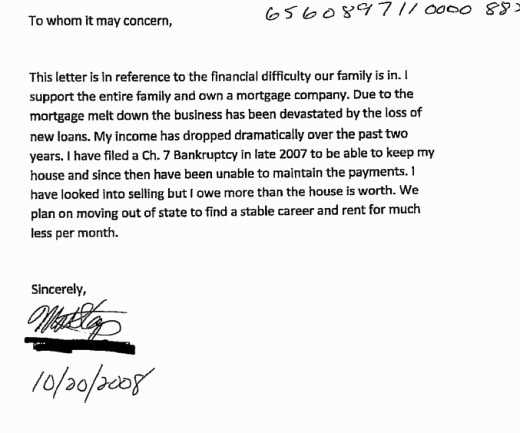

- Personal Information: Full name, account number, and contact details.

- Reason for Difficulty: A clear explanation of the situation affecting your ability to make payments, such as health issues, job loss, or unforeseen expenses.

- Requested Action: Specify what you are asking for, whether it’s a temporary pause, modified payment terms, or other relief options.

- Supporting Documents: Provide evidence, such as medical bills, unemployment notices, or any documentation that supports your claim.

Crafting a Clear and Concise Message

Be straightforward and to the point. Avoid using overly emotional language; instead, focus on the facts and how you plan to resolve the situation. The goal is to present yourself as responsible and willing to work through the challenge.

Common Mistakes to Avoid

- Not providing enough detail or evidence to support your claim.

- Being overly vague or unclear about the nature of your financial struggle.

- Failing to mention how you plan to address the issue or when you expect to regain financial stability.

How to Submit Your Request

Once your message is ready, follow the submission guidelines provided by your lender. Ensure you use the correct contact methods, whether by email, mail, or through an online portal. Keep a copy of your communication and follow up if necessary.

Why You Need a Communication for Financial Assistance

When unexpected circumstances disrupt your financial stability, it is essential to formally communicate with your lender to explain your situation. This document serves as a request for understanding, and it can help you avoid further penalties or even foreclosure. Properly outlining your situation increases the chance of receiving support or adjusting terms to better fit your current financial state.

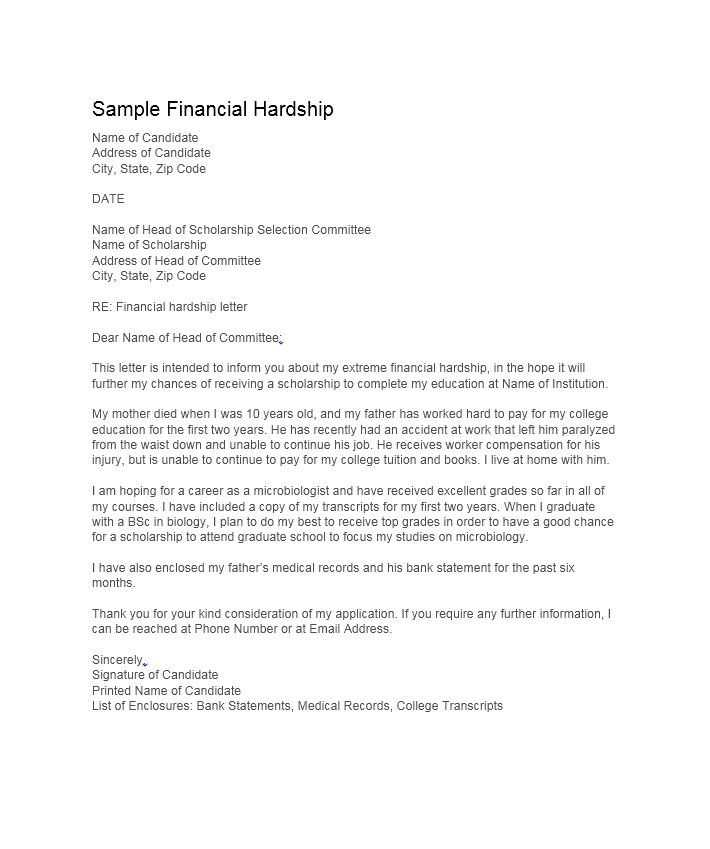

How to Write an Effective Financial Statement

Crafting a clear and effective request involves presenting your case in a straightforward manner. Begin by briefly explaining the cause of your financial strain, then outline any temporary solutions or requests you seek from the lender. Maintain a professional and respectful tone throughout, emphasizing your intention to resolve the situation and resume regular payments as soon as possible.

Key Components to Include in Your Document

Ensure your communication contains all necessary details to help your lender evaluate your request:

- Personal Details: Include your full name, account number, and contact information.

- Explanation of Circumstances: Describe the specific events or situations leading to financial difficulty.

- Requested Assistance: Specify the relief you seek, such as a payment reduction or temporary deferral.

- Supporting Documentation: Provide any evidence that reinforces your situation, such as medical records or unemployment notices.

Common Errors to Avoid During Writing

Avoid these common mistakes to improve your chances of a positive outcome:

- Being unclear or vague about your financial situation.

- Failing to provide necessary supporting documents.

- Not offering a clear plan for how you intend to recover from the financial setback.

How a Financial Assistance Request Impacts Loan Decisions

Submitting a well-crafted request can influence the lender’s decision by providing them with a clearer understanding of your situation. It shows your willingness to communicate and work towards a solution. A well-structured communication increases the likelihood of negotiating better terms or receiving a temporary payment pause.

Best Practices for Submitting Your Request

Once your document is ready, ensure that it is submitted according to your lender’s preferred method, whether by email, physical mail, or through their online platform. Keep a copy for your records and follow up if you do not receive a response in a timely manner.