Credit Report Request Letter Template Guide

In certain situations, individuals may need to obtain detailed financial data from agencies or institutions to ensure accuracy and stay informed about their financial standing. This can include inquiries about loan histories, credit scores, and other important metrics that can affect financial decisions. Knowing how to structure such a formal inquiry can help make the process smoother and more efficient.

Essential Steps for Making Your Inquiry

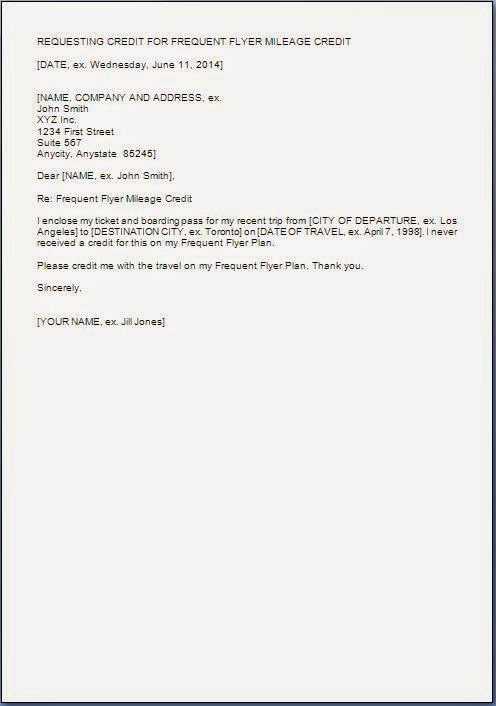

When reaching out to a financial organization, it is important to craft a clear and professional message. Here are some tips on what to include:

- Recipient Information: Begin by addressing the organization or agency that holds the required details.

- Personal Identification: Ensure that you provide necessary personal data such as full name, address, and identification number to confirm your identity.

- Purpose of Inquiry: Clearly explain why you are seeking this information and how it will be used.

- Contact Details: Include the best way to reach you for any follow-up or clarification.

Key Elements to Include

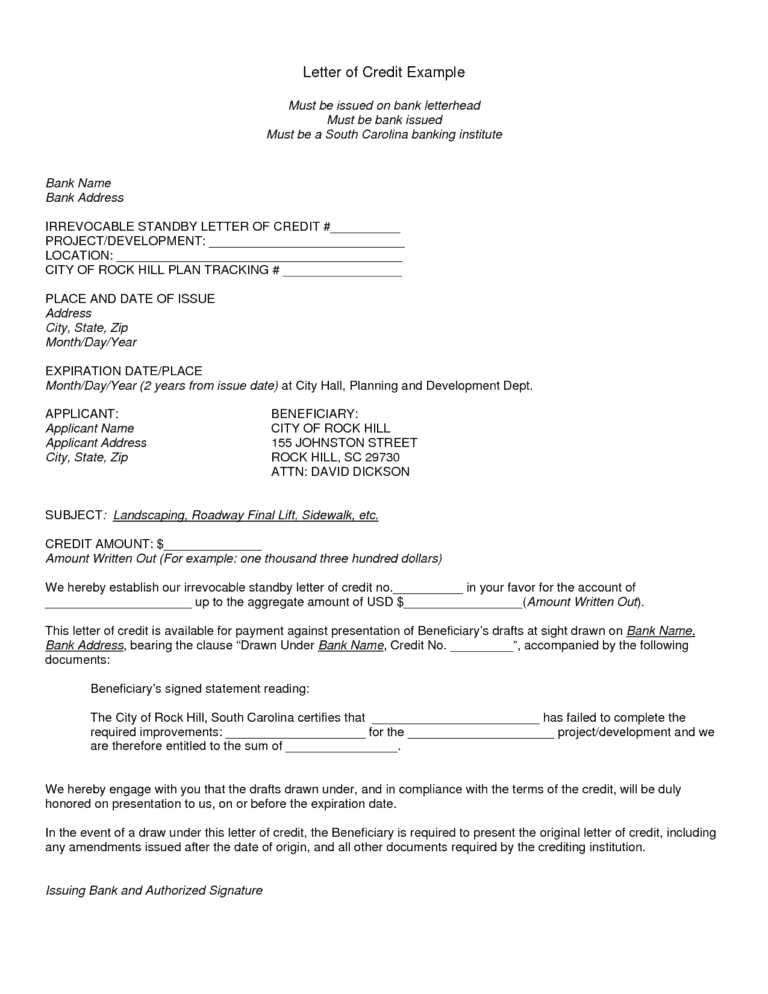

Be concise but thorough when outlining your needs. Here’s what should be part of your formal communication:

- Your full name and address

- Details on why the information is being requested

- Any relevant dates or timelines for processing

- Contact details for any follow-up actions

What to Avoid in Your Formal Request

Avoid providing unnecessary or irrelevant information. Stick to the essentials that will help the institution locate the information quickly and efficiently. Additionally, ensure that your language remains polite and professional throughout.

Where to Submit Your Formal Inquiry

Once your document is ready, send it to the appropriate department or office. This could be done by mail, email, or through an online portal, depending on the organization. Make sure to verify the proper submission method for each institution to avoid delays.

How to Obtain Your Financial Information

When seeking detailed financial data from agencies or institutions, it’s important to understand how to properly structure your inquiry. This ensures that you receive the necessary information quickly and without complications. A well-written request will make the process smoother and help you obtain the data you need to make informed financial decisions.

Why Accessing Your Financial History Matters

Your financial records contain essential details that can impact various aspects of your life, including loan applications, credit scores, and financial planning. Keeping track of your personal financial standing helps avoid errors and ensures accuracy when dealing with financial institutions.

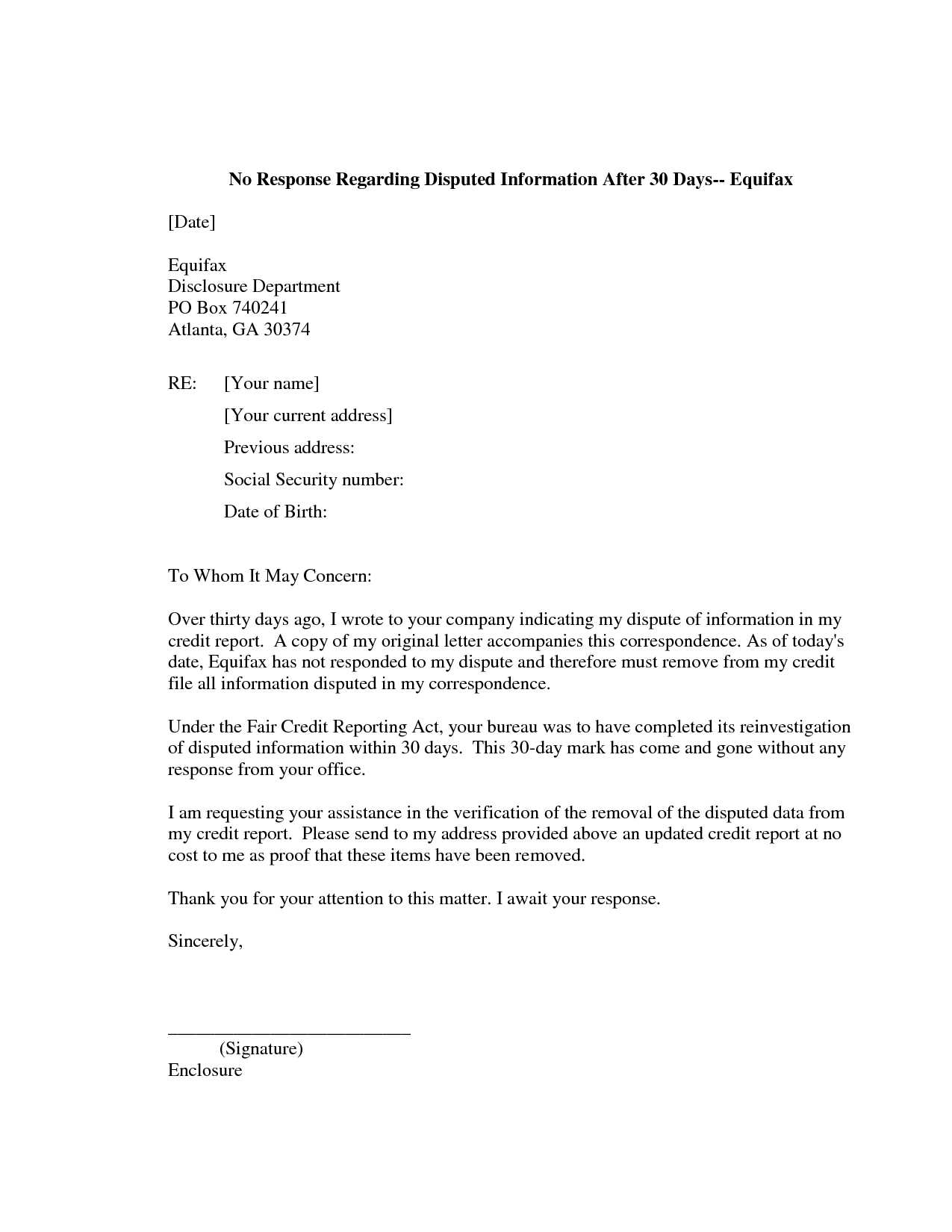

How to Properly Write Your Formal Inquiry

To create an effective formal request, ensure it contains all necessary details that will allow the institution to locate and verify the information promptly. Include personal identification information, the specific data you require, and a clear statement of purpose for the inquiry.

Key Components to Include:

- Your full name and address

- Details about why the information is needed

- Clear instructions on how you prefer to receive the details

- Contact information for follow-up or clarification

Avoiding Common Mistakes

Many individuals make simple mistakes when drafting their formal requests, such as leaving out important identification details or failing to clarify the purpose of the inquiry. Ensure your communication is clear and direct to prevent unnecessary delays.

Things to Avoid:

- Providing vague or incomplete personal details

- Omitting a clear explanation of the purpose

- Using unclear or overly complex language

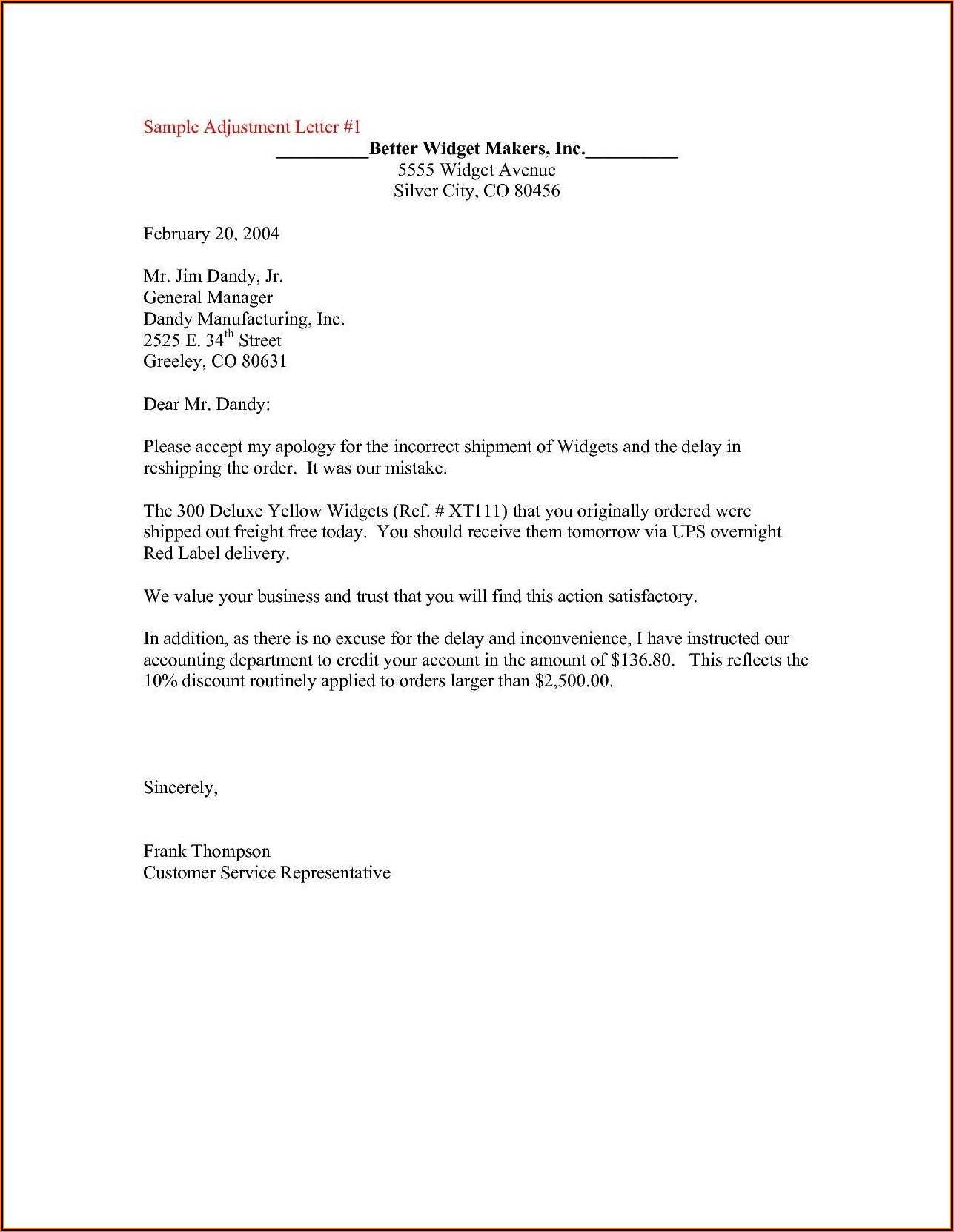

Where to Direct Your Formal Request

Once your inquiry is written, send it to the correct department within the organization holding the information. Depending on the institution, you may need to mail it, email it, or submit it through an online portal. Be sure to follow the submission guidelines provided by the organization to ensure timely processing.

Next Steps After Receiving Your Information

Upon receiving the requested information, thoroughly review the documents to ensure their accuracy. If you notice any discrepancies, follow up with the institution to correct the details. This will ensure your financial records remain accurate and up to date.