Letter of Medical Necessity Wheelchair Template

When it comes to securing coverage for necessary mobility aids, it’s crucial to provide the right documentation that justifies the need for the equipment. Many individuals face the challenge of proving the importance of certain items to their well-being, especially when dealing with insurance companies. Having the correct paperwork in place can make all the difference in receiving the support you need.

One key document plays a significant role in this process. It outlines why a specific product is essential for daily living and offers a detailed explanation that aligns with insurance requirements. Knowing how to effectively communicate the necessity of such items can improve the chances of approval and prevent unnecessary delays.

Understanding the structure and content of such documents is vital. By carefully following the necessary steps and ensuring that each section is properly addressed, you can increase the likelihood of obtaining the coverage needed without additional complications. This guide will provide insight into how to create a compelling request to help navigate the process smoothly.

Understanding the Medical Necessity Letter

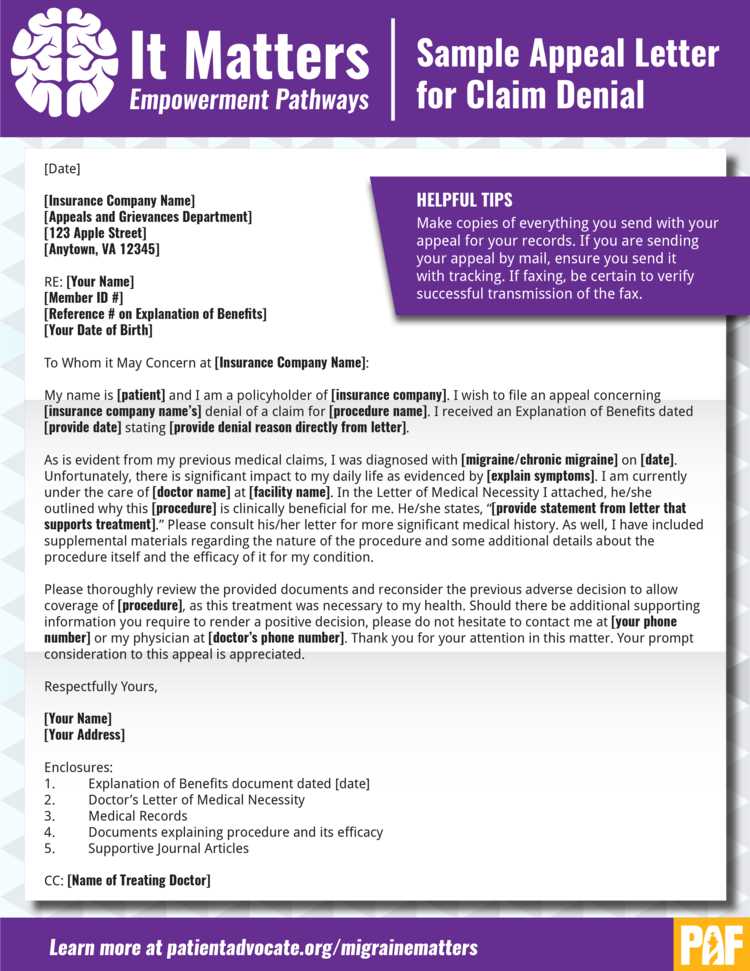

In the process of securing coverage for important mobility aids, it’s essential to present a detailed explanation that supports the need for specific equipment. This document serves as a formal request to insurance providers, outlining the reasons why such items are indispensable for an individual’s health and quality of life. The document should be clear, precise, and tailored to meet the expectations of the insurer.

To create a successful submission, it is important to understand what the document should include. The purpose is to convince the insurance company that the requested aid is critical, not just convenient. Below is a breakdown of the main sections that should be covered:

| Section | Description |

|---|---|

| Patient Information | Details about the individual requiring the equipment, including their medical history and current health status. |

| Physician’s Statement | A professional statement from a healthcare provider outlining the necessity of the requested item. |

| Detailed Explanation | A clear description of how the equipment will assist in improving the patient’s daily living and overall health. |

| Supporting Evidence | Any additional documents or data, such as medical records or test results, that reinforce the need for the equipment. |

By ensuring that these components are accurately and thoroughly addressed, individuals can improve the chances of their request being approved, leading to a smoother approval process for the necessary equipment.

Why a Letter is Required for Wheelchair Coverage

Insurance providers require specific documentation to evaluate requests for coverage of essential mobility equipment. This is necessary to confirm that the requested item is vital for the individual’s daily functioning and overall health. Without such a formal request, it is challenging for insurers to understand the full scope of the individual’s needs, which could lead to a denial of coverage.

Establishing the Need for Assistance

In many cases, insurers need clear evidence that an individual’s health condition requires the support of a particular mobility aid. A well-crafted document provides the insurer with an explanation of why this equipment is not just beneficial, but critical. It is essential for healthcare providers to offer a detailed and compelling reason why the equipment is necessary for the patient’s well-being and independence.

Aligning with Insurance Guidelines

Insurance companies often have specific criteria for approving claims related to mobility aids. These guidelines are based on medical necessity and are designed to ensure that only those who truly need such items receive coverage. Providing a thorough request helps to demonstrate that the individual’s needs align with the insurer’s requirements, increasing the likelihood of approval and avoiding delays in receiving support.

Key Components of a Medical Necessity Letter

When requesting insurance coverage for mobility aids, it is crucial to include certain essential elements in the documentation to ensure the request is taken seriously and processed efficiently. These components help to clearly communicate why the equipment is vital for the individual’s health, providing insurers with the information they need to make an informed decision.

Each section of the request should serve a specific purpose and provide detailed information to back up the claim. Key elements include personal and medical details, a professional statement, and supporting evidence. Here’s a closer look at these important sections:

1. Patient Information: This section includes basic details such as the patient’s name, age, diagnosis, and medical history. It’s important to include relevant health conditions that justify the need for assistance in daily activities.

2. Physician’s Statement: A statement from a healthcare provider explaining the necessity of the equipment. This should clearly outline how the condition affects the patient’s mobility and daily life, emphasizing that the requested item is critical for improving their overall well-being.

3. Detailed Explanation of Need: A description of how the equipment will directly impact the patient’s life. This section should focus on the individual’s specific limitations and how the item will aid in overcoming them, enhancing their independence.

4. Supporting Documentation: Any relevant medical records, test results, or other documents that validate the need for the requested equipment. This could include diagnoses, treatment plans, and mobility assessments that further demonstrate the necessity of the aid.

Including all these components in a well-organized and clear manner ensures that the insurer receives all the necessary information to process the request efficiently, increasing the chances of approval.

How to Tailor the Template to Your Needs

Customizing the request for insurance coverage is an important step in ensuring that it meets the unique requirements of your situation. A standardized form can be helpful, but it’s essential to modify it to reflect the specifics of your health condition, lifestyle, and the equipment you are requesting. By doing so, you increase the chances of your request being approved quickly and without unnecessary complications.

To effectively personalize the document, start by carefully reviewing each section. Include detailed information about your medical condition, how it affects your ability to perform daily tasks, and why the item is necessary for improving your quality of life. This information should be tailored to address your unique needs and health status. Be sure to provide any supporting evidence, such as medical records, that demonstrate the importance of the equipment in your case.

Additionally, you should ensure that the language used is clear and direct, avoiding vague terms and focusing on specifics. For example, instead of stating that the aid would “help” you, explain how it will “enable you to perform specific tasks, such as moving between rooms or participating in daily activities independently.” Personalizing the explanation in this way helps to paint a clear picture for the insurer, making it easier for them to approve your request.

By tailoring the document in this way, you create a stronger, more compelling case that reflects your individual needs, ultimately improving the likelihood of a successful approval process.

Common Mistakes to Avoid in Medical Letters

When requesting coverage for essential mobility aids, it’s crucial to submit a well-written and accurate document. Even small errors or omissions can lead to delays or denials. Understanding the most common mistakes and how to avoid them can help ensure that the request is processed smoothly and successfully.

1. Lack of Specific Details: One of the most frequent errors is failing to provide clear, specific information about the condition and how the requested equipment will address it. A vague explanation can leave the insurer unsure about the need for the item. Always focus on precise details, such as how the equipment will improve mobility or assist in daily tasks.

2. Incomplete Patient Information: Another common mistake is omitting essential personal or medical details. Without these, the insurer cannot fully assess the request. Be sure to include comprehensive patient information, including the diagnosis, medical history, and current physical limitations.

3. Overlooking Supporting Documentation: Insufficient evidence can weaken the case for the requested equipment. Failing to provide relevant medical records, assessments, or test results may result in the claim being rejected. Ensure that all necessary supporting documents are attached to validate the need for the equipment.

4. Using Vague Language: General or unclear language can hinder the approval process. Avoid terms like “might help” or “could be useful.” Instead, use strong and confident language that clearly explains the specific impact the equipment will have on the patient’s ability to function in daily life.

5. Not Following Insurance Guidelines: Many insurers have specific criteria for coverage, and failing to follow their guidelines can lead to a rejected request. Be sure to carefully read and adhere to any requirements provided by the insurance company to increase the likelihood of approval.

By being aware of these common mistakes and taking steps to avoid them, you can improve the chances of a successful outcome when seeking approval for essential mobility aids.

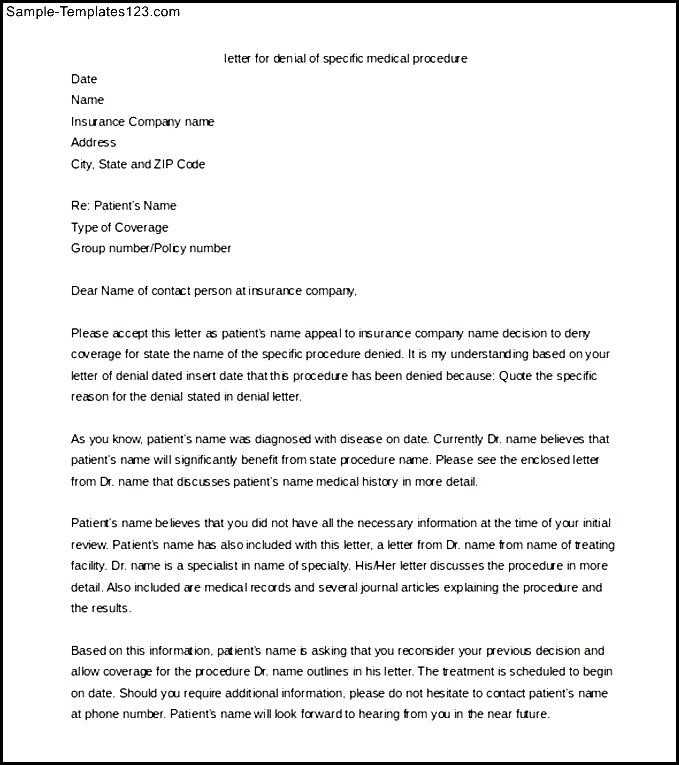

Submitting Your Request for Insurance Approval

Once the necessary documentation has been prepared, the next step is to submit your request to the insurance provider. This process can vary depending on the insurer, but following the correct steps will ensure that your request is received and reviewed efficiently. Proper submission can speed up the approval process and reduce the likelihood of delays or rejections.

To submit your request effectively, follow these steps:

- Double-check the documentation: Ensure that all the required components are included, such as personal information, a statement from your healthcare provider, and any supporting evidence. Missing documents could cause a delay in processing.

- Review the insurer’s submission guidelines: Many insurance companies have specific submission processes, such as online forms, fax numbers, or mailing addresses. Make sure to follow these instructions to avoid complications.

- Submit electronically or by mail: If the insurer accepts digital submissions, this is often the fastest and most efficient method. However, if you are submitting by mail, use a service that provides tracking to ensure the documents are received.

- Request confirmation: After submission, ask for confirmation of receipt from the insurer. This will give you peace of mind that your request is in progress and can help you track the status.

- Keep copies of everything: Always retain copies of all documents submitted, as well as any correspondence from the insurance company. This will be helpful in case you need to follow up or appeal a decision.

By taking these steps, you can ensure that your request for coverage is submitted properly and reviewed promptly. This will give you the best chance of receiving approval without unnecessary delays.