Hardship Letter Template for Mortgage Modification

When facing financial struggles, it may become necessary to seek adjustments in the terms of existing loans. This process requires a formal request to the lender, outlining the current challenges and explaining why new terms are necessary to manage payments more effectively. Crafting a well-structured appeal can significantly improve your chances of securing a favorable response from your lender.

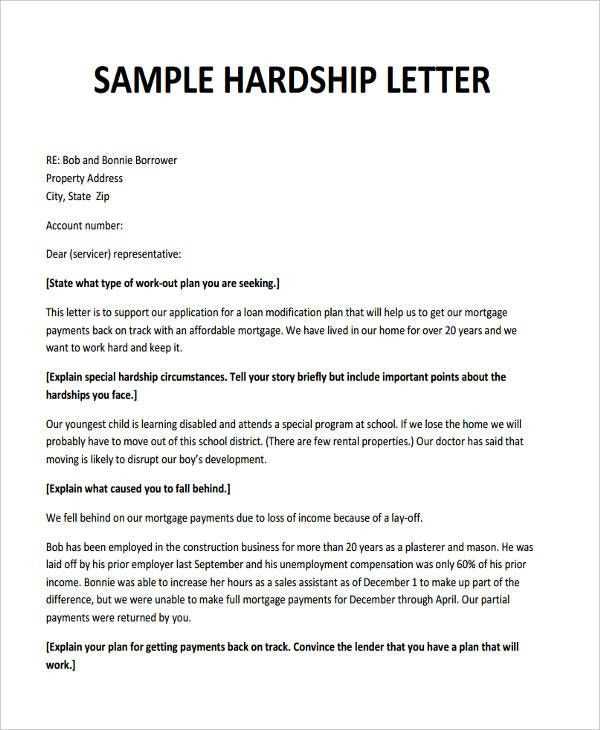

Essentials of a Strong Request

A well-written appeal should clearly convey the reasons behind your financial difficulties while demonstrating a genuine effort to resolve the situation. Including key details helps establish credibility and trust with the lender. Here are the essential components:

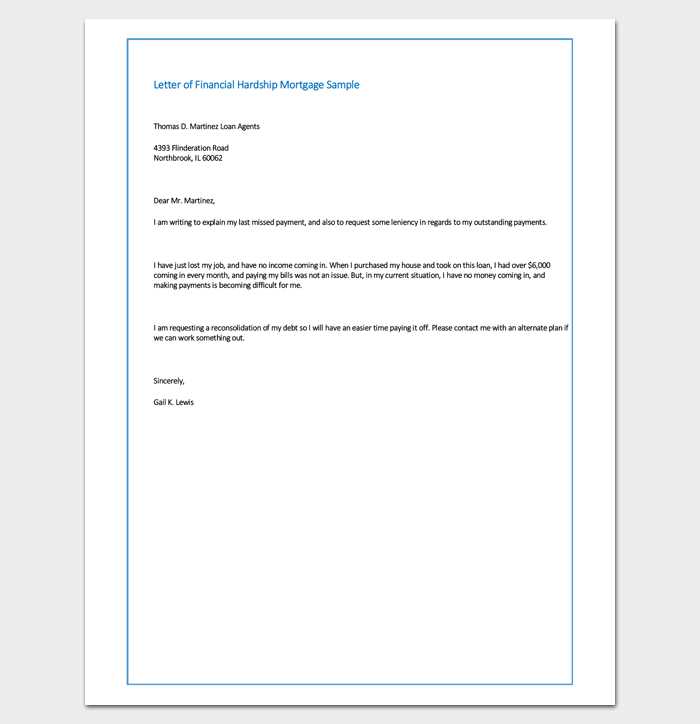

- Introduction: Briefly introduce yourself and the purpose of your request.

- Financial Challenges: Clearly explain the issues that have impacted your ability to meet the current terms.

- Request for Adjustment: State what adjustments you are seeking and how they will help you meet your obligations.

- Commitment to Repayment: Reinforce your intention to continue making payments under the new terms.

- Supporting Documents: Include any relevant paperwork that can back up your claims, such as income statements, medical bills, or job loss notices.

How to Effectively Explain Your Financial Struggles

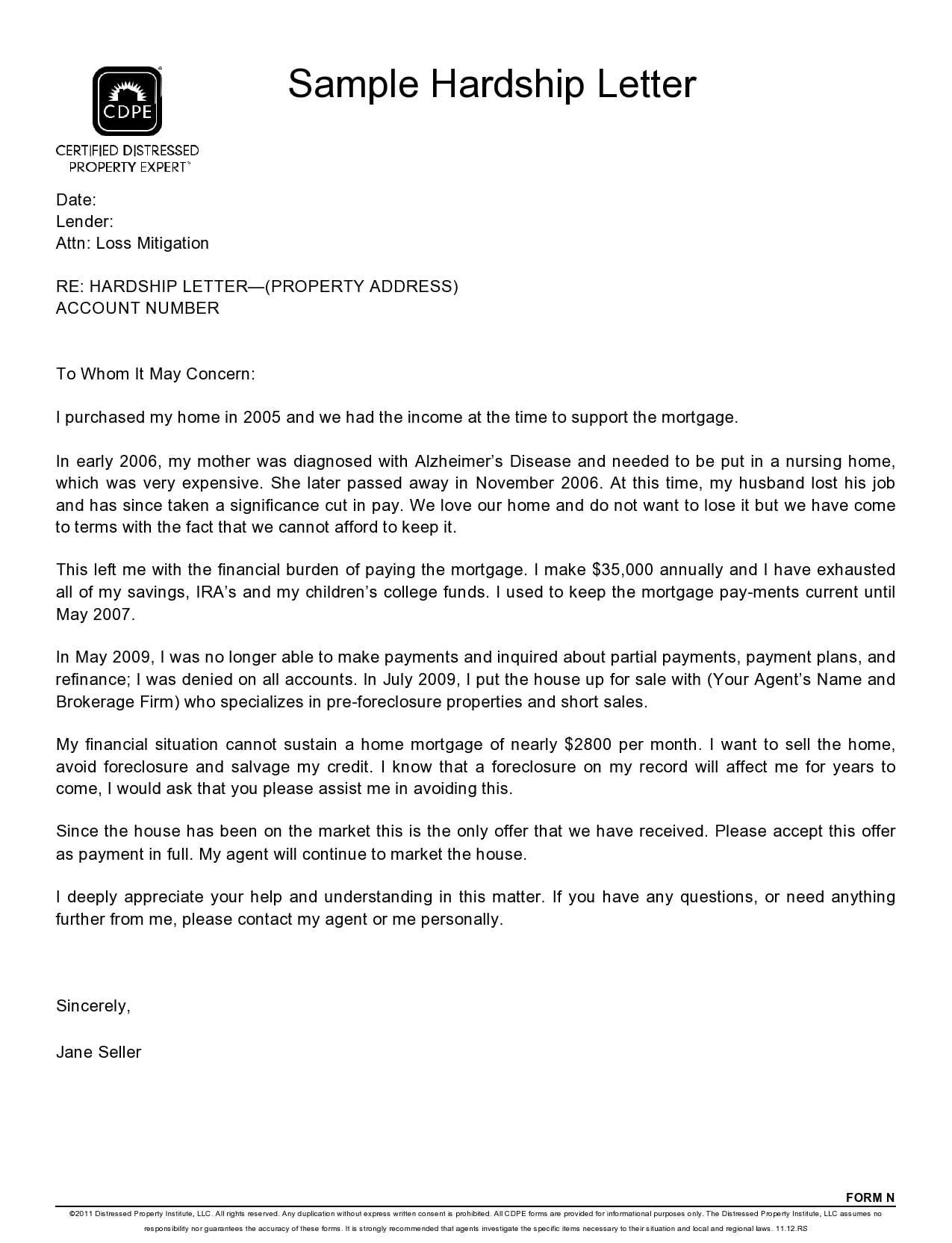

It’s important to be honest and transparent about the factors that have affected your finances. Whether it’s job loss, medical expenses, or other unforeseen circumstances, lenders will appreciate a detailed and straightforward explanation. Use a clear, factual tone to help the lender understand the severity of the situation.

Common Mistakes to Avoid

When writing your appeal, avoid vague language or over-explaining your personal situation. Focus on relevant facts and avoid going into unnecessary details that might detract from the main message. Also, ensure that your request is realistic and achievable.

Next Steps After Submission

Once your request is submitted, it’s important to remain proactive. Follow up with the lender to confirm receipt and inquire about the review process. Be prepared to provide additional documentation if necessary and remain flexible in your negotiations to find a mutually agreeable solution.

Request for Loan Adjustment: Crafting a Persuasive Appeal

When facing financial difficulties, it may be necessary to request a change in the terms of your existing loan to make payments more manageable. The ability to communicate your situation effectively can greatly influence the lender’s willingness to grant adjustments. By structuring your appeal carefully and clearly, you can present a compelling case for why a modification is in both your and the lender’s best interest.

Understanding the Need for a Request

The first step in this process is recognizing when you are unable to meet your current payment obligations. Lenders understand that financial setbacks happen, but they require clear and honest communication. It’s essential to convey the impact of your financial situation on your ability to make timely payments, whether due to job loss, medical issues, or other unforeseen circumstances.

Key Elements of an Effective Request

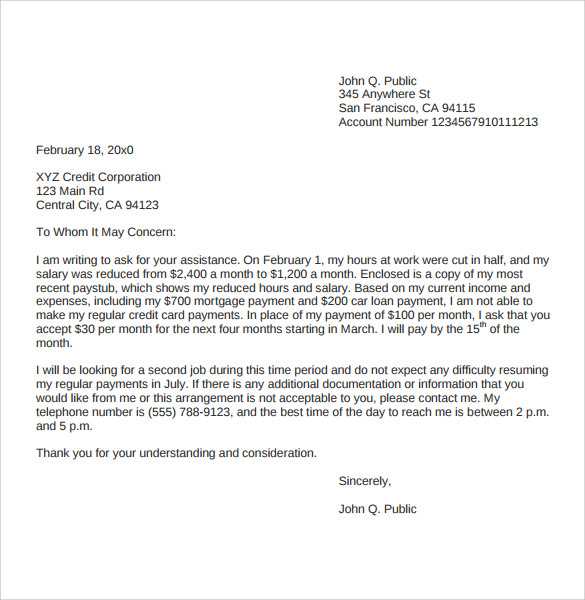

To craft an effective appeal, focus on the key components that lend credibility and clarity to your request. Begin with a brief introduction, explaining your circumstances and why you’re seeking a change. Clearly outline the adjustments you’re requesting and how these will help you fulfill your repayment obligations. A persuasive appeal should also emphasize your intention to continue meeting your new terms and demonstrate your commitment to resolving the issue.

How to Explain Financial Struggles Clearly

Be straightforward and transparent about the financial challenges you’re facing. Avoid unnecessary details that might cloud your message. Focus on the most relevant factors affecting your financial stability and explain them concisely. Lenders appreciate clarity, so ensure that your explanation is both factual and easy to understand.

Tips for Crafting a Persuasive Appeal

Keep your tone respectful and professional. Express empathy for the lender’s position while highlighting your willingness to work together to find a solution. Include any supporting documents that can strengthen your case, such as income statements, medical records, or job loss notifications. A well-supported request increases the likelihood of receiving a positive response.

Common Errors to Avoid in Your Request

There are several pitfalls to avoid when making your appeal. Avoid vague language or over-explaining your personal situation. Focus on relevant facts and be concise. Don’t make unrealistic demands; instead, request adjustments that are feasible for both parties. Additionally, don’t forget to proofread your request for grammatical or spelling errors that might undermine its professionalism.

Next Steps After Submitting Your Appeal

Once you’ve submitted your request, it’s important to follow up with the lender to ensure it has been received and is being reviewed. Be patient but proactive in seeking updates. If additional information is requested, provide it promptly. Remaining flexible and cooperative throughout the process will demonstrate your commitment to resolving the situation responsibly.