Personal Loan Payoff Letter Template for Easy Use

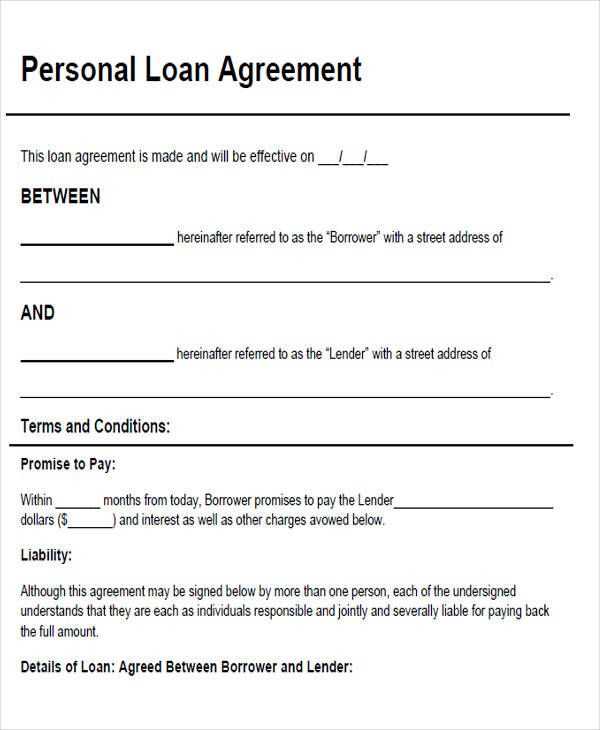

When clearing outstanding balances with a creditor, it’s crucial to have proper documentation that confirms the debt has been fully satisfied. This formal acknowledgment ensures that both parties are in agreement and provides a clear record for future reference. A well-structured statement can help avoid confusion and legal disputes after the settlement is completed.

Obtaining this official confirmation typically involves requesting a formal statement from the lender that outlines the final amount required to close the debt. This document serves as proof that the terms of the agreement have been met and can be essential when finalizing financial matters.

Crafting such a document requires specific details, and understanding the necessary components can help you ensure that it serves its purpose effectively. With the correct information included, the final statement can smoothen the process of debt closure and prevent any misunderstandings that might arise later.

What You Need to Know

When a debt is fully paid, it’s important to have written confirmation that the agreement has been completed. This documentation acts as official proof that all payments have been settled, ensuring that no further obligations exist between the borrower and lender. It can also be crucial for your credit records and may be required for future financial transactions.

The key to this document is clarity. It should specify the total amount settled, any remaining balance (if applicable), and the date the payment was made. This type of formal statement is often issued by the creditor or lending institution once the outstanding balance has been cleared.

In addition to confirming that the debt is resolved, this documentation can be used for record-keeping and resolving any potential disputes in the future. It ensures both parties are on the same page regarding the closure of the financial obligation.

What is a Debt Settlement Confirmation?

Once a borrower completes their financial obligation, a formal document is often required to confirm that the amount owed has been fully settled. This statement serves as an official acknowledgment that the debt has been cleared, ensuring that both the borrower and lender are in agreement about the completion of the terms. It is an essential part of closing any financial agreement.

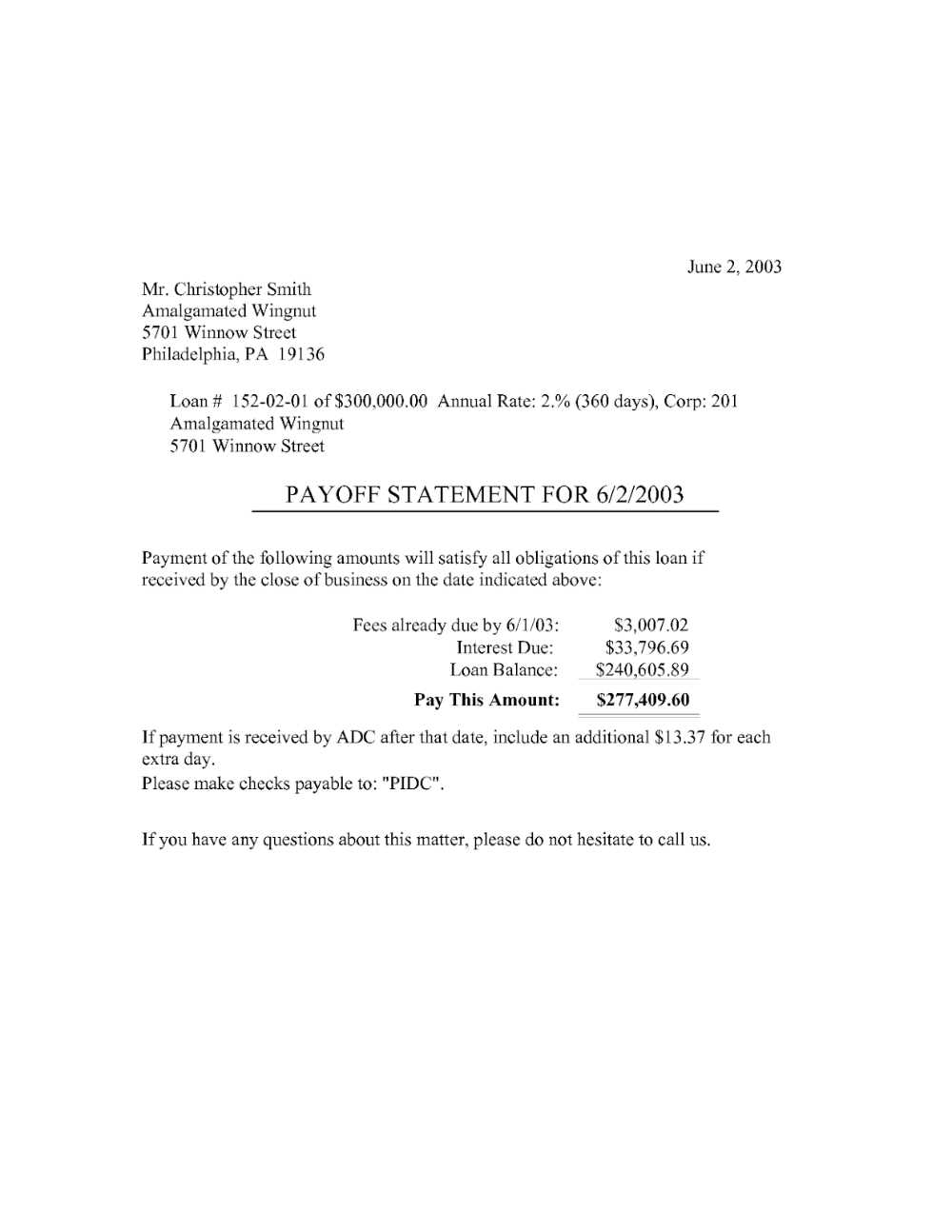

Key Details Included in the Confirmation

The document typically contains information about the total amount paid, any adjustments made, and the date the final payment was processed. It also states that no further balances remain, providing a clear record for both parties. This written confirmation can be crucial for resolving potential disputes and ensuring accurate credit reporting.

Why This Document Matters

Having a signed confirmation that the debt has been fully satisfied helps protect both parties. For the borrower, it ensures that no further payments are due and can be used as proof for credit purposes. For the lender, it closes the financial agreement and provides evidence that the debt has been fully resolved.

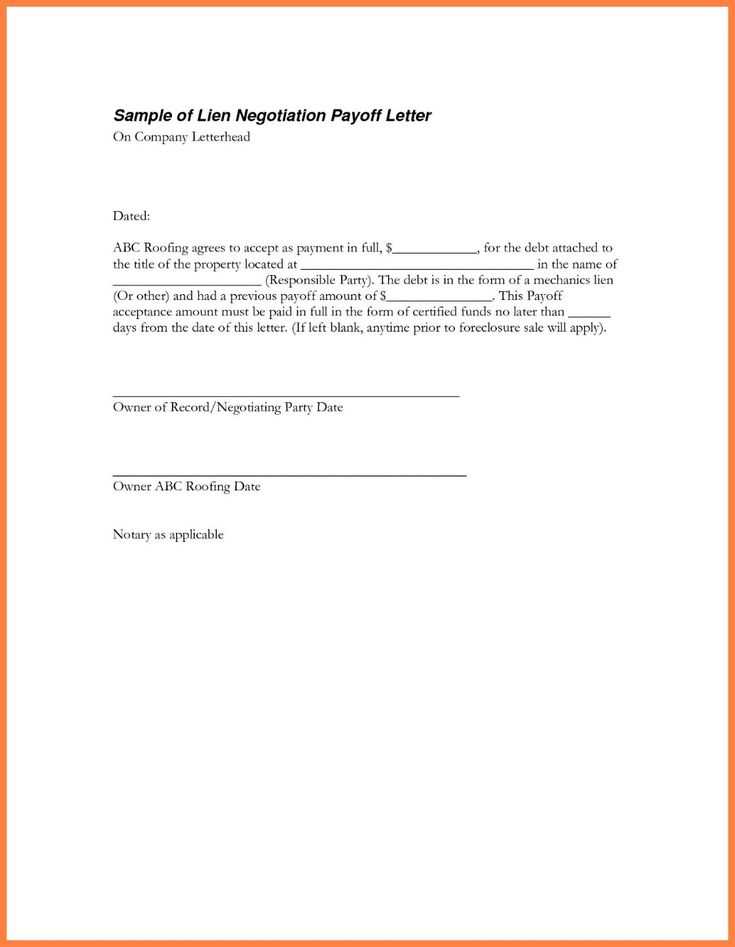

Essential Components of a Settlement Statement

When closing a financial agreement, certain key details must be included in the official statement to ensure all aspects of the debt’s resolution are clearly documented. These components serve as a formal record of the transaction and provide both parties with a reliable reference to confirm the terms have been met and the agreement is completed.

Crucial Information to Include

The statement should list the total amount that was paid to settle the debt, including any interest or fees applied. It should also specify the date of the final payment, confirming the exact point at which the borrower fulfilled their obligation. Additionally, the document should state that no remaining balance is owed, making it clear that the agreement is fully satisfied.

Additional Important Details

Alongside the payment amount and dates, the statement should include identification details of both parties involved, ensuring that the agreement is linked to the correct individuals. It may also reference any specific terms of the original contract, especially if there were any changes or modifications throughout the settlement process. These elements provide a comprehensive overview of the debt’s resolution, offering security and transparency for both sides.

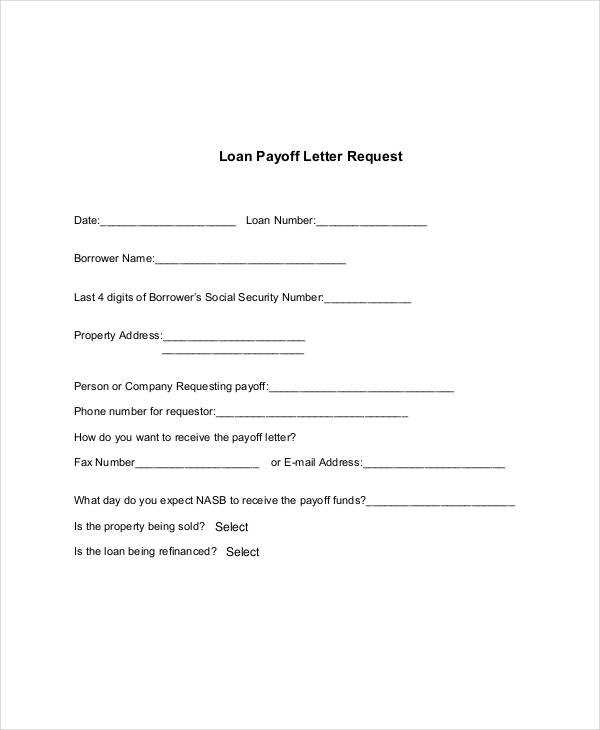

How to Request a Debt Settlement Statement

When you have completed all the payments on your financial agreement, it’s important to request an official document confirming that the balance has been fully cleared. This process ensures that both parties are in alignment regarding the closure of the debt. The steps to acquire such a statement can vary depending on the creditor, but they generally follow a straightforward procedure.

Steps to Request the Statement

To request a confirmation of debt resolution, follow these steps:

- Contact the creditor or financial institution through their official communication channels.

- Provide your account details, including the loan number or any relevant reference identifiers.

- State that you would like an official document confirming the full settlement of the debt.

- Request that the statement include the settlement amount, date of payment, and confirmation of no remaining balance.

- Verify the contact details, ensuring that the document will be sent to the correct address or email.

Things to Keep in Mind

Make sure to allow enough time for the creditor to process your request, as it may take several days or weeks. Additionally, ensure that the document includes all the necessary details to prevent any future disputes regarding the completion of the agreement. If there are any discrepancies, contact the creditor immediately to resolve the issue.

Why Timely Documentation is Crucial

Ensuring that debt resolution is properly documented and delivered in a timely manner is essential for both parties involved in the agreement. Without official proof that the debt has been fully satisfied, misunderstandings and disputes may arise, potentially affecting future financial transactions. Having a clear and prompt record is vital to avoid complications down the line.

Key Reasons for Prompt Documentation

- Prevents Misunderstandings: Early confirmation of debt closure reduces the chances of any confusion regarding the remaining balance.

- Protects Your Credit Score: Timely documentation ensures that your credit report accurately reflects the paid-off status of your account.

- Facilitates Future Transactions: A settled debt record can be required when applying for future credit, making it easier to access financial products.

- Avoids Legal Issues: Having a proper, timely record can protect you from potential claims made by the creditor or third parties in the future.

Best Practices for Ensuring Timely Documentation

- Request the statement as soon as the final payment is made.

- Follow up with the creditor if there’s any delay in receiving the document.

- Ensure the document includes all necessary details, such as the payment amount and final balance.

Common Errors in Handling Debt Settlement Documents

When dealing with the completion of a financial agreement, it’s easy to overlook key details or make mistakes that can cause complications later. Handling the necessary documentation with care is essential for ensuring that the debt is fully resolved and recorded. Common errors can lead to confusion, delays, or even potential disputes, making it important to be aware of these issues before finalizing everything.

Frequent Mistakes to Avoid

- Missing Information: Failing to include critical details like the final payment amount, date of settlement, or the outstanding balance can make the document invalid or incomplete.

- Delaying Requests: Waiting too long to request official proof of debt settlement can lead to potential issues with your credit or financial records.

- Incorrect Contact Details: Sending the document to the wrong address or using outdated contact information can delay the processing and receipt of the settlement confirmation.

- Failure to Review: Not double-checking the document for accuracy may lead to overlooked errors, such as discrepancies in the amount or terms.

How to Prevent These Mistakes

- Request the document promptly after making the final payment.

- Ensure all relevant details are correctly filled in, including payment amounts and balance confirmation.

- Double-check contact information before submitting or requesting the document.

Using a Settlement Statement to Close the Agreement

Once all payments for an outstanding financial agreement have been completed, the final settlement statement serves as the official document that signifies the conclusion of the arrangement. This statement is essential for formally closing the agreement and ensuring that all obligations have been met. It provides the necessary confirmation that the debt has been fully resolved, preventing any future disputes over the matter.

Key Steps for Using the Settlement Document

The settlement document is typically used to officially close the agreement and may be required when dealing with certain administrative or financial procedures. It ensures that both parties are on the same page regarding the cleared balance and final payment. Below is a breakdown of how this document is used in the closure process:

| Step | Description |

|---|---|

| 1. Review the Statement | Ensure that the document accurately reflects the paid amount, final balance, and other essential details. |

| 2. Submit for Closure | Send the statement to the appropriate department or entity to officially close the agreement in their system. |

| 3. Confirm Closure | Follow up to ensure that the agreement has been marked as closed and that no further obligations remain. |

Benefits of Properly Using the Statement

- Prevents future financial disputes or misunderstandings.

- Protects your credit by confirming the full settlement.

- Allows for the smooth completion of the financial agreement, freeing you from any further obligations.