Transfer of Ownership Letter Template Guide

When an individual decides to give up rights to an asset and pass them to someone else, it is essential to formalize the process through proper documentation. This ensures that all parties involved are aware of the transaction and that the change of possession is legally recognized. Creating a clear and well-organized document can prevent misunderstandings and provide both sides with a sense of security throughout the procedure.

A well-structured document serves as a formal record, detailing important information such as the item in question, the parties involved, and the conditions of the arrangement. By following a specific format, individuals can ensure that the agreement is legally binding and recognized by the appropriate authorities. This type of record is particularly useful in cases where proof of the transaction is necessary for future reference or legal purposes.

Whether you’re handling a vehicle, property, or another valuable asset, having the right paperwork is crucial for both the transferor and the recipient. The goal is to make sure that both sides understand their roles and responsibilities, avoiding potential legal complications down the line. A detailed, comprehensive document not only protects the interests of both parties but also ensures that the shift of control is carried out smoothly and efficiently.

What is a Document for Transferring Property Rights

Such a document is a formal means of conveying the control or possession of a particular asset from one individual to another. It ensures clarity and legal validation of the change, protecting both parties involved. Whether for a vehicle, land, or other possessions, the document outlines the terms and conditions of the agreement, making the process transparent and accountable.

Key Elements of the Document

This type of document generally includes a few essential details, such as:

- Identification of the parties – Names and contact information of both the individual relinquishing control and the one assuming it.

- Description of the item – Detailed description of the property or asset being handed over.

- Terms of the agreement – Any relevant conditions, such as the date of transfer or special clauses that may apply to the transaction.

- Signatures – Both parties must sign the document to indicate consent and validate the exchange.

Importance of the Document

By formalizing the exchange in writing, individuals ensure that the transaction is recognized by legal authorities. It can be crucial for various purposes, such as:

- Proof of transaction – In case any disputes arise, the document serves as official evidence of the agreement.

- Tax and legal obligations – It may be necessary for tax filings, registration, or meeting other legal requirements.

- Clarity for both parties – It eliminates any misunderstandings or confusion about the terms, dates, and responsibilities associated with the exchange.

Why You Need a Document for Changing Property Control

Having the right paperwork when passing control of an asset is essential for ensuring that the exchange is legally recognized and fully protected. Without proper documentation, there can be ambiguity surrounding the terms of the transaction, potentially leading to disputes or complications down the line. This document serves as both a formal record and a safeguard for both parties, ensuring the process is clear and accountable.

Legal Protection and Clarity

When formalizing the process of relinquishing an asset, a properly drafted document ensures that both the giver and the recipient are aware of their rights and responsibilities. By providing a clear outline of the agreement, this document helps avoid misunderstandings, and its legal validity gives both parties confidence in the transaction. It can also be crucial if legal issues arise later, offering proof of the agreement and its terms.

Essential for Record Keeping

Many transactions require official documentation for future reference, whether for tax purposes, asset registration, or resolving disputes. A well-organized record simplifies these processes, providing a reliable source of information. Without this formality, it may be difficult to prove the details of the transaction or track ownership in the future. Proper documentation acts as a safeguard, ensuring that everything is handled efficiently and according to legal requirements.

Key Components of a Proper Template

A well-constructed document for conveying asset control includes several critical elements that ensure the transaction is clear, legally binding, and easy to understand. These components help outline the terms, provide clarity for both parties, and safeguard the interests of those involved. A comprehensive template includes all necessary details that facilitate the smooth completion of the process.

Some essential components include:

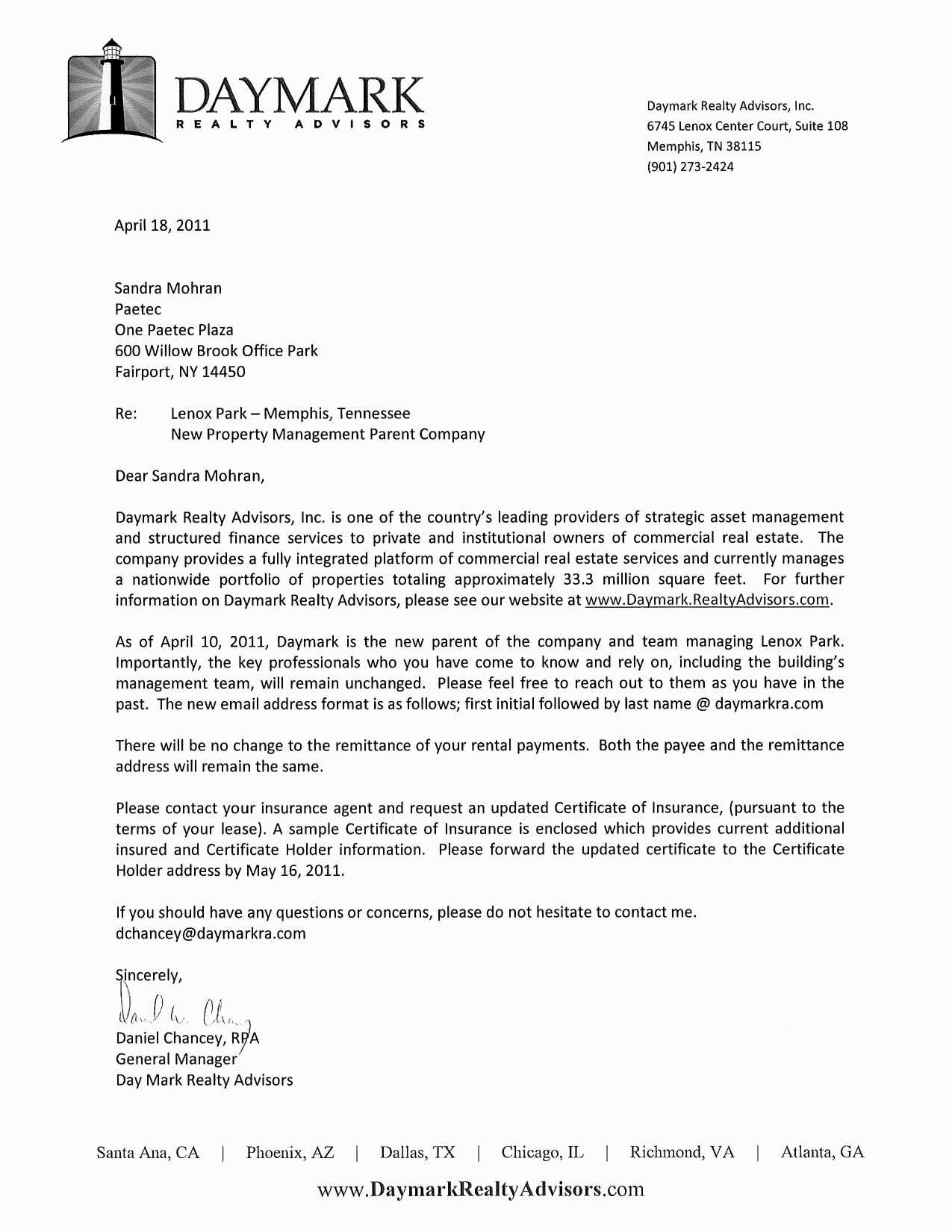

- Identification of the Parties – Clear names, addresses, and contact information for both the individual giving up control and the one receiving it.

- Description of the Item – A detailed description of the asset, including any relevant identification numbers or characteristics that distinguish it.

- Terms of the Agreement – Specific conditions such as the date of the transaction, responsibilities of both parties, and any clauses that may apply to the exchange.

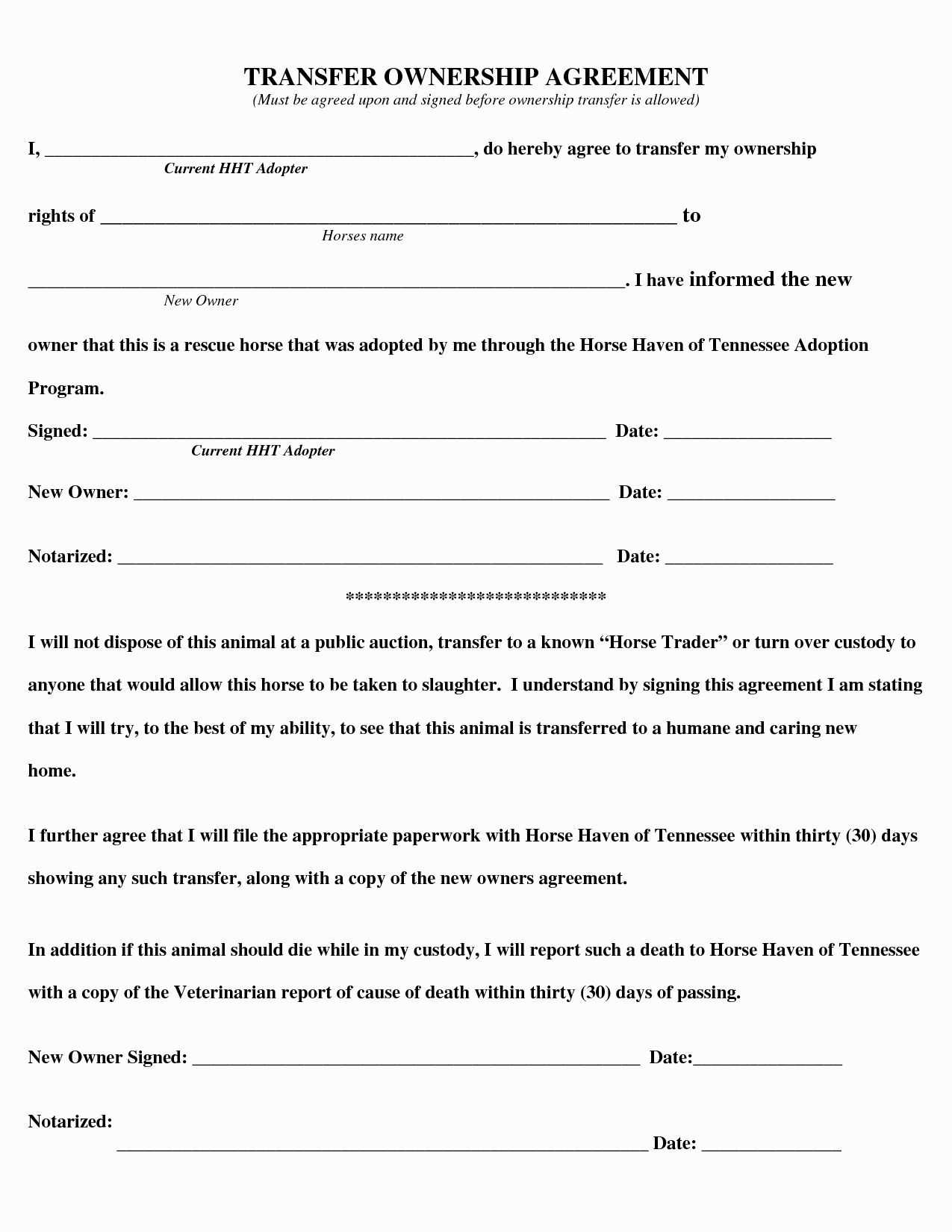

- Signatures – The document must be signed by both individuals to validate the agreement and confirm mutual consent.

- Witness or Notary Section – Depending on the legal requirements, it may be necessary to include a section for witnesses or a notary to verify the authenticity of the signatures.

By incorporating these key elements into the document, both parties ensure a smooth and legally sound transaction, preventing potential misunderstandings and future complications.

Step-by-Step Guide to Drafting the Document

Creating a document for conveying control of an asset requires careful attention to detail to ensure the process is clear, accurate, and legally binding. Following a systematic approach will help in drafting a comprehensive document that outlines all necessary terms and conditions. Below is a step-by-step guide to assist in the creation of a well-organized and effective agreement.

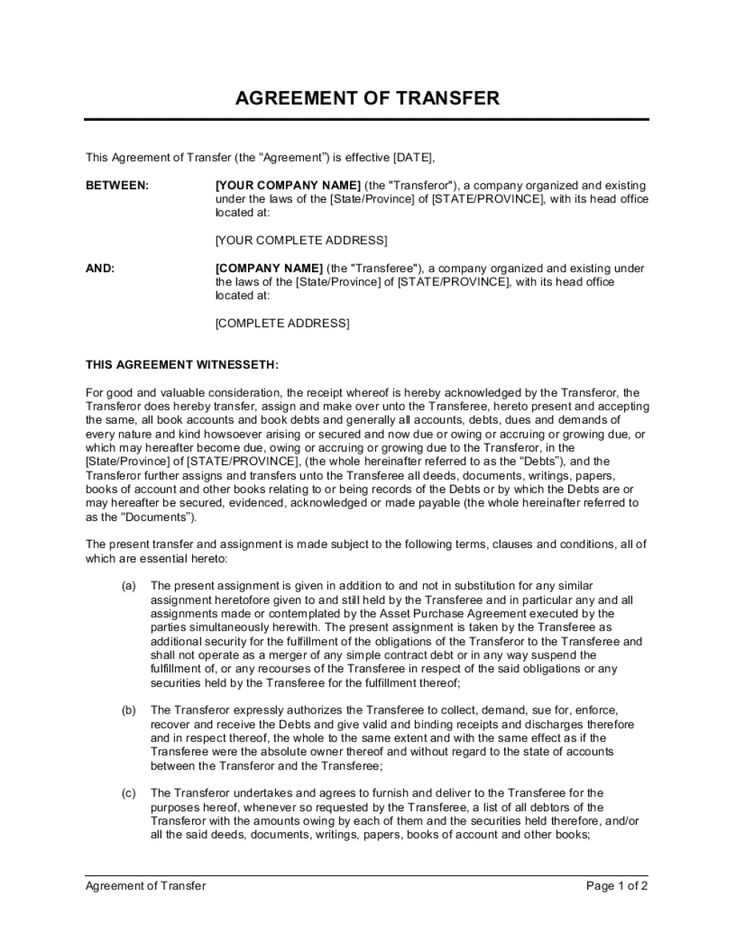

| Step | Action | Description |

|---|---|---|

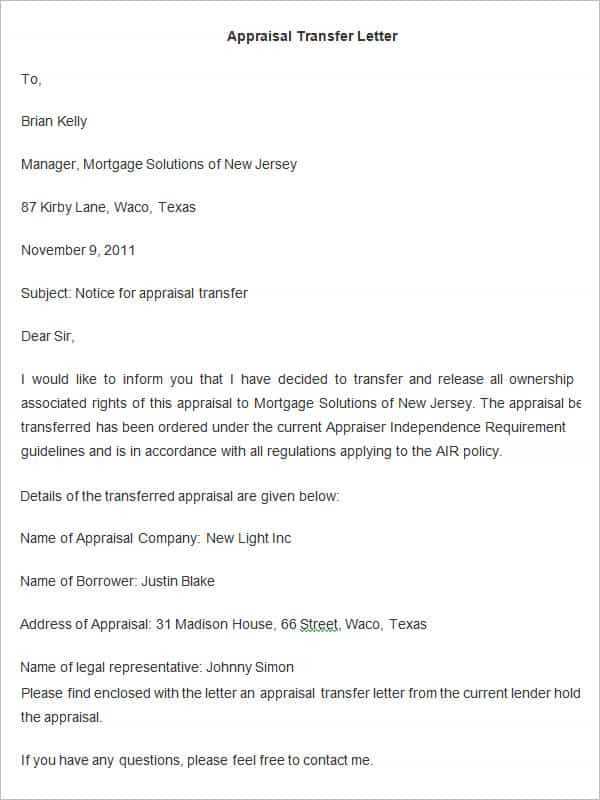

| 1 | Header Information | Begin by including the date of the transaction, along with the names and contact information of both parties involved. |

| 2 | Asset Description | Clearly describe the asset being transferred. Include any unique identifiers such as serial numbers, make, model, or other distinguishing features. |

| 3 | Terms and Conditions | Outline any conditions related to the transaction, such as the effective date, responsibilities of both parties, and any other relevant terms. |

| 4 | Signatures | Ensure that both parties sign the document to indicate agreement. Consider including spaces for witnesses or notary if required. |

| 5 | Final Review | Before finalizing the document, review all details to confirm accuracy and ensure all necessary sections are included. |

Following these steps ensures that all key aspects of the transaction are clearly outlined, providing both parties with a legally valid record of the agreement.

Legal Implications of Asset Control Shifts

Changing the control of an asset can have significant legal consequences, especially when the transaction is not properly documented. A formal agreement is crucial to ensure that the shift of responsibility is recognized and enforceable. Without the appropriate paperwork, parties may face challenges in proving the validity of the arrangement, and disputes may arise regarding the terms or execution of the agreement.

Impact on Liability

When control of an asset is transferred, the new party assumes both the benefits and the potential liabilities associated with it. This includes financial obligations, maintenance responsibilities, and legal accountability for any actions related to the asset. Failure to clarify these responsibilities in writing can lead to confusion, with both parties unsure of their roles, which could cause financial or legal repercussions later.

Tax and Regulatory Considerations

In many cases, the change of possession requires the filing of specific documents with government authorities or tax agencies. This could involve updating records for property taxes, vehicle registration, or other compliance matters. Not having the proper paperwork can lead to fines, legal penalties, or issues with future transactions involving the asset. Proper documentation ensures that the transaction complies with relevant regulations and avoids potential tax liabilities.

Common Mistakes to Avoid When Writing

When drafting a document for transferring control of an asset, it’s important to avoid certain pitfalls that can lead to confusion, legal challenges, or unenforceable agreements. Even small mistakes can have significant consequences, so attention to detail is essential in order to ensure clarity and legitimacy. Below are some common errors that should be avoided during the writing process.

Some key mistakes to watch out for include:

- Ambiguous Language – Using unclear terms or leaving out important details can lead to misunderstandings. Be as specific as possible about the asset, the parties involved, and the terms of the exchange.

- Incomplete Information – Failing to provide all necessary details, such as names, contact information, and a full description of the asset, can make the document invalid or difficult to enforce.

- Neglecting Signatures – Without proper signatures from both parties, the document may not hold legal weight. Ensure both individuals sign the agreement and include a section for witnesses or a notary, if needed.

- Failure to Follow Legal Requirements – Each jurisdiction may have specific rules regarding asset transfers. Not adhering to these regulations can result in the document being invalid or unenforceable. Make sure to research any legal requirements before finalizing the document.

- Forgetting to Keep Copies – It’s crucial to keep copies of the signed agreement for both parties. Without proper documentation, future disputes or clarifications may become difficult to resolve.

By being aware of these common mistakes and taking the necessary precautions, you can avoid complications and ensure that the agreement is clear, enforceable, and legally binding.