Pension Opt Out Letter Template

Withdrawing from a company-sponsored retirement scheme can be a complex decision. It involves understanding various aspects of the plan, the implications of your choice, and following a specific procedure to officially remove yourself from participation. Knowing the right steps to take can help ensure that the process is smooth and in accordance with company policies.

In this section, we will explore the necessary steps and considerations for individuals looking to cease contributions to a retirement program. We’ll also discuss the key components of a formal request, ensuring you have a clear understanding of how to proceed. Understanding the legal framework and potential consequences of this action is crucial to making an informed decision.

By following a proper procedure, individuals can confidently manage their retirement options without encountering unnecessary complications. This guide will provide a clear and structured approach to help you navigate this important decision.

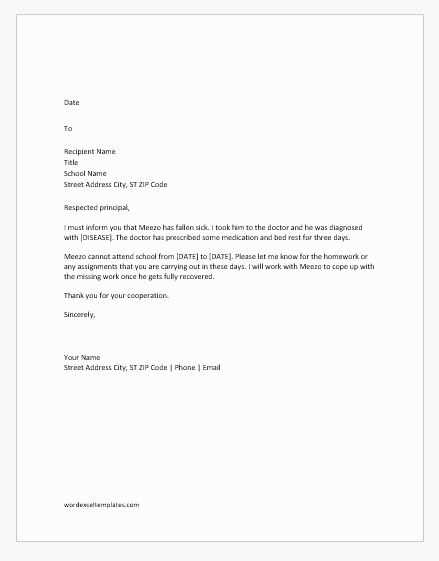

When an individual decides to disengage from a workplace savings program, it is essential to formally communicate their intent. This written request serves as an official declaration that the person no longer wishes to participate in the company’s contribution plan. It is a structured document designed to ensure the request is clear, legally recognized, and properly processed by the employer.

This document typically includes key personal details, the decision to discontinue participation, and a formal acknowledgment of the understanding of any consequences tied to this decision. By submitting this form, the individual takes the necessary step to stop future deductions or contributions to the retirement scheme, while also ensuring that the employer is fully aware of their choice.

It is important to approach this matter with care, as the document also serves as a record for both the employee and the employer, protecting both parties in the event of future disputes or clarifications regarding the decision. The content and structure of this document are crucial to ensure its acceptance and proper processing within the company’s established procedures.

When to Consider Withdrawing from the Retirement Program

Deciding to stop participating in a workplace savings plan is not a decision to be taken lightly. There are certain situations where this choice may make sense, especially when personal financial goals or circumstances change. Understanding when it might be appropriate to make such a decision requires careful evaluation of your current situation and future plans.

If you find that contributing to the scheme is no longer a priority or that other financial commitments demand more immediate attention, it may be the right time to formally withdraw. Similarly, if the scheme’s benefits no longer align with your long-term objectives, such as retirement plans or other investment options, stepping back could be a viable option. Additionally, a change in employment status or financial situation could prompt a reevaluation of whether continued participation is in your best interest.

Before making any decisions, it’s important to fully understand the implications, including potential tax consequences, employer matching contributions, and the impact on your future financial security. Weighing these factors carefully can help determine whether it’s the right moment to discontinue involvement in the program.

How to Write a Withdrawal Request

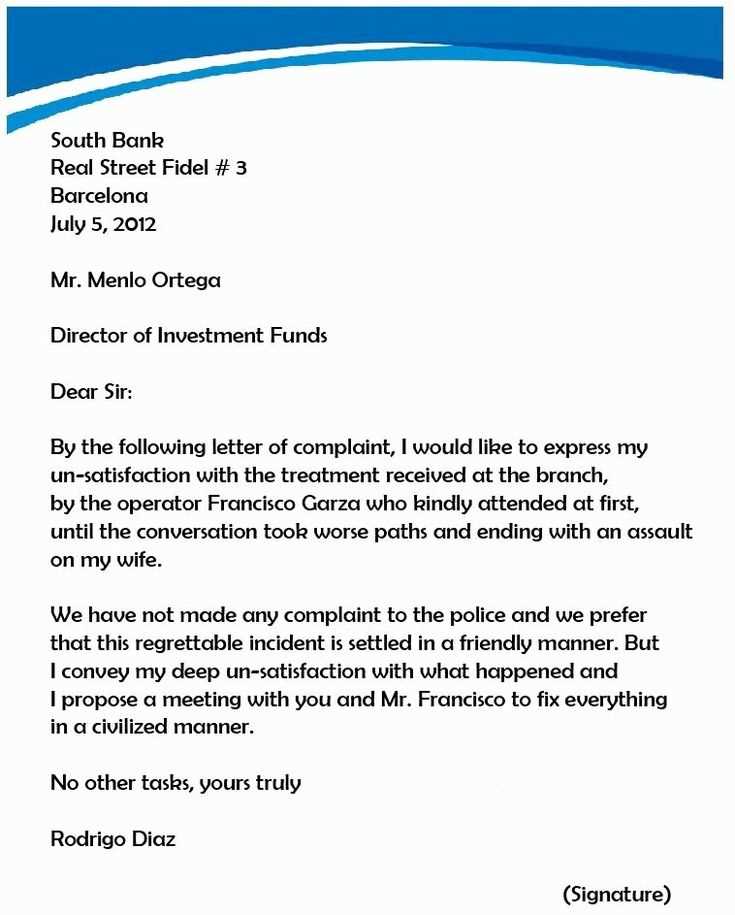

When you decide to stop participating in a company-sponsored savings program, it’s essential to submit a formal request. The document should be clear, professional, and concise, ensuring that your intent is communicated effectively to your employer. Writing this request correctly helps to avoid confusion and ensures that the process is handled promptly.

Start by addressing the request to the appropriate department or person responsible for managing the program. Include your full name, employee ID (if applicable), and the date of the request. Be direct and state your intention to cease participation in the savings scheme. It is also important to acknowledge any understanding of the potential consequences or benefits that may be affected by your decision.

Finally, close the request by thanking the recipient for their attention to the matter and providing any necessary contact information should they need further clarification. A well-structured withdrawal document will ensure that the process is smooth and your request is processed according to company protocols.

Key Information to Add in the Document

When preparing a request to discontinue participation in a workplace savings plan, it is crucial to include specific details to ensure the document is clear and comprehensive. Providing the right information helps facilitate the process and prevents any confusion or delays. Below are some key elements to consider:

- Personal Information: Include your full name, employee identification number, and department or role within the company.

- Intent to Withdraw: Clearly state your decision to stop contributing to the savings program and specify the effective date of your withdrawal.

- Understanding of Consequences: Acknowledge any potential effects of your decision, such as changes in future benefits or financial implications.

- Contact Information: Provide a phone number or email address for follow-up questions or clarifications.

- Signature: Sign the document to confirm the accuracy of the information and validate your request.

Including these essential details ensures that your request is properly documented and processed without unnecessary delays or confusion. Properly structured and informative documentation makes the withdrawal process smoother for both you and the employer.

Understanding Legal Consequences

When deciding to discontinue participation in a workplace savings program, it’s crucial to understand the potential legal ramifications of your decision. While this step may seem straightforward, there are several legal considerations that could affect your future financial situation, tax responsibilities, and employer relationships. Being aware of these consequences ensures that you make an informed choice and avoid unexpected issues down the line.

Key Legal Implications

Ceasing involvement in such a scheme can have several legal consequences. Some of these may affect your rights to certain benefits, impact your tax obligations, or alter your relationship with the employer. Understanding these factors can help you navigate the decision-making process more effectively.

| Consequence | Potential Impact |

|---|---|

| Tax Implications | Discontinuing contributions may result in changes to your tax obligations, including possible penalties or adjustments to your taxable income. |

| Benefit Eligibility | You may lose eligibility for certain employer-sponsored benefits or face changes in the amount you are entitled to in the future. |

| Employer Contributions | If your employer matches contributions, you may forfeit future matching funds, which could significantly affect your long-term savings. |

Seeking Legal Advice

Given the potential complexities, it’s advisable to consult with a legal or financial advisor before making such a decision. Professional advice can help you fully understand the long-term effects and ensure that your withdrawal aligns with your overall financial goals.

What Happens After Sending the Request

Once you have submitted your request to discontinue your participation in the employer-sponsored program, several steps follow to process your decision. The action taken after submission can vary depending on company policy, legal requirements, and the specifics of your situation. Understanding what happens next ensures you stay informed throughout the entire process.

After sending the request, your employer or the program administrator will typically acknowledge receipt of your document and begin reviewing your request. They may contact you for further clarification if necessary. Below is an outline of the typical steps that follow:

- Acknowledgment of Receipt: You should receive a confirmation that your request has been received, often via email or in writing.

- Review and Processing: The employer or administrator will assess your request to ensure that it aligns with the rules of the program and any legal requirements.

- Confirmation of Withdrawal: Once your request is processed, you will receive an official confirmation indicating that your participation has been ended, including any details about the next steps.

- Impact on Contributions: After your participation is officially ended, the employer will stop making contributions to the program on your behalf, and you may need to adjust any future financial planning.

It is important to keep a record of all communication and confirmations during this process to ensure that everything is properly documented. Should any issues arise, having clear proof of your actions will be crucial for resolving matters efficiently.