Hard Inquiry Dispute Letter Template Guide

When your credit report includes entries that you believe were wrongly made or not authorized, addressing these errors is crucial for maintaining a healthy financial profile. Taking action involves notifying the relevant parties and providing clear communication to correct the record. This section explores the essential steps involved in formally addressing such discrepancies and requesting their removal from your credit history.

Why It Is Important to Address Mistakes

Unauthorized credit checks can lower your score and affect your financial opportunities. If you find that your credit report contains assessments that you did not approve, it is important to act quickly. Correcting these records helps prevent any long-term effects on your financial standing and improves your creditworthiness.

Understanding the Impact on Your Credit Score

Each time a credit check is made, it can slightly decrease your overall score. When multiple unapproved checks appear, the damage can accumulate, leading to a significant drop. Addressing this issue helps protect your credit score from unnecessary harm.

How to Effectively Communicate with Credit Agencies

Reaching out to credit reporting agencies with a formal request is a key step. The request should be precise and include supporting information, such as a clear explanation of why the check was unauthorized and any relevant documentation proving your claim.

Steps to Follow for Addressing Unauthorized Checks

To address these issues properly, follow these key actions:

- Review Your Credit Report: Carefully go through your credit history to identify any unapproved assessments.

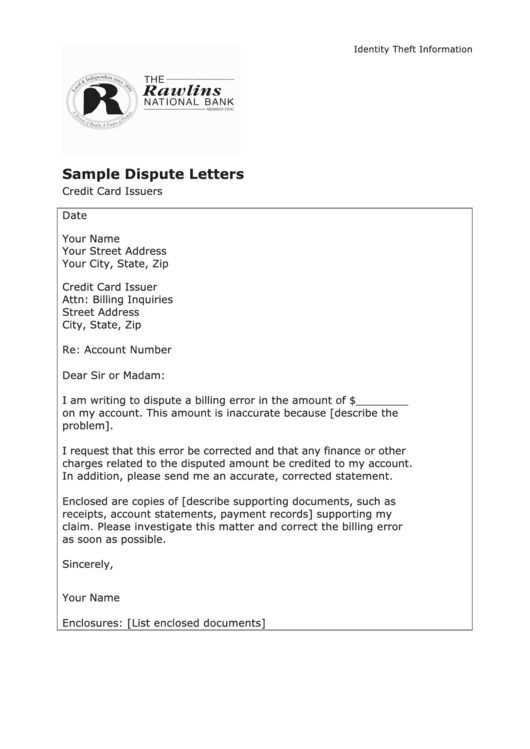

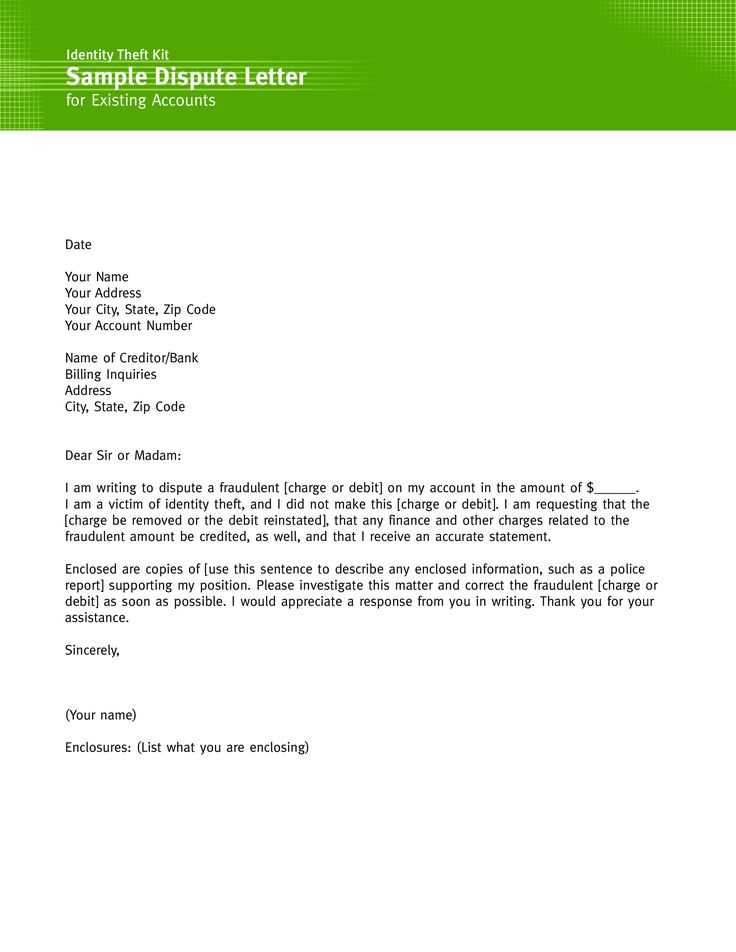

- Prepare Your Request: Write a formal request explaining the situation and providing proof of your claims.

- Submit Your Request: Send your request to the credit reporting agencies and any other relevant institutions.

- Follow Up: If you don’t receive a response within a reasonable time, contact the agency again for an update.

What to Include in Your Communication

Your written request should include:

- Your personal identification details (name, address, and any reference numbers related to your case).

- A brief summary of why you believe the assessment was incorrect or unauthorized.

- Any documentation that supports your claim, such as statements or emails confirming no authorization.

- A clear request for the removal of the incorrect entry from your report.

What to Do If Your Request Is Denied

If your attempt to resolve the issue is unsuccessful, you can escalate the matter. Consider reaching out to a financial advisor or seeking legal assistance to ensure your rights are upheld. Additionally, you may need to file a formal complaint with relevant financial oversight bodies.

Understanding Unauthorized Credit Assessments and Their Impact

When an external entity checks your creditworthiness without your permission, it can affect your financial health. This section provides a deeper understanding of the effects such actions can have, how to address them, and the steps you can take to ensure your credit report remains accurate and fair.

Consequences of Unapproved Credit Checks

Every time your credit is reviewed by a third party, it may have a small negative impact on your score. Unapproved assessments can accumulate, causing a significant drop in your credit score, which in turn can affect your ability to secure loans, credit cards, or even favorable interest rates. Addressing unauthorized actions promptly is essential to prevent lasting damage.

Why It’s Crucial to Address Incorrect Assessments

If you notice that your credit record contains any unauthorized checks, it’s vital to act. Disputing such records helps ensure that your credit score isn’t affected by mistakes, which can be particularly harmful when applying for loans or other financial services. It also ensures that your credit report is accurate and up-to-date.

Key Information to Include in Your Request

To effectively address unapproved credit assessments, your communication should include essential details such as your personal information, a description of the unauthorized action, and any supporting documentation that validates your claim. Be clear and concise in stating why the check was incorrect and what you expect to be done.

How to Submit Your Credit Challenge

Once you have your request prepared, it’s important to send it to the relevant credit bureaus or financial institutions. Be sure to use the appropriate channels and keep a record of all communications to ensure your challenge is properly processed. Following up is essential if you don’t receive a timely response.

Next Steps if Your Request Is Denied

If your challenge is rejected, you still have options. Consider reaching out to consumer protection agencies or a legal advisor for further assistance. In some cases, filing a formal complaint with regulatory bodies might be necessary to resolve the issue.