Hardship Letter Template for Loan Modification Request

When facing financial difficulties, it’s essential to clearly explain your situation to the relevant parties in order to explore potential solutions. Crafting a well-structured message is an important step toward negotiating better terms. This message serves as a tool to present your circumstances and request support, ensuring your challenges are understood by those who can help.

Key Elements to Consider

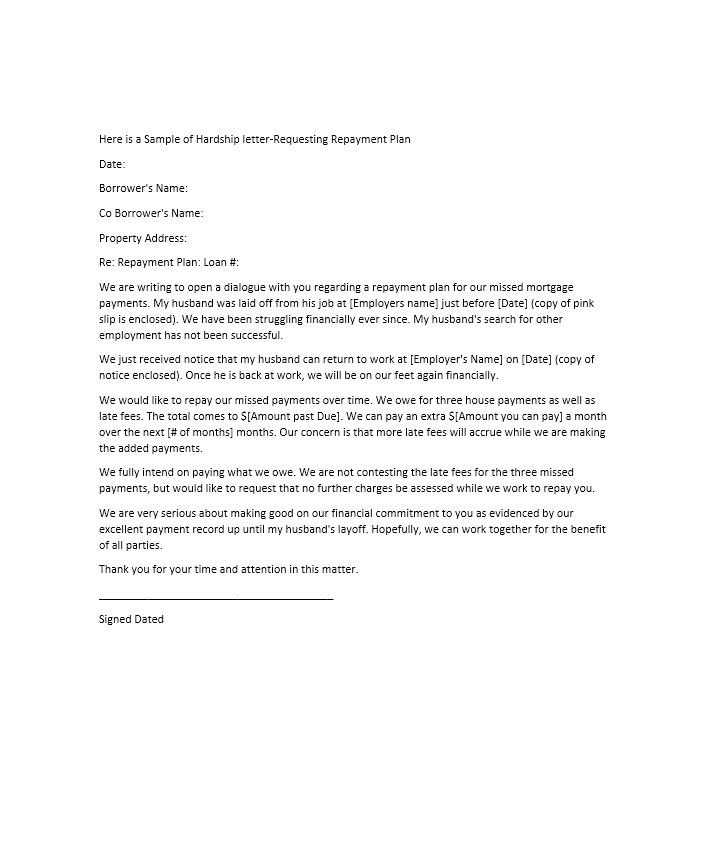

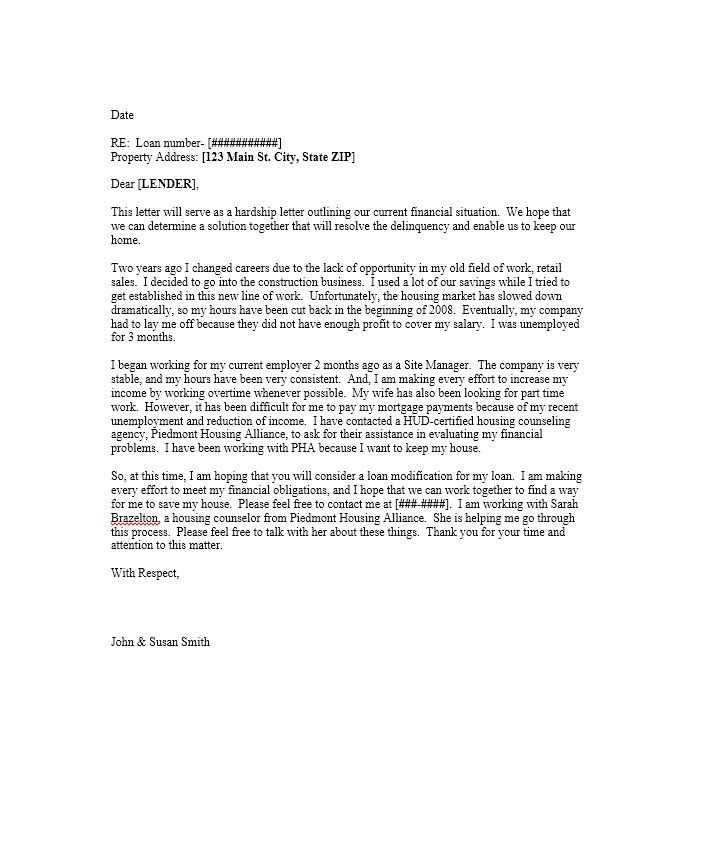

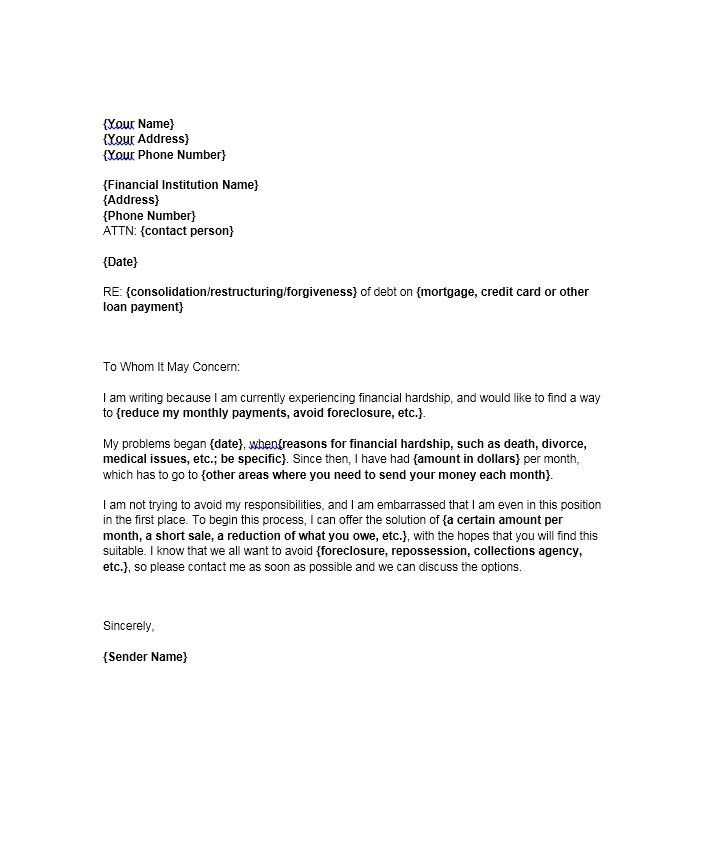

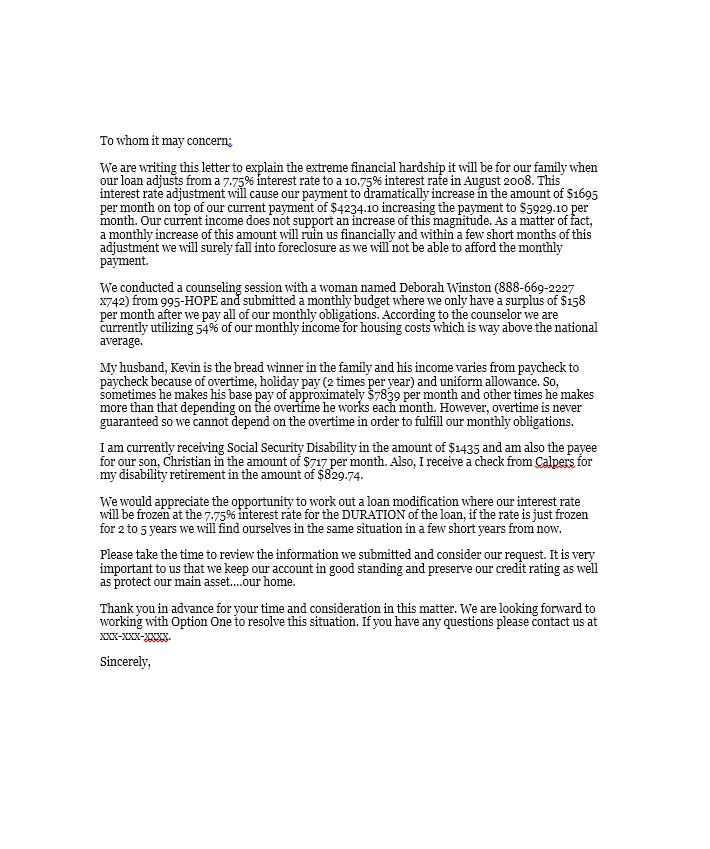

There are several crucial elements that should be included when presenting your situation. Providing a detailed overview of your current financial standing, including specific challenges, helps the recipient understand your need. Transparency and honesty play a key role in building trust and increasing the likelihood of a positive outcome.

- Personal Details: Start with basic information to identify your account or relationship.

- Financial Hardships: Describe the factors affecting your ability to meet current obligations.

- Request for Adjustment: State clearly what kind of changes you are seeking, whether it’s more favorable terms, a reduction in payments, or other adjustments.

- Supporting Documentation: Include any documents that can validate your claims, such as income statements or medical records.

How to Present Your Case Persuasively

Effectively demonstrating the challenges you face requires more than just stating facts. It’s important to express your situation with clarity and empathy, showing that you are actively seeking a viable solution. This can involve explaining how you have tried to manage payments, what circumstances led to the current difficulties, and how adjusting the terms would enable you to fulfill your obligations moving forward.

Avoiding Common Errors

There are several common mistakes to avoid when crafting this type of message. Failing to provide enough detail, not clearly stating your needs, or submitting incomplete information can hinder your chances of receiving assistance. Additionally, avoid a tone that is overly demanding or emotional, as this can detract from the professionalism of your communication.

Best Practices for Submission

Once your message is prepared, ensure that it is submitted to the appropriate parties in a timely and organized manner. It is also beneficial to follow up to confirm receipt and check the status of your request. Keeping all correspondence professional and courteous throughout the process helps maintain a positive relationship.

What Happens Next?

After submission, the recipient will review your message and decide on an appropriate course of action. This could involve a direct response, a request for additional information, or an offer to modify the terms based on your current financial capacity. It’s important to remain patient during this process while staying engaged in case further communication is needed.

Request for Financial Adjustment: Key Considerations

When facing financial challenges, it is often necessary to communicate your situation clearly to relevant parties in order to seek more favorable conditions. Such a request helps explain your struggles and outline potential solutions, demonstrating your willingness to work towards a manageable arrangement.

Crucial Elements to Include in Your Appeal

When presenting your case, it’s important to include certain key information that helps the recipient understand your situation. Begin by outlining your personal details and account information, followed by an honest description of your financial struggles. Make sure to clearly state what kind of changes or adjustments you are seeking and provide supporting documentation to verify your claims. This thoroughness helps establish credibility and builds a stronger case for your appeal.

- Personal Information: Ensure your identity and account details are easily identifiable.

- Financial Difficulties: Describe specific circumstances, such as job loss or medical expenses, that are affecting your ability to meet your obligations.

- Desired Outcome: Clearly state the adjustments you are requesting, whether it’s lower payments or an extension of terms.

- Proof of Hardship: Include documents that support your claims, like income statements or medical records.

Presenting Your Financial Situation Effectively

To make your request more compelling, be clear and concise when describing your financial difficulties. Avoid vague language and focus on specific facts that paint a clear picture of why adjustments are necessary. Highlight any efforts you’ve made to manage your financial obligations, such as reducing expenses or finding additional income. This shows that you are actively trying to resolve the situation and not simply relying on others to bear the burden.

Common Mistakes to Avoid

When preparing your appeal, avoid certain pitfalls that can weaken your case. Do not provide incomplete or vague information, as this can leave the recipient unsure of your needs. Similarly, an overly emotional or demanding tone can make the message seem less professional. Always focus on a calm, factual approach that reflects your seriousness and respect for the recipient.

Best Practices for Submission

Once your appeal is ready, ensure that it is submitted to the correct person or department in a timely manner. Double-check the submission guidelines to ensure all required documentation is included and that it is sent to the right contact. It is also a good idea to follow up after submission to confirm receipt and check on the status of your request.

Next Steps After Submission

After your appeal is submitted, the recipient will review your situation and decide whether to make the requested adjustments. You may receive a response requesting additional information or a proposal for revised terms. Be prepared for potential negotiation and stay engaged throughout the process to ensure the best possible outcome.