Free Proof of Funds Letter Template Download

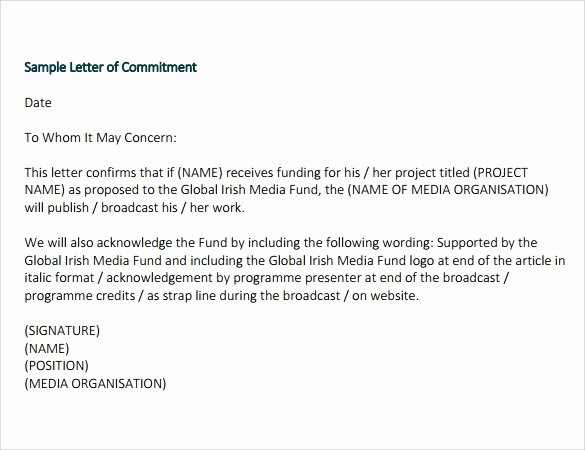

When you need to show your financial reliability, certain documents can help substantiate your ability to meet obligations. These written statements provide clarity about your monetary standing, assuring others of your financial capability. This section will guide you on creating an official document that proves your economic status for various situations.

Reasons for Requiring Financial Verification

There are several instances where demonstrating financial security is essential. Whether applying for a loan, leasing property, or securing a visa, this type of written proof is often required by institutions or authorities to ensure that you can meet necessary financial commitments.

Common Uses

- Visa applications

- Rental agreements

- Loan applications

- Real estate transactions

Essential Elements of a Valid Document

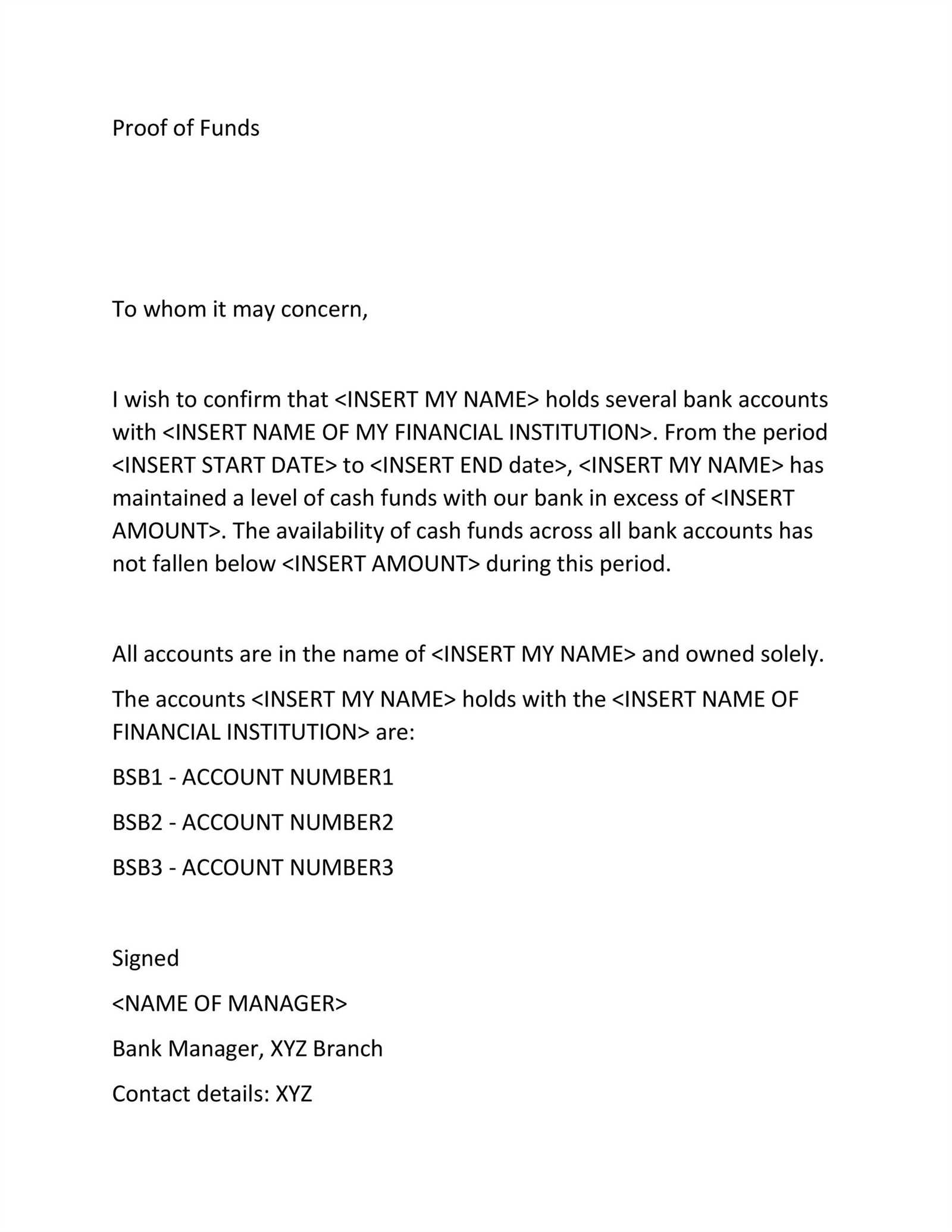

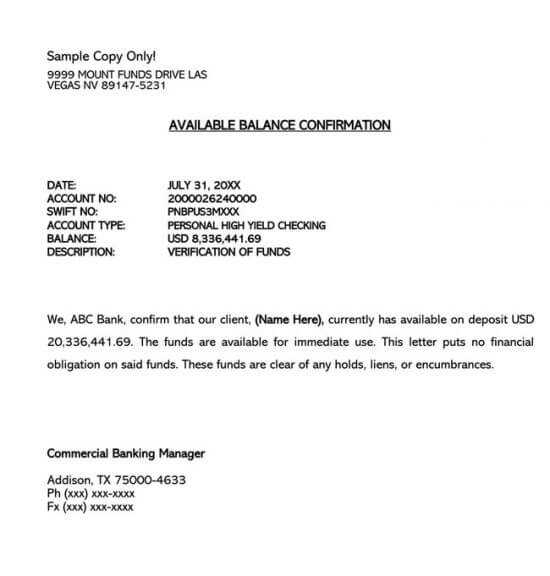

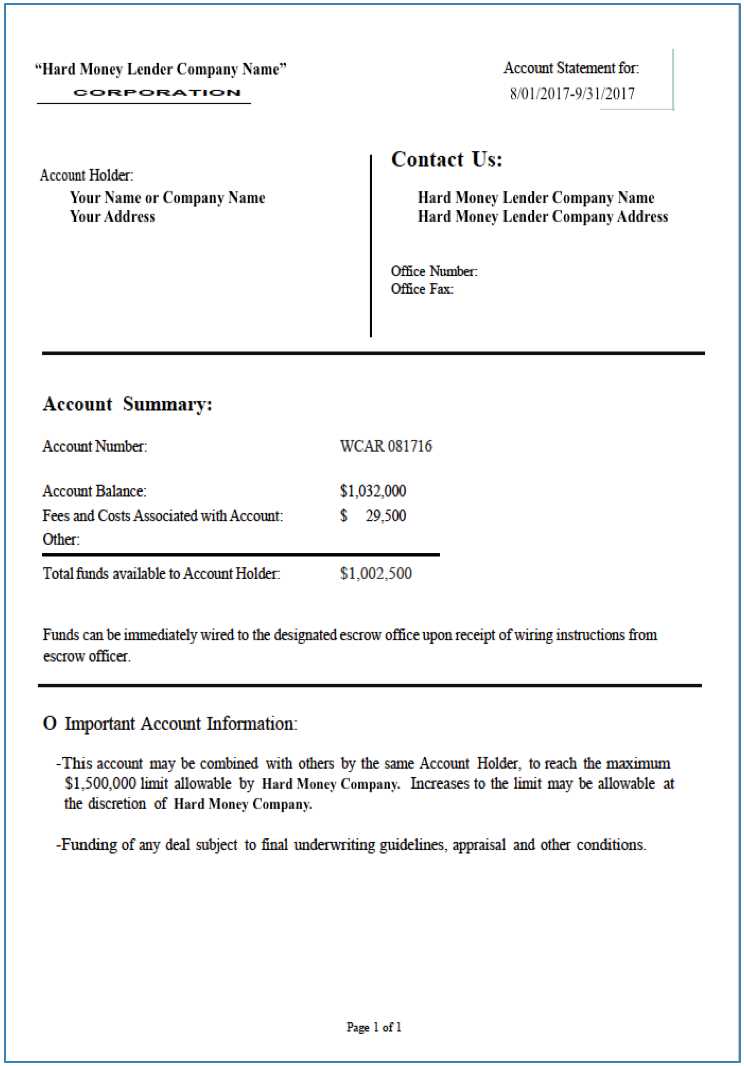

A well-crafted statement should include specific details to ensure its authenticity. Make sure to list the source of funds, the account holder’s name, and the available balance. These key points help verify that the individual has the means to follow through on any financial obligations.

What to Include:

- Name of the account holder

- Details of the bank or financial institution

- Account balance

- Date of document creation

Key Considerations

Always ensure that the document is properly signed and, if necessary, notarized. This adds to its credibility, making it a legitimate form of verification for any process requiring financial assurance.

How to Avoid Mistakes When Drafting

To avoid complications or rejection, ensure the information provided is accurate and clear. Double-check that the figures are correct and that the document is up-to-date. Any errors in the details or formatting could lead to delays or questions about the authenticity of the information.

Using Financial Statements in Real Life Situations

Once you’ve prepared the document, it can be submitted to various institutions to meet their requirements. Remember, the document must be clear, concise, and easy to understand, reflecting your true financial position to anyone reviewing it.

Creating a Document to Verify Financial Stability

When you need to demonstrate your ability to cover financial commitments, certain written forms are essential. These documents help establish your financial credibility and can be required in various situations such as leasing, loan applications, or visa processes. Here, we will explore how to effectively create a document to validate your economic position.

When You Need Financial Verification

There are several scenarios where proving financial capacity is a requirement. For instance, when renting a property or applying for a loan, institutions often ask for a written statement verifying your financial resources. This process ensures that you can meet any future obligations without complications.

Key Elements to Include

A complete and valid document should contain all necessary details to be accepted by authorities. It should include your full name, account information, and the available balance. In some cases, additional information about the source of funds or a bank’s certification might be requested to further authenticate the document.

Common Mistakes to Avoid

When drafting this document, be cautious of common errors such as incorrect amounts or outdated information. These mistakes can cause delays or result in the document being rejected. Ensure that all details are current and accurately reflect your financial standing.

Practical Uses for Financial Verification

Once you’ve crafted the document, you can use it in a variety of contexts where financial verification is necessary. Whether for securing a rental property, applying for a loan, or supporting a visa application, this document will serve as a reliable proof of your economic reliability.