Collection Removal Letter Template and Guide

Dealing with negative marks on your credit or financial record can be stressful, especially when those entries are inaccurate or outdated. Taking steps to address these issues proactively can help improve your standing and potentially enhance your financial opportunities.

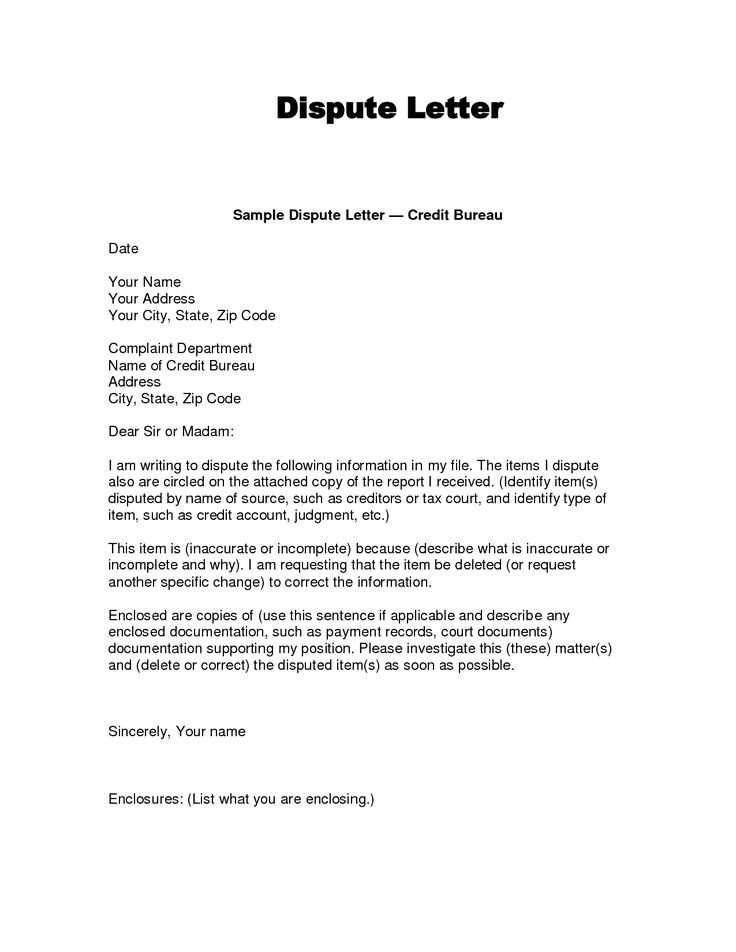

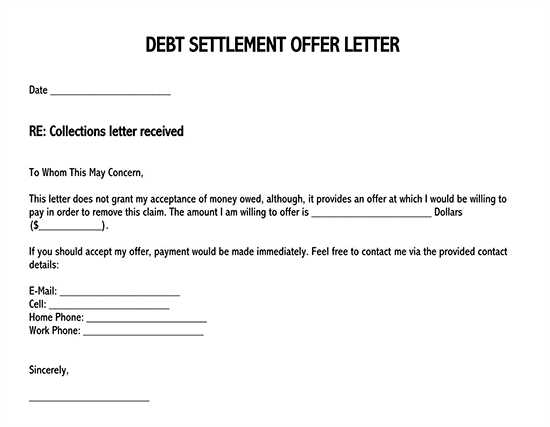

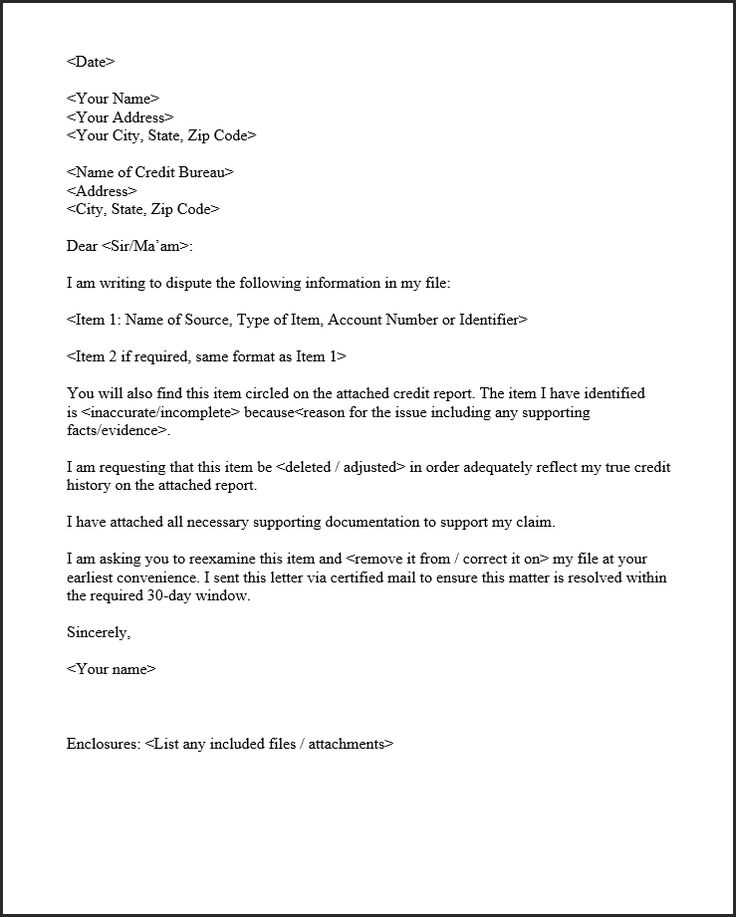

One powerful approach involves formally requesting the removal of such entries. This process requires careful wording and an understanding of how these disputes are typically handled by agencies. Crafting a professional request can significantly increase the chances of a favorable outcome.

When preparing such a request, it’s crucial to include specific details that support your case, such as evidence of inaccuracies or explanations of why the entry should be removed. Additionally, being clear and concise in your communication can make the process smoother.

Whether you are disputing outdated information or addressing incorrect reporting, having a structured approach can be the key to successfully clearing your financial history and moving forward with a more accurate record.

Understanding the Purpose of Collection Removal Letters

When negative entries appear on a financial report, it can significantly impact one’s creditworthiness. The goal of formally requesting the removal of these items is to clear inaccuracies and present a more favorable record. The process serves as a way to address discrepancies that may have been reported incorrectly or no longer reflect the current financial situation.

The Importance of Addressing Inaccuracies

Inaccurate information can result in unfair consequences for individuals, such as denied loans or higher interest rates. By initiating the formal request process, individuals have the opportunity to challenge these errors, ensuring that their financial history is accurately represented.

How This Process Helps Improve Financial Health

Clearing outdated or incorrect entries can improve one’s credit score and overall financial health. Taking action on these matters can lead to better opportunities for loans, mortgages, and other financial services, providing individuals with more favorable terms.

How to Write an Effective Removal Request

Crafting a clear and professional communication is essential when addressing incorrect or outdated information on your financial report. The purpose of this request is to provide a detailed explanation and supporting evidence for why certain entries should be reconsidered. A well-structured message can greatly improve the chances of a favorable outcome.

Key Elements to Include

Start by clearly identifying the entries you are disputing and provide all relevant details, such as account numbers, dates, and amounts. Be sure to explain why the information is inaccurate or no longer valid, offering any supporting documentation that strengthens your case. This helps to establish credibility and clarity in your communication.

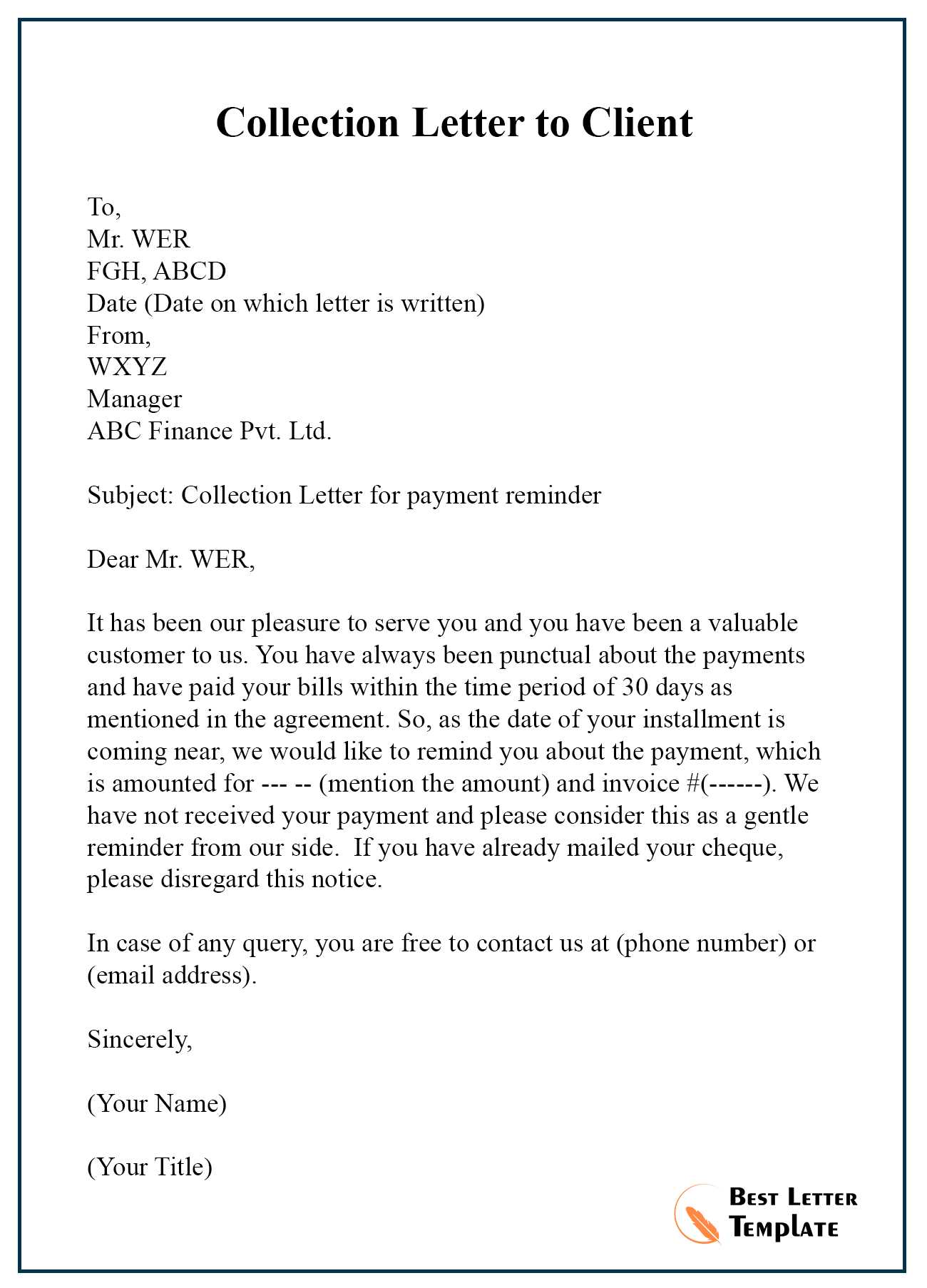

Maintaining a Professional Tone

Even if you feel frustrated by the inaccuracies, it is important to keep the tone respectful and professional. Avoiding harsh language and focusing on the facts can improve the likelihood of a positive response. Your request should remain concise and to the point while clearly conveying your objective.

Essential Information to Include in Your Letter

When submitting a formal request to address inaccuracies on your financial record, it is important to provide all necessary details to support your case. Including the right information ensures that your request is taken seriously and increases the chances of a positive outcome.

Personal and Account Details

Begin by including your full name, address, and contact information. Clearly state the account number or reference related to the disputed entry. This allows the recipient to quickly locate the relevant information in their records and begin the review process.

Supporting Evidence and Explanation

Attach any documents or evidence that support your claim, such as bank statements, payment records, or letters from other institutions. Additionally, provide a brief but clear explanation of why the information should be corrected or removed, focusing on the facts that back your position.

Common Mistakes to Avoid When Writing

When composing a request to address inaccuracies, it’s crucial to avoid common pitfalls that can undermine your chances of success. Making errors in your communication could delay the process or even result in rejection. Understanding these mistakes can help you craft a more effective and professional message.

Incorrect or Incomplete Information

One of the most frequent mistakes is failing to provide all the required details. This includes missing account numbers, unclear explanations, or failure to attach supporting documents. Without these essential elements, your request may not be processed correctly.

Unprofessional Tone or Language

Using an aggressive or overly emotional tone can work against you. A professional, factual approach is more likely to yield positive results. It’s important to remain calm and respectful, even if you are disputing an error.

| Mistake | Impact | Best Practice |

|---|---|---|

| Missing Account Details | Delays in processing | Ensure all account numbers and personal info are included |

| Lack of Supporting Documents | Weakens your case | Attach relevant evidence to strengthen your claim |

| Aggressive Language | Negative response | Maintain a professional and respectful tone |

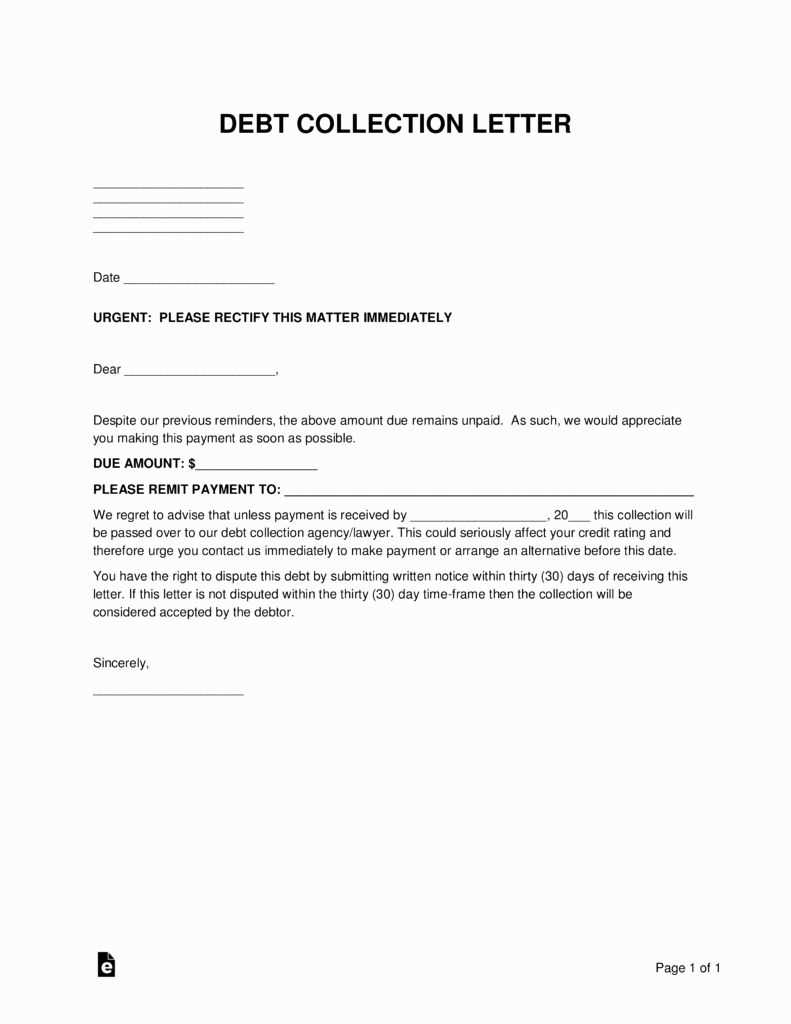

How Collection Agencies Respond to Requests

When you submit a formal request to have inaccurate or outdated entries addressed, the agency receiving your communication will typically follow a set process to evaluate your case. Understanding how these organizations respond can help you manage your expectations and ensure you take the right steps after submitting your request.

Initially, agencies will verify the information you provided, checking your personal details and any supporting evidence attached to your request. They may also cross-check their own records to confirm the accuracy of the disputed entry. If they find discrepancies, they will likely initiate the necessary adjustments.

If your request is well-supported and clearly written, the agency may be more likely to honor your request promptly. However, if there are gaps or contradictions in your submission, they might ask for additional documentation or clarification, which could delay the process.

The Legal Impact of Collection Removal Letters

Submitting a formal request to correct or update inaccurate entries on your financial report can have significant legal implications. Depending on the situation, your action could influence both your rights as a consumer and the obligations of the organization holding the incorrect information.

Consumer Rights and Protection

Under consumer protection laws, you have the right to dispute any incorrect or outdated information on your financial record. Organizations must legally respond to your request within a specified timeframe and either correct or provide justification for maintaining the entry. Failing to comply with these laws can result in legal consequences for the agency.

Potential Consequences for Agencies

Should an organization neglect to address a legitimate dispute or fail to remove incorrect data, they may face legal repercussions. This could include fines or penalties for not adhering to regulatory standards. Additionally, if the issue escalates, individuals may seek further legal action to protect their creditworthiness.

Tips for Following Up After Sending the Letter

After submitting your formal request, it’s important to stay proactive and ensure that your case is being processed. Following up effectively can help you maintain momentum and receive the necessary resolution in a timely manner.

Stay Organized and Keep Records

One of the first things to do after sending your communication is to keep track of any responses or acknowledgments you receive. This will help you follow up efficiently and avoid confusion. Be sure to document all correspondences, including dates and contact details.

When and How to Follow Up

- Wait for a reasonable period, usually 30 to 45 days, to allow the recipient time to process your request.

- If you don’t receive a response within this timeframe, consider sending a polite reminder email or letter.

- Always maintain a professional tone and clearly reference your initial submission to help the recipient quickly locate your request.

By staying organized and polite, you can increase the likelihood of a swift and positive outcome.