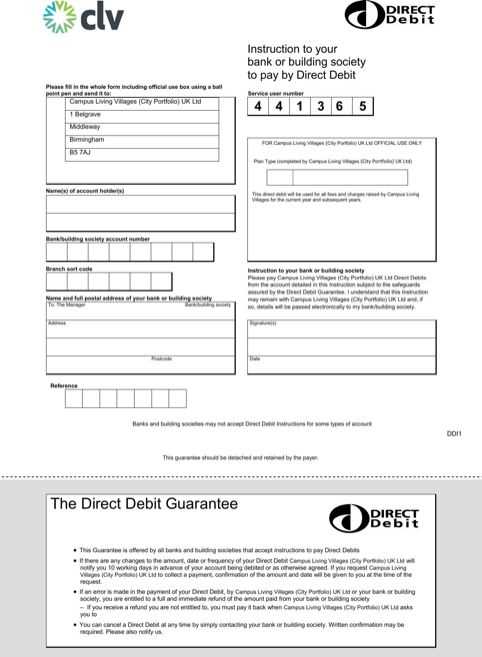

Direct Debit Advance Notice Letter Template

When managing recurring payments, clear communication is essential. Informing customers about upcoming charges or changes to their billing details ensures transparency and fosters trust. It is important to outline payment dates, amounts, and any alterations in terms to prevent confusion and ensure smooth transactions.

Effective communication plays a vital role in maintaining a good relationship with customers. By sending a well-structured notification ahead of time, you can help recipients prepare and avoid surprises. The key is to provide all necessary details in a straightforward and professional manner.

Properly notifying clients reduces the chances of disputes and enhances customer satisfaction. Knowing what information to include and how to phrase it can make a significant difference in how the communication is received.

Understanding Payment Notifications

Notifying customers about upcoming payments is an essential part of managing financial transactions. This process helps ensure clients are well-informed about the charges they can expect and when to expect them. Properly structured alerts contribute to a positive customer experience and reduce the risk of misunderstandings or disputes.

These communications should provide clear and detailed information regarding the following:

- The amount to be paid

- The payment date or schedule

- Any changes in terms, fees, or billing cycles

- Instructions on how to proceed if there are issues or concerns

When customers receive timely and accurate updates, they are more likely to make payments on time and remain satisfied with the service. The goal is to create a transparent and straightforward process that makes managing payments easier for both businesses and customers alike.

What is a Payment Reminder Communication

A payment reminder communication is a formal message sent to inform customers about upcoming charges. It is typically issued in advance, providing essential details regarding the payment amount, date, and any changes in the terms. This allows clients to prepare for the transaction and avoid any surprises.

The purpose of this type of communication is to ensure that customers are aware of the financial commitment they will need to fulfill. It serves as a proactive step to promote transparency and reduce the likelihood of misunderstandings between the service provider and the client.

Such reminders can be sent through various channels, such as email, postal mail, or through an online account portal. They are an important aspect of maintaining positive customer relations and ensuring timely payments.

Key Elements of a Payment Reminder

When crafting a communication to inform customers about an upcoming charge, it’s essential to include several important components. These elements ensure the message is clear, actionable, and professional. A well-structured reminder should cover all necessary details to prevent confusion and ensure smooth processing of the payment.

The critical elements include:

- Payment Amount – Clearly state the amount that will be charged to the customer.

- Payment Date – Include the exact date or billing cycle when the charge will occur.

- Changes to Terms – If there are any modifications to fees or services, they should be highlighted.

- Instructions for Queries – Provide guidance on how customers can address any questions or concerns.

- Company Contact Information – Make sure customers can easily reach out for further assistance.

Including these elements in the communication ensures that customers are fully informed, and it helps prevent any potential issues when the time comes for payment. Clear, transparent information fosters trust and strengthens customer relationships.

How to Write a Clear Communication

Writing an effective and clear message about upcoming payments is key to ensuring the recipient understands the important details. By using simple language and a well-organized structure, the message becomes easier to digest and respond to. Follow these essential steps to create a communication that leaves no room for confusion.

1. Be Concise and to the Point

Avoid unnecessary jargon or overly complex sentences. Keep the content short, clear, and easy to follow. The main purpose is to deliver essential information without overwhelming the reader.

2. Organize Information Effectively

Break down the details in a logical and structured format. This makes it easier for the reader to find the relevant information quickly. Use bullet points or tables where appropriate to highlight key facts.

| Element | Details |

|---|---|

| Payment Amount | The exact sum due for payment. |

| Payment Date | The date when the payment will be processed. |

| Changes to Terms | Any alterations to services or pricing. |

| Contact Information | How to reach the company for questions or concerns. |

By structuring your message in a straightforward way and keeping language simple, you enhance its clarity and increase the likelihood that the recipient will act on the information promptly.

Legal Requirements for Payment Notifications

There are certain legal obligations that businesses must follow when informing customers about upcoming payments. These requirements ensure that the customer is fully aware of the terms and conditions surrounding the transaction. Failing to adhere to these regulations can result in disputes, fines, or damaged customer relationships.

1. Clear and Timely Communication

It is legally required to notify customers within a specific time frame before a payment is processed. This allows the customer sufficient time to review the information, ask questions, or dispute any charges if necessary. The notification should be sent in advance, typically within 7 to 14 days prior to the payment date.

2. Accurate and Transparent Information

All details provided in the notification must be correct, including the payment amount, payment date, and any changes to terms or fees. Misleading or vague information can lead to legal complications and damage trust with the customer. Always include clear instructions on how the recipient can contact the business for further clarification.

Compliance with these legal requirements not only protects the business but also ensures that customers can make informed decisions and avoid surprises when it comes to their financial obligations.

When to Send Your Notification

Timing plays a crucial role in ensuring that customers receive sufficient notice about upcoming payments. Sending the communication at the right moment helps avoid confusion and gives the recipient enough time to act, if necessary. Understanding the appropriate timeframe is key to meeting legal requirements and maintaining a positive relationship with customers.

1. Minimum Required Timeframe

In most cases, businesses are legally obligated to send the communication a certain number of days before the payment is processed. This could vary depending on local regulations, but it is generally required to be sent between 7 to 14 days in advance. This allows the recipient enough time to review the information and address any concerns.

2. Timing for Changes or Updates

If there are any changes to the terms, such as updated pricing or adjustments to the payment schedule, it’s important to send the communication well in advance. This ensures that customers have ample time to understand the changes and plan accordingly. The earlier this information is sent, the less likely it is to cause confusion or dissatisfaction.

By carefully considering when to send the notification, businesses can ensure they meet legal standards and maintain transparency with their customers.

Common Mistakes to Avoid

When creating a communication to inform customers about an upcoming charge, it’s important to be cautious of certain pitfalls. Small errors can lead to misunderstandings, confusion, and even legal issues. To ensure your message is effective and well-received, avoid the following common mistakes.

1. Providing Incomplete Information

Failing to include all the necessary details can leave customers uncertain about what to expect. Always ensure your message contains:

- The exact payment amount

- The specific date the charge will occur

- Any changes to terms or conditions

- Instructions for reaching out with questions or concerns

2. Sending Notifications Too Late

Delaying the communication can lead to frustration and confusion. Customers need enough time to review the information, make adjustments, or ask questions. Always send the notification well in advance, following legal requirements for timing.

3. Using Vague or Confusing Language

Unclear language can easily cause misunderstandings. Ensure that all details are explained in straightforward, easy-to-understand terms. Avoid jargon or overly complex sentences that might confuse the recipient.

By avoiding these mistakes, businesses can ensure that their communications are effective, professional, and compliant with legal standards.