Credit Explanation Letter Template for Mortgage Applications

When applying for a loan, especially a home loan, it is not uncommon for lenders to ask for further clarification regarding financial details that may raise concerns. These clarifications help to provide a clearer picture of the applicant’s financial history and current situation. Submitting a well-crafted document that explains these discrepancies can be the key to a successful loan application process. Below, we will explore how to create a detailed and persuasive explanation to address financial issues that might arise during your application review.

Essential Components of a Persuasive Financial Clarification

To ensure your explanation is effective, there are a few important elements that must be included. A clear and concise structure is crucial in making sure the lender can quickly understand the context behind any inconsistencies.

- Introduction: Briefly explain who you are and provide context for the discrepancy.

- Detailed Explanation: Offer a clear and honest account of the financial event or issue, including dates and amounts where applicable.

- Supporting Documents: Attach any relevant paperwork or evidence that supports your explanation, such as bank statements, pay stubs, or legal documents.

- Closing Statement: Conclude by emphasizing your commitment to fulfilling the loan terms and how the issue has been resolved or will be addressed.

Formatting Tips for a Professional Presentation

Presenting your clarification in an organized and professional manner will increase its chances of being taken seriously. Here are a few tips to help you achieve this:

- Use a clear and easy-to-read font.

- Avoid excessive jargon; keep your language simple and direct.

- Ensure the document is well-structured with paragraphs, bullet points, and clear headings.

When to Submit Your Clarification

Timing is critical when submitting additional documentation to a lender. If discrepancies in your financial history are identified, it’s best to provide your explanation as soon as possible to avoid delays in the approval process. Early submission can also demonstrate your proactive approach and willingness to address any concerns that arise.

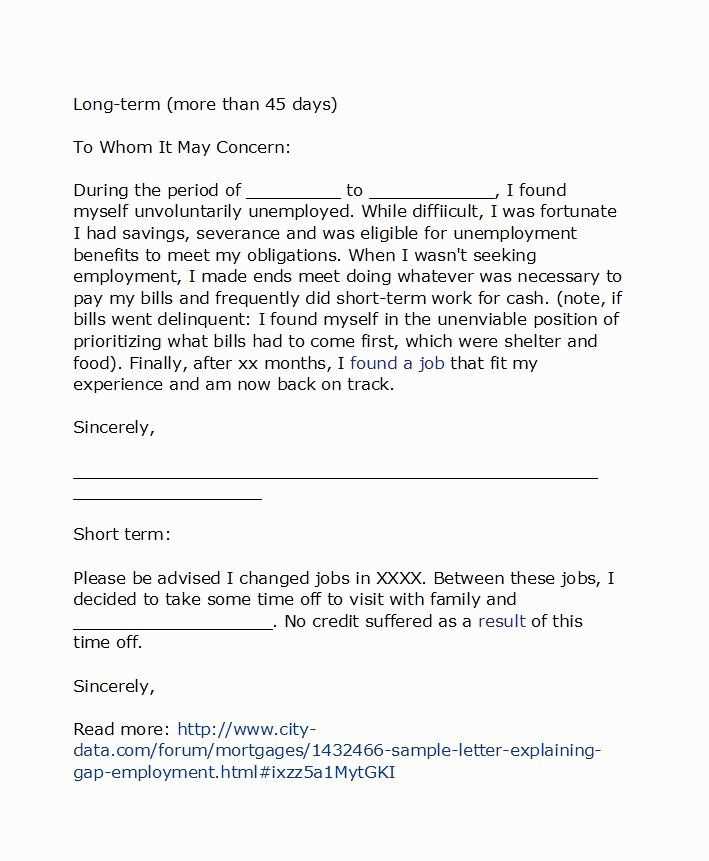

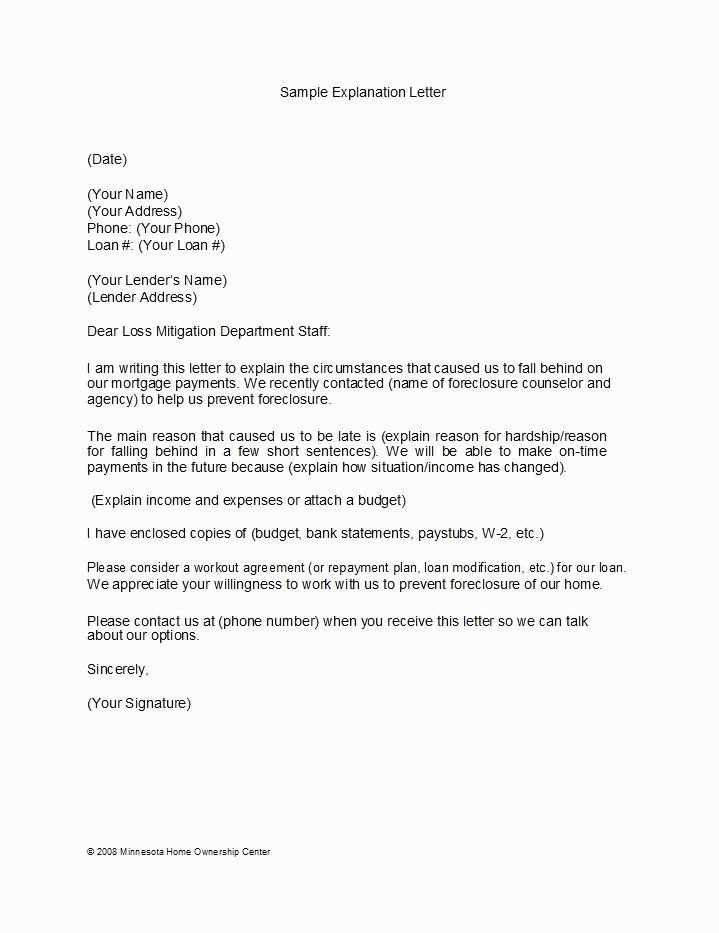

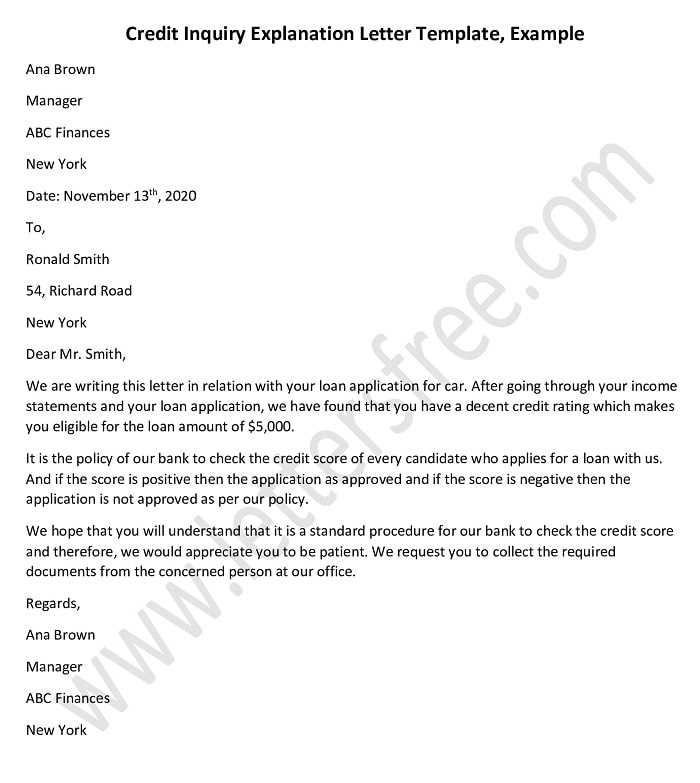

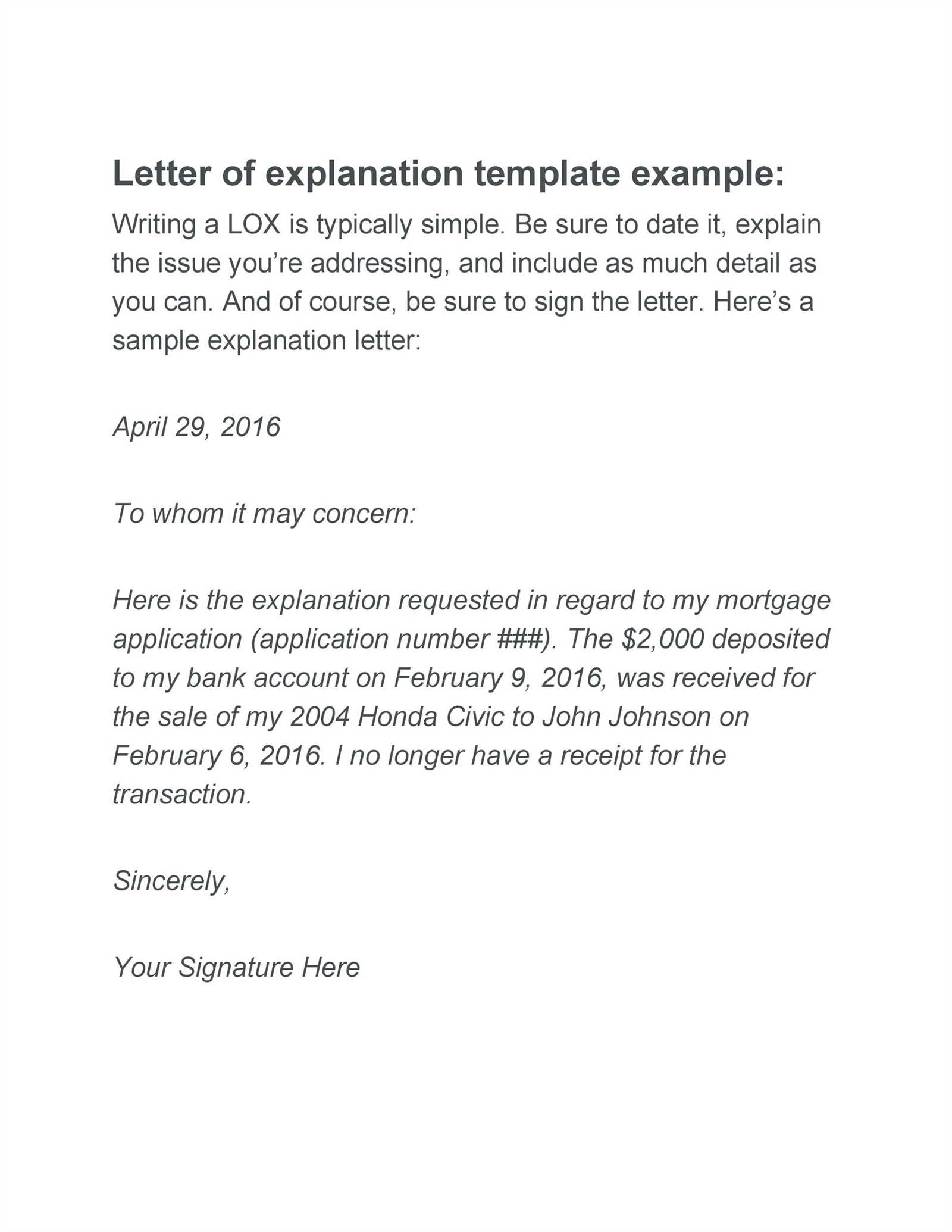

Examples to Guide Your Writing

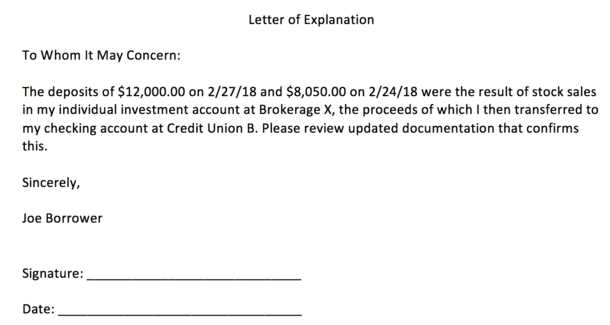

To assist you further, here is a basic structure of how your document might look:

Dear [Lender's Name], I am writing to provide clarification regarding [specific financial issue]. On [date], I experienced [describe event]. The amount in question was [amount], and the circumstances surrounding this were as follows: [explain the situation briefly]. Attached, you will find the relevant documentation to support this explanation. I hope this information provides clarity, and I am more than willing to provide any additional details as needed. Thank you for your time and consideration. Sincerely, [Your Name]

This example is a simple and professional way to address any concerns regarding your financial background. Customize it as needed, ensuring that all relevant information is included to support your case.

Understanding the Purpose of Financial Clarifications

When applying for a loan, especially when certain financial details may raise concerns, providing additional information can help resolve any misunderstandings. A well-crafted document that explains any discrepancies can play a crucial role in gaining approval. This section will explore the essential components and best practices for creating a document that effectively addresses any financial inconsistencies.

Key Elements of an Effective Statement

To craft a clear and convincing statement, ensure that the following elements are present:

- Clear Introduction: Briefly introduce the issue you are addressing and explain why the clarification is necessary.

- Detailed Information: Provide a thorough yet concise explanation of the financial situation, with relevant dates, amounts, and context.

- Supporting Evidence: Attach any documentation that can substantiate your claims, such as financial records or legal notices.

- Concluding Remarks: End the statement by emphasizing your willingness to work through the issue and ensuring the lender that all matters will be resolved.

How to Format Your Financial Statement

The format of your explanation is as important as the content. To make sure it is clear and professional, follow these guidelines:

- Use a legible font and keep the layout simple.

- Organize your content logically with paragraphs and bullet points where appropriate.

- Be concise–avoid unnecessary information or overly technical language.

Common Errors to Avoid in Your Statement

Here are some common mistakes that applicants often make and should avoid:

- Being Vague: Don’t leave out important details; clarity is essential.

- Overloading with Information: Stick to the facts that are directly relevant to the situation.

- Using Jargon: Ensure that your language is easy to understand and professional.

Tips for Writing a Persuasive Document

To improve the chances of your document being taken seriously, consider the following tips:

- Be Honest: Provide a truthful explanation of your situation, as transparency builds trust.

- Stay Professional: Maintain a respectful and formal tone throughout the document.

- Be Concise: Avoid long-winded explanations; make your point clearly and succinctly.

When to Submit Your Statement

Timing is crucial when submitting any additional information. Provide your clarification as soon as you are asked to avoid delays in the review process. Prompt submission shows that you are proactive and cooperative.

Examples of Documents for Loan Applications

Below is an example of a simple and effective way to present your financial explanation:

Dear [Lender's Name], I am writing to provide clarification regarding [financial issue]. On [date], the amount of [amount] was impacted by [circumstance]. The event was resolved by [resolution]. Attached are the necessary documents to support this explanation. I hope this clears up any concerns and I am happy to provide further details if needed. Thank you for your time and understanding. Sincerely, [Your Name]

This format ensures that all the necessary details are presented clearly and professionally, helping to avoid any confusion during the approval process.