Template Letter for Disputing Errors with Credit Bureau

Errors on your financial record can negatively impact your ability to secure loans, mortgages, or even jobs. When inaccurate details appear, it’s crucial to take action quickly to correct them. Taking the proper steps can lead to an improved financial standing and a more accurate report reflecting your true financial situation.

If you notice any discrepancies in your file, one of the most effective methods is to formally address these issues with the responsible organizations. By crafting a clear and concise request, you can prompt a thorough review and correction of any mistaken entries.

In this guide, we will explore how to effectively communicate with the relevant parties, ensuring your concerns are understood and resolved in a timely manner. A well-written communication can make all the difference in getting the necessary adjustments made quickly and without hassle.

Identifying and Addressing Mistakes

When discrepancies appear on your financial records, they can create significant problems, ranging from affecting your loan applications to hindering your overall financial reputation. Recognizing such errors is the first step in resolving them. It’s essential to carefully review every section of your report for any inaccurate entries, whether they relate to outstanding balances, payment histories, or other personal data.

Understanding the Impact of Mistakes

Even minor errors can have serious consequences, as they may cause lenders or institutions to make inaccurate assumptions about your financial reliability. Whether the error is due to a clerical mistake or outdated information, the longer it remains uncorrected, the greater the potential impact on your financial opportunities.

Steps to Initiate Corrections

Once you’ve identified a mistake, the next step is to communicate your concerns to the right parties. This typically involves providing a detailed request, explaining the nature of the error, and including any supporting evidence that could help clarify the situation. A professional, concise approach increases the likelihood of a swift resolution.

Why Disputing Inaccurate Information Matters

Incorrect data on your financial record can lead to serious consequences, affecting everything from loan approvals to interest rates. Even small errors can have a disproportionate impact on your financial future. Addressing these inaccuracies as soon as they are identified is crucial for maintaining control over your financial situation.

Inaccurate entries can misrepresent your financial behavior, causing potential lenders to view you as a higher risk. This can result in higher borrowing costs or even outright rejections for credit applications. Correcting these errors ensures that your financial profile accurately reflects your true standing, making it easier to access financial opportunities when needed.

| Impact of Inaccurate Information | Possible Consequences |

|---|---|

| Incorrect Payment History | Lower credit score, higher interest rates |

| Outdated Personal Information | Rejected loan applications, identity verification issues |

| Unrecognized Accounts or Balances | Increased debt, misrepresentation of financial stability |

By taking prompt action to rectify these errors, you protect your financial health and ensure that your record is a true reflection of your actions and obligations.

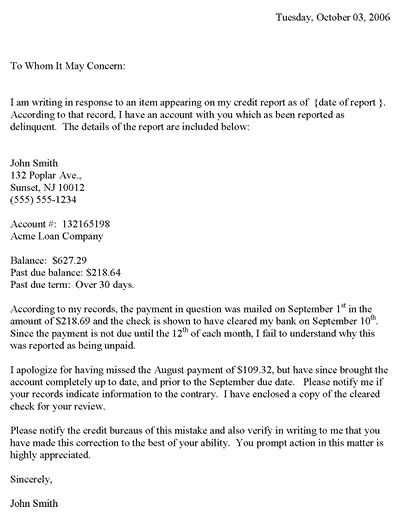

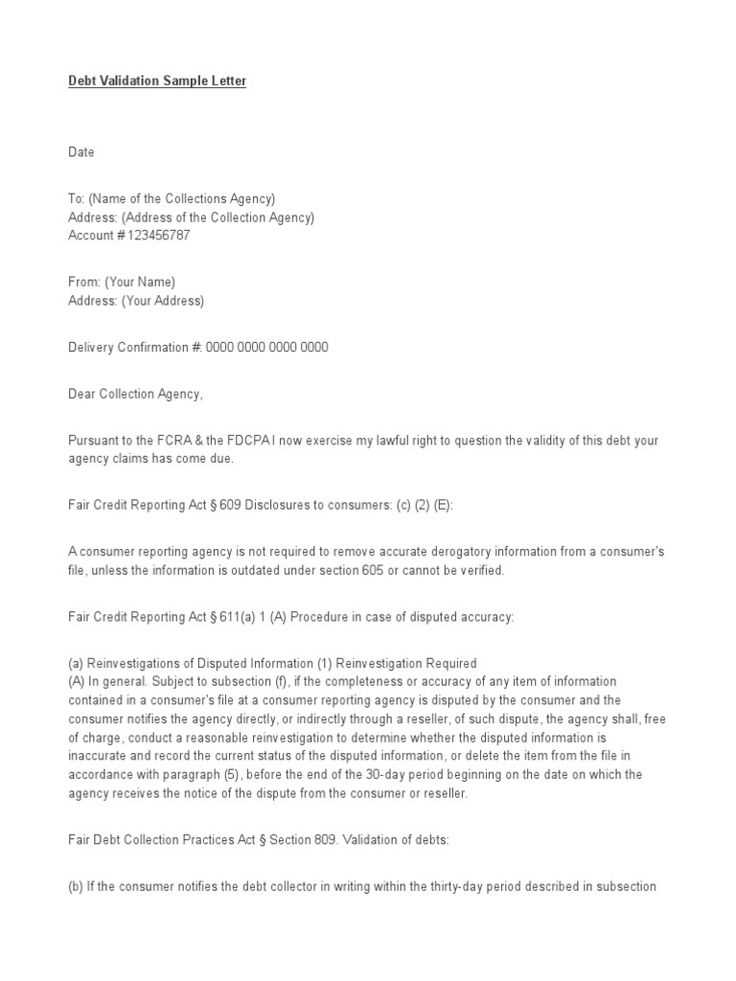

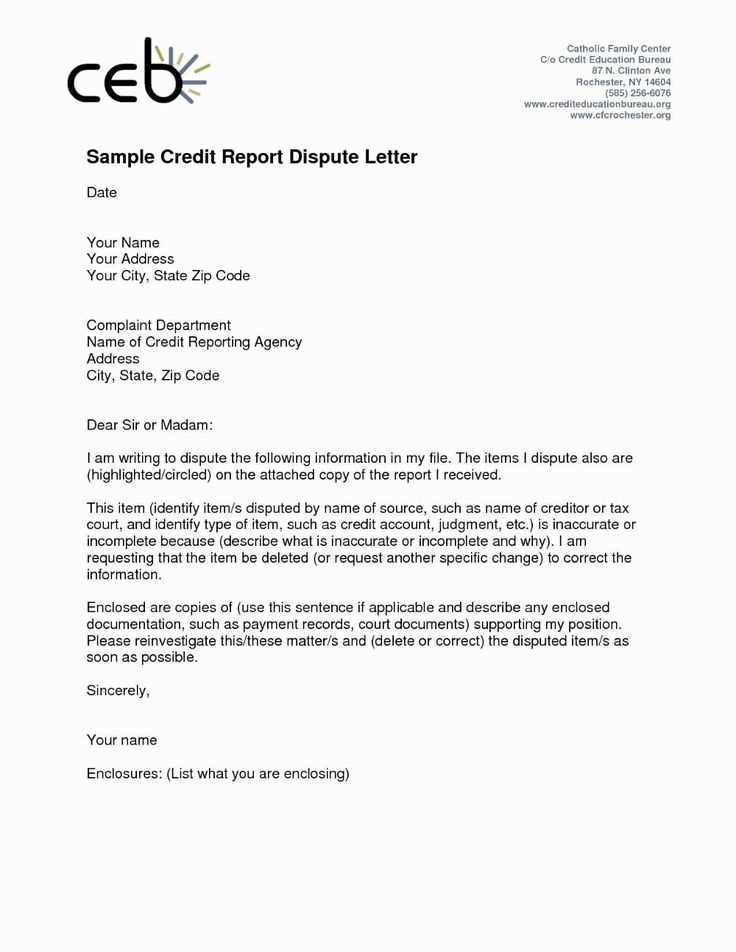

Key Elements of a Credit Dispute Letter

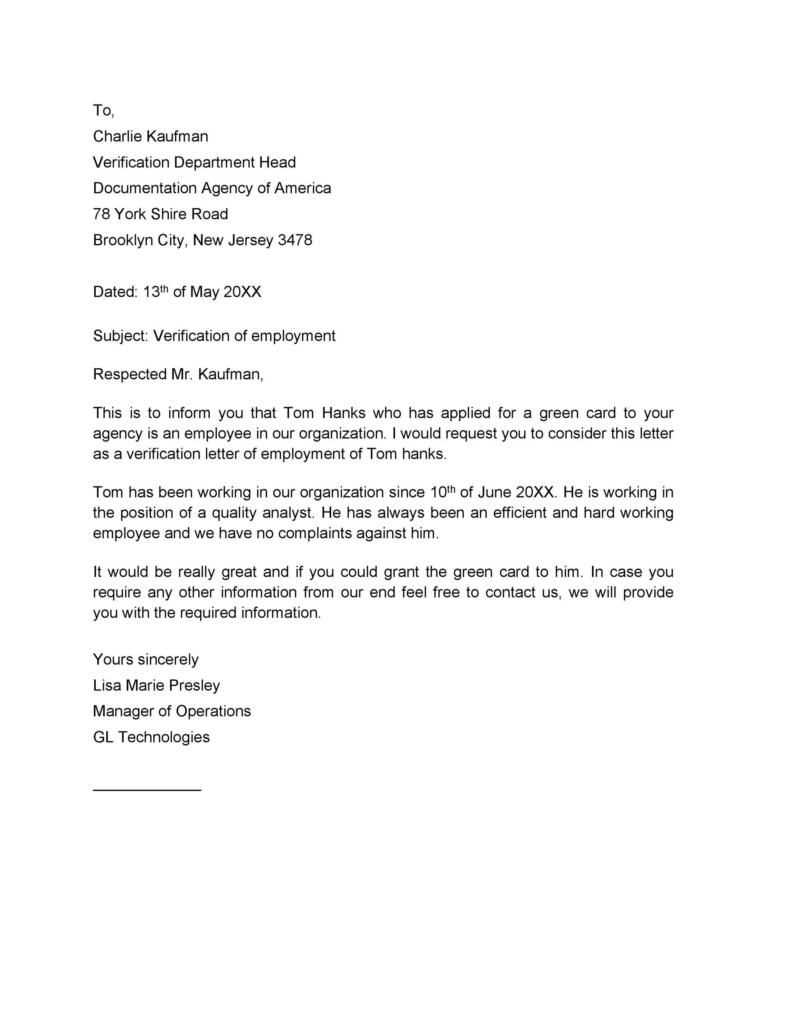

When challenging inaccurate entries in your financial file, it’s important to provide a clear and detailed explanation of the issues at hand. A well-crafted request increases the chances of a swift resolution. This means including all relevant details, supporting documentation, and a professional tone throughout the communication. By being thorough, you ensure that the recipients can quickly identify the problem and take appropriate action.

Important Information to Include

Your communication should include essential personal details, such as your full name, address, and any identification numbers relevant to your financial record. Additionally, specify the inaccurate entry and explain why it is incorrect. Be sure to attach copies of documents that support your claim, such as bank statements or payment confirmations, to give the recipients the necessary proof to investigate further.

Clarity and Professionalism Matter

Present your concerns in a concise and organized manner. Avoid unnecessary language and focus on providing facts. A professional tone helps establish your credibility and encourages prompt action. It’s also essential to clearly state the desired outcome, whether it’s the removal or correction of a particular entry, so that the recipients know exactly how to proceed.

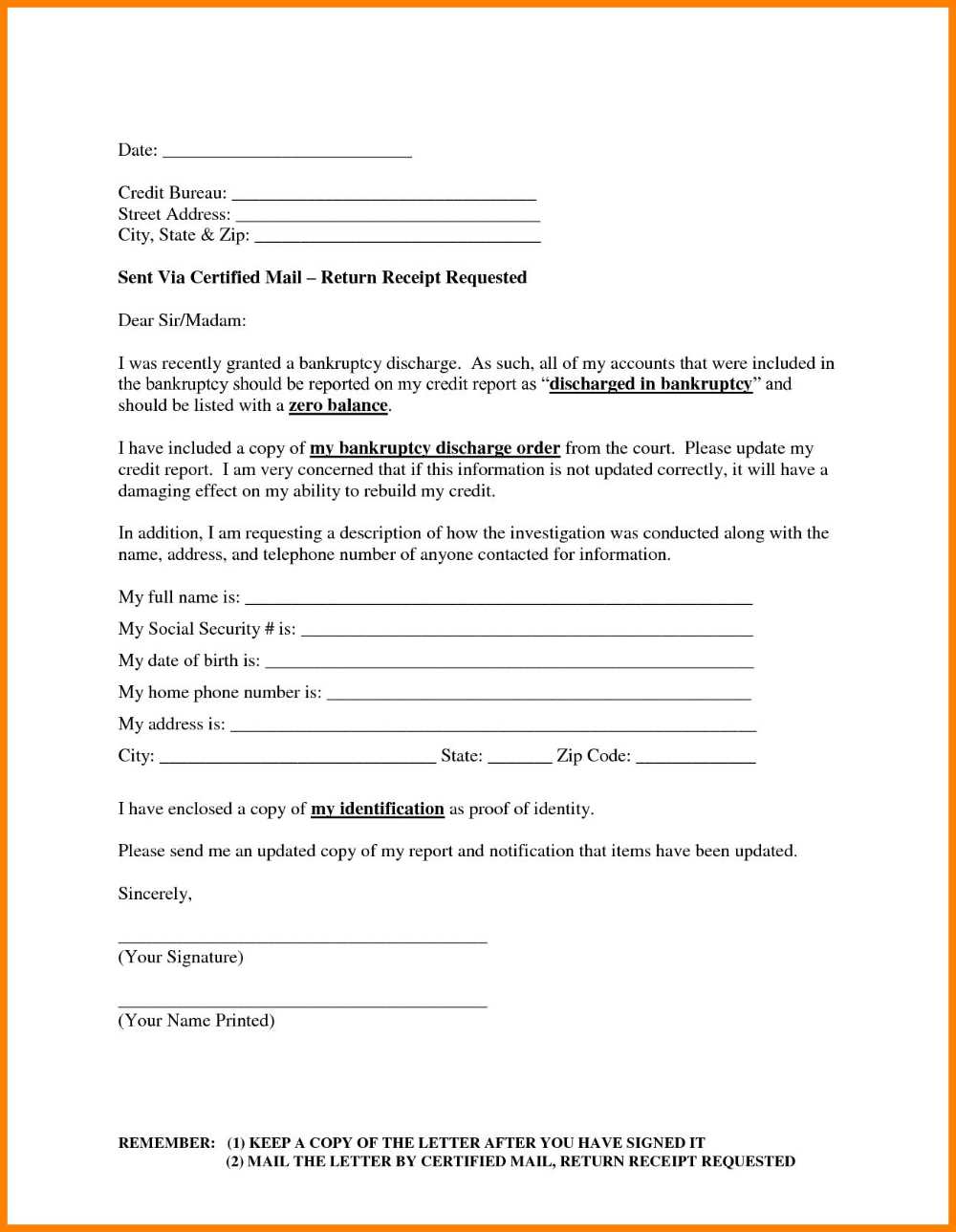

How to Submit Your Dispute Letter

Once you have crafted a detailed and clear request to address errors in your financial record, the next step is to submit it to the relevant parties. The process is straightforward, but it’s important to ensure that everything is sent properly to avoid delays. The submission method and how you track the progress are essential in ensuring your issue is addressed promptly.

Methods of Submission

There are several ways to submit your request, depending on the entity you are addressing. Common methods include:

- Mail: Sending a physical copy through certified mail ensures that you have a record of delivery.

- Online Submission: Many institutions allow you to file disputes directly through their website, which may offer faster processing times.

- Phone or Email: Some organizations may accept disputes via phone or email, though it’s best to confirm that these methods are appropriate for formal requests.

Tracking and Following Up

Once submitted, it’s crucial to monitor the progress of your request. This can be done by:

- Confirming receipt of your submission, especially if sent by mail.

- Using any tracking numbers or confirmation emails provided.

- Contacting the relevant party after a few weeks to check the status and ensure the issue is being addressed.

Being diligent in following up increases the likelihood of a timely resolution and ensures that the necessary corrections are made efficiently.

Common Pitfalls to Avoid in Disputes

While addressing errors in your financial record, it’s important to approach the process carefully. Mistakes or oversights in your approach can lead to delays, rejected claims, or even further complications. By being aware of common missteps, you can ensure a smoother and more successful resolution to your concerns.

Failure to Provide Adequate Documentation

One of the most common errors is failing to include sufficient proof to support your claims. Without clear evidence, such as bank statements or transaction receipts, it’s difficult for the recipient to verify your concerns. Always ensure that any supporting documents are legible and directly related to the issue at hand.

Vague or Unclear Communication

Another pitfall is presenting your case in an unclear or overly general manner. A lack of specificity can cause confusion and delay the process. Be precise in describing the error, explaining why it is incorrect, and stating what outcome you are expecting. A direct and well-organized message helps the receiving party understand and act on your request more efficiently.

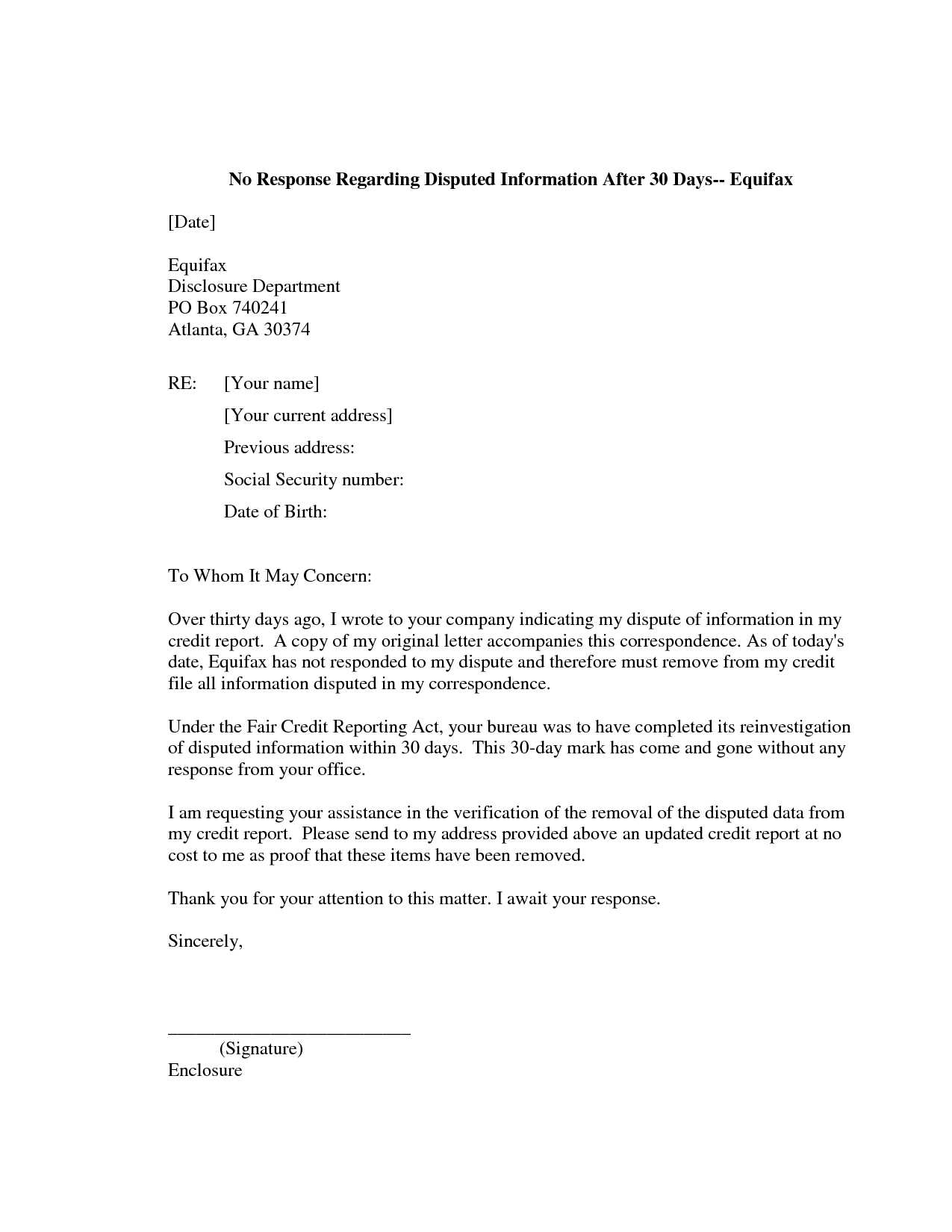

What to Expect After Submitting a Dispute

Once you’ve submitted your request to correct inaccuracies in your financial file, it’s important to know what happens next. The process of reviewing and resolving the issue typically involves several stages, each of which can take some time. Understanding these steps helps you manage your expectations and track the progress of your claim.

Initial Acknowledgment and Review

After submission, the organization responsible will likely acknowledge receipt of your request. This may be done through email, phone, or a formal letter. The next step involves a review of your case, where the relevant team will assess the provided evidence and determine if the information needs to be corrected or updated. During this time, they may contact you for additional details or clarification.

Resolution and Outcome

Once the review is complete, the institution will inform you of the decision. If they agree with your request, the error will be corrected, and a new report or statement may be issued. If they do not agree, you will typically be provided with an explanation, which may include information on how to further challenge the decision if necessary.

Effective Strategies for Following Up

After submitting a request to correct errors in your financial file, it’s important to stay proactive and monitor the progress of your claim. Following up ensures that your issue is being addressed and can help avoid unnecessary delays. A strategic approach to follow-ups is essential for obtaining timely resolutions.

When and How to Follow Up

Timing and method of follow-up are key factors. Consider the following strategies:

- Wait for Confirmation: After submitting your request, wait for an acknowledgment or confirmation, which usually takes a few days to a week.

- Set a Reminder: If you haven’t received any updates within the expected time frame, schedule a follow-up call or email to check the status of your claim.

- Be Professional: Always maintain a polite and professional tone in your communications, regardless of any frustration you may feel.

What to Ask During Follow-Up

When contacting the relevant party for an update, be sure to ask the following questions:

- Has the review of my request been completed?

- Are there any additional documents or information required?

- What is the expected timeline for resolving the issue?

By keeping these strategies in mind, you can help ensure your claim is processed efficiently and accurately.