Judgement Proof Letter Template for Legal Protection

When facing potential legal challenges, it’s crucial to secure your assets from external claims. One effective way to safeguard your financial interests is by drafting an essential document that communicates your inability to pay under certain circumstances.

Creating such a document provides peace of mind, ensuring that creditors or legal entities are aware of your situation. It helps set clear expectations, offering protection for individuals who may be at risk of losing assets due to judgment-based actions.

In this guide, we will explore how to properly create such a document, including the necessary elements and common mistakes to avoid. This resource will help you navigate the complexities of legal defense and take proactive steps in protecting your financial well-being.

Legal Protection Document Guide

When facing potential financial claims or lawsuits, it is vital to ensure that your assets remain safe. By drafting an official communication, you can clearly outline your financial limitations, thus protecting your property from being seized. This document acts as a safeguard, preventing creditors or legal authorities from taking unfair action based on unrealistic expectations.

Key Elements to Include

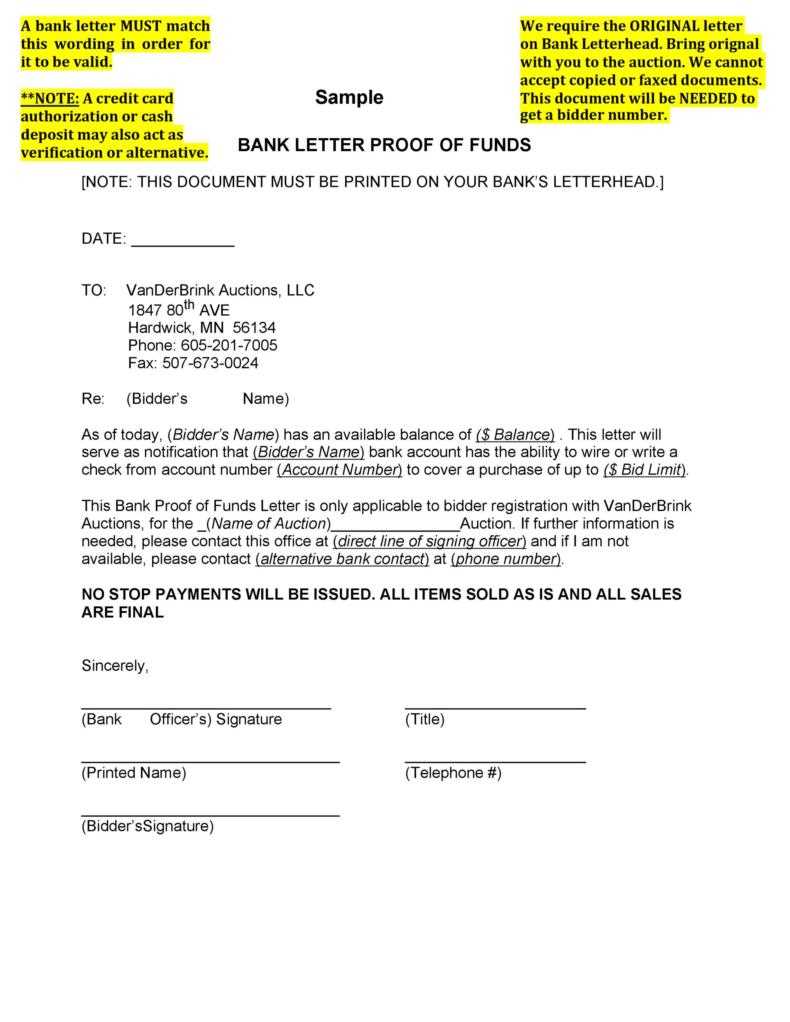

In order for this document to be effective, certain components must be included. First, it should clearly state your current financial situation, emphasizing the limitations that prevent you from meeting certain obligations. It is also important to detail any assets you own, noting which are protected from potential claims. Additionally, using proper legal language is essential for making the document enforceable in court, should it ever need to be referenced.

Common Pitfalls to Avoid

While drafting this important document, avoid vague or incomplete statements that might be misinterpreted. It’s essential to ensure that all information is accurate and presented in a professional manner. Furthermore, ensure the document is signed and dated, as failure to do so may render it less reliable in any legal proceedings.

The Importance of Legal Protection

In today’s complex legal environment, safeguarding one’s assets and ensuring financial stability is more critical than ever. Legal safeguards provide individuals with the necessary tools to protect themselves from unwarranted claims and lawsuits. By having clear and structured documentation, individuals can reduce the risk of losing valuable property or being held accountable for debts they cannot afford to pay.

How Protection Benefits Financial Security

When individuals take proactive steps to protect their assets, they are essentially securing their financial future. Legal safeguards prevent the risk of asset seizure by creditors or other legal entities, ensuring that one’s hard-earned resources are kept safe in the event of a dispute. This security allows individuals to maintain their livelihood and avoid unnecessary stress during financially challenging times.

Ensuring Clarity in Legal Matters

Properly drafted documents provide clarity in legal matters, ensuring that there is no ambiguity about one’s financial situation. By clearly stating the limitations of an individual’s financial capacity, these documents help to prevent misinterpretations that could lead to costly legal battles. Having a clear record can be a strong defense against attempts to claim assets unfairly.

Steps to Create a Legal Protection Document

Creating a document to protect your assets in the event of legal claims is an essential step toward securing your financial future. The process involves clearly outlining your current financial situation, specifying which resources are protected from potential lawsuits, and ensuring that all necessary legal requirements are met. Following the right steps ensures the document is legally sound and effective in safeguarding your property.

Gather Essential Information

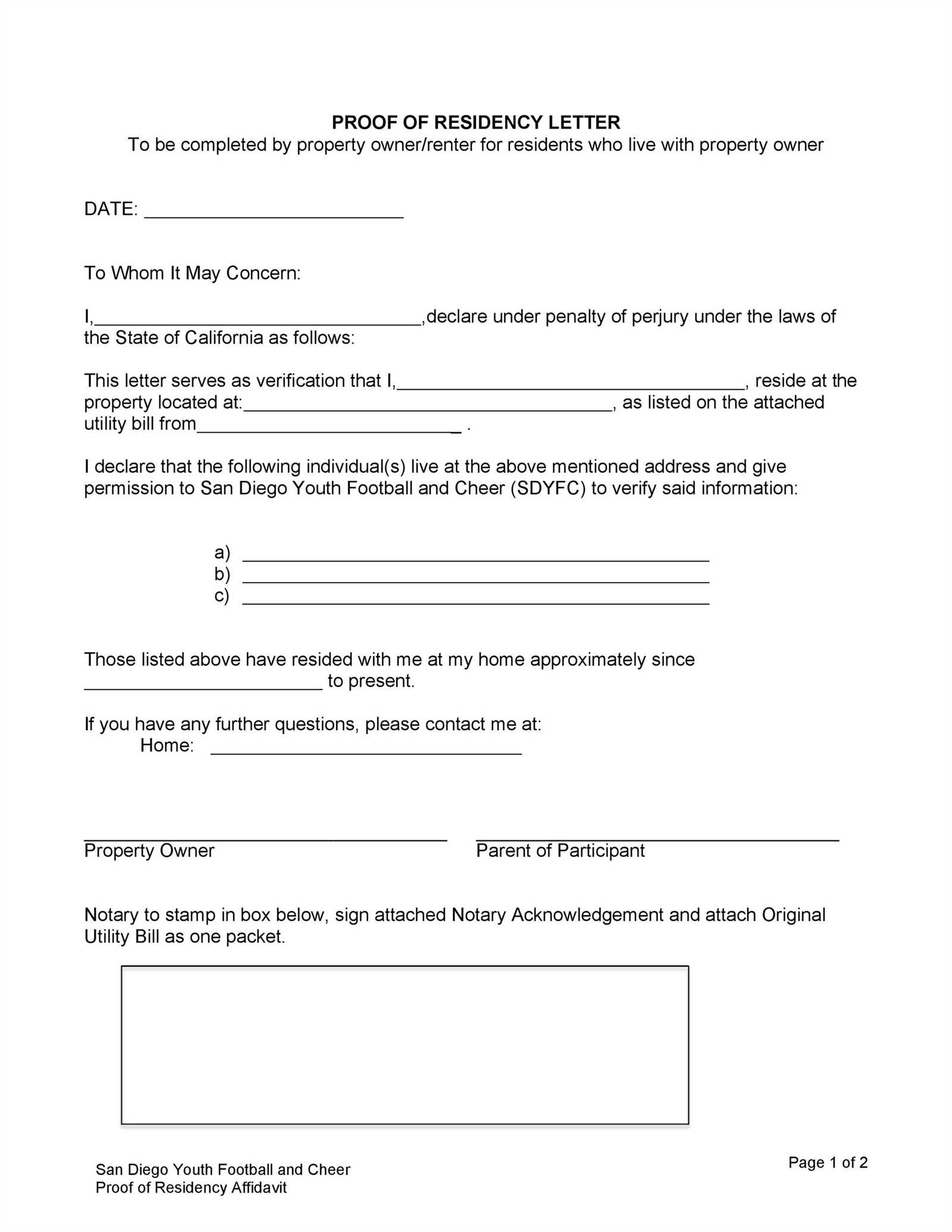

Before drafting the document, gather all relevant financial information, including income, debts, and a list of assets. Clearly outlining your financial situation is crucial for making the document credible and accurate. This information will serve as the foundation of the document, helping to paint a clear picture of your financial limitations and the protections in place.

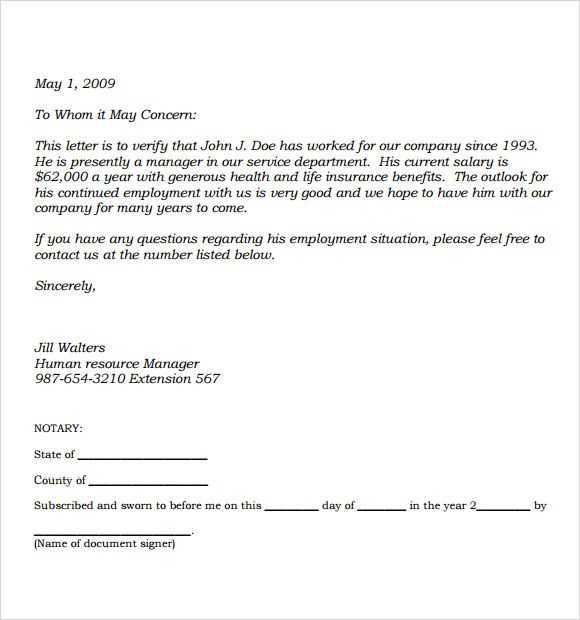

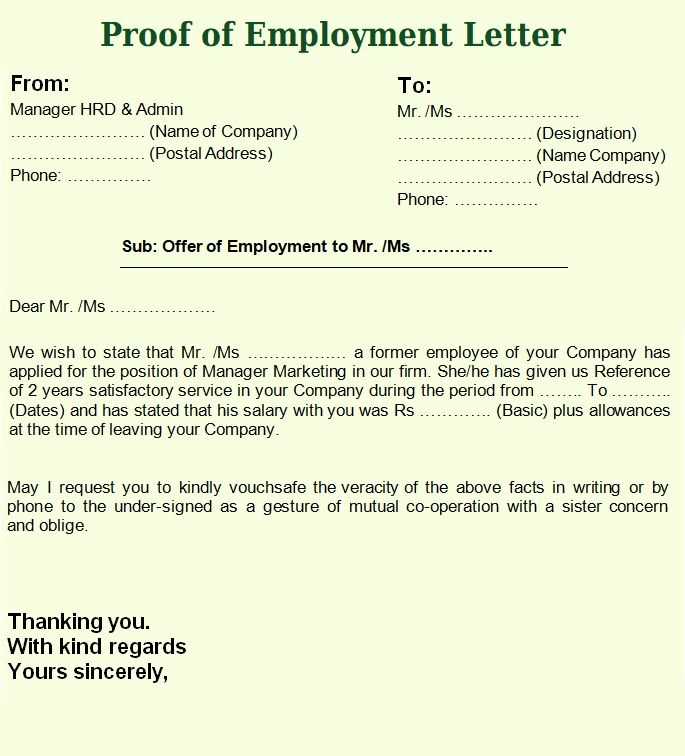

Drafting the Document

Once you have gathered all necessary information, start drafting the document. Ensure that it includes a concise explanation of your current financial status and an outline of the assets that are legally protected. Be precise and avoid any ambiguous language that could weaken the document’s effectiveness. It is also important to use formal legal language to ensure that the document is recognized in case it needs to be presented in court.

Avoiding Errors in Document Creation

When preparing a document to safeguard your assets from legal claims, it’s essential to avoid common errors that could undermine its effectiveness. Precision and clarity are key in ensuring the document serves its intended purpose. Small mistakes can lead to misinterpretations, making the document less reliable in legal matters.

Common Mistakes to Watch Out For

- Vague Statements: Avoid generalities that could be misinterpreted. Provide specific details about your financial situation and the assets you’re protecting.

- Incomplete Information: Ensure all relevant financial data is included. Omitting crucial details may weaken your position in the event of legal proceedings.

- Ambiguous Language: Use clear, formal language to avoid confusion. Avoid colloquial or imprecise terms that could be subject to different interpretations.

- Missing Signatures: Always sign the document and, if necessary, have it notarized to verify its authenticity.

Ensuring Legal Validity

To ensure the document holds legal weight, it’s important to verify its compliance with local laws. Consulting a legal professional to review the document before finalizing it can prevent costly mistakes. This extra step guarantees the document’s accuracy and legitimacy, providing you with the protection you need.

When to Consider Using This Document

There are specific situations where drafting a document to outline your financial limitations and asset protection is beneficial. It provides clarity and protection when facing potential legal action, ensuring your financial security remains intact. Knowing when to use such a document can help you avoid unnecessary stress and prepare for possible legal challenges.

Situations Where Protection is Needed

- Facing a Lawsuit: If you’re involved in a lawsuit and are concerned about losing assets, this document can help establish your financial limitations.

- Financial Hardships: When experiencing financial difficulties, outlining what is and isn’t available for claims can prevent creditors from unfairly seizing property.

- Debt Negotiation: If you are negotiating with creditors, presenting such a document may help clarify what you can afford to pay and avoid unnecessary claims on assets.

- Protecting Exempt Property: If certain assets are legally protected, this document helps ensure they are not mistakenly considered in a financial dispute.

When to Consult Legal Assistance

It’s wise to consult with a legal professional if you find yourself in one of these situations. A lawyer can help you understand whether this type of document is necessary, how to create it effectively, and ensure its legal validity. Taking this step will provide additional assurance that your financial interests are safeguarded.

Advantages of a Legal Protection Document

Creating a document to safeguard your financial interests offers a range of benefits, particularly in situations involving potential legal disputes or financial claims. Such a document provides a clear and formal record of your financial situation, helping to protect your assets from unnecessary seizure. It can offer peace of mind and greater control over your financial future.

One of the main advantages is that it helps to clarify your financial position in the event of legal challenges. By outlining what assets are exempt from claims, it reduces the risk of losing important property. Additionally, this document can make debt negotiations smoother by establishing clear boundaries regarding what you can afford to pay.

Moreover, this legal tool helps in reducing stress by offering a formalized way to manage your financial resources. It ensures that creditors or litigants have a clear understanding of what can and cannot be pursued. By being proactive, you are more likely to avoid disputes and legal complications down the line.

Other Legal Support Resources

In addition to drafting a formal document for financial protection, there are various other resources available to support individuals facing legal or financial challenges. These resources can help clarify your rights, provide professional guidance, and offer practical steps to navigate through complex legal matters.

Legal aid organizations, financial advisors, and online platforms can provide valuable assistance when it comes to understanding your options and ensuring that your rights are fully protected. Below is a table outlining some of the available resources:

| Resource | Description | How It Helps |

|---|---|---|

| Legal Aid Societies | Non-profit organizations that offer free or low-cost legal assistance. | Provide legal advice and representation, particularly for low-income individuals. |

| Financial Advisors | Professional experts in managing finances and offering debt solutions. | Help in creating plans to manage debt, protect assets, and negotiate with creditors. |

| Online Legal Resources | Websites offering templates, guides, and articles on legal matters. | Provide self-help tools for drafting documents and understanding legal concepts. |

| Consumer Protection Agencies | Government bodies that oversee consumer rights and financial practices. | Assist with disputes involving unfair business practices and financial transactions. |

By utilizing these resources, individuals can gain a better understanding of their situation and make informed decisions to protect their financial future.