Fair Market Value Letter Template for Property Valuation

When drafting important documents for assessing the worth of assets, it’s essential to have a clear structure and precise wording. These documents are crucial in legal, financial, and real estate contexts, providing an official record of estimated worth. Ensuring the content is well-organized and easy to understand is key to their effectiveness.

Having the right format and including all necessary details is essential in these cases. Whether used for property evaluation, asset transfer, or tax purposes, this type of document serves as an authoritative source. It should be written with accuracy and clarity to reflect an accurate assessment.

Properly crafted forms not only avoid confusion but also help protect individuals and organizations from potential disputes. In this article, we will explore how to create a structured and legally sound document that can be easily adapted for different scenarios and needs.

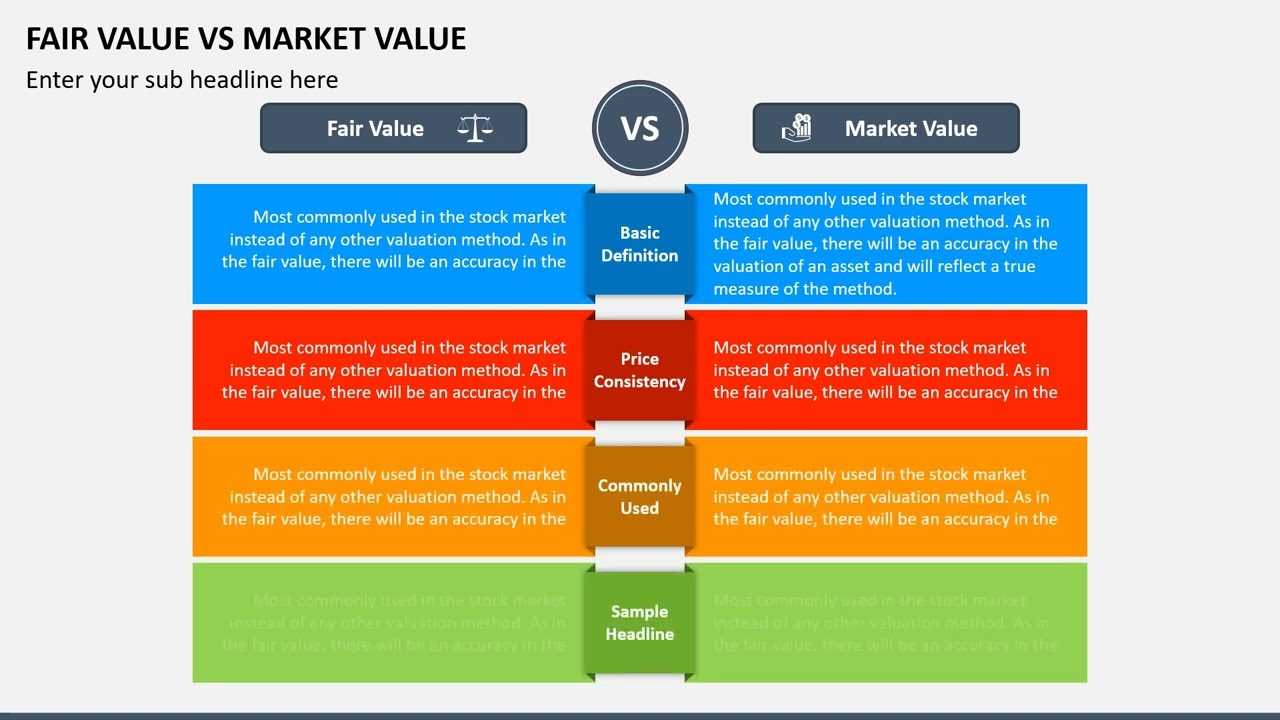

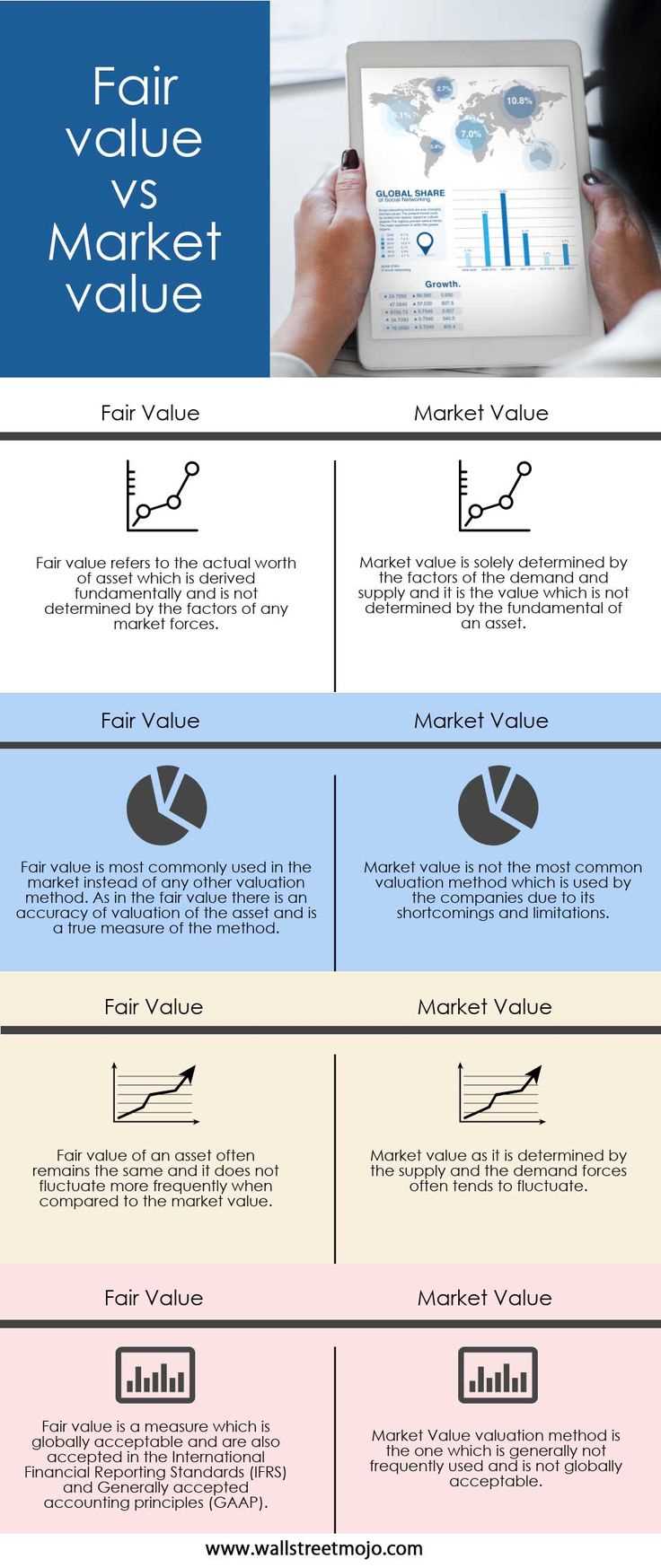

Understanding Valuation Documents

In many professional fields, accurate written assessments of asset worth are required for various transactions. These documents play a significant role in proving the estimated worth of a property, item, or investment. They serve as a formal tool to convey the results of an appraisal, providing clarity for both parties involved in a deal.

Purpose of Valuation Statements

These official records are often requested for use in financial transactions, legal matters, or taxation. Their primary function is to offer a neutral, unbiased estimate that both parties can agree on. Without these documents, disputes over the exact value of an asset can arise, making them a necessary element of many business deals.

Elements of a Proper Valuation

A well-crafted assessment document should be comprehensive, including specific details like the asset’s characteristics, the methodology used to determine its worth, and any relevant market conditions that may have influenced the final estimate. It is crucial that such a record is clear and unambiguous, ensuring it can stand up to scrutiny if necessary.

Essential Components of a Valuation Document

To create an effective document that accurately communicates an asset’s worth, it is crucial to include specific elements that ensure clarity and reliability. These components help build trust between parties and make the document legally sound, should it be required for official purposes.

Basic Information is the foundation of any document of this nature. It must clearly identify the asset being assessed, including relevant details like its physical description, location, or condition. Without this, the reader cannot fully understand what is being evaluated.

Methodology and Approach used in the assessment is another key element. This part outlines the steps taken, the criteria used to assess the item, and the sources of information consulted. Providing this transparency reassures the reader that the value assigned is not arbitrary, but based on sound principles.

Lastly, the appraiser’s qualifications must be included. This ensures that the person providing the assessment has the proper expertise to make an informed judgment. The more credible the evaluator, the more reliable the document becomes.

Determining When to Use a Template

Knowing when to rely on a pre-designed document format can help streamline the process of creating professional assessments. While custom reports are sometimes necessary, using a standard format is often more efficient and effective for certain situations. This approach ensures consistency and saves time while maintaining accuracy.

One key instance where using a predefined structure is helpful is when the asset being assessed falls within a common category, such as residential property or typical business equipment. In these cases, the structure of the document is largely the same, and the focus should be on filling in the relevant details rather than creating a new format from scratch.

Additionally, using a ready-made format is advantageous when you need to provide a document quickly. In legal, tax, or financial situations, having a standard form can ensure that all necessary information is included without needing to spend time creating a new document every time. It also helps maintain compliance with regulations and ensures the document is accepted by relevant authorities.

Steps to Create a Professional Document

Creating a professional assessment record involves following a series of structured steps to ensure it is both clear and credible. The process is straightforward, but attention to detail is critical to achieving the desired results. Below are the necessary steps to help guide you through the creation of a comprehensive document.

Step 1: Gather Relevant Information

Before beginning, collect all the details needed for the evaluation. This may include:

- The specific asset being assessed

- Condition or quality of the item

- Relevant market trends or data

- Documentation of past transactions or appraisals

Step 2: Draft the Structure

Once you have all the necessary information, start drafting the document. Make sure to follow a consistent format, including:

- Introduction with a brief description of the asset

- Details about the assessment methodology

- The actual estimated worth or evaluation

- Conclusion with any necessary disclaimers or additional information

These steps will ensure that your document is comprehensive, well-organized, and professional, while also providing all the necessary information for the reader to understand the assessment thoroughly.

Avoiding Common Mistakes in Documents

When creating professional records to assess an asset’s worth, there are several common errors that can reduce the credibility and clarity of the document. These mistakes can lead to misunderstandings, disputes, or legal challenges. By being mindful of these pitfalls, you can ensure the document is both accurate and reliable.

| Common Mistakes | How to Avoid |

|---|---|

| Inaccurate Asset Description | Ensure that the asset is described in detail, including all relevant characteristics such as condition, location, and specifications. |

| Lack of Methodology Transparency | Clearly outline the process and criteria used to determine the estimated worth, providing justification for your assessment. |

| Failure to Include Supporting Data | Always include relevant data, such as market trends, previous appraisals, or comparable asset sales, to support your valuation. |

| Overly Complicated Language | Use simple, straightforward language that makes the document easy to read and understand, avoiding unnecessary jargon. |

By avoiding these common mistakes, you will create a document that is both professional and trustworthy, ensuring that all parties involved have confidence in the assessment.

Legal Factors in Asset Evaluation Documents

When creating an official assessment record, it is essential to consider the legal implications to ensure the document holds up in various legal or financial contexts. The proper use of such records can prevent disputes, protect both parties involved, and ensure compliance with relevant laws. Below are some critical legal factors to keep in mind when drafting these documents.

Regulatory Requirements

In many jurisdictions, specific rules and standards must be followed to create a legally binding document. These may include:

- Compliance with local laws and regulations governing asset valuation

- Adherence to accepted appraisal methods and procedures

- Ensuring that the document is signed and dated by an authorized individual

Potential Legal Consequences

Failure to create a legally sound document can lead to various issues, such as:

- Disputes over the asset’s worth during transactions

- Potential challenges in court or arbitration

- Liability for providing inaccurate or misleading information

By taking these legal factors into account, you ensure that the document serves its intended purpose and withstands scrutiny when necessary.