Solvency Letter Template from Accountant South Africa

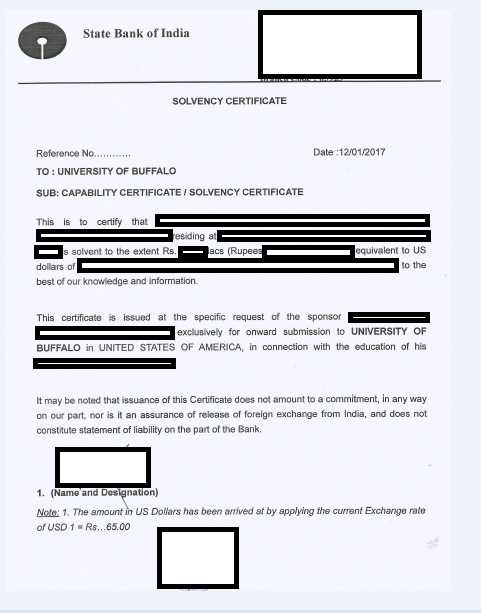

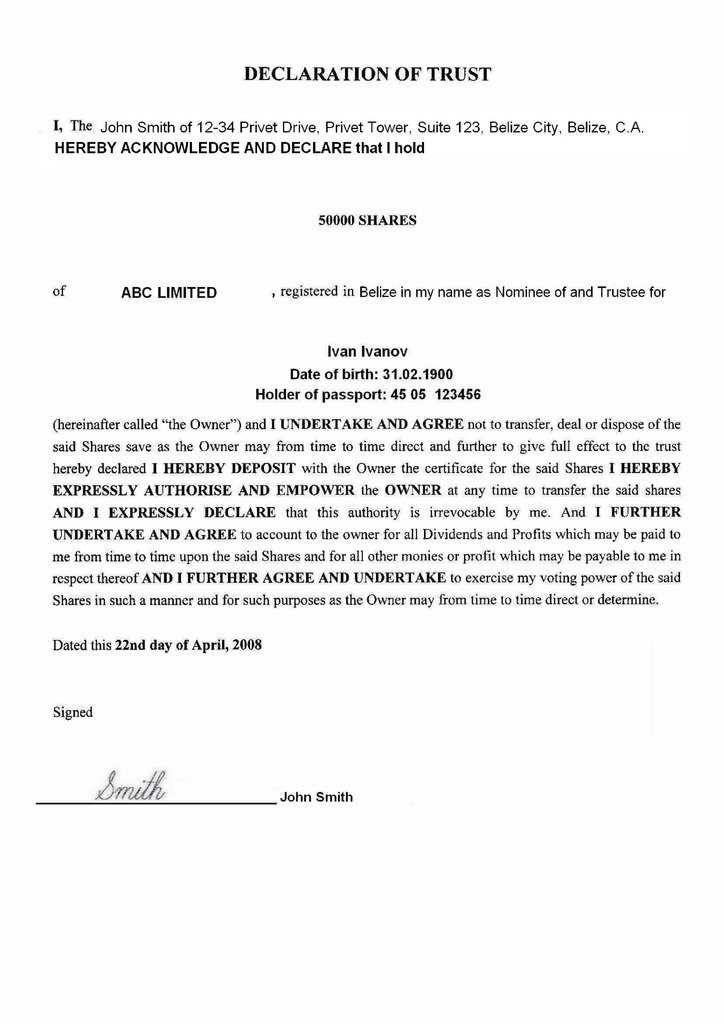

When engaging in certain financial activities, it’s crucial to provide a formal declaration confirming your ability to meet obligations. This document acts as proof of financial health, often required for loans, business dealings, and other agreements where trust in your financial status is essential. Crafting a clear and professional statement is vital for ensuring your credibility is recognized by stakeholders.

Key Aspects of a Financial Verification Document

The core elements of such a document include a detailed assessment of your financial situation, showcasing your assets, liabilities, and overall stability. The goal is to present a comprehensive picture that highlights your capacity to meet current and future financial responsibilities.

Essential Information to Include

- Financial statement summary

- Confirmation of solvency status

- Details of assets and liabilities

- Affirmation of financial management practices

Preparing the Document

Creating this type of statement involves both careful analysis and accurate documentation. A financial professional will typically assess all relevant financial records and draft a clear statement that reflects your position. It’s important that the document is both transparent and straightforward to avoid any misinterpretations or confusion.

Role of a Financial Expert in Document Creation

A financial expert plays an essential role in drafting this document, ensuring it is both legally sound and accurately represents your financial status. Their expertise allows them to structure the declaration in a way that meets specific regulatory requirements and industry standards.

Common Pitfalls to Avoid

- Incomplete financial data

- Failure to meet required formats

- Misrepresentation of financial status

It is crucial to avoid these issues to ensure the document is accepted and serves its intended purpose effectively. Accuracy and honesty are paramount in fostering trust and transparency in any financial relationship.

Using the Verification Document

This formal declaration is often requested in various situations, including loan applications, business partnerships, and even when entering into contracts with clients or vendors. Its purpose is to provide assurance to those involved that you possess the financial capability to fulfill commitments and obligations.

What is a Financial Health Declaration?

Importance of Financial Statements in South Africa

Essential Details in a Financial Declaration

Expert’s Role in Document Preparation

Legal Standards for Financial Declarations in South Africa

Common Problems with Financial Documentation

Effective Applications of a Financial Declaration

A financial health declaration serves as an official document providing evidence of an entity’s ability to meet its financial obligations. This declaration is often requested by parties that need assurance about the financial stability and responsibility of an individual or business. It acts as a guarantee that financial commitments can be fulfilled, protecting the interests of lenders, investors, and business partners.

In South Africa, financial statements are crucial for both businesses and individuals seeking to demonstrate their fiscal health. These documents are used in a variety of contexts, including loan applications, business transactions, and regulatory compliance. The accuracy and transparency of these reports are vital for building trust in the financial system.

Key elements in a financial declaration include a thorough overview of assets, liabilities, and equity. The information must be clear and concise, covering important aspects such as cash flow, outstanding debts, and other financial obligations. The declaration should provide enough detail to verify that the individual or organization can meet its financial responsibilities without risk of default.

The role of a financial expert in preparing such documents is pivotal. These professionals assess the financial standing of a business or individual and draft a document that reflects true financial health. Their expertise ensures that the declaration meets required legal standards and that the information is presented in a way that is both accurate and understandable to external parties.

Legal requirements for these declarations vary based on jurisdiction, but in South Africa, there are specific standards for what must be included and how the document should be formatted. Adhering to these standards ensures the document’s acceptance in formal financial contexts and helps avoid legal challenges or delays in business transactions.

Common issues with these documents often involve incomplete or inaccurate financial data. Errors in reporting, failure to provide comprehensive information, or misstatements about financial conditions can render the declaration invalid. Such mistakes can undermine credibility and lead to financial and legal repercussions.

These declarations are used in many practical applications, including securing loans, establishing business partnerships, or meeting regulatory requirements. A well-prepared document not only fosters trust but also ensures that businesses and individuals can proceed with transactions confidently, knowing their financial standing is clearly understood.