Effective Debt Collectors Letter Template for Recovery

htmlEdit

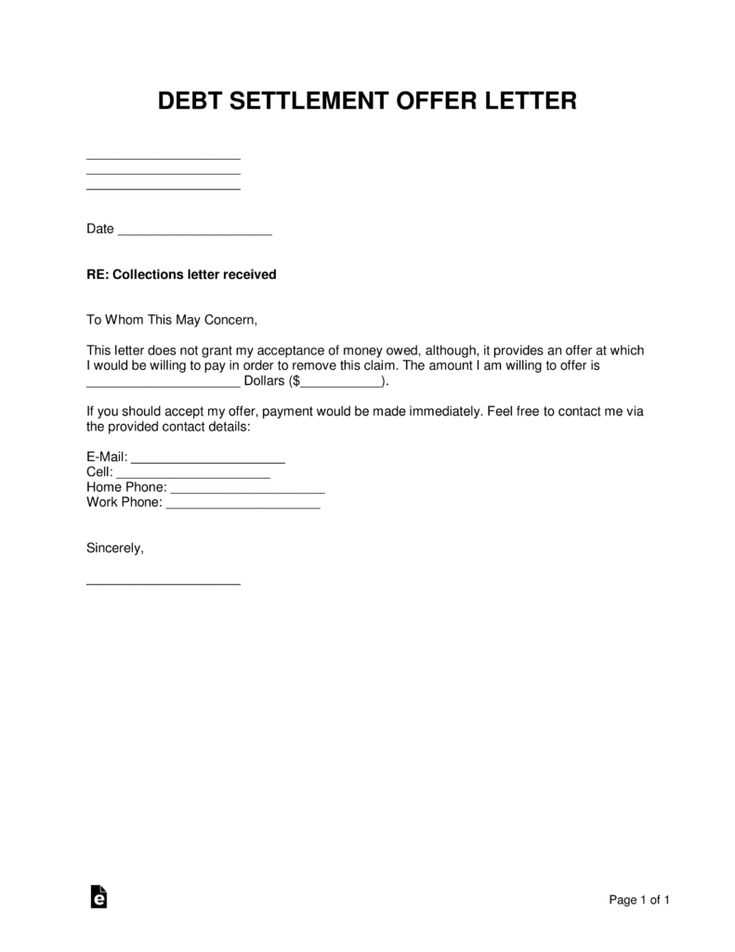

When financial obligations go unmet, it often becomes necessary to initiate formal communication. Such messages are designed to remind individuals of their responsibilities while maintaining a professional tone. These communications are an essential part of the recovery process, aimed at resolving outstanding matters efficiently.

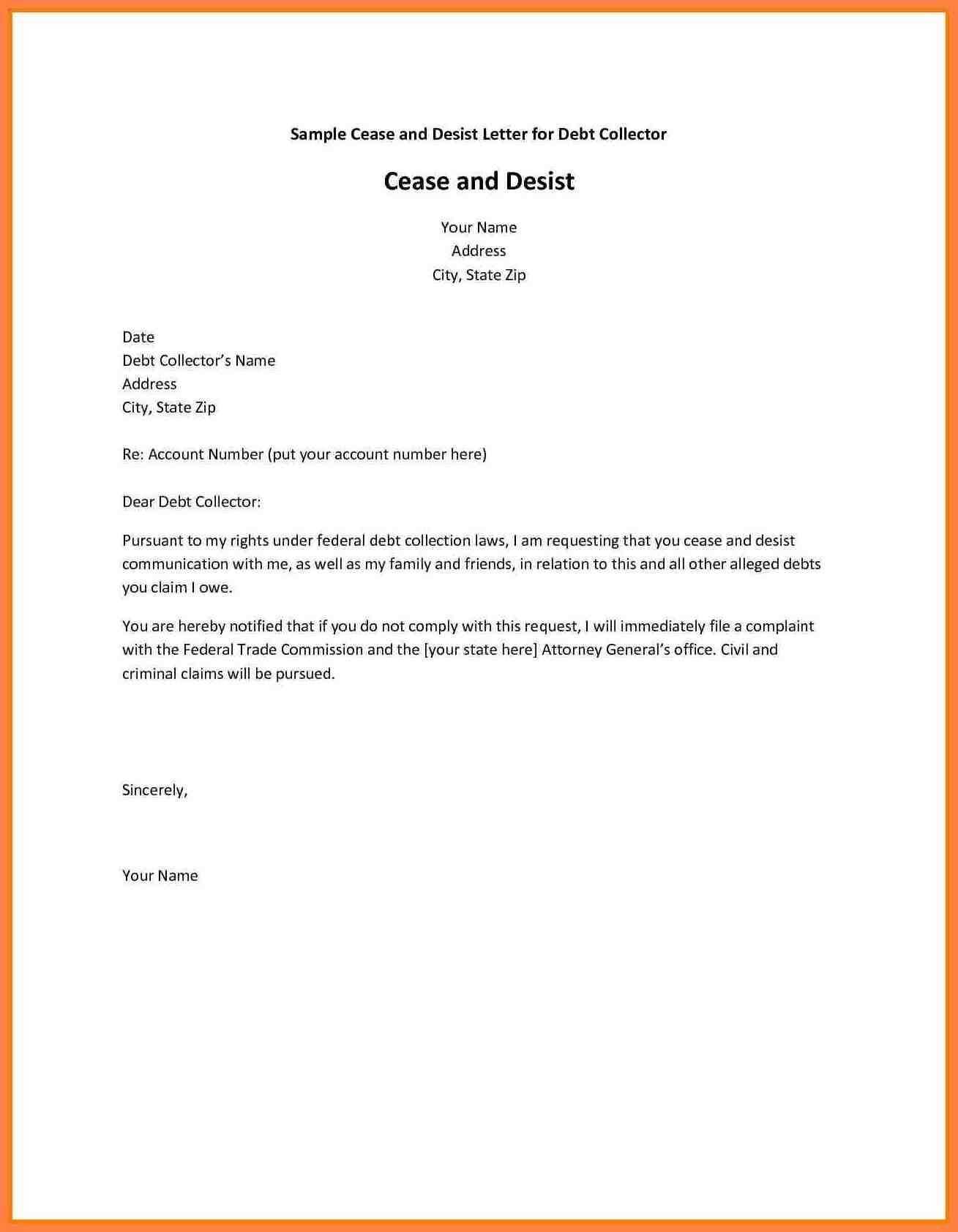

It is crucial to structure these notices properly to ensure clarity and compliance with applicable laws. A well-crafted message can effectively convey the urgency of the situation, while also encouraging timely resolution. Key elements include a clear outline of the outstanding amount, payment terms, and a polite yet firm request for action.

htmlEdit

htmlEditDebt Recovery Communication Format

Effective communication aimed at addressing overdue payments requires a structured approach to ensure clarity and professionalism. Crafting these messages with a careful tone and appropriate details can lead to quicker resolutions and better outcomes for all parties involved. The proper format of such messages is key to maintaining legal compliance and ensuring the recipient understands the situation clearly.

The following table outlines the essential components that should be included when drafting these types of communications:

| Component | Description |

|---|---|

| Recipient Information | Clearly state the name and address of the recipient to avoid confusion. |

| Outstanding Amount | Include the exact amount due, as well as any relevant fees or interest. |

| Payment Terms | Specify the due date and any options for payment. |

| Consequences of Non-payment | Describe the potential actions that may be taken if payment is not received. |

| Contact Information | Provide the necessary details for the recipient to reach out with any questions or concerns. |

htmlEdit

Understanding the Importance of Debt Recovery Notices

Formal communication is crucial when financial obligations remain unpaid. These messages serve as a reminder, urging individuals to settle their outstanding balances. A well-constructed message can prevent misunderstandings and provide clarity about the next steps in resolving the issue.

Here are several key reasons why these communications are vital:

- Clear Communication: These messages help in articulating the exact amount owed and the timeframe within which payment is expected.

- Legal Compliance: Sending formal reminders ensures adherence to regulations governing financial matters and avoids potential legal issues.

- Professionalism: They provide an opportunity to maintain professionalism while addressing the situation, avoiding emotional or confrontational exchanges.

- Increased Payment Likelihood: A structured communication can encourage faster payment, as it often provides a clear path for resolution.

- Documentation: These messages act as records of communication in case further action is needed.

Ultimately, effective notices not only foster timely repayment but also preserve a positive relationship between all parties involved.

htmlEdit

Key Components of an Effective Communication

To ensure a clear and professional message when addressing outstanding financial obligations, certain elements must be present. These components help convey the necessary information in a structured manner while encouraging the recipient to take appropriate action. Each part of the message plays a role in making it efficient and actionable.

Here are the essential elements of a well-crafted message:

- Recipient Information: Begin with the correct details of the recipient to avoid confusion and ensure the message reaches the right person.

- Outstanding Amount: Clearly state the total amount due, including any applicable charges or interest.

- Clear Due Date: Specify the date by which payment should be made to avoid any misunderstandings.

- Consequences of Non-payment: Politely outline the potential actions that could follow if payment is not made within the given timeframe.

- Payment Instructions: Include clear and simple instructions for making the payment, such as available methods or account details.

- Contact Information: Provide easy-to-find contact details for any inquiries or clarifications the recipient may need.

Incorporating these elements ensures the message is both professional and effective, fostering a prompt resolution of the matter at hand.

htmlEdit

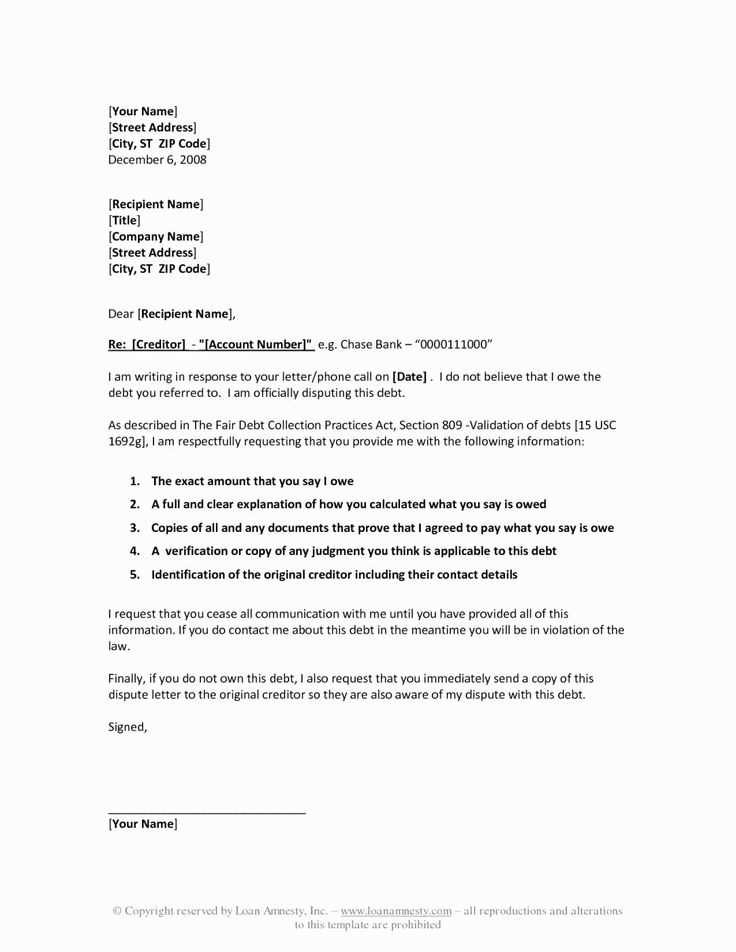

How to Address Debtors Professionally

When communicating about unpaid obligations, it’s essential to maintain a respectful and professional tone. A well-written message not only conveys the necessary information but also helps to preserve a positive relationship, even in difficult situations. Ensuring clarity and courtesy in communication can lead to a more productive outcome.

Key Approaches for Professional Communication

- Use Formal Language: Address the recipient using polite and neutral language, avoiding any harsh or accusatory words.

- Be Clear and Concise: State the issue and expectations clearly to avoid confusion, ensuring all details are easy to understand.

- Avoid Emotional Language: Keep the tone factual and focused on the matter at hand, without any emotional charge or pressure.

- Offer Solutions: Provide clear options for resolving the matter, such as payment plans or alternative methods of settlement.

Maintaining Professionalism in Difficult Situations

- Remain Calm and Neutral: Regardless of the circumstances, always maintain composure and neutrality when discussing outstanding obligations.

- Provide Necessary Information: Ensure that all relevant details, such as the amount owed and payment instructions, are included and easily accessible.

- Be Patient: Understand that some situations may take time to resolve, and remain courteous and patient in your follow-up communications.

htmlEdit

Legal Considerations When Writing Letters

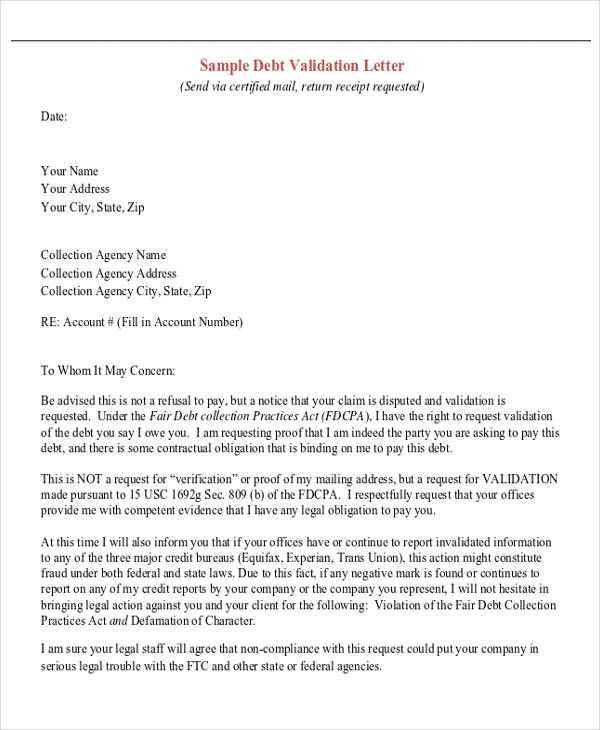

When sending formal communications regarding overdue financial matters, it is crucial to ensure that the message complies with legal requirements. Failing to adhere to relevant laws can result in complications, including legal challenges. Therefore, understanding the legal framework surrounding these communications helps protect both parties and facilitates an efficient resolution process.

Key Legal Guidelines to Follow

- Accuracy of Information: Ensure that all details, such as amounts owed and payment terms, are correct to avoid misleading or incorrect claims.

- Fair Treatment: The tone of the message should remain respectful and professional, avoiding threats or any form of harassment.

- Compliance with Regulations: Follow any applicable local, state, or national regulations, including those regarding consumer rights and privacy laws.

- Documentation: Retain copies of all communications as a record of the actions taken, in case of future disputes.

Important Legal Terms to Be Aware Of

- Statute of Limitations: Understand the time frame within which legal action can be initiated based on the nature of the financial obligation.

- Consumer Protection Laws: Be aware of laws that protect individuals from unfair practices and ensure that communications do not violate those rights.

- Notice Requirements: Some jurisdictions require specific language or steps to be included in formal communications to comply with the law.

htmlEdit

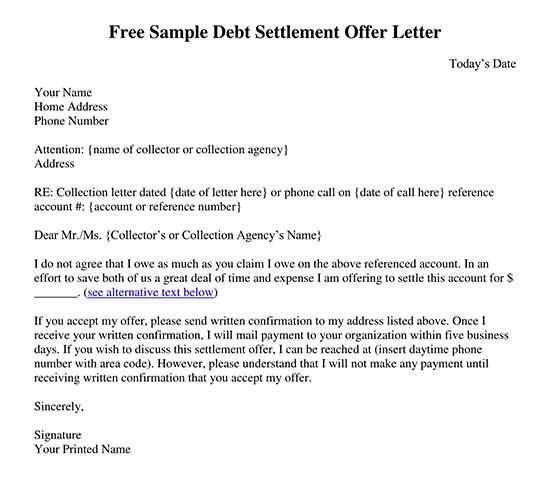

Common Mistakes to Avoid in Debt Recovery Communications

When addressing unpaid financial obligations, it is essential to approach the situation with care and professionalism. Common errors can lead to misunderstandings, delays, or even legal challenges. Recognizing and avoiding these mistakes is crucial in achieving a timely resolution while maintaining positive relations with the recipient.

Here are several common pitfalls to avoid when drafting these formal messages:

- Vague or Unclear Language: Avoid ambiguous terms that may confuse the recipient. Be precise in outlining the amounts owed and any applicable deadlines.

- Aggressive Tone: Using a harsh or threatening tone can lead to negative outcomes. Keep the tone polite and professional, even if the situation is frustrating.

- Failing to Include Payment Options: Always provide clear instructions on how the recipient can make the payment. Offering flexibility can increase the chances of resolution.

- Ignoring Legal Requirements: Ensure that your communication complies with relevant laws and regulations. Failing to do so can create legal complications.

- Not Providing Contact Information: Always include your contact details in case the recipient has any questions or requires clarification regarding the payment process.

By avoiding these common mistakes, you ensure a more effective and efficient process, ultimately leading to a quicker resolution of the financial matter.

htmlEdit

How to Follow Up After Sending a Formal Communication

After sending a formal communication regarding overdue financial matters, it is important to follow up effectively to ensure a resolution. A timely and respectful follow-up can prompt action, clarify misunderstandings, and demonstrate your commitment to resolving the issue professionally. Following the right approach helps maintain a positive relationship with the recipient while encouraging prompt payment or action.

Steps to Take After the Initial Communication

- Give Sufficient Time: Allow a reasonable amount of time for the recipient to respond before initiating a follow-up. This demonstrates patience and understanding.

- Be Professional and Courteous: In your follow-up, maintain a respectful tone. Reaffirm your willingness to resolve the matter amicably and professionally.

- Provide Clear Instructions: If applicable, remind the recipient of the necessary steps to take, including payment methods or further contact details.

Effective Follow-Up Methods

- Send a Reminder: If there is no response, send a polite reminder highlighting the previous communication and the need for prompt action.

- Offer Assistance: If the recipient is facing difficulties, offer possible solutions, such as payment plans or alternate arrangements.

- Maintain Documentation: Keep a record of all communications and responses in case further action is required.