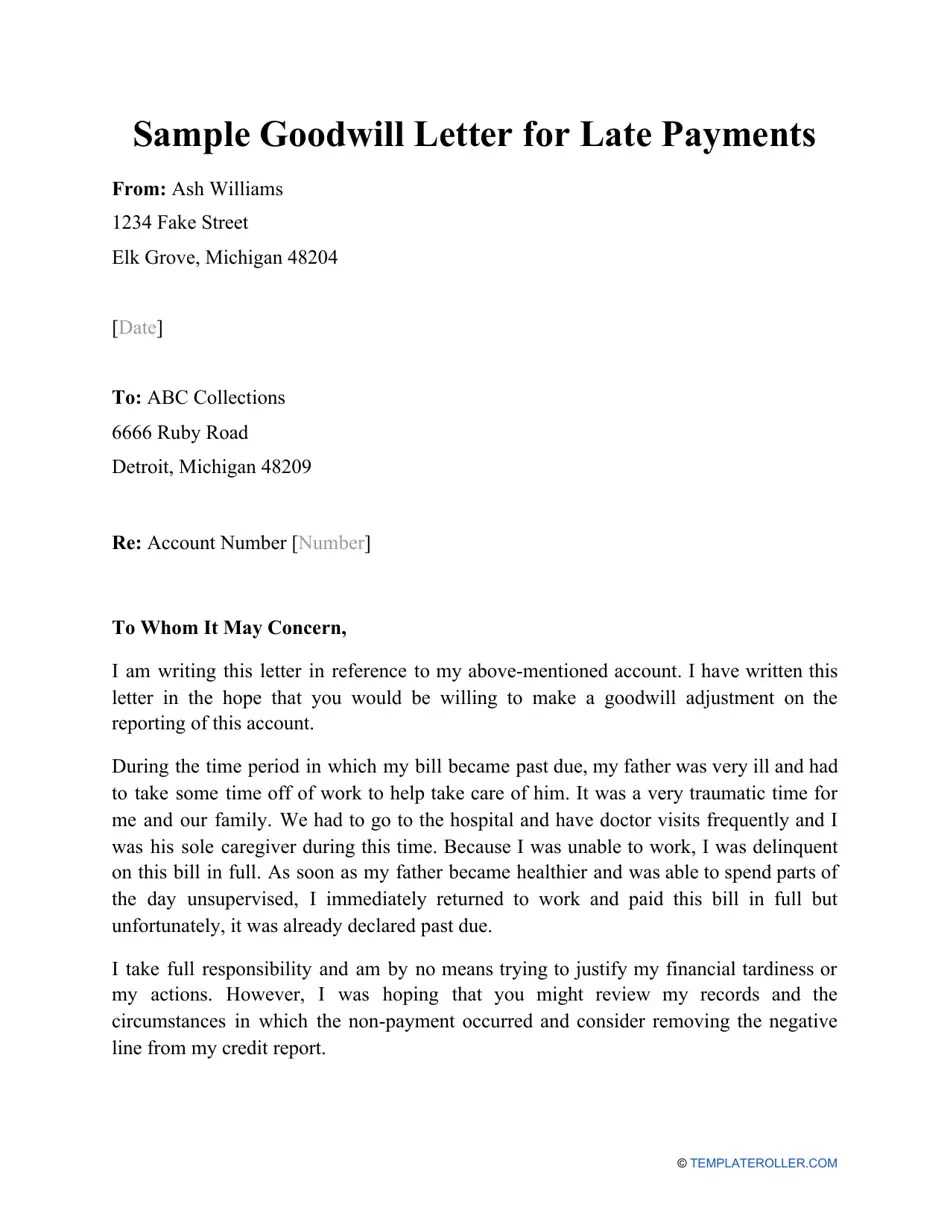

Free Goodwill Letter Template for Late Payment

When facing a financial challenge, certain negative marks on your credit report may not always reflect the full picture. An effective approach can be to request the removal of these marks by reaching out to your creditors. A well-written appeal can often help in negotiating these changes, especially when your payment history was otherwise consistent.

Crafting a compelling appeal involves presenting a strong case while maintaining a respectful and professional tone. By acknowledging the mistake, explaining the circumstances, and emphasizing your overall financial reliability, you increase the chances of a favorable outcome.

In this guide, you will find detailed instructions on how to draft a request that aligns with creditor expectations. Additionally, we’ll explore how timing and a clear approach can significantly influence the results of your request. Taking the right steps can pave the way for credit score improvements.

Request for Credit Adjustment After Delay

If you’ve missed a payment but your financial history is otherwise solid, reaching out to your creditor to request a correction can be an effective step. In some cases, creditors are willing to remove negative marks from your credit report, especially if the delay was an isolated incident and you have maintained a good record overall.

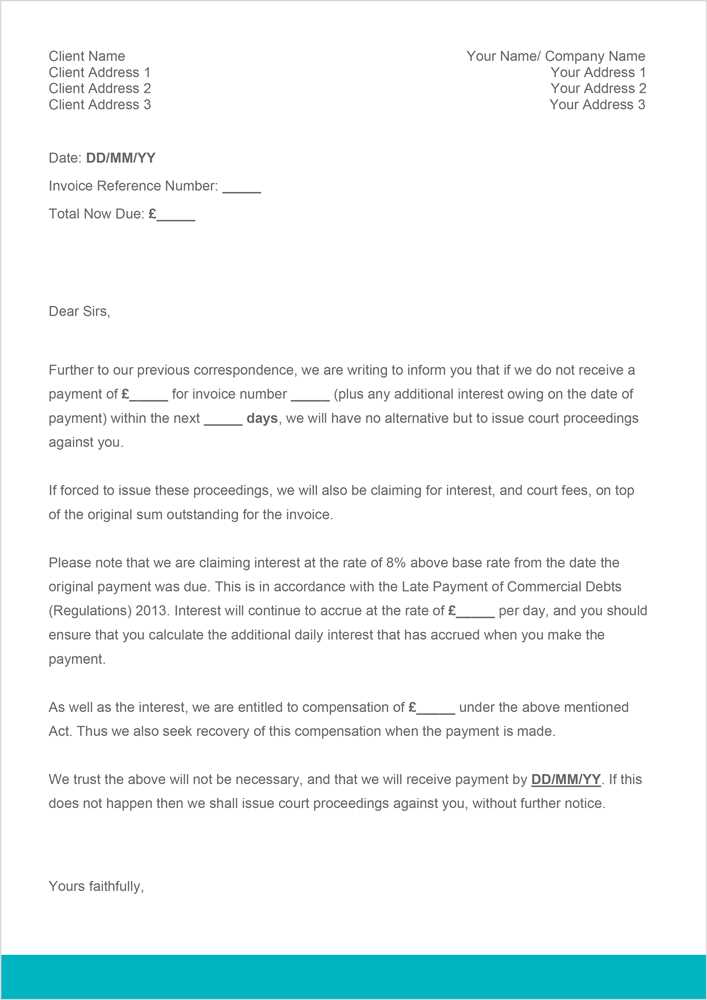

How to Structure Your Appeal

Begin by clearly acknowledging the missed due date, providing a valid reason for the delay, and emphasizing your commitment to maintaining responsible financial habits. It’s important to be polite and concise, showing that you understand the mistake while highlighting your consistent payment behavior. Including supporting evidence, such as a copy of your payment history or other relevant documents, can strengthen your case.

Important Considerations

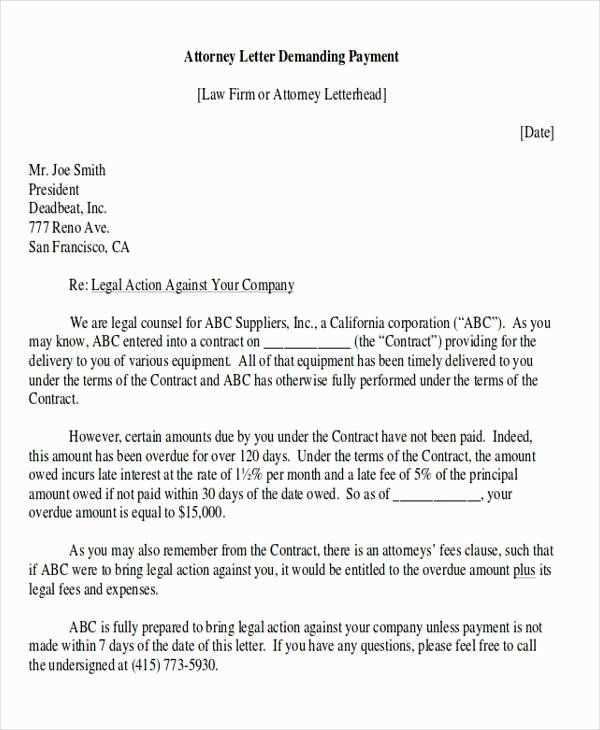

Timing plays a key role in the success of such a request. The earlier you approach the creditor after the issue arises, the better the chances of a positive response. Also, ensuring that the appeal is sent to the right department can save time and improve your chances of receiving the desired outcome. While not all requests will be successful, maintaining a respectful tone and providing a well-thought-out explanation can make a significant difference.

Benefits of Requesting Payment Removal

Requesting the removal of a negative mark from your credit record can have several significant advantages, especially if you have a generally strong financial history. By addressing the issue with your creditor, you may be able to improve your credit score, which can enhance your financial standing and increase your chances of qualifying for future loans or credit lines.

Improved Credit Score

One of the primary benefits of successfully having a mark removed is the potential improvement in your credit score. A higher score can open doors to better interest rates, more favorable loan terms, and access to higher credit limits. With a cleaner credit report, lenders may view you as a less risky borrower, which can positively impact your financial options.

Better Financial Opportunities

When your credit score improves, you may find it easier to secure financing for major purchases, such as a home or car. Additionally, lower interest rates on existing and future debt can help you save money over time. With a stronger credit history, you also increase your chances of approval for rental applications, insurance, and even job opportunities in some industries.

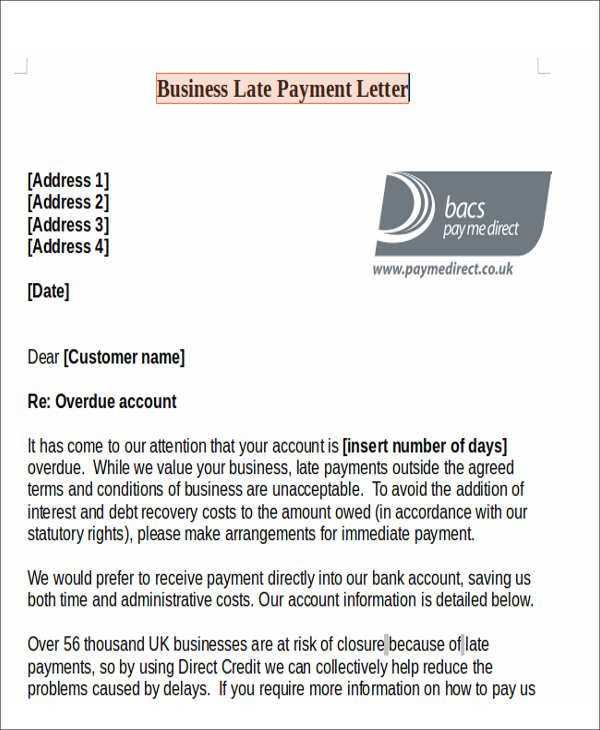

How to Craft an Effective Request

Creating a compelling request involves more than just asking for a change; it requires a clear, respectful, and well-organized message that highlights your commitment to good financial behavior. The goal is to present a solid case while maintaining professionalism, ensuring that your appeal is both convincing and polite.

Start by briefly explaining the situation, acknowledging the mistake, and offering a valid reason for the delay. Make sure to emphasize your strong payment history and demonstrate that this was an isolated issue. Keep your tone courteous and avoid being confrontational, as creditors are more likely to respond positively to a thoughtful and well-reasoned appeal.

Incorporate any relevant documentation, such as past payment records or communication with your bank, to back up your claims. Providing clear evidence strengthens your request and shows your commitment to resolving the issue. Lastly, express gratitude for their time and consideration, making it clear that you value their partnership.

Key Elements to Include in Your Letter

An effective appeal should contain specific information that makes your case clear and persuasive. By including the right details, you increase the likelihood of a positive response. Here are the essential components to consider:

- Clear Identification – Include your full name, account number, and any relevant identifiers to help the creditor locate your file quickly.

- Explanation of the Situation – Briefly describe the circumstances that led to the issue. Be honest and transparent about the cause.

- Acknowledgment of the Mistake – Accept responsibility for the missed deadline, but frame it as an isolated incident in your otherwise strong payment history.

- Supporting Evidence – Attach any documents that show your consistent payment behavior, such as bank statements or account history.

- Request for Adjustment – Clearly state your request, asking for the removal of the negative mark from your credit file.

- Polite Tone and Gratitude – End the communication with a courteous note, thanking the creditor for their time and consideration.

Including these key elements ensures that your appeal is both professional and compelling, improving your chances of success.

Impact of Late Payments on Credit

When payments are not made on time, they can have a lasting effect on your financial standing. Missed or delayed payments are recorded on your credit report and can influence your credit score, making it harder to secure loans or favorable interest rates in the future. Understanding the consequences of these marks is important for maintaining financial health.

| Impact Level | Description |

|---|---|

| Minor Impact | Payments that are only a few days overdue typically result in a small decrease in your credit score. |

| Moderate Impact | A delay lasting 30 days or more may lead to a more noticeable drop in your credit score. |

| Severe Impact | Accounts that remain unpaid for several months can cause significant damage, making it challenging to obtain new credit or loans. |

The longer an overdue amount remains unpaid, the more negative the effect on your financial reputation. Timely resolution of these issues is crucial to restoring your standing and avoiding further complications.

Best Time to Submit Your Letter

Timing plays a crucial role in the effectiveness of your request. Submitting your appeal at the right moment can increase the chances of a positive outcome. Knowing when to approach your creditor is just as important as how you present your case.

The best time to send your request is soon after the issue occurs, ideally as soon as you realize the mark has been applied to your record. The longer you wait, the harder it may be to persuade your creditor to make any adjustments. Additionally, if you’ve recently made several on-time payments or improved your financial habits, your request will be more compelling.

It’s also helpful to avoid sending requests during busy periods, such as at the end of the month or during holidays, when the creditor’s response time might be slower. Aim to send your appeal when the creditor can give it the attention it deserves, increasing the likelihood of success.

Increasing Chances of Successful Removal

When requesting a change to your financial record, presenting a strong and thoughtful case is key to improving your chances of success. By following a few best practices, you can significantly enhance the likelihood of having the negative mark removed.

Be Honest and Transparent

It’s important to be upfront about the reason for the delay. Creditors are more likely to respond positively if you show genuine responsibility for the situation. Avoid exaggerating or making excuses. A clear and honest explanation demonstrates integrity and can build trust with the creditor.

Maintain a Respectful Tone

Always approach your request with courtesy. A polite and professional tone can go a long way in making a positive impression. Be patient and avoid demanding or overly emotional language, as this can negatively affect how your request is received.

Incorporating these strategies will help you present a more convincing appeal, increasing the chance of a favorable outcome. Patience and persistence, along with a well-crafted request, are often key to success.