Debt Management Plan Letter Template

In financial dealings, clear and structured communication is essential, especially when discussing repayment arrangements. Crafting a well-organized document can help individuals and organizations navigate complex payment discussions. This section aims to provide the necessary structure for communicating repayment terms effectively, ensuring all parties understand their obligations.

Effective communication in these matters involves laying out specific terms in a concise and professional manner. By following a straightforward format, one can ensure that the terms are easily understood and legally binding. A carefully written document not only presents the details clearly but also serves as a reference point in case of future discussions.

Personalizing the approach can help address the unique circumstances of each case, making the communication more relevant and impactful. Proper wording can also help foster trust and encourage a cooperative attitude between involved parties. This guide will walk you through creating an effective communication format for repayment terms.

When navigating financial obligations, it is essential to communicate clearly and professionally. A well-structured document outlining the terms of repayment can significantly improve understanding and cooperation between all parties involved. This section highlights the key elements that should be included in such a communication.

Key Elements to Include

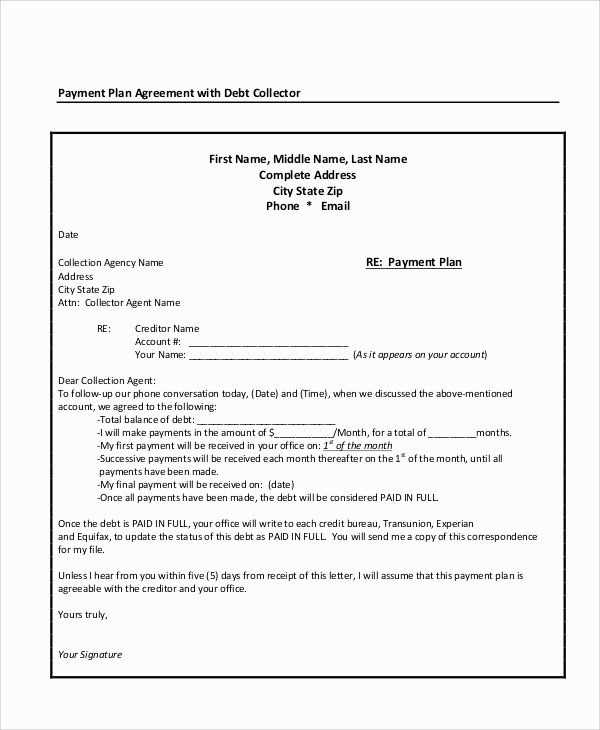

- Introduction: Start by briefly explaining the purpose of the document and acknowledging the financial agreement.

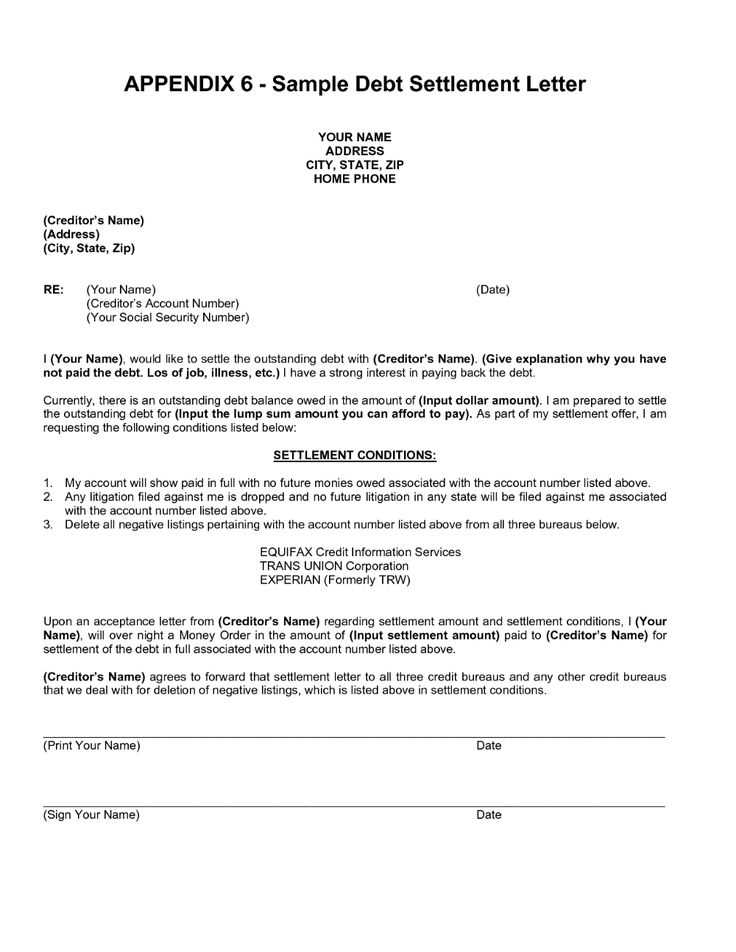

- Payment Terms: Clearly outline the repayment schedule, including amounts, due dates, and any special conditions.

- Agreement Details: Specify any agreements made, such as interest rates, penalties for missed payments, or adjustments to the original terms.

- Closing Remarks: End with a reaffirmation of the agreement and a request for acknowledgment or confirmation from the recipient.

Best Practices for Clear Communication

- Be concise: Avoid unnecessary jargon or overly complicated language. Stick to the facts and present them in a straightforward manner.

- Use professional tone: Maintain a respectful and neutral tone throughout the document to encourage cooperation and mutual respect.

- Include all details: Ensure that every aspect of the repayment agreement is covered, leaving no room for confusion or ambiguity.

Understanding Debt Management Letters

Effective financial communication is crucial when discussing repayment agreements. A well-constructed document serves as a formal method of outlining expectations, ensuring that all parties involved are clear on the terms and responsibilities. This section will break down the structure and purpose of such documents in financial contexts.

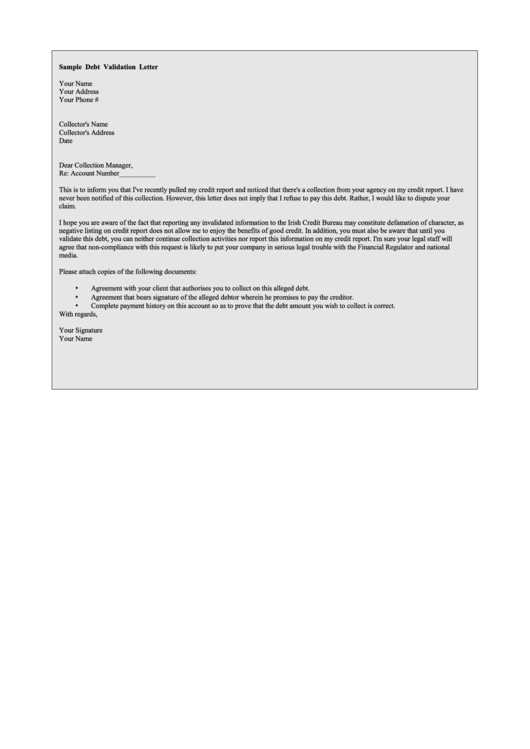

Purpose and Role of Financial Communication

These communications are designed to establish clear terms for repaying outstanding obligations. The primary role of such documents is to ensure transparency, minimize misunderstandings, and formalize the expectations between the involved parties. By providing a written record, it serves as a reference point should any disputes arise later.

Core Components

- Introduction: A brief overview that sets the tone and clarifies the intent of the document.

- Agreement Summary: This includes key details such as payment amounts, due dates, and any modifications to original terms.

- Clarity and Confirmation: A section that confirms the recipient’s understanding and agreement to the outlined terms.

Essential Elements of a Debt Letter

When creating a document to formalize a financial agreement, it is important to include specific details that ensure clarity and mutual understanding. A well-crafted communication will not only outline the repayment terms but also establish a sense of accountability and transparency. This section will highlight the key elements that should be present in such a document.

The main components of any financial agreement document include an introduction that sets the tone, a clear explanation of the terms, and a conclusion that reinforces the agreement. Each of these elements plays a crucial role in ensuring both parties are on the same page and that the document serves as a valid reference in the future.

By incorporating these core elements, one can create a document that is not only legally sound but also fosters a positive relationship between the parties involved, setting a foundation for timely and successful repayment.

How to Customize Your Template

Personalizing a financial agreement document ensures it meets the specific needs of both parties involved. By adapting the content to reflect the unique terms of the agreement, you make sure that it is both relevant and effective. Customization can involve adjusting the language, payment details, or other conditions to suit the particular circumstances of the situation.

When modifying your document, it’s important to focus on the most critical aspects, such as payment schedules, amounts, and any special terms that apply. This allows for flexibility and clarity, ensuring the document is tailored to both your situation and expectations.

| Section | Customization Tips |

|---|---|

| Introduction | Adjust the tone to match the formality of the situation and clarify the document’s purpose. |

| Payment Terms | Specify exact amounts, due dates, and any adjustments or additional terms. |

| Conditions | Include any specific conditions or agreements that might apply to the particular situation. |

| Conclusion | Summarize the terms and provide a section for both parties to confirm their understanding. |

Tips for Clear Communication in Letters

Effective communication is key when dealing with financial agreements. Ensuring that the document is clear, concise, and easy to understand can prevent misunderstandings and promote smooth cooperation. This section outlines several tips for crafting messages that convey your intentions without ambiguity.

Use Simple and Direct Language

When composing your document, aim for clarity by using straightforward language. Avoid jargon or overly complex sentences, as they can confuse the reader. Focus on being direct while maintaining a professional tone.

Stay Organized and Structured

A well-structured document enhances readability and comprehension. Break down information into sections, and use bullet points or numbered lists to highlight key points. This organization helps the recipient quickly grasp the important details without sifting through large paragraphs of text.

- Be Specific: Clearly state all terms, amounts, and deadlines.

- Avoid Ambiguity: Refrain from vague language that could lead to confusion.

- Proofread: Double-check for errors that could affect the message’s clarity.

Common Errors to Avoid in Writing

While drafting a formal document to outline financial agreements, it is crucial to avoid common mistakes that can lead to confusion or miscommunication. These errors can undermine the effectiveness of the communication and cause unnecessary complications. This section highlights some of the most frequent pitfalls to watch out for when preparing such documents.

One of the primary mistakes is the use of unclear or ambiguous language. Vague terms and overly complex sentences can make the document difficult to understand, leaving room for misinterpretation. Another issue is poor organization, which can make the document feel cluttered and hard to follow. Ensuring logical flow and structure is essential for clarity.

Additionally, failing to proofread before sending is a mistake that many people make. Spelling and grammatical errors, even minor ones, can affect the professional tone of the document and undermine its credibility. Always review the document thoroughly to catch any mistakes that may have been overlooked initially.

Advantages of Using a Debt Template

Utilizing a structured document format offers numerous benefits, particularly when dealing with financial agreements. A pre-designed structure can help ensure that all the necessary information is included and organized correctly. This approach reduces the chances of leaving out important details or making errors that could cause confusion later on.

Efficiency and Time Savings

One of the key advantages is the time-saving factor. Instead of starting from scratch, a pre-structured format provides a foundation that can be easily customized to suit your needs. This eliminates the need for repeated reworking, allowing you to focus on personalizing the content and ensuring accuracy.

Consistency and Professionalism

Using a standardized structure also helps maintain consistency across different documents. This can be especially useful when handling multiple agreements, as it ensures that all communications adhere to the same format and tone. It creates a more professional appearance, which can instill confidence in the recipient and reflect positively on you.