Paid in Full Letter Template from Creditor

When a financial obligation is fully settled, it’s important for both parties involved to have official documentation to confirm the completion of the transaction. This formal confirmation serves as proof that the outstanding amount has been cleared, ensuring that there are no further claims or misunderstandings. Such a document plays a crucial role in maintaining accurate financial records and safeguarding both the debtor’s and the lender’s interests.

Creating this kind of statement involves clear and precise language. It should outline the terms of the agreement, the amount settled, and the date of completion. This not only protects the debtor but also serves as a formal acknowledgment for the lender that their claim has been satisfied. Whether it’s for personal or business transactions, having a written record of the settlement is essential in many legal and financial contexts.

Crafting this document carefully is necessary to avoid any potential confusion. The wording should be concise, direct, and unambiguous, ensuring that all involved parties understand the resolution of the debt. With the right approach, this confirmation can provide peace of mind and prevent any future disputes.

A debt settlement document is an official statement confirming that a financial obligation has been completely cleared. This type of written confirmation ensures that the debtor no longer owes any remaining balance to the lender. It serves as a critical record for both parties, providing legal assurance that the debt has been resolved without any further actions required.

Typically, this document includes the amount that was owed, the date of the payment, and the acknowledgment that the full balance has been met. Its purpose is to protect both the borrower and the lender, offering clear evidence that the financial transaction has been fully concluded. For individuals and businesses alike, it can be an important tool to avoid future disputes and guarantee that there are no remaining obligations tied to the original debt.

Purpose of a Full Payment Notice

This formal document serves as confirmation that an outstanding debt has been completely satisfied. It is an essential piece of evidence for both the debtor and the lender, signifying the conclusion of the financial relationship regarding that specific obligation. Its purpose is not only to declare the debt cleared but also to protect both parties from future disputes regarding the balance.

Ensuring Legal Clarity

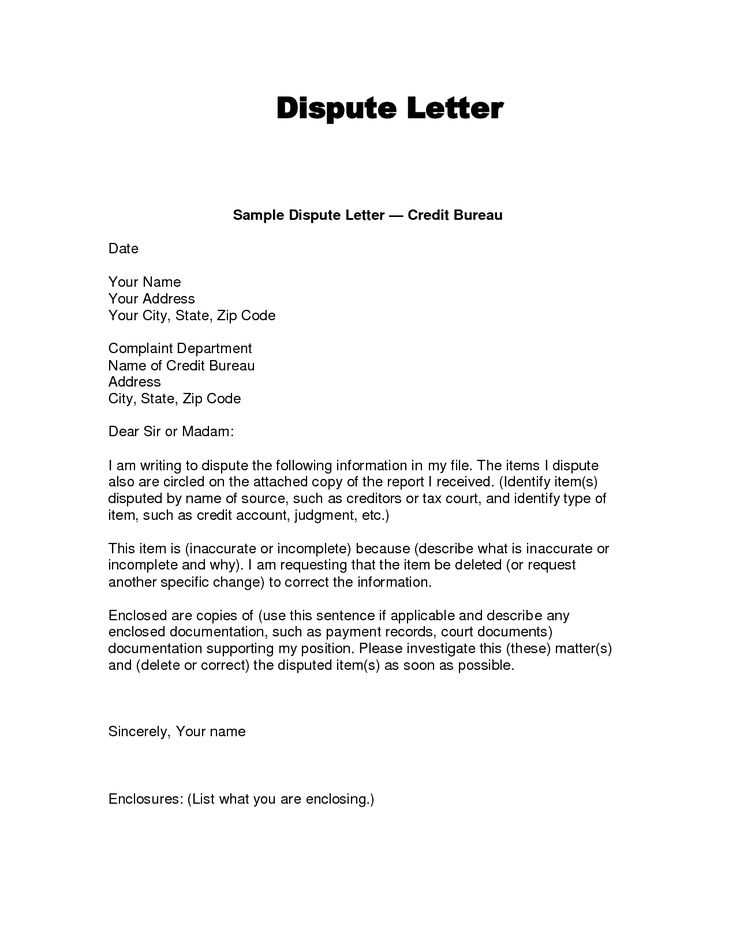

By providing a clear record of the payment, this document ensures that no further claims can be made. It protects the individual or business that made the payment by guaranteeing that the lender cannot claim that the debt remains outstanding. This written confirmation can be used in future legal situations, offering peace of mind to both sides.

Facilitating Financial Transparency

Having such a document is crucial for maintaining accurate financial records. It allows individuals and businesses to demonstrate the resolution of financial matters, which is important when applying for new credit or when reviewing past financial activities. This transparency helps to avoid misunderstandings and keeps all parties informed of the settled status.

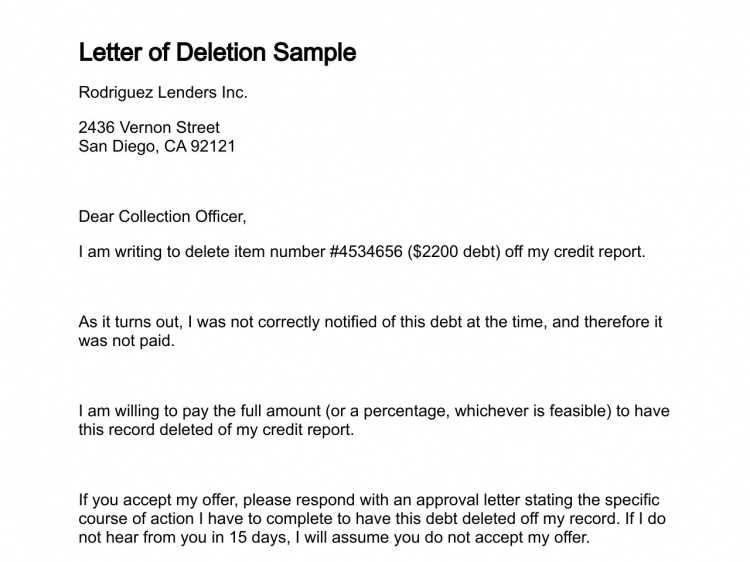

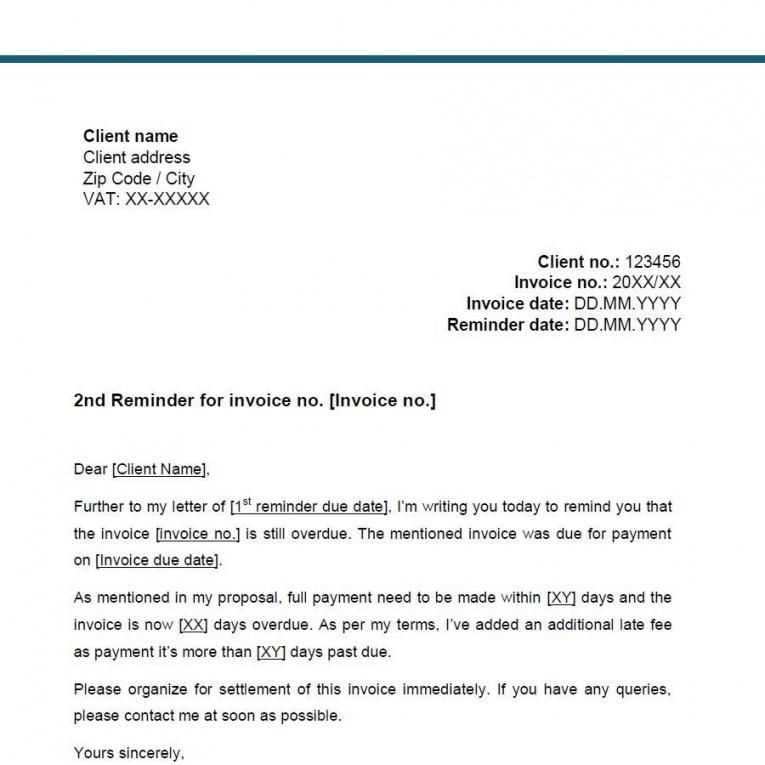

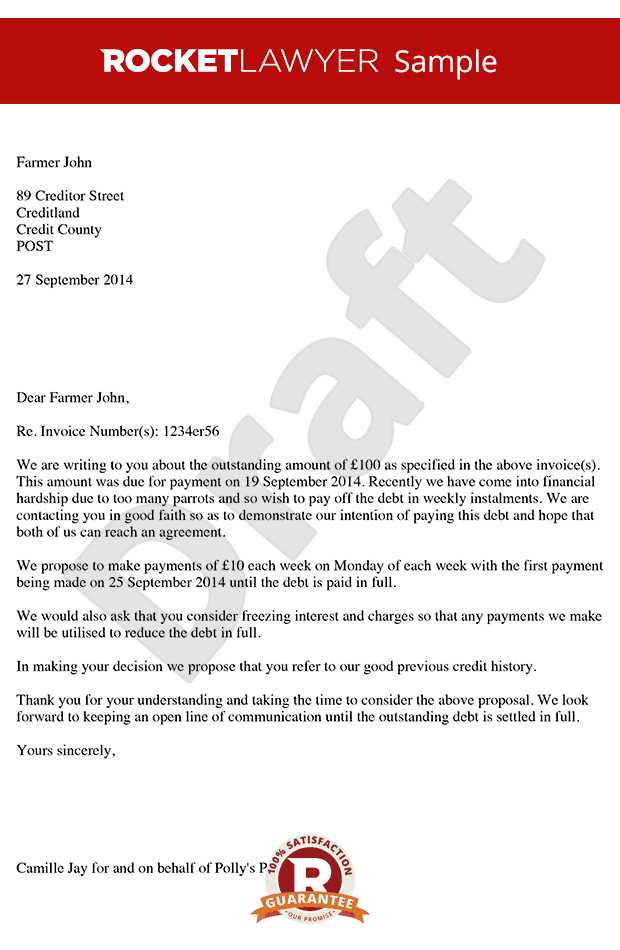

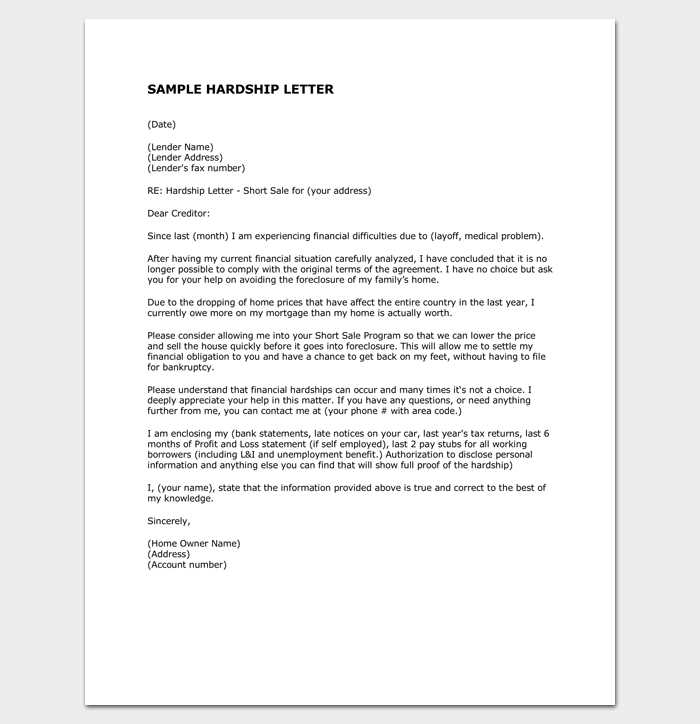

How to Create a Payment Confirmation

Creating a payment confirmation document involves including key details to clearly state that the debt has been settled in full. The process starts with gathering all necessary information about the transaction, such as the amount paid, the date of payment, and the identity of both parties involved. This ensures that the document accurately reflects the completion of the financial arrangement.

Once the relevant information is collected, the next step is to structure the document professionally. Begin with a statement acknowledging that the full amount has been cleared, followed by a summary of the payment terms. It’s important to specify the debt’s original amount, the settlement date, and a clear indication that no further payments are required. Concluding with a signature or official stamp can further authenticate the document, providing assurance to both parties involved.

Essential Details to Add in the Document

To ensure that the document accurately confirms the resolution of a debt, several critical pieces of information must be included. These details help clarify the transaction and provide a complete record for both parties involved. Without these essential elements, the document may lack the necessary clarity and legality.

Key Information to Include

- Debtor’s and lender’s details: Include the names and contact information of both the borrower and the lender.

- Debt amount: Clearly state the original amount of the debt and the payment made to settle it.

- Date of settlement: Mention the exact date when the payment was completed.

- Payment method: Specify how the payment was made (e.g., wire transfer, check, or cash).

- Confirmation statement: A clear statement indicating that the debt has been completely settled.

Additional Considerations

- Balance summary: Provide a breakdown of any adjustments or prior payments made before the final settlement.

- Legal disclaimer: Include a statement that confirms the lender cannot pursue further claims regarding this specific debt.

- Signatures: Both parties should sign the document to validate the agreement.

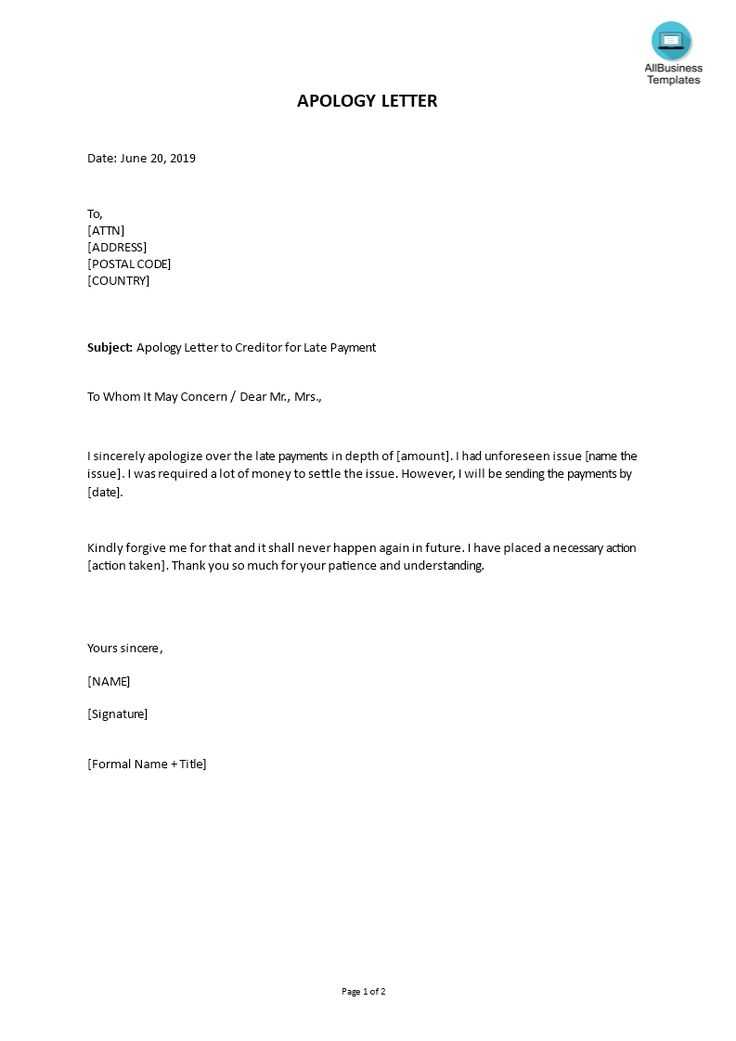

Common Mistakes to Avoid in Notices

When drafting a formal document confirming the settlement of a financial obligation, it is crucial to avoid common errors that could lead to confusion or legal complications. These mistakes can undermine the clarity and effectiveness of the document, potentially resulting in future disputes. Ensuring accuracy and completeness in every section is vital to making the document legally sound and useful for both parties.

Typical Errors to Watch Out For

| Common Mistake | Why It’s Problematic |

|---|---|

| Missing payment details | Without specific information about the payment, such as the amount and method, the document may not serve as an accurate record. |

| Incorrect debtor or lender information | Failure to list the correct names and contact details can create confusion and make the document less reliable. |

| Vague settlement statement | Not clearly stating that the debt has been fully resolved can lead to misinterpretations or future claims. |

| Omitting the date of payment | Without a clear date, the document may lack a definitive timeline for the debt resolution. |

| Failure to sign the document | Unsigned notices can be challenged in legal settings, rendering them invalid for proving debt settlement. |

How to Avoid These Mistakes

To prevent errors, take the time to double-check all information before finalizing the document. Ensure that all parties involved are clearly identified, and include comprehensive details of the transaction. If necessary, seek professional advice to make sure the document is thorough and legally sound.

Effect of a Paid in Full Confirmation

Confirming that a debt has been settled in full carries significant implications for both the payer and the recipient. This official acknowledgment serves as a clear statement that all financial obligations have been met, which can provide peace of mind and protect both parties in the future. The effect of such a confirmation is far-reaching, often influencing legal, financial, and personal matters related to the transaction.

Impact on the Debtor

- Clearance of Outstanding Debt: A settlement confirmation eliminates any remaining obligation, ensuring that the debtor is no longer liable for the debt.

- Improved Credit Score: For many, resolving a debt in full can positively impact their credit history and improve their creditworthiness.

- Legal Protection: The document serves as proof that the debt was resolved, protecting the debtor from future claims or legal action related to the same debt.

Impact on the Lender

- Resolution of Financial Issue: The lender can close the account and confirm that the loan or credit has been repaid in full, allowing for proper record-keeping.

- Establishing Credibility: By acknowledging that a debt has been cleared, the lender may maintain a positive relationship with the debtor, which could lead to future business opportunities.

- Protection Against Disputes: A formal settlement confirmation prevents potential disputes over payment status, offering legal clarity.