Bank Change of Address Letter Template for Easy Use

Keeping your personal details up to date with your financial institution is essential to ensure smooth communication and avoid disruptions. When you relocate or modify your contact details, notifying your provider in a formal and organized way is necessary for maintaining accurate records.

The process of notifying your provider requires careful attention to detail. Providing all relevant information in a clear and concise format will help your request be processed efficiently. Understanding the key components of this communication can make the task simpler and faster.

In this article, we will explore the most important steps and tips for submitting such a request. Whether you are looking for a sample format or need guidance on the specifics of what to include, you’ll find helpful advice to ensure your update is successful.

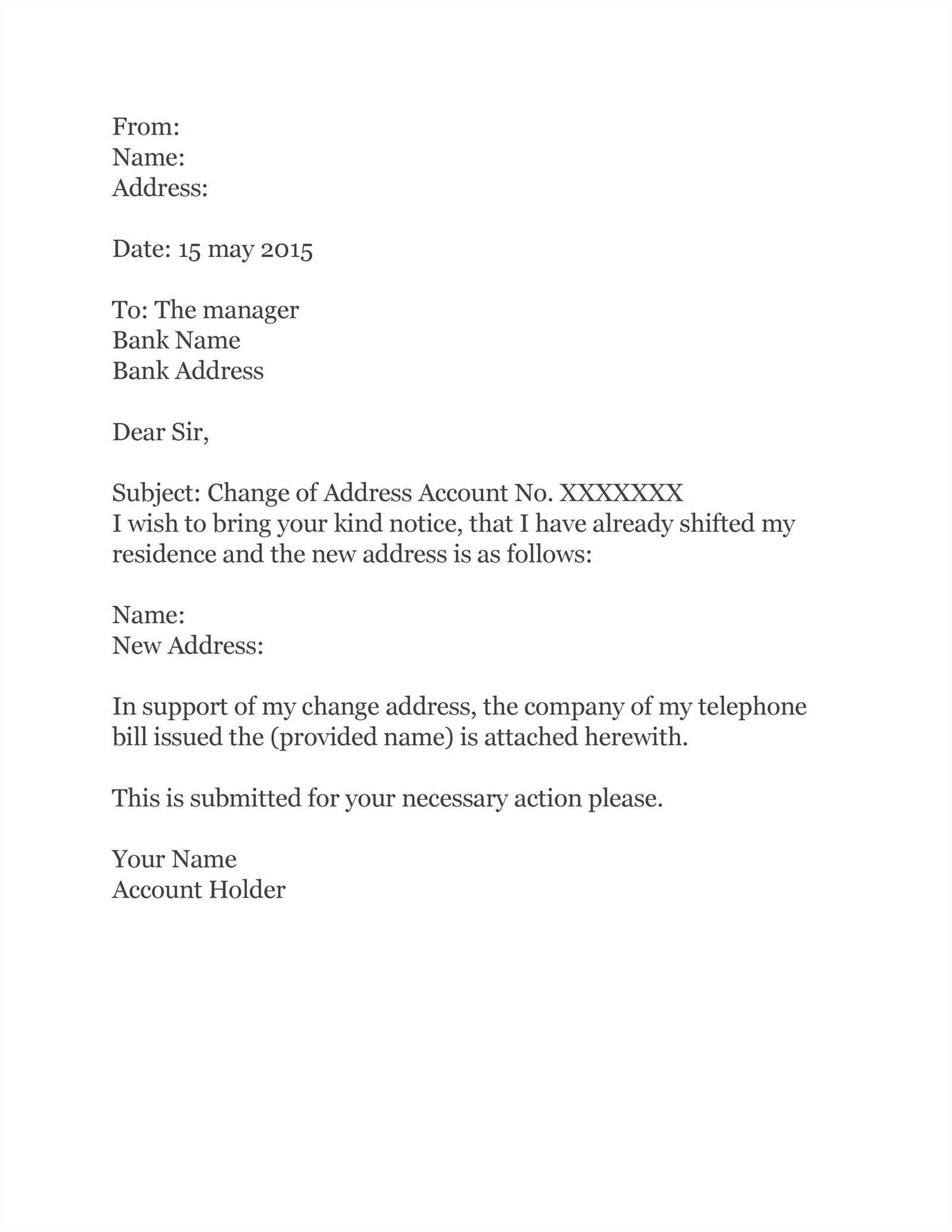

How to Notify Your Bank of Address Change

When you relocate or modify your personal details, it is important to inform your financial institution to ensure uninterrupted services. A well-structured communication is key to notifying them of your updated contact information. The process should be straightforward, but attention to detail is necessary to ensure your request is processed efficiently.

First, make sure to include all necessary information in your correspondence. This includes your full name, previous and new contact information, and account number. Additionally, providing a reason for the update, if applicable, can make the process smoother.

Once you have gathered all relevant details, the next step is to submit your request. You can choose to send it via mail, email, or through your financial institution’s online portal, depending on their preferred method of communication.

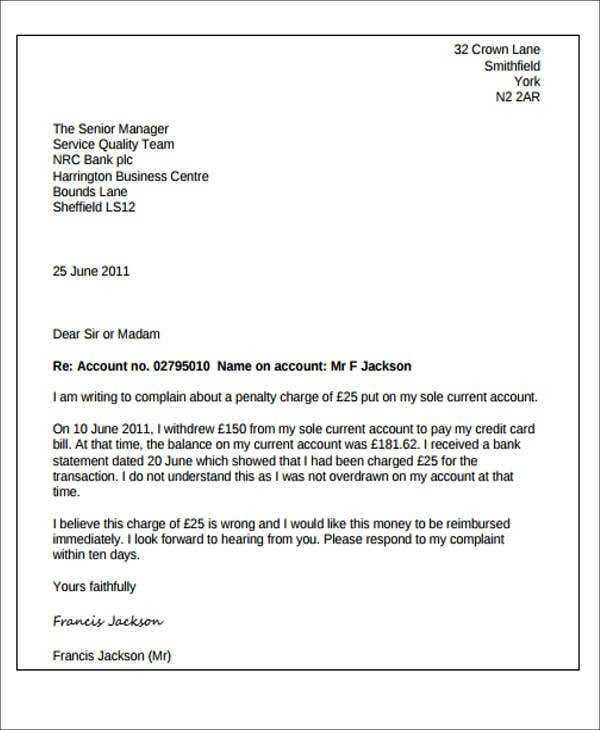

Essential Information to Include in Your Letter

When notifying your financial institution about an update to your personal details, it’s crucial to provide all the relevant information to ensure a smooth process. Your communication should be clear, concise, and include all necessary data for the institution to process your request quickly and accurately.

Start by including your full name, account number, and any other identifiers that the institution uses to track your records. This will help them find your account easily. Additionally, be sure to specify both your previous and new contact details so that they can make the required adjustments in their system.

It’s also helpful to mention the effective date of the change. This allows the institution to update your information in a timely manner and avoid any miscommunication. If needed, include any supporting documents, such as a utility bill or government-issued ID, to verify your new contact information.

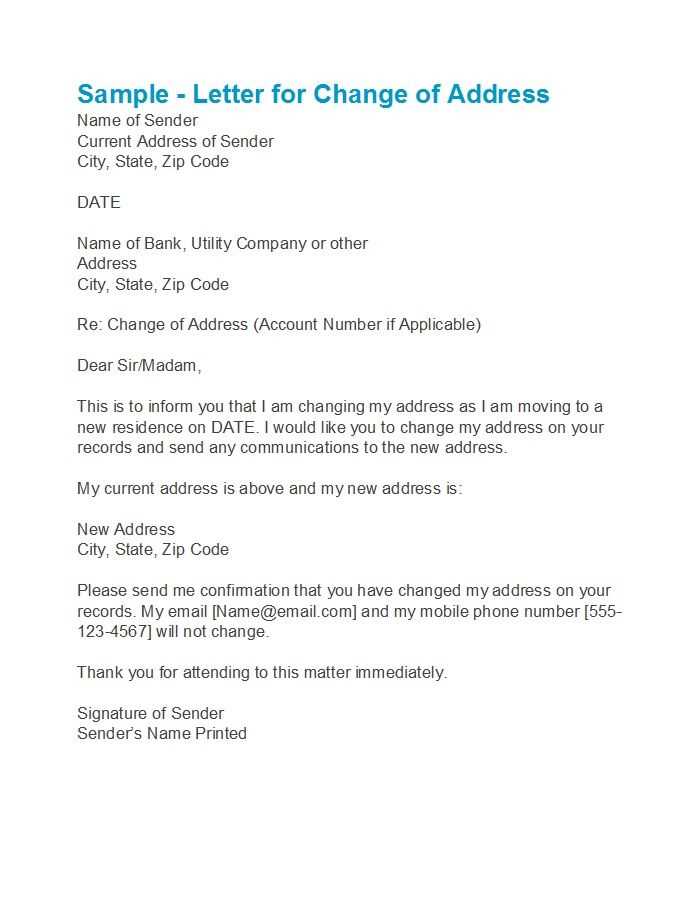

Creating an Effective Address Update Letter

When informing your financial provider about a modification in your personal contact details, clarity and precision are key. A well-crafted document ensures that the update is processed without delays and that all necessary information is provided. To create an effective communication, focus on being clear, direct, and professional.

Structure Your Request Clearly

Start with a formal greeting, followed by a clear statement of your intent to update your information. Ensure the document includes your full name, account number, and both old and new details. Be sure to specify the date from which the update should take effect, as this can help avoid confusion.

Maintain a Professional Tone

Even though the purpose is simple, it’s important to keep the tone respectful and professional. Avoid unnecessary details and focus only on the essential information. This will help the recipient process your request swiftly and with less chance of oversight.

Important Tips for a Successful Request

Submitting a request to update your personal details with your financial provider can be straightforward if you follow a few essential guidelines. Ensuring accuracy, clarity, and proper documentation can significantly reduce the chances of any delays or complications in processing your update.

First, double-check all the information you provide. Inaccurate or incomplete data can lead to mistakes and unnecessary follow-up. Also, be sure to keep a copy of your request for your records, whether it’s sent via mail or electronically. This will help in case of any future issues or questions.

Additionally, it’s important to submit the request well in advance of when you need the changes to take effect. Financial institutions often require a certain processing time, and submitting early ensures your details are updated promptly.

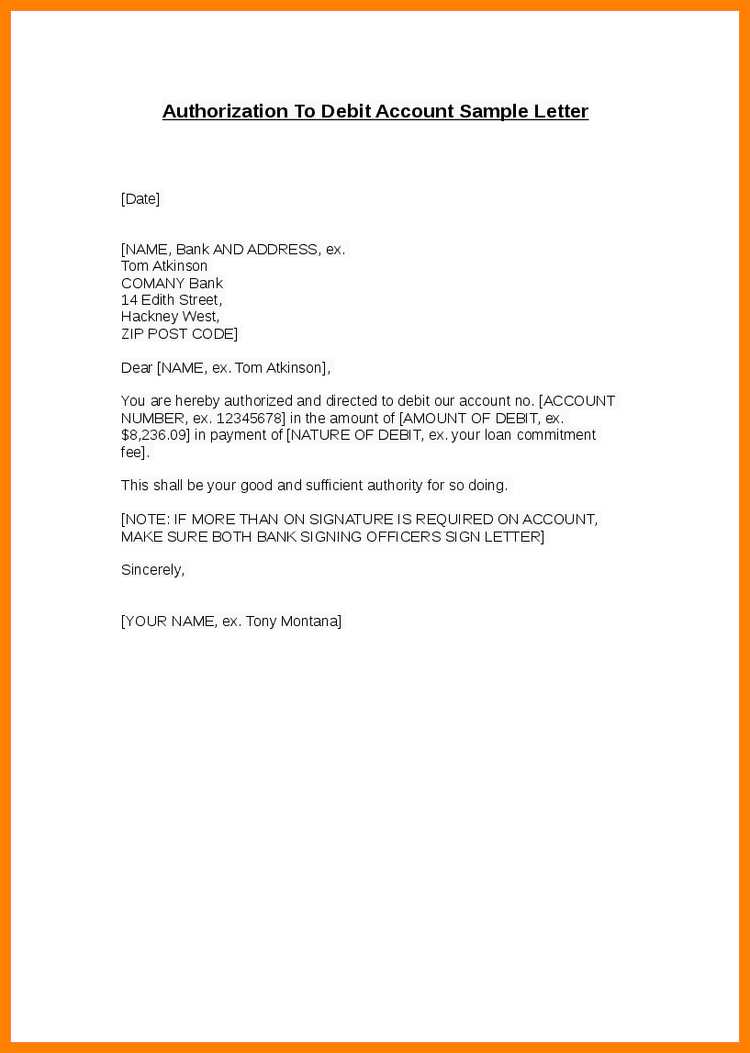

Sample Template for Address Change Letter

To make the process of updating your contact details easier, having a clear structure for your request can help ensure that all necessary information is included. Below is a sample format that you can adapt to fit your specific needs when notifying your financial provider.

Here is a simple outline to follow:

- Full Name: Provide your complete legal name as registered with the institution.

- Account Number: Include the account number(s) to ensure your request is linked to the correct record.

- Old Contact Information: List your previous details that need to be updated.

- New Contact Information: Clearly specify your new details.

- Effective Date: State when you would like the updates to take effect.

- Reason (Optional): You can briefly mention why the update is being made, though this is not always necessary.

Using this format can help make the process smoother and ensure all necessary details are included for a quick update.

When to Send Your Update Request

Timing plays a significant role when notifying your financial institution about any updates to your personal details. Sending the request at the right time can prevent any disruption in your services or communication. It is essential to plan ahead to ensure that your information is updated promptly and accurately.

Submit in Advance

It is recommended to send your request well before the effective date of your new contact information. Financial institutions typically need time to process such requests, and submitting your update early can prevent delays or misunderstandings.

- Preferred Time Frame: Aim to submit your request at least 10 to 14 days before the update is needed.

- Consider Processing Time: Some institutions may require additional time during busy periods.

Monitor Your Update Progress

After sending your request, it’s important to follow up if necessary. If you haven’t received confirmation or if there’s no indication that your information has been updated, contact the institution to verify that the change has been processed correctly.

Why Updating Your Bank Information Matters

Keeping your personal details up to date with your financial institution is crucial for maintaining uninterrupted service and ensuring that important communications and transactions are handled efficiently. Failing to update your contact information can lead to missed notifications, delayed payments, or even security risks.

Preventing Service Disruptions

When your personal information is not current, you risk not receiving important notices or account updates. This can lead to issues like missing critical updates about your account or failing to receive verification codes needed for secure online transactions.

| Potential Consequences | Impact |

|---|---|

| Missed Payment Notifications | Late fees and penalties for unpaid balances |

| Unreceived Security Alerts | Increased risk of fraud and identity theft |

| Failed Communication | Loss of important updates and reminders |

Enhancing Security and Accuracy

Regularly updating your contact details ensures that any suspicious activity can be quickly addressed, and it helps maintain the accuracy of your account information. Keeping everything current also allows for smooth verification processes, adding an extra layer of security to your financial transactions.