Free 609 Credit Dispute Letter Templates to Improve Your Credit Score

When it comes to improving your financial situation, addressing inaccurate information on your record is crucial. A well-structured request can help you challenge and correct mistakes, enhancing your chances of success. Many individuals turn to pre-made documents to simplify the process and avoid the complexities of creating their own from scratch. These resources provide a straightforward way to approach the task efficiently.

Utilizing reliable resources that guide you through the necessary steps can save time and effort. These ready-to-use documents are designed to make your communication clearer and more effective. By understanding the basic structure and elements required, you can confidently initiate the process and address discrepancies that may be affecting your financial reputation.

Taking the right approach is key to achieving favorable outcomes. Knowing how to compose your message properly, with the correct tone and format, can significantly impact the likelihood of a positive response. With the right materials at your disposal, the process becomes more manageable, and you can focus on resolving the issue rather than worrying about the technicalities of writing a proper request.

Why Choose Free 609 Letter Templates

Many people seeking to improve their financial records prefer to use pre-written resources that simplify the process. These ready-made documents save time, ensure accuracy, and allow for quick action when correcting inaccuracies. Instead of spending time crafting your own from scratch, these tools offer a structured format that guides you through the necessary steps with clarity and precision.

Using professionally designed materials can eliminate the uncertainty of creating effective communication. They are designed to meet the standard requirements set by organizations, ensuring that your message is clear and well-received. Efficiency is a major advantage, as these documents provide a proven method for addressing errors in an effective manner, improving your chances of a favorable outcome.

Furthermore, the accessibility of these resources makes them an attractive option for those looking to handle such matters independently. With easy access and a user-friendly format, you can focus on your financial goals without the added stress of figuring out the specifics of the communication process. By using these tools, you are empowered to take control of your financial situation and work toward a resolution that benefits you.

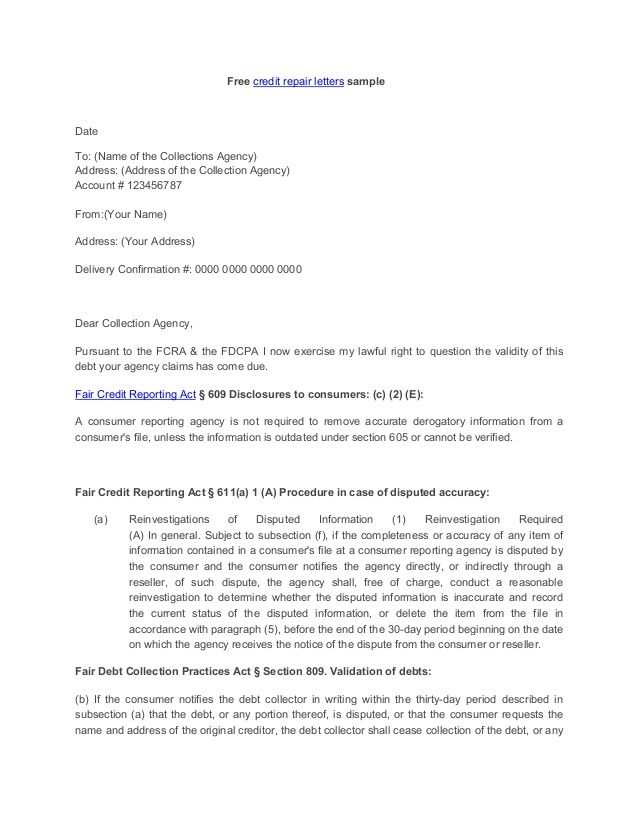

Overview of Credit Dispute Letters

When errors or inaccuracies appear on your financial record, it’s important to formally challenge these mistakes. A well-constructed document serves as the official request to address and correct any incorrect information. These communications are typically submitted to the relevant agencies or institutions, urging them to review the information and make necessary amendments. Understanding the essential components and structure of such a document can significantly increase your chances of a successful outcome.

In order to create an effective appeal, certain elements must be included to ensure clarity and compliance. Below is an overview of the key sections that should be present in these formal requests:

| Section | Description |

|---|---|

| Personal Information | Includes your full name, address, and identification number to confirm your identity. |

| Identification of Error | Clearly explains the specific mistake or discrepancy that needs correction. |

| Supporting Documents | Any additional evidence or paperwork that backs your claim, such as receipts or statements. |

| Requested Action | Describes what action you wish the recipient to take in response to the error. |

| Signature and Date | Confirming your intent by signing the document and including the date of submission. |

By including these key components, the document becomes a professional, clear, and actionable request that increases the likelihood of a positive response from the recipient. A structured format not only ensures proper communication but also demonstrates your commitment to resolving the issue in an organized manner.

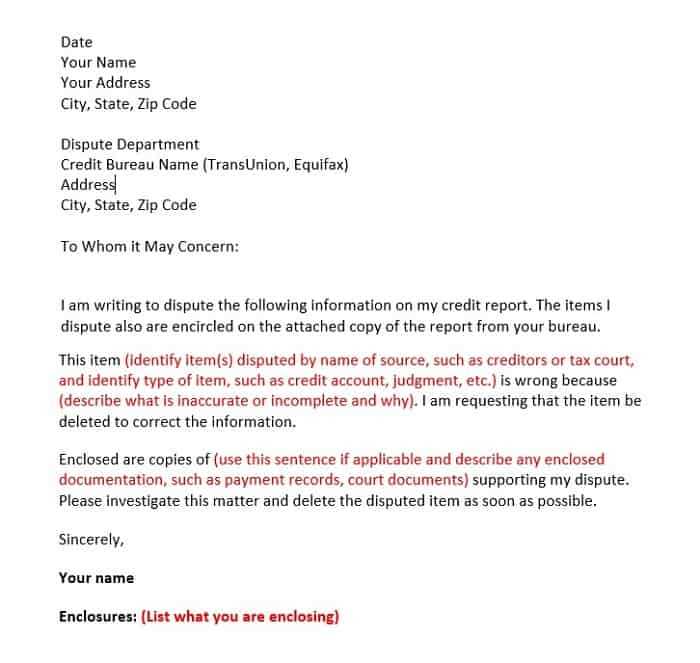

Overview of Credit Dispute Letters

When errors or inaccuracies appear in personal financial records, it’s important to take action to have them corrected. A formal communication sent to the appropriate institution is often the first step in addressing such issues. These requests are meant to challenge the inaccuracies, providing clear explanations and evidence to support the claim. Understanding the structure and content of these communications can make a significant difference in the outcome.

The purpose of such messages is to prompt an investigation into the identified mistakes. They serve as a request for validation, seeking clarification or rectification where necessary. The success of these efforts depends largely on the clarity and accuracy of the information presented. Below is a brief overview of the key elements that should be included in such communications:

| Element | Purpose |

|---|---|

| Sender’s Information | Identifies the person initiating the request. |

| Recipient Details | Ensures the communication is directed to the correct organization. |

| Issue Description | Clearly outlines the specific error being challenged. |

| Supporting Evidence | Provides any documents that validate the claim. |

| Request for Action | Clearly states what correction is being requested. |

By adhering to a clear format and including all necessary information, these communications become a powerful tool for individuals seeking to correct inaccuracies and protect their financial reputation.

Streamlining the Dispute Process

The process of addressing errors in your financial records can be overwhelming and time-consuming. However, taking the right approach and using the appropriate resources can significantly simplify the entire procedure. By following a structured and straightforward method, you can reduce the complexity of the situation, allowing for quicker resolution and a higher chance of success.

One effective way to streamline the process is by using pre-structured materials that guide you through each step. These resources are designed to eliminate the guesswork, offering a clear path from start to finish. Efficiency is achieved by ensuring that all necessary details are included, eliminating the need to worry about missing key information or miscommunication.

Additionally, maintaining a professional tone and format is essential for a successful outcome. These pre-designed documents help ensure that your request is well-organized and meets the standards required by financial institutions. Consistency in your approach also boosts your credibility and increases the likelihood of a prompt and favorable resolution.

Key Features of Effective Templates

When selecting resources to address inaccuracies in personal records, it’s important to understand the essential features that make them effective. A well-designed resource ensures that all necessary information is included, properly formatted, and easy to understand. The following elements are critical in ensuring that these materials serve their purpose efficiently.

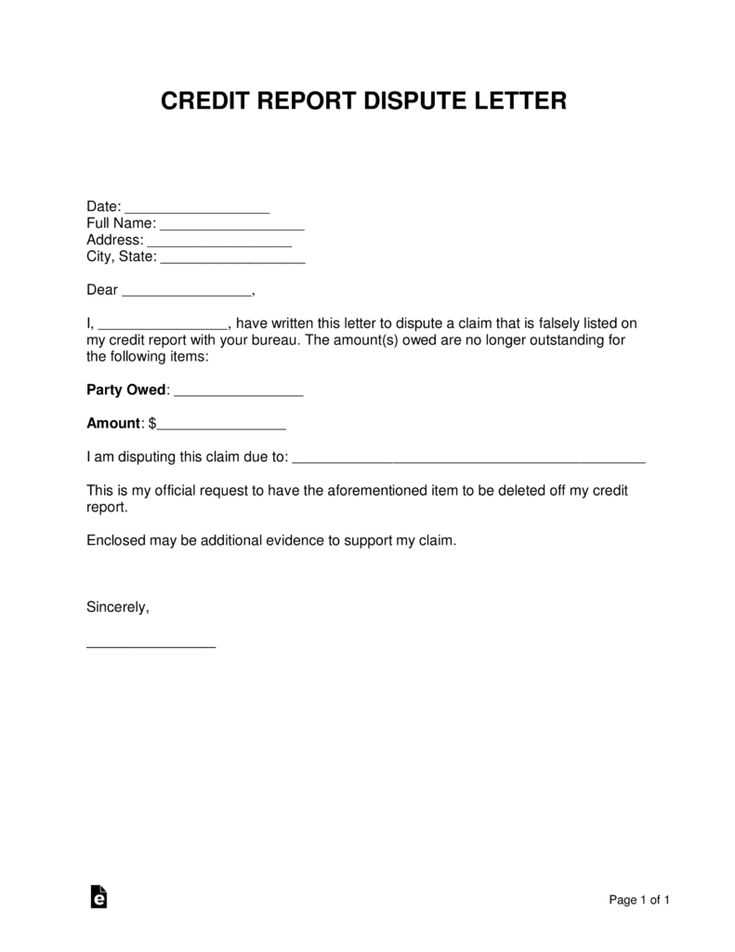

Clear Structure

One of the most important aspects of an effective resource is a clear, easy-to-follow structure. A well-organized document allows for a smooth and streamlined process, guiding the user step by step through the necessary actions. Key components typically include:

- Personal information at the beginning

- Specific details about the issue being addressed

- Request for action or resolution

Concise Language

Effective resources use language that is both concise and straightforward. The clarity of the message is crucial in ensuring that the recipient fully understands the situation and the requested action. This helps to avoid confusion and increases the likelihood of a timely resolution. Essential qualities of concise language include:

- Avoiding unnecessary jargon or complex wording

- Focusing on key facts and relevant details

- Maintaining a professional and respectful tone

By incorporating these key features, the process of resolving discrepancies becomes more efficient and less prone to error. Whether you’re handling it yourself or using a structured resource, having a clear and straightforward format is vital for success.

What to Look for in a Template

When searching for a useful resource to address issues in your personal records, it’s important to know which features will ensure its effectiveness. Not all materials are created equal, and understanding what to prioritize can make a significant difference in the outcome. The right tool should provide clarity, ease of use, and structure, allowing you to communicate your concerns efficiently.

First and foremost, look for a resource that offers a clear, logical format. It should break down each step of the process and guide you in presenting the necessary details. A well-organized document makes it easier to communicate your point and avoids any confusion that could delay a resolution. The simpler and more straightforward the structure, the better.

Next, check for accuracy and relevance. The content should be up-to-date and applicable to your specific situation. Whether you’re dealing with a specific error or a general issue, the material should help you articulate your request in a precise manner. Pay attention to the examples or instructions included, as these can help tailor the document to your exact needs.

Finally, ensure that the tone of the document is professional and respectful. While addressing a problem, maintaining a polite and composed demeanor is essential to increase the chances of receiving a positive response. The best resources will guide you in crafting a message that strikes the right balance between firmness and courtesy.

Common Mistakes in Dispute Letters

When addressing inaccuracies in financial records, it’s essential to avoid common mistakes that can undermine the effectiveness of your communication. A poorly structured or unclear message can result in delays or even a failure to resolve the issue. Being aware of these common errors can help ensure that your request is clear, professional, and impactful.

Some of the most frequent mistakes include:

- Vague or incomplete information: Failing to provide enough details about the issue can confuse the recipient and delay the process. Always ensure that you are specific about the error and provide supporting evidence when necessary.

- Unprofessional tone: While it’s important to be firm about the need for action, maintaining a respectful and professional tone is key to achieving a positive response.

- Not following proper format: A disorganized document can be hard to read and may miss key elements, such as personal information or a clear request. Ensure that the structure is logical and all important details are included.

- Excessive detail: Including too much irrelevant information can make your request confusing. Stick to the facts and focus on the core issue to keep the communication concise.

- Failure to review: Overlooking mistakes in spelling, grammar, or formatting can make your message appear unprofessional. Always proofread your document before sending it.

Avoiding these mistakes will increase the likelihood that your communication is well-received and that your concerns are addressed in a timely manner.

Avoiding Errors for Better Results

Achieving a successful resolution when addressing inaccuracies in your personal records requires attention to detail and careful communication. Common mistakes can lead to unnecessary delays or complications, which is why it’s crucial to ensure that your message is clear, concise, and properly structured. By avoiding these errors, you increase the likelihood of your request being processed quickly and effectively.

Double-Check Your Information

One of the most critical steps in ensuring a positive outcome is verifying that all the details you provide are accurate and up-to-date. Missing or incorrect information can significantly slow down the process, as the recipient may need to request additional clarification or documentation. Always review the details before submission to ensure everything is correct.

Maintain a Professional Tone

It’s essential to approach the situation with a calm and respectful attitude. Using a firm yet polite tone helps convey your seriousness without appearing confrontational. Remember that the goal is to resolve the issue, not escalate it. Clear communication combined with professionalism often leads to better results.

By being mindful of these simple but crucial elements, you can avoid unnecessary complications and make the process smoother, increasing the chances of a favorable resolution.