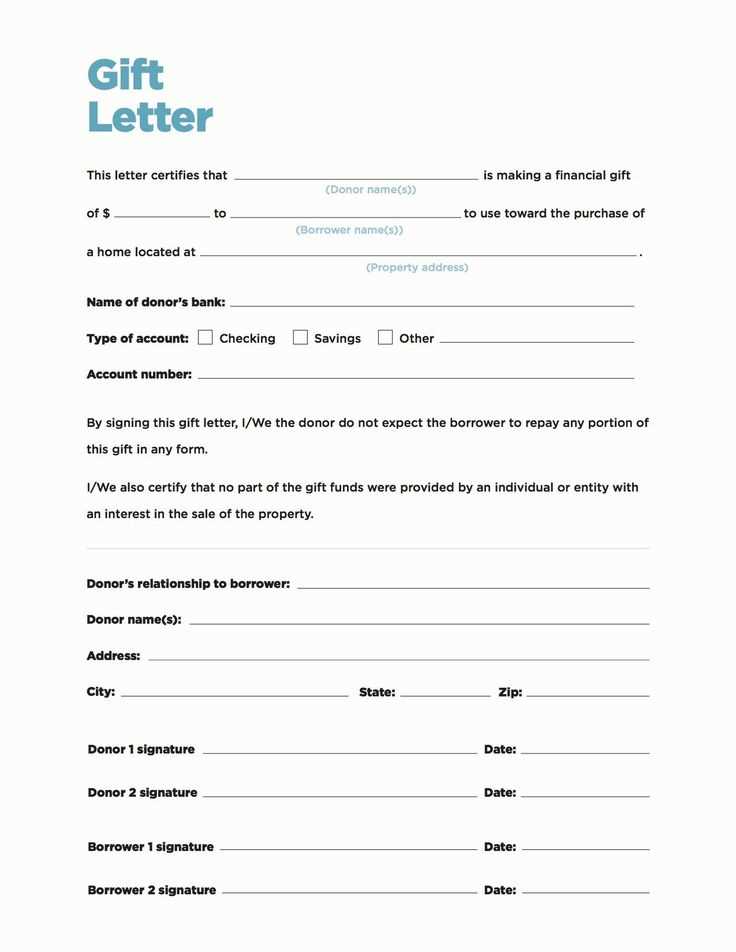

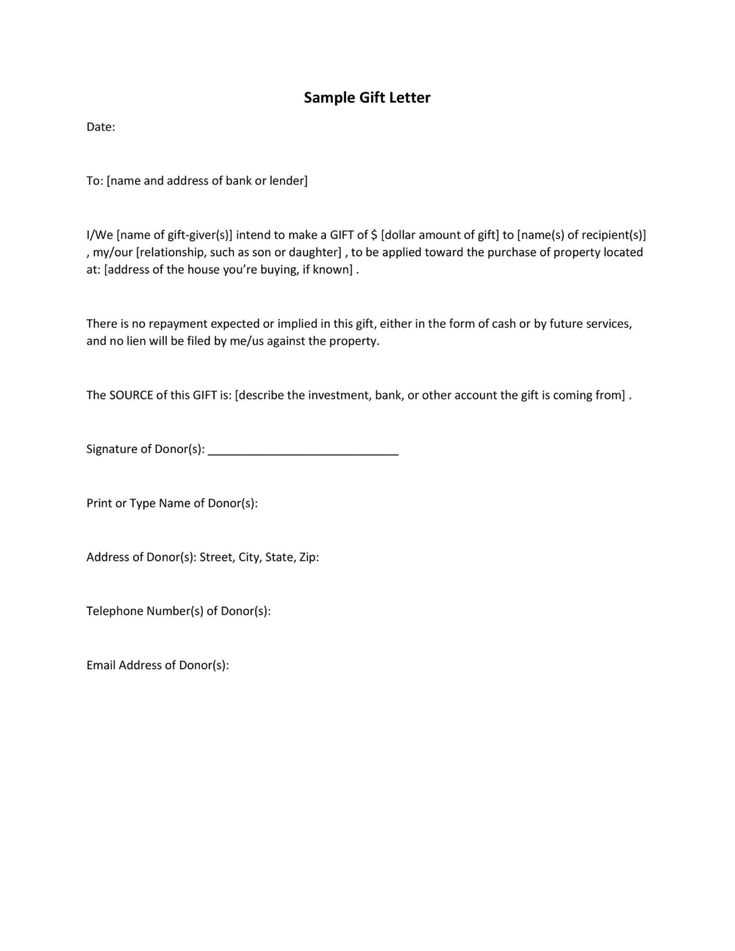

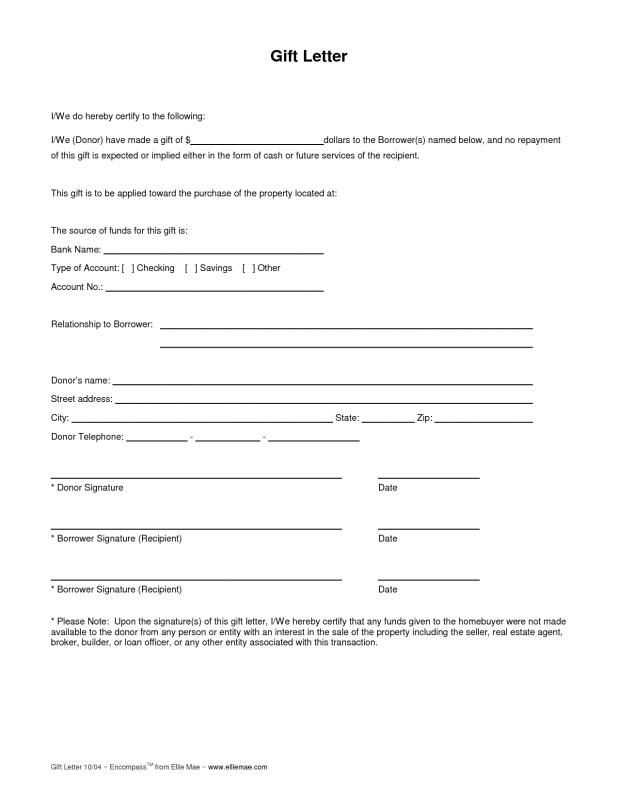

Gift Letter Template for Home Purchase

When acquiring real estate, sometimes external financial support is necessary. This can come from family, friends, or other individuals offering help to cover a portion of the costs. To ensure transparency and meet lender requirements, it’s important to provide a formal statement detailing the nature of this assistance. This document must clearly specify that the funds are a gift and not a loan, eliminating any confusion during the approval process.

Key Elements to Include in Your Statement

To make sure the document meets all necessary criteria, it should include the following essential information:

- Donor’s Information: Name, relationship to the buyer, and contact details.

- Amount Given: The total sum being provided.

- Declaration of No Repayment: A clear statement that the money is not expected to be paid back.

- Signature: Both the recipient and the person providing the funds should sign it.

- Date: Include the date the assistance is offered.

Step-by-Step Instructions for Crafting the Document

Creating the statement doesn’t need to be complicated. Start by addressing the document to the lender. Begin with the donor’s details, followed by the amount of financial help being provided. Include a brief explanation that the funds are a gift with no repayment required. Finally, ensure both parties sign the document, confirming its authenticity and acceptance.

Common Mistakes to Avoid

While the document is straightforward, certain errors can delay approval. Avoid the following:

- Failure to include necessary details such as the donor’s relationship or contact information.

- Ambiguity about whether the funds are a gift or a loan.

- Missing signatures or dates.

How This Statement Affects the Approval Process

Lenders require this type of document to verify that the buyer is not taking on additional debt. By clearly stating the money is a gift, they ensure that the buyer’s financial situation is accurately represented. This can speed up the approval process and make it more likely to be accepted without complications.

Understanding the Document for Financial Assistance in Property Acquisition

When seeking to acquire real estate, many buyers receive financial support from family or friends to help cover part of the cost. This support must be formally documented to meet lending requirements. The document serves as proof that the funds provided are a gift and not a loan, ensuring that the borrower’s financial situation is clearly represented for the lender.

Key Details to Include in the Document

The document must include specific information to avoid any confusion during the approval process. Essential elements include:

- The donor’s name, contact details, and relationship to the buyer.

- The exact amount being provided as support.

- A statement confirming that the funds are a gift and will not be repaid.

- Both parties’ signatures and the date the support was offered.

How This Document Supports Loan Approval

Lenders require clarity on any additional financial assistance a buyer might receive. This document proves that the buyer is not incurring new debt, making them a more reliable borrower. By confirming that the money is a gift with no repayment expectation, the buyer’s financial situation becomes transparent, speeding up the approval process and increasing the chances of securing a loan.

When writing the document, it’s crucial to ensure that all necessary details are provided to avoid delays. Incomplete or unclear statements may result in rejection or further scrutiny from the lender. Being meticulous and thorough with this paperwork will help streamline the mortgage process.