How to Use the 609 Letter Template for Credit Disputes

If you’ve discovered errors in your credit report, it is essential to know the best way to address them. One effective method involves crafting a formal document to request the removal of inaccuracies. This process can help clear up any mistakes that might negatively impact your credit score and overall financial standing. Taking action is important, as correcting these discrepancies can open doors to better financial opportunities.

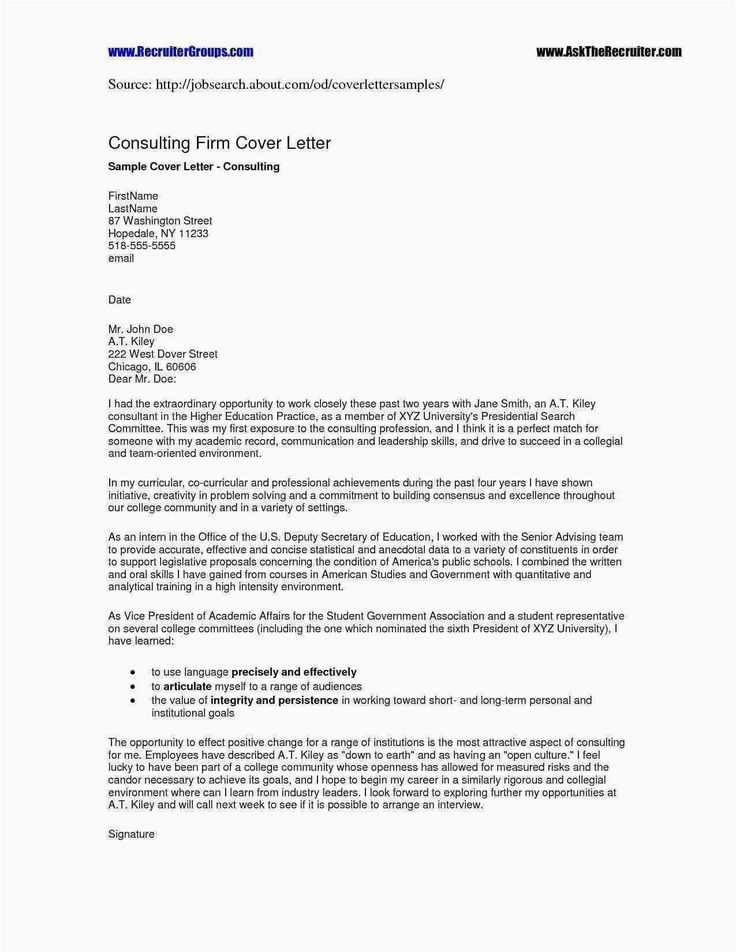

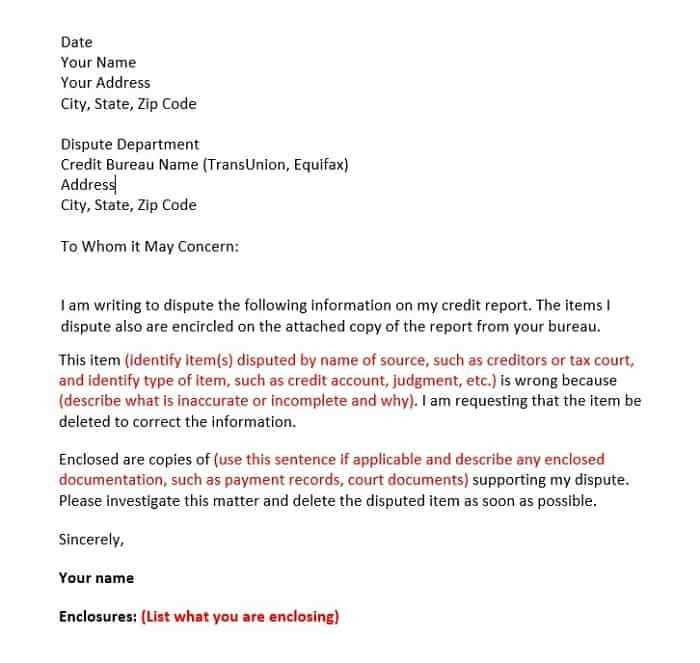

In order to initiate a dispute, you’ll need to create a well-structured communication that clearly identifies the issue and provides supporting evidence. This written request should outline your case in a concise manner, ensuring the recipient understands the problem and your expectations. Knowing the right format for this correspondence can make the entire process more efficient and increase your chances of success.

By following a specific structure, you can enhance your chances of getting a timely resolution. Understanding the proper approach and format for this kind of communication is crucial. A carefully crafted message not only demonstrates your seriousness but also ensures that all necessary details are included for a swift review and decision-making process.

Here’s the Revised Version Without Repeated Words:

When crafting a formal communication for correcting inaccuracies in your financial record, it’s important to ensure that the message is clear, concise, and free from unnecessary repetition. Each section should provide essential details without overusing the same terminology. This not only enhances readability but also maintains a professional tone that increases the likelihood of a successful dispute resolution.

Effective Structure

The structure of the message is critical in making a strong case. It should begin with an introduction, followed by a clear explanation of the issue. Supporting evidence should be included in a manner that is easy to understand, demonstrating the error and the steps taken to correct it. This organized format allows the recipient to quickly assess the problem and respond appropriately.

Avoiding Redundancy

In order to keep the communication impactful, it’s essential to avoid repeating the same terms or phrases. Use varied vocabulary to convey the message clearly and professionally. By doing so, you ensure that your communication remains engaging and demonstrates your attention to detail, which can positively influence the review process.

Understanding the Dispute Process

What Is the Purpose of This Document?

How to Draft a Dispute Request

Common Errors to Avoid in the Communication

How the Document Affects Your Credit Score

When to Submit the Form

Tracking the Status of Your Dispute

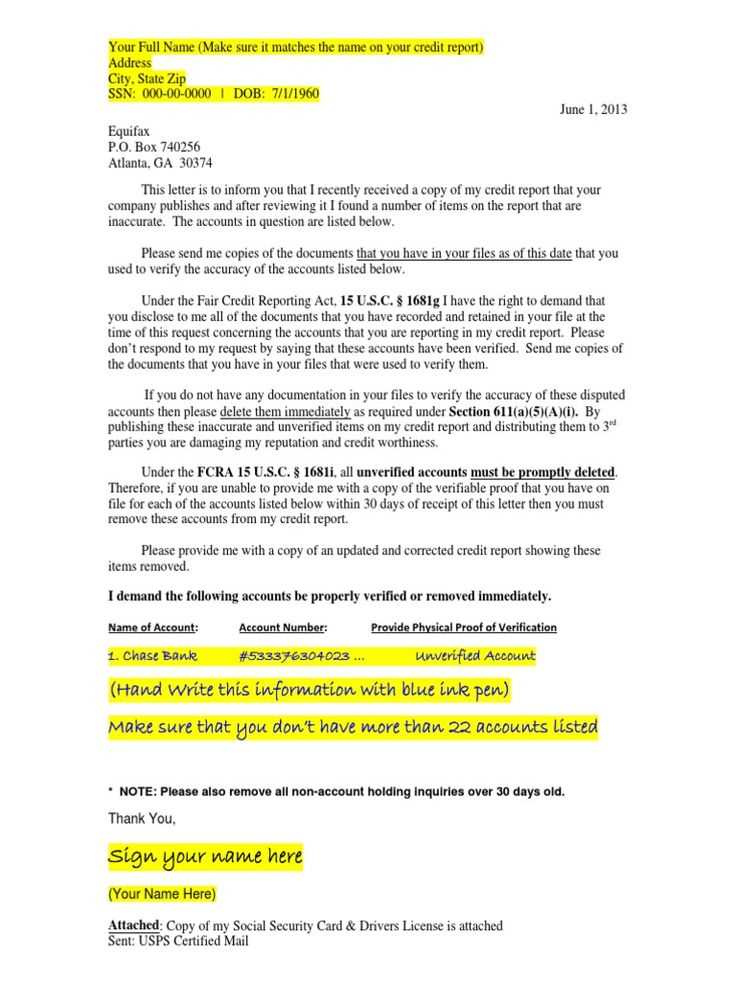

When facing discrepancies on your credit report, it’s essential to know the proper procedure for addressing the issue. By initiating a formal dispute, you can request the correction or removal of inaccurate information. A well-crafted request increases the likelihood of a successful outcome, ensuring that your financial history is accurately represented. This process is designed to protect consumers from errors that could negatively impact their credit scores.

The main goal of this document is to formally challenge any inaccuracies in your credit report. Whether it’s an erroneous late payment, incorrect account balance, or other errors, the purpose is to bring the mistake to the attention of the credit bureaus. Once the dispute is received, they will investigate the claim, and if the information is proven incorrect, they are required to update your record.

To write an effective dispute request, you need to be precise and provide clear evidence. This means detailing the error, providing supporting documentation, and articulating your request in a professional manner. A structured and formal approach is crucial for getting the desired results.

Common mistakes when drafting these requests include vague descriptions of the error, failing to include necessary documentation, and using overly emotional language. Avoiding these pitfalls ensures that your dispute is taken seriously and processed quickly.

Submitting an inaccurate record correction request can significantly influence your credit score. If successful, the correction may lead to a higher score, which in turn can improve your financial standing and eligibility for loans or credit. It’s essential to understand how this request interacts with credit reporting agencies to anticipate its potential impact.

Timing is also crucial. You should send the dispute request as soon as you identify the error, but also ensure that you’re providing enough time for the credit bureau to conduct its investigation. Some cases may require follow-ups or further documentation, so staying informed on the process is key.

After submitting the dispute, tracking its progress will keep you informed about any updates. Credit reporting agencies are required to respond within a specific time frame, and knowing how to follow up can help speed up the resolution. By checking the status regularly, you can ensure that your case is being handled appropriately.