Outstanding Payment Letter Template for Professional Reminders

When clients fail to fulfill their financial obligations, it is essential to send a formal reminder to encourage timely resolution. Crafting a clear and respectful communication can make all the difference in recovering funds while maintaining good business relationships. The right approach not only ensures you get paid but also keeps your professionalism intact.

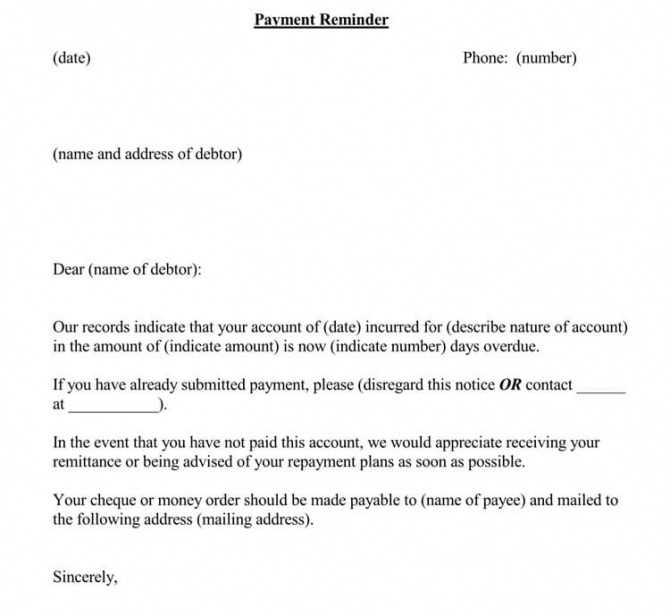

Key Elements of a Professional Reminder

A well-structured message should contain all the necessary information to help the recipient understand the importance of settling their account. Here are the crucial components:

- Clear Identification: Include the recipient’s name and relevant details about the transaction.

- Respectful Tone: Keep the language courteous yet firm to maintain professionalism.

- Specific Amount Due: Mention the exact amount owed along with the due date.

- Deadline for Resolution: State a clear deadline for payment or the next steps if payment is not made.

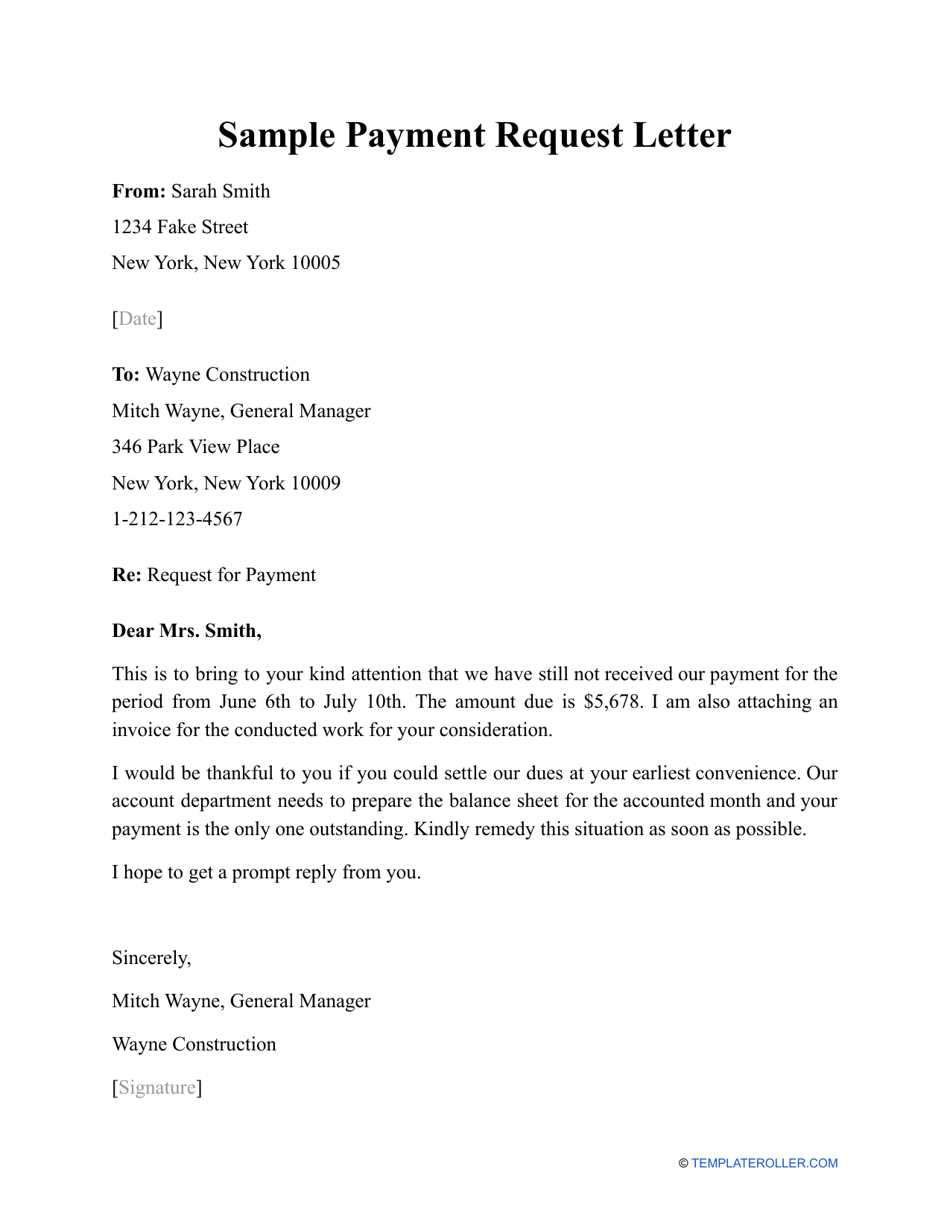

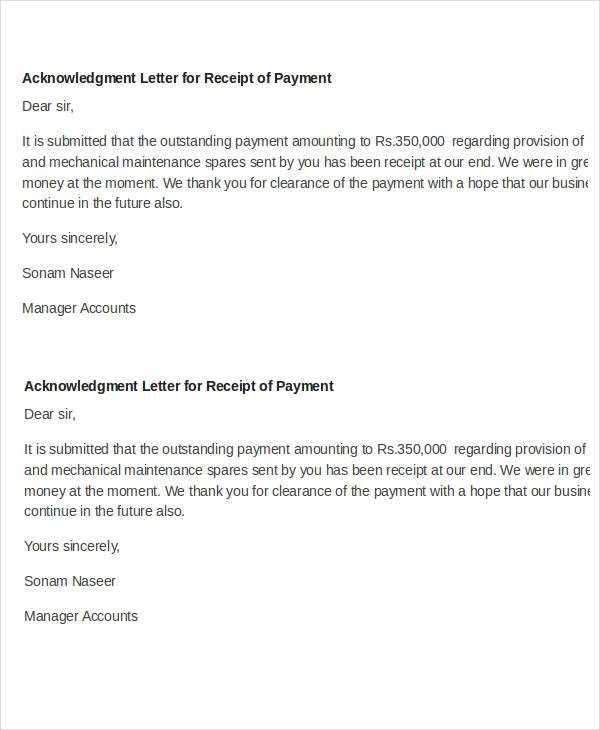

Crafting a Concise and Polite Message

Even though the request concerns money, it is crucial to approach it with tact. Use a polite but firm tone, ensuring the client feels the need to act without feeling reprimanded. A well-crafted message is not only a request but a reminder of the importance of financial obligations in a business relationship.

Customizing the Request for Different Situations

Depending on the nature of the client relationship or the context, the reminder can vary in terms of urgency and tone. For long-standing customers, a gentle nudge might suffice, while for newer clients, a more direct approach may be necessary. Adjust the communication to align with the situation at hand.

Best Practices for Effective Communication

- Timeliness: Send the reminder as soon as a payment becomes overdue to show urgency.

- Follow-Up: If no response is received, send a follow-up message, reminding them of the consequences of non-payment.

- Clear Contact Information: Ensure your contact details are easily accessible in case the client needs to discuss the matter further.

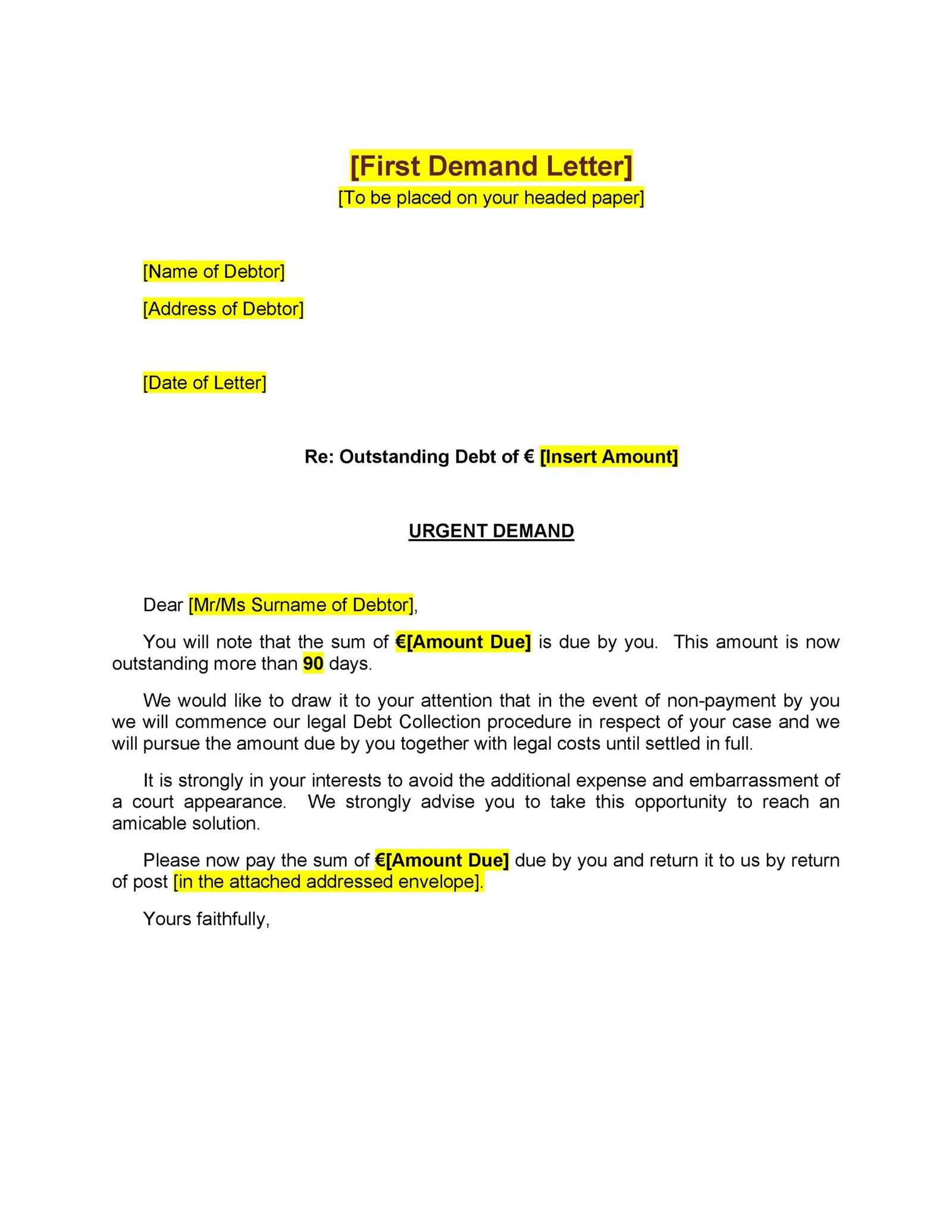

Why Use a Formal Request for Unsettled Balances

When clients have not settled their debts, a well-crafted reminder can encourage swift action without damaging business relationships. It serves as a professional nudge, prompting them to fulfill their obligations while preserving mutual respect. A clear and direct approach ensures that both parties understand the urgency without causing unnecessary tension.

Key Elements of an Effective Request

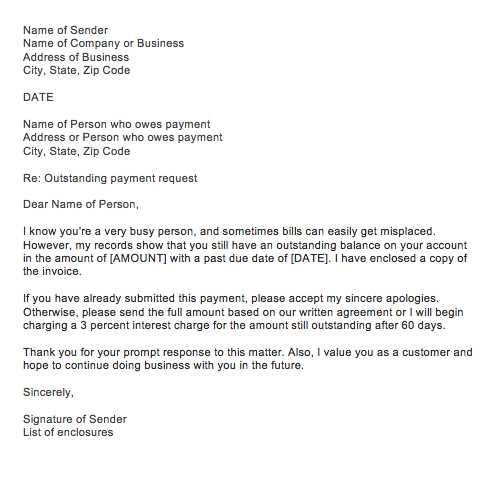

A successful request should be clear and to the point, highlighting the necessary details. Key components include:

- Client Identification: Clearly state the recipient’s details and transaction history.

- Amount Due: Specify the exact sum required and the due date to avoid confusion.

- Polite Yet Firm Tone: Maintain professionalism with a balance of courtesy and urgency.

- Action Required: State the next steps and any potential consequences if the issue remains unresolved.

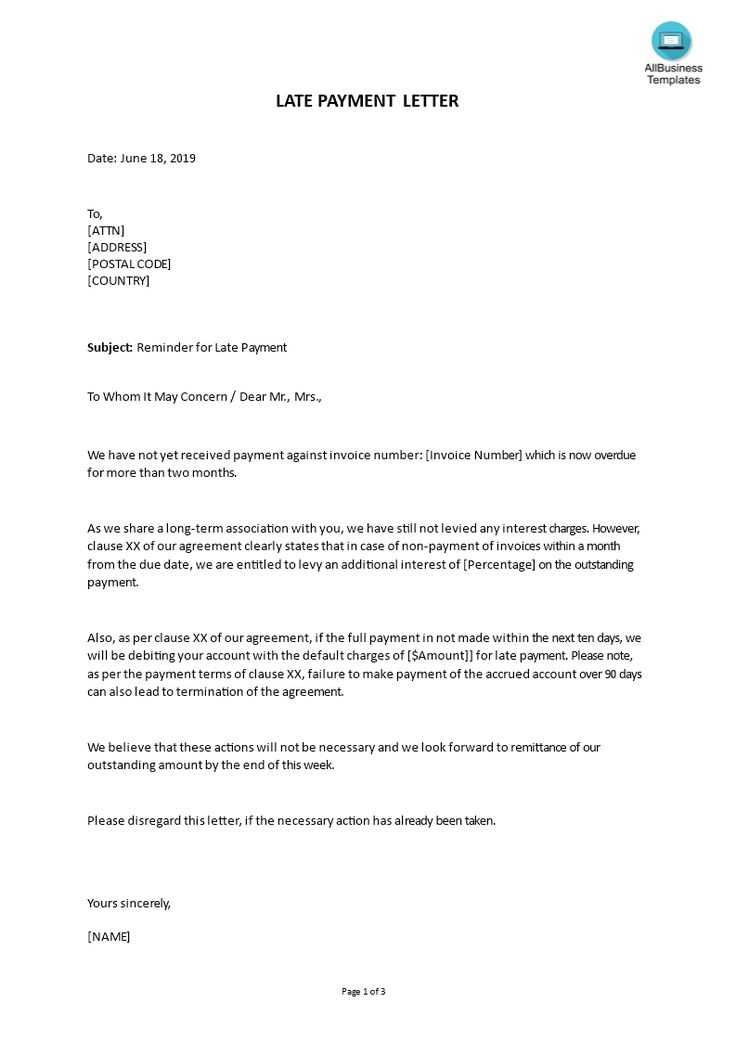

Common Errors to Avoid in Requests

While drafting a formal request, avoid certain pitfalls that can undermine its effectiveness:

- Unclear Information: Ensure all necessary details are included, such as transaction specifics and due dates.

- Overly Harsh Language: While it’s important to be firm, excessive harshness can damage the relationship.

- Failure to Include a Deadline: Without a clear timeframe, the recipient may not feel a sense of urgency.

By staying clear, courteous, and precise, you will increase the likelihood of prompt payment while fostering positive ongoing business relations.

Best Practices for Sending Requests

- Send Timely Reminders: The sooner the reminder is sent after a missed payment, the better the chances of resolution.

- Follow-Up: If you don’t receive a response, consider sending a follow-up message to reiterate your request.

- Offer Payment Options: Flexibility in payment methods can help expedite the settlement process.