Mortgage Discharge Letter Template and Guide

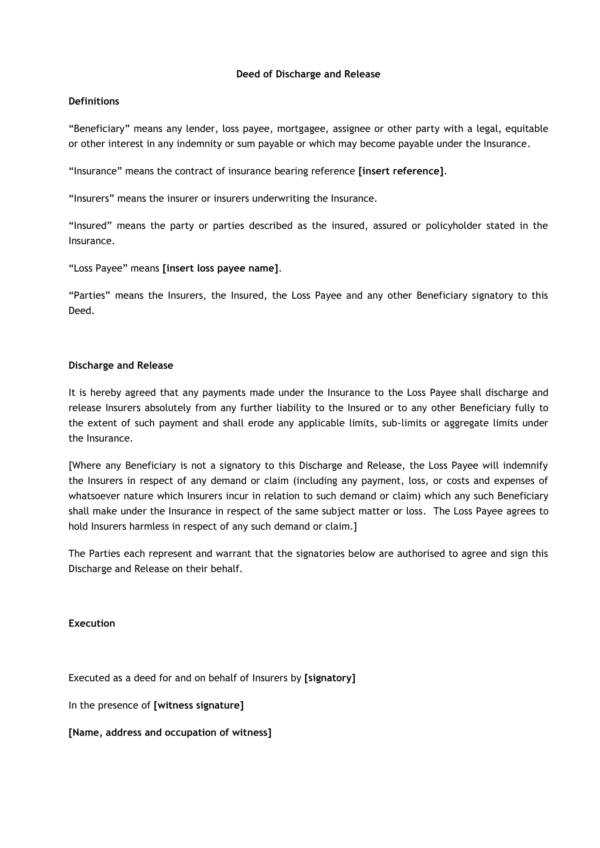

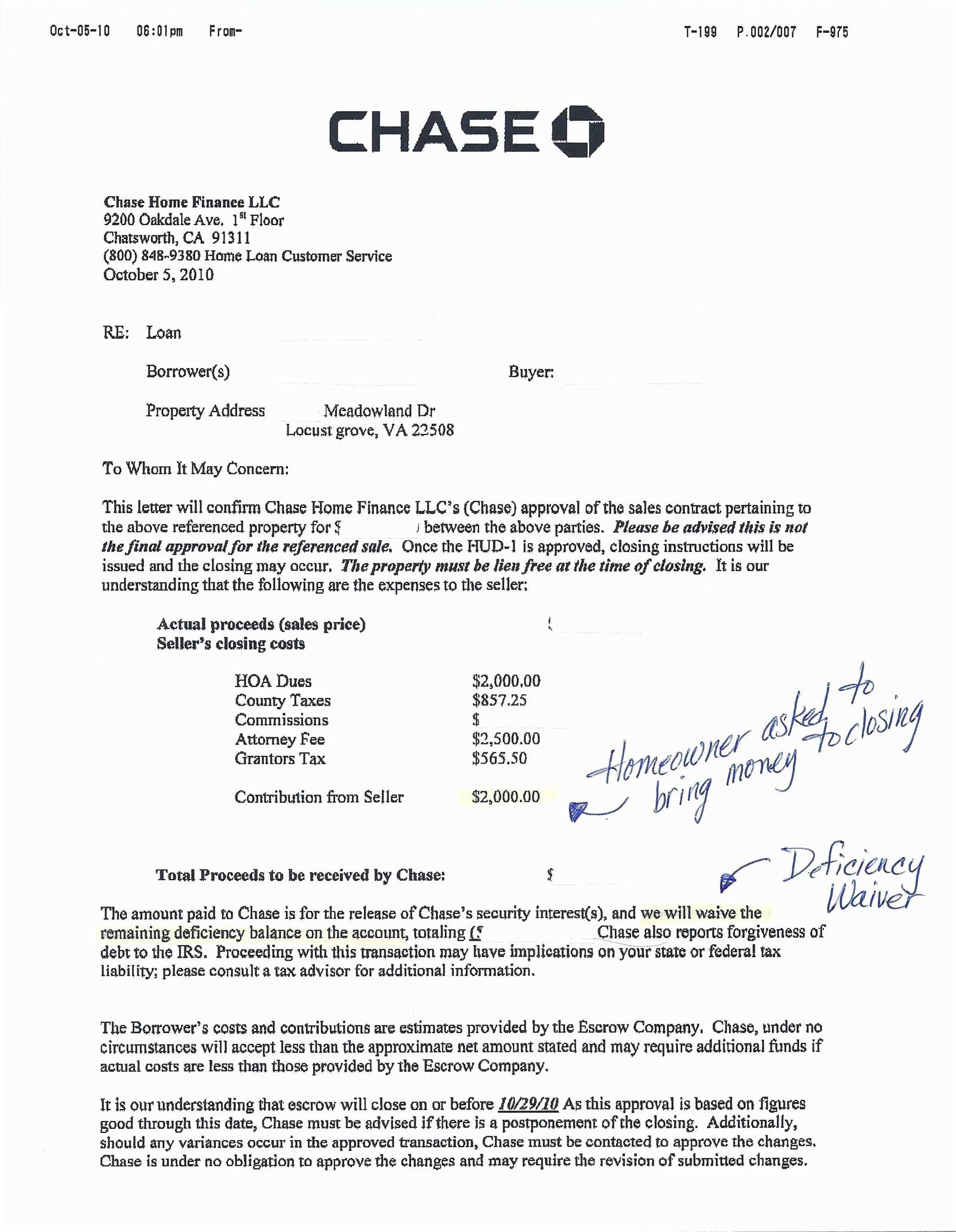

When you complete your financial obligations with a lender, it’s important to have proper documentation that proves the loan has been fully settled. This document is essential for both legal and personal records, ensuring that you no longer owe any money to the institution. Knowing how to create this document, as well as the necessary components, can help simplify the process and avoid potential misunderstandings in the future.

Why This Document is Important

Once your financial agreement is fulfilled, obtaining a formal statement from the lender is crucial. It serves as proof that the debt has been cleared and protects both parties in case of any future claims or disputes. Additionally, it is often required by institutions to update their records and to facilitate the release of any collateral tied to the loan.

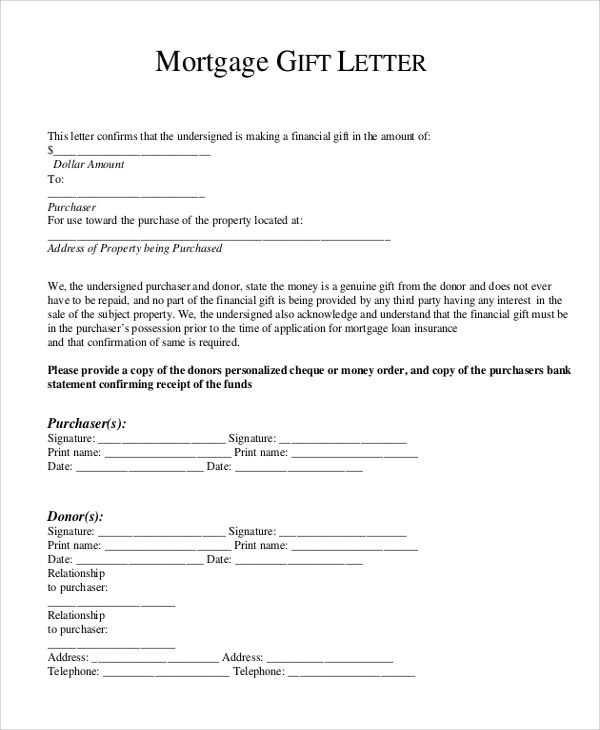

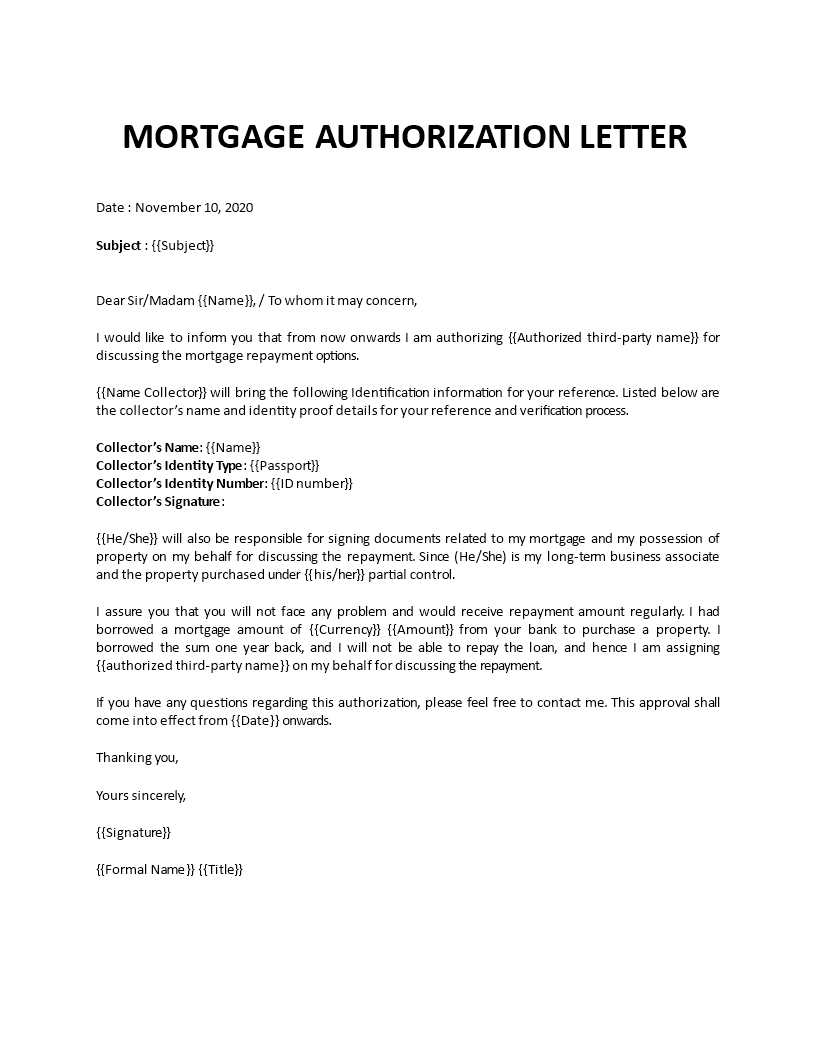

Key Components of the Document

- Identification Information: Full names of both the borrower and lender, along with any relevant account numbers or loan details.

- Statement of Settlement: A clear declaration that the loan has been paid off in full and that there are no remaining balances.

- Signatures: Signatures from both parties involved, acknowledging the completion of the agreement.

- Loan Details: Any specifics regarding the original loan terms and payment history.

How to Create the Document

Creating a formal statement of loan satisfaction involves following a structured format. Begin by addressing the lender’s institution and including all necessary details such as the borrower’s and lender’s information, loan number, and full payment amount. Ensure that the statement clearly indicates the loan is fully settled and include a request for the lender’s official confirmation. Finally, sign the document and make sure the lender provides their confirmation as well.

Common Mistakes to Avoid

There are several common errors that individuals may make when drafting this type of document. One of the most frequent mistakes is failing to include all the correct account information, which can delay or invalidate the process. Another common issue is the lack of official signatures from both parties, which makes the document legally unenforceable. Always ensure that every detail is accurate and complete to avoid complications.

Understanding Loan Clearance Documentation and Its Importance

When you have fully repaid a loan, it is essential to obtain formal documentation from the lending institution confirming that the debt has been cleared. This official paper serves to release both parties from any further obligations and ensures that the records are updated accurately. Understanding the steps to create this document and knowing its components can help you avoid any complications during the process.

Why You Need a Release Document

Once the loan is settled, receiving an official statement is crucial for your personal records. It serves as proof that the outstanding balance has been paid off and protects you from any potential future claims by the lender. This document is also necessary to ensure that no further actions can be taken against you, such as the repossession of collateral or additional fees.

How to Create a Loan Release Statement

Creating a proper release statement requires attention to detail. Start by including the full names of the borrower and lender, along with any relevant loan account numbers. The document should clearly state that the debt is fully paid and that no balance remains. Additionally, the statement should include the date of settlement and any relevant loan terms, along with signatures from both parties involved to validate the completion.

Common Mistakes in Release Requests

One common error is failing to provide the correct account or loan details, which can delay the process. Another mistake is not obtaining the necessary signatures or failing to ensure that both parties acknowledge the release. Inaccurate or incomplete information can lead to misunderstandings, so it is important to double-check all details before submission.

Key Information for Loan Release Forms

To create a valid release document, you must include essential details, such as the borrower’s name, lender’s name, loan number, the total amount paid, and the date of settlement. Additionally, you should ensure that the document confirms that all terms of the agreement have been fulfilled and that there are no remaining balances or obligations. A proper release document should also include both parties’ signatures for legal validity.

Where to Find Release Letter Templates

Many online resources offer free templates that can guide you in creating a release statement. These templates typically include the necessary sections and structure required for a valid document. Make sure to use a reputable source to ensure the template is legally sound and up to date with current requirements. Customizing these templates with your loan-specific details will help you create a proper and effective release form.