Free 609 Letter Template for Credit Dispute

If you’ve noticed inaccuracies on your credit report, it can affect your financial standing. There are simple ways to challenge these errors, helping you improve your score and potentially secure better financial opportunities.

One effective approach is through a formal process where you request the removal of disputed information. This method is available to anyone seeking to correct misleading or outdated details that could be harming their creditworthiness.

By using a well-structured document, you can present your case clearly and legally. Such a request is a powerful tool in addressing incorrect entries, whether they involve late payments, outdated accounts, or mistaken debts. In this guide, we’ll explore how you can easily draft such requests and the advantages of doing so.

What is a 609 Letter Template

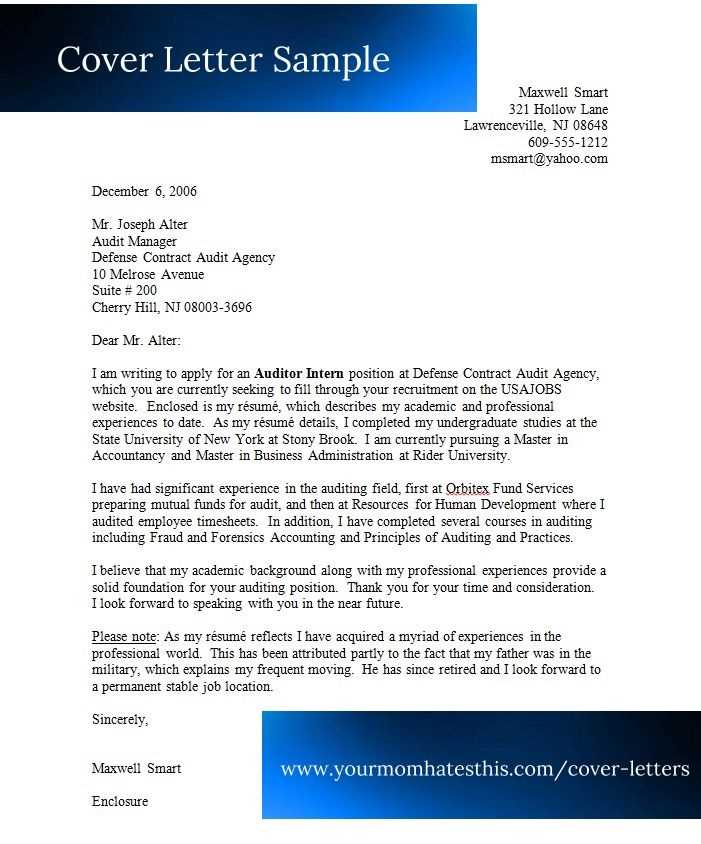

This document is a formal request used to challenge inaccuracies found on a credit report. It allows individuals to dispute misleading or outdated information that may negatively affect their credit score.

The primary goal of such a document is to ensure that only accurate and up-to-date data is reflected on a credit report. By following a structured approach, individuals can effectively communicate their concerns to credit reporting agencies, asking for corrections or removals of incorrect entries.

Often used in cases involving mistaken debts or outdated accounts, this request serves as a tool for consumers looking to improve their financial standing. It provides a clear, concise method to address discrepancies without the need for complex legal procedures.

How to Use a Free Template Effectively

Using a ready-made form for disputing credit report errors can simplify the process, but it’s important to tailor it to your specific situation. A well-structured form is only useful if the information it contains is accurate and relevant to your case.

Steps to Follow

- Ensure the details you’re disputing are correct. Review your credit report carefully before filling out the document.

- Personalize the information. Make sure all your contact details and the errors in question are clearly stated.

- Be concise. A focused request is more likely to be taken seriously, so avoid including unnecessary information.

What to Avoid

- Do not make vague claims. Be specific about which entries are incorrect and why.

- Avoid using unprofessional language. A formal tone increases the credibility of your request.

- Do not submit incomplete forms. Make sure every required field is filled out properly before sending.

By following these guidelines, you can maximize the effectiveness of your request and increase the chances of having the inaccuracies removed from your report.

htmlEdit

Understanding Credit Report Disputes

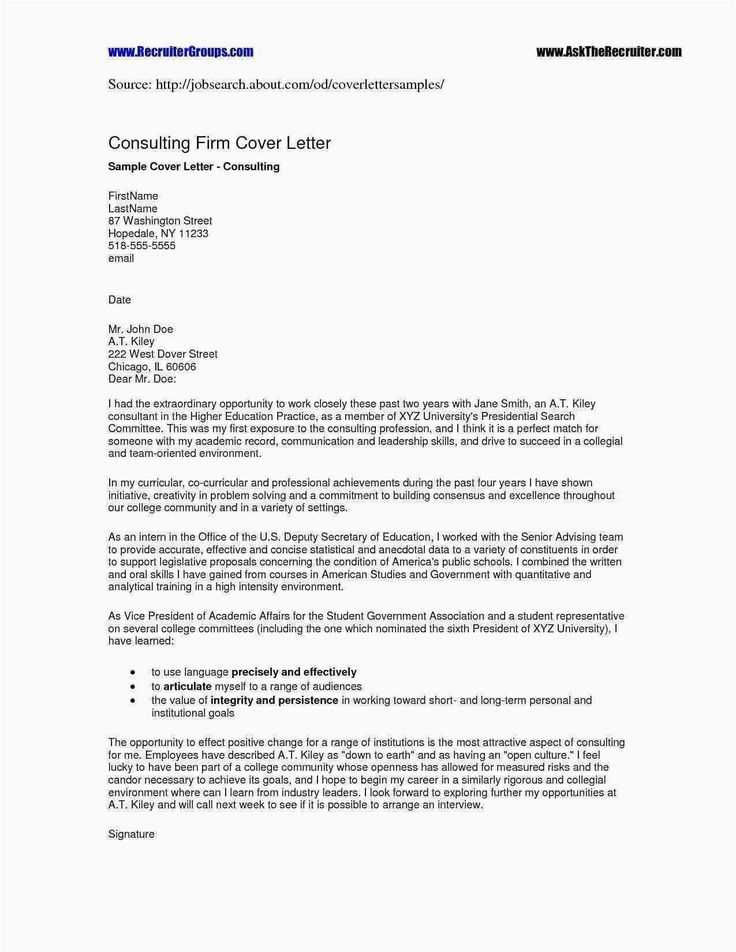

Disputing errors on a credit report is a crucial process for individuals aiming to ensure that their financial history is accurately represented. Mistakes on a credit report can negatively impact credit scores, potentially leading to unfavorable loan terms or even denials. It is important to know the correct steps to address discrepancies and how to effectively challenge incorrect entries.

Credit report disputes typically involve identifying inaccuracies in the information provided by credit bureaus and submitting a formal request for review. These discrepancies can range from incorrect account details to outdated or missing information. By addressing such issues, individuals can improve their financial standing and protect their future borrowing potential.

Properly handling disputes requires understanding the mechanisms in place for resolution. Credit agencies have a set process for investigating claims, which usually involves a period of review and response. Being informed about these procedures allows individuals to track the progress of their claims and take appropriate actions if necessary.

htmlEdit

Steps for Writing a Dispute Request

When challenging incorrect information on a credit report, crafting a clear and formal request is essential for an effective resolution. The process involves outlining discrepancies, providing supporting evidence, and ensuring that all communication is professional and precise. A well-written dispute can lead to a quicker investigation and correction of errors.

1. Identify the Inaccurate Information

The first step in the process is to thoroughly review your credit report and pinpoint the exact entries that are inaccurate. It is important to focus on specific details such as account numbers, balances, or any other discrepancies that do not reflect your actual financial history.

2. Provide Supporting Documentation

Once the discrepancies are identified, gather any relevant documents that can help prove the error. This might include bank statements, receipts, or any other records that demonstrate that the information on the report is incorrect. Be sure to include copies, not originals, to avoid losing important paperwork.

Organize your claim in a clear and logical manner, ensuring all relevant details are easily accessible. The more detailed and accurate your dispute, the more likely it is to be resolved swiftly and in your favor.

Clearly state your request by specifying the exact correction you are seeking. Avoid vague language and be direct about the changes you wish to see on your credit report.

htmlEdit

Avoiding Common Errors in Dispute Requests

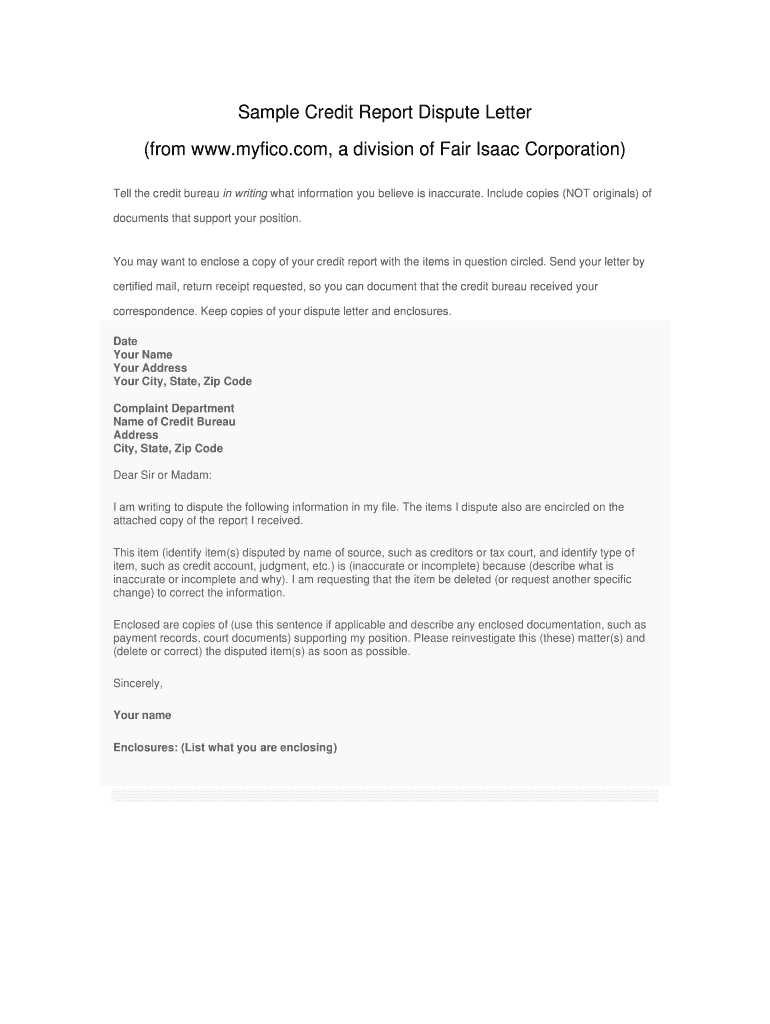

When challenging inaccuracies on a credit report, it is essential to avoid mistakes that could delay the resolution or reduce the effectiveness of your claim. Simple errors, such as providing incorrect information or failing to include necessary documentation, can lead to a longer review process or the rejection of your request. Understanding the most common errors and how to prevent them is crucial for a successful outcome.

| Common Error | How to Avoid It |

|---|---|

| Incorrect Account Information | Double-check the account details, such as numbers and balances, before submitting the request. Ensure accuracy to avoid confusion during the review process. |

| Failure to Include Supporting Documents | Gather all necessary evidence, such as receipts or statements, to back up your claim. Missing documents can cause delays or lead to the rejection of your dispute. |

| Vague or Ambiguous Language | Be specific and clear about the errors and the corrections you are requesting. Using clear, direct language helps prevent misunderstandings and ensures your request is processed efficiently. |

Attention to detail is key when filing a dispute. Avoiding these common errors will help ensure that your request is taken seriously and addressed in a timely manner.

htmlEdit

How Disputing Improves Your Credit Score

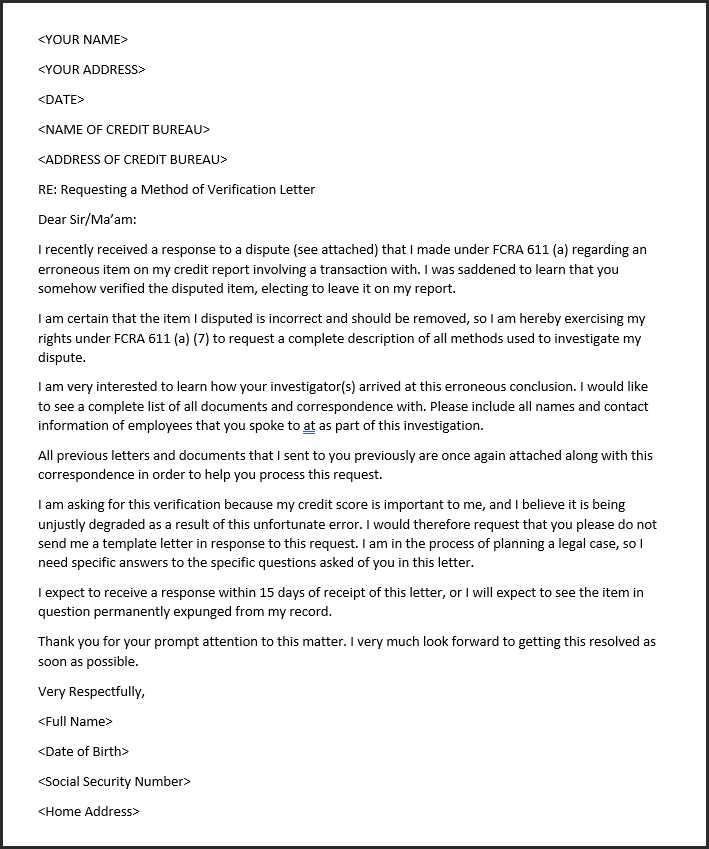

Challenging inaccuracies on your credit report can have a significant positive impact on your credit score. When incorrect information is removed or corrected, your overall financial profile becomes more accurate, potentially improving your creditworthiness. Addressing errors ensures that lenders have an accurate view of your financial history, which can lead to better loan terms and increased approval chances.

Removing Negative Entries

Incorrect entries, such as late payments or overdue accounts, can severely affect your credit score. Disputing these errors can result in their removal, leading to a direct improvement in your score. This is especially important if the mistake caused a negative impact that didn’t reflect your actual payment behavior.

Updating Outdated Information

Sometimes, outdated or irrelevant information can lower your credit score. For example, accounts that have been paid off or closed may still appear as active or outstanding. By disputing these inaccuracies, you can ensure that your credit report reflects your true financial status, which could lead to an increase in your credit score.