Proof of Auto Insurance Letter Template Guide

When dealing with transportation requirements, it is often necessary to present a formal statement that confirms the presence of appropriate coverage. This document serves as a verification of security, ensuring that the vehicle in question is properly protected in case of incidents. Below, you will find an outline for drafting such a document to meet various legal and organizational standards.

Core Information to Include

For clarity and to avoid delays, it is essential to include key data in the statement. Here are the necessary components:

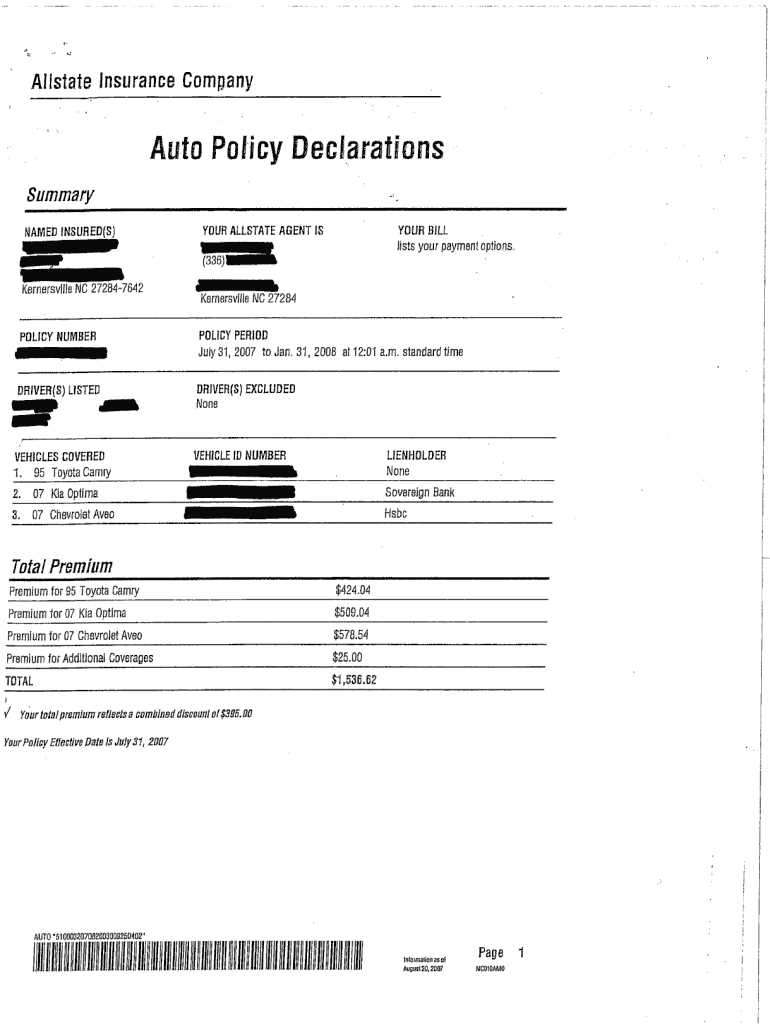

- Policy Holder’s Name: Identify the individual or entity covered.

- Vehicle Information: Clearly describe the vehicle by make, model, and identification number.

- Coverage Period: Specify the time frame during which the protection is valid.

- Provider Details: Include the name and contact of the coverage provider.

Steps to Draft the Document

Follow these steps to ensure the document is effective and meets all necessary criteria:

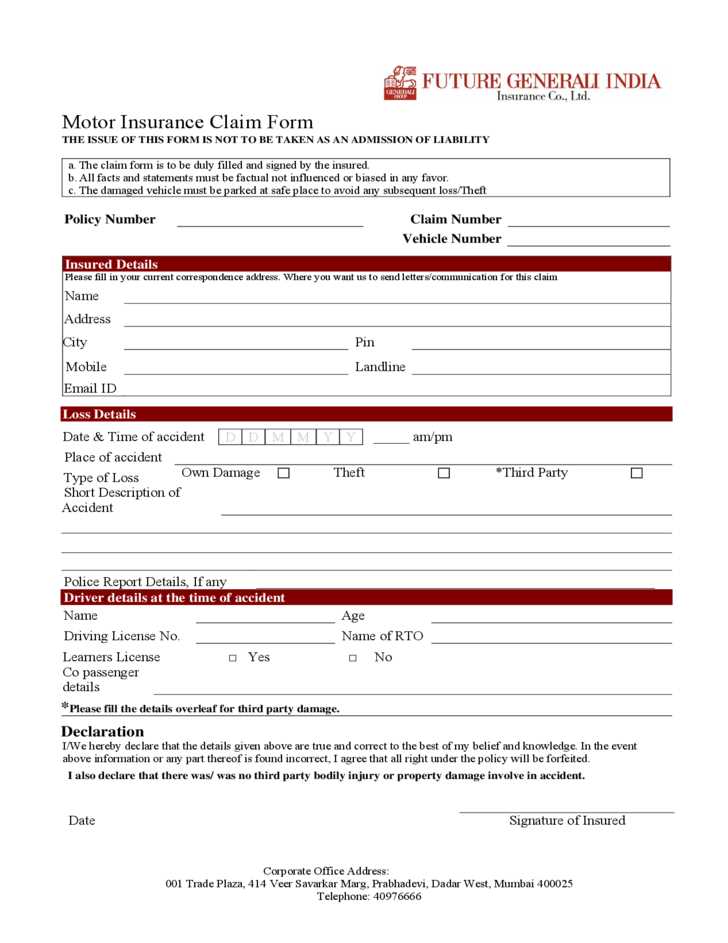

- Begin with a clear and concise declaration confirming the coverage.

- Include the relevant details about the vehicle and the owner.

- Provide contact information for the insurance provider.

- Verify the validity of the coverage dates and terms.

Common Issues to Avoid

While drafting this document, there are common pitfalls to avoid:

- Incomplete Information: Ensure all details are correct and up-to-date.

- Incorrect Dates: Double-check the validity period to avoid confusion.

- Unclear Language: Use simple and precise language to eliminate misunderstandings.

When and How to Submit

Once you have prepared the document, it is crucial to submit it within the required time frame. Depending on the purpose, whether for legal, registration, or financial reasons, timely submission can prevent unnecessary complications. Always keep a copy of the document for your records.

Understanding the Importance of Coverage Verification and Documentation

Having an official document that verifies a vehicle’s coverage is essential for various legal and financial processes. This document serves as a confirmation that the necessary protection is in place, whether for regulatory compliance, registration, or other administrative purposes. It is important to understand how to create a valid document, what information should be included, and how to avoid common mistakes to ensure that the document meets all requirements.

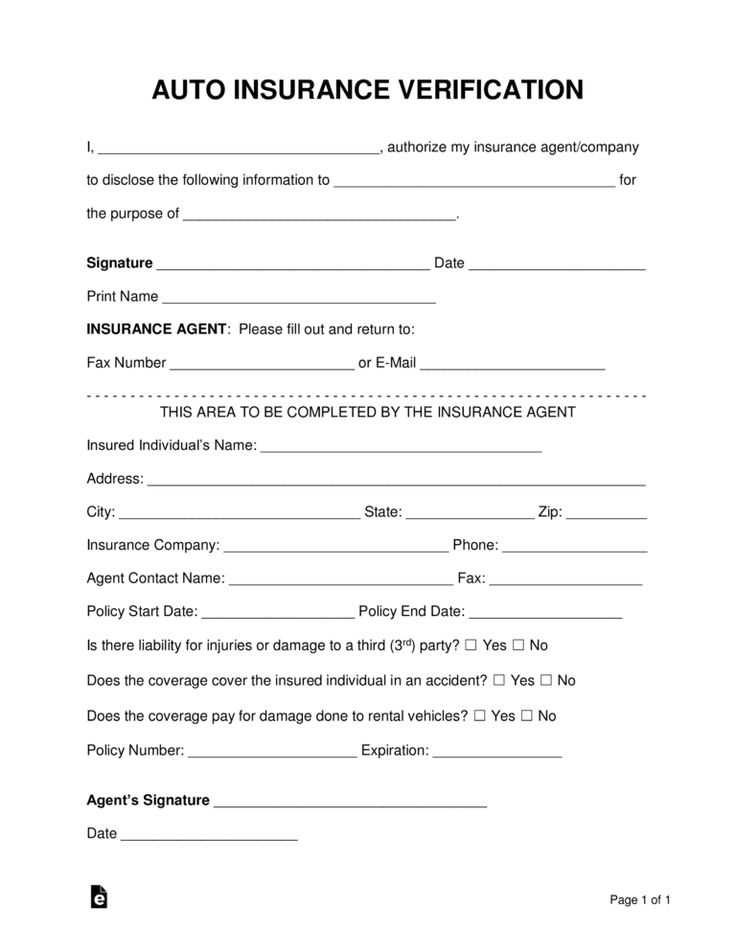

How to Create a Valid Verification Document

To create an effective and legally acceptable verification, follow a structured approach. Begin by clearly stating the presence of coverage, then provide relevant details such as the vehicle’s identification and the name of the provider. Ensure that the document is written in clear and formal language, without ambiguity, to avoid complications during verification processes.

Key Information to Include in the Document

The following elements are necessary to make the verification document valid:

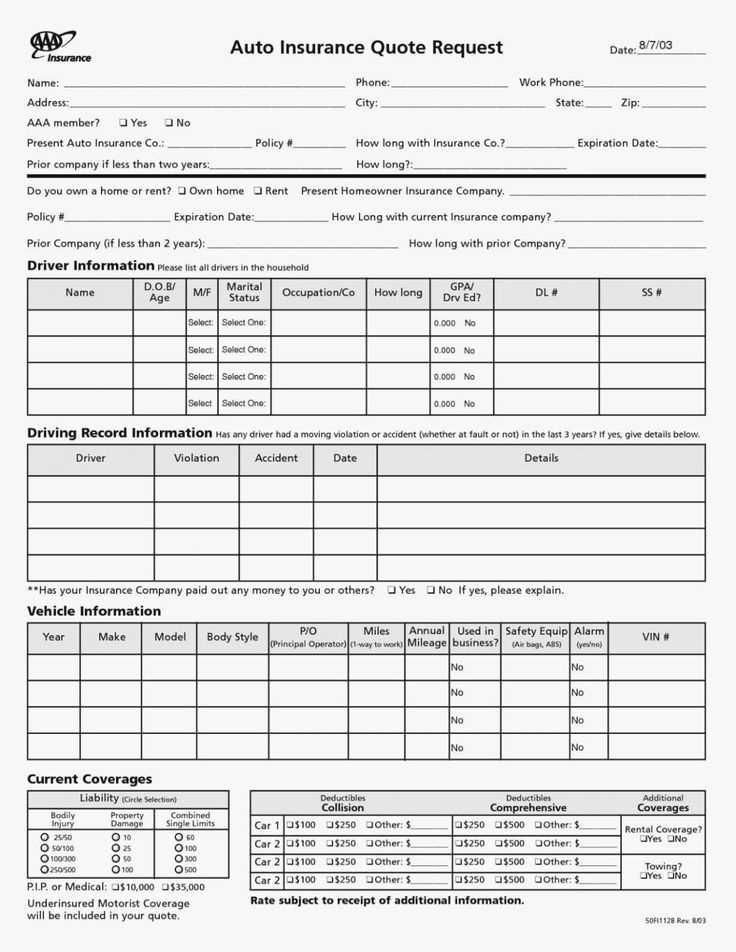

- Owner Details: Full name and contact information of the individual or entity holding the policy.

- Vehicle Identification: Include the make, model, and identification number (VIN) of the vehicle covered.

- Coverage Dates: Clearly indicate the start and end dates for which the coverage is valid.

- Provider Information: Name, address, and contact details of the company offering the coverage.

Common Pitfalls to Avoid

When drafting this document, avoid these common mistakes:

- Incomplete Information: Ensure all required details are present and accurate.

- Incorrect Dates: Double-check that the coverage dates match the policy period.

- Vague Language: Use precise and clear wording to avoid confusion or misinterpretation.

When to Submit Verification Documents

It is crucial to submit the verification within the required timeframe. This may be needed for vehicle registration, compliance with legal regulations, or when requested by an authority. Timely submission ensures that you stay in good standing and avoid penalties.

How to Personalize the Document

While using a standard format is useful, it is important to personalize the document to suit specific needs. Include any additional information required by the institution requesting the verification, and ensure that the format aligns with the accepted guidelines.

Legal Requirements for Verification Documents

Each jurisdiction may have its own legal requirements for what should be included in a verification document. Be sure to research and follow local regulations to ensure the document is legally valid. This will prevent delays or rejections when submitting the document for verification.