Free Credit Dispute Letter Template for Word

When reviewing your financial history, you might come across inaccuracies that could affect your score and overall standing. These mistakes can range from simple clerical errors to more serious discrepancies that could impact your financial decisions. It’s important to address these issues promptly and in a professional manner to ensure that they are corrected.

Knowing the right approach is crucial for resolving these problems efficiently. You don’t need to navigate the complex process alone–there are resources available that can guide you through the necessary steps. By using a well-structured request, you increase the chances of a successful resolution. This guide will help you understand how to approach this process with confidence.

Taking the time to compose a clear and accurate communication can make all the difference. Your message should be direct yet polite, detailing the nature of the issue and the steps you wish to take for correction. Using the right format not only saves time but also ensures that your request is taken seriously by the recipient.

Understanding Credit Disputes and Letters

When reviewing your financial records, errors can sometimes arise that need to be addressed. These inaccuracies may affect how you are viewed by lenders, influencing your ability to secure loans or favorable rates. Recognizing these issues and knowing how to formally challenge them is key to maintaining a healthy financial standing.

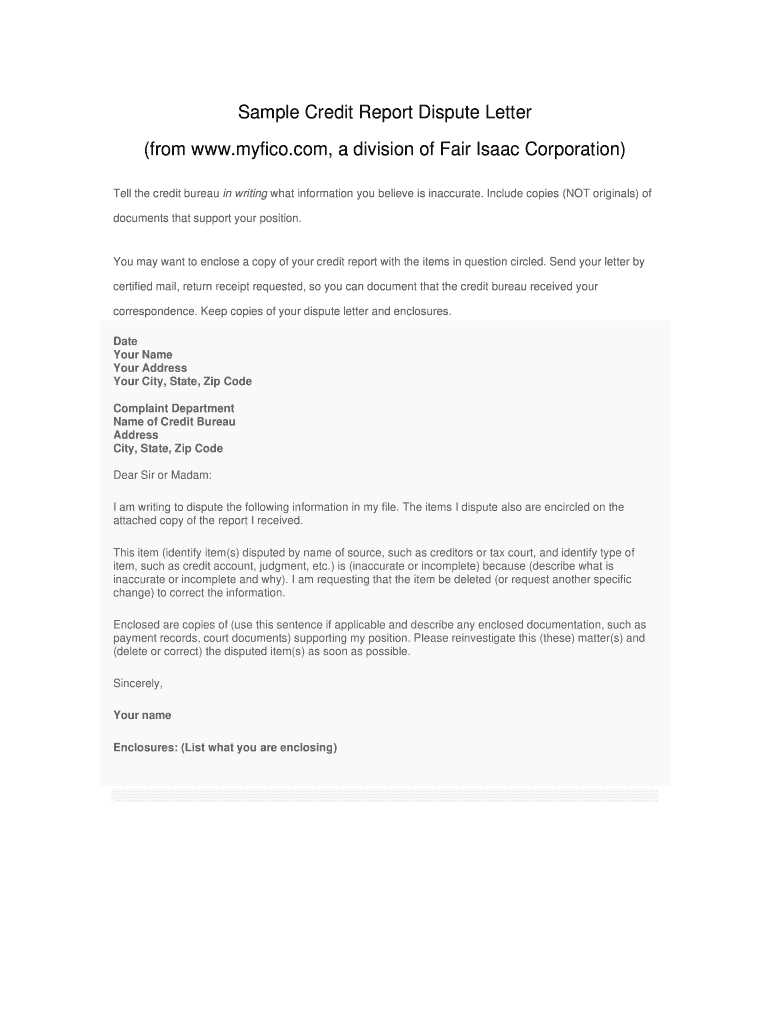

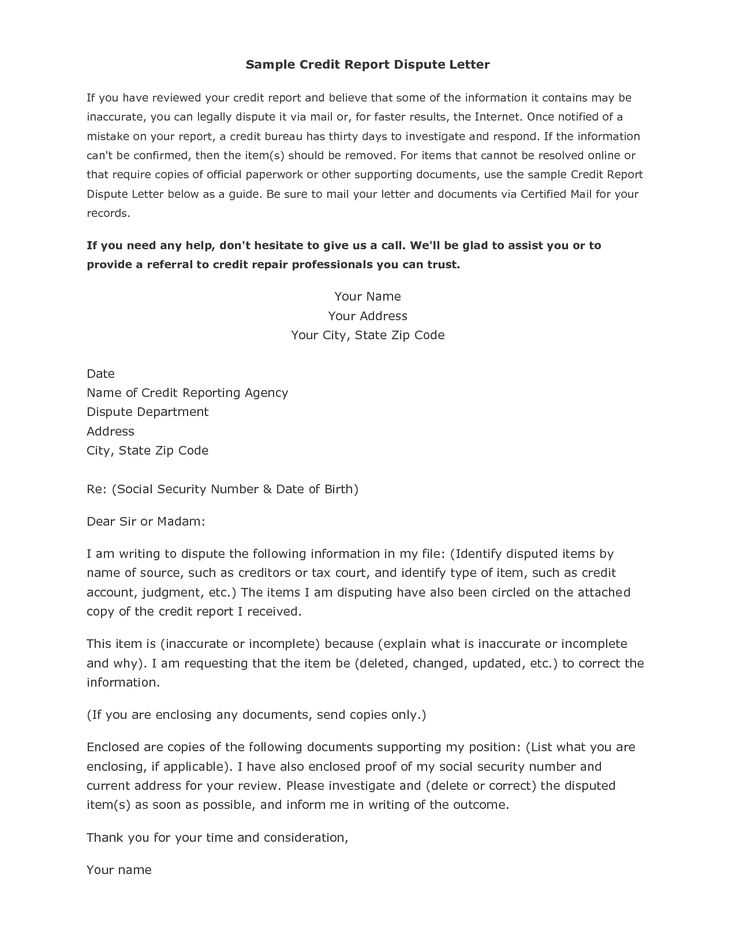

The process of notifying the responsible entity about such mistakes typically involves creating a formal communication that clearly outlines the issue at hand. A well-crafted message ensures that your concerns are heard and acted upon swiftly. Whether the error is due to a misreported balance or an incorrect account status, taking the right steps to highlight these problems can lead to corrections and improvements in your financial profile.

Understanding the structure of such a request is essential for presenting your case effectively. The communication should be concise, factual, and polite, presenting only the necessary information to facilitate the resolution. This approach not only demonstrates your seriousness but also ensures that the process moves forward without unnecessary delays.

Why You Need a Credit Dispute Template

When dealing with inaccuracies in your financial reports, it’s important to present your case clearly and professionally. A well-structured document can help you communicate your concerns effectively, ensuring that the recipient understands the issue and takes action. Without a proper format, your request might be ignored or delayed, prolonging the time it takes to resolve the matter.

Ensuring Clarity and Accuracy

Using a predefined structure helps ensure that all the necessary details are included in your request. This reduces the chances of missing important information and increases the likelihood that your issue will be addressed promptly. A clear, organized format allows you to stay focused on the specific problem and present your case logically, making it easier for the recipient to understand your point of view.

Saving Time and Effort

Having a ready-made format to follow can save you significant time. Instead of drafting a new communication from scratch, you can simply fill in the relevant details, ensuring that all required points are covered. This allows you to address the issue quickly and efficiently, without having to worry about the structure or wording of your request.

How to Use a Credit Dispute Letter

When addressing an issue with your financial records, it’s important to follow a systematic approach to ensure your concerns are heard. By utilizing a structured document, you can communicate your points clearly and concisely. The goal is to present your issue in a way that makes it easy for the recipient to understand and act on it.

Here are the basic steps to follow when using such a formal communication:

- Identify the Issue – Clearly state what is wrong with the information reported. Provide specific details about the error, such as incorrect balances, dates, or other discrepancies.

- Gather Supporting Documents – Attach any relevant proof that backs your claim, such as account statements, receipts, or confirmation letters. This helps substantiate your request.

- Fill in the Necessary Information – Be sure to include your personal details, the account in question, and any other identifying information that will help locate the issue quickly.

- Be Clear and Concise – Keep your message to the point. Avoid unnecessary information that could distract from the main issue. Make your request clear and actionable.

- Follow Up – After sending your communication, track the progress. If necessary, send a polite reminder if you do not hear back within a reasonable time frame.

By following these steps, you can increase the chances of resolving the issue quickly and efficiently. The clearer and more organized your request, the more likely it is to receive prompt attention and correction.

Essential Elements of a Dispute Letter

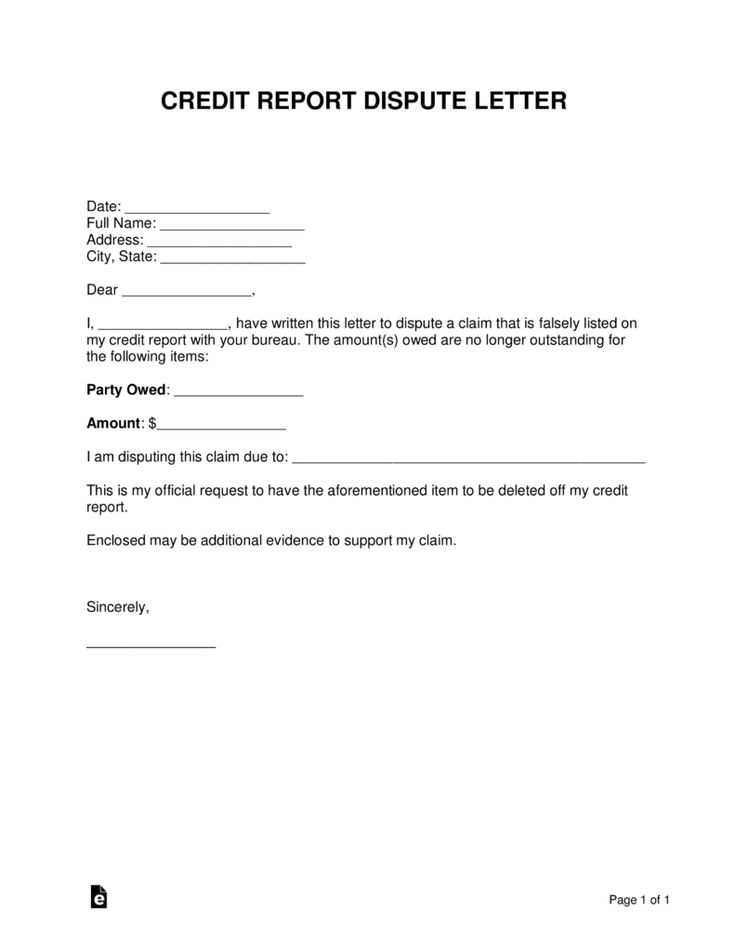

To effectively address inaccuracies in your financial records, your communication needs to contain key information. This ensures the recipient can quickly identify the issue and take the necessary steps to correct it. A well-organized message will help make your case clear and increase the likelihood of a prompt resolution.

Key Information to Include

Your message should start by providing all relevant personal details, such as your full name, address, and account number. This helps the recipient locate your records quickly. Next, clearly describe the problem you have identified in your records. Provide specific dates, amounts, and any other relevant details that can pinpoint the exact error.

Supporting Documentation and Requests

Attach any proof or supporting documents that validate your claim, such as receipts, bank statements, or other official records. These documents back up your request and strengthen your case. Finally, make a clear request for correction, specifying how you would like the issue to be resolved. A polite yet firm tone ensures that your concerns are taken seriously.

Common Mistakes to Avoid in Disputes

When challenging inaccuracies in your financial records, certain errors can hinder the effectiveness of your request. Avoiding common pitfalls can ensure that your communication is clear, professional, and more likely to be taken seriously. Below are some of the most frequent mistakes people make during this process.

| Mistake | Impact | How to Avoid |

|---|---|---|

| Vague Descriptions | Unclear explanations make it harder for the recipient to identify the issue. | Be specific, include exact dates, amounts, and account details. |

| Missing Proof | Without supporting documentation, your claim is less likely to be taken seriously. | Attach any relevant documents that support your case, such as bank statements or receipts. |

| Using Aggressive Language | A harsh tone may alienate the recipient and delay resolution. | Maintain a professional and polite tone throughout your communication. |

| Ignoring Deadlines | Failure to follow up or adhere to deadlines may result in your case being overlooked. | Be prompt in submitting your request and follow up if necessary. |

By being mindful of these mistakes, you can ensure your communication is both effective and respectful, leading to a quicker resolution of any issues in your financial records.

Tips for Writing an Effective Letter

When addressing an issue with your financial information, how you write your communication can make a significant difference. A well-crafted message can help convey your concerns clearly and increase the likelihood of a positive outcome. Here are some tips to ensure your communication is both effective and professional.

Be Clear and Direct

State the purpose of your message right at the beginning. Avoid unnecessary details that do not contribute to the issue at hand. Clearly describe the problem you’ve identified, specifying dates, amounts, and account numbers where applicable. A direct approach will help the recipient quickly grasp the nature of the concern.

Maintain a Professional Tone

Even if you’re frustrated or upset, it’s crucial to keep a polite and respectful tone throughout your message. Using professional language helps ensure that your request is taken seriously and can lead to a more favorable response. Avoid using aggressive or demanding language, as this may hinder the resolution process.